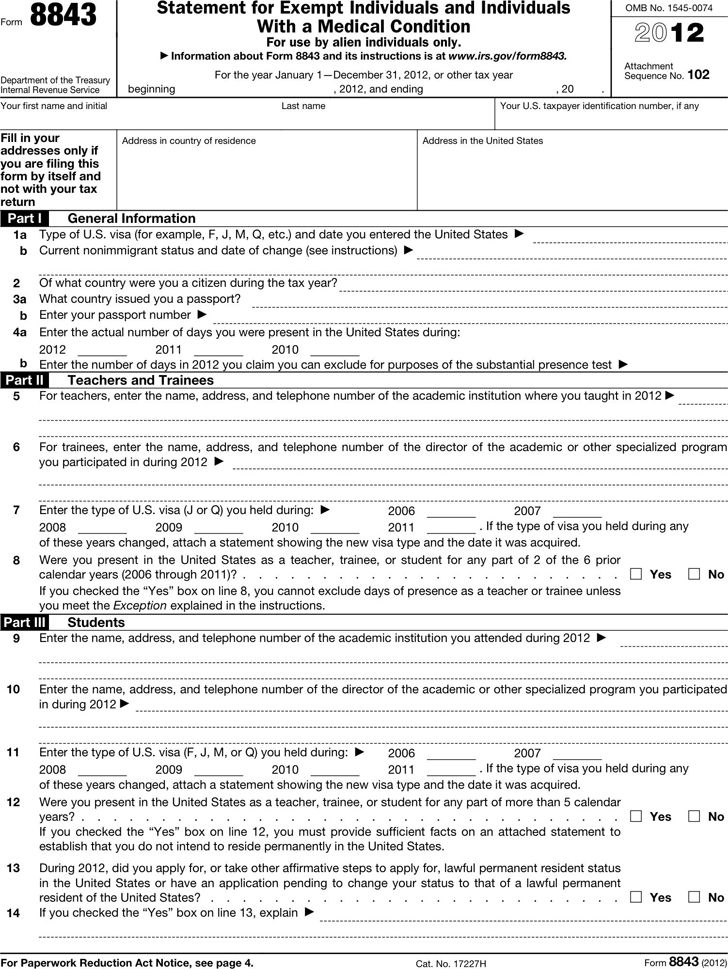

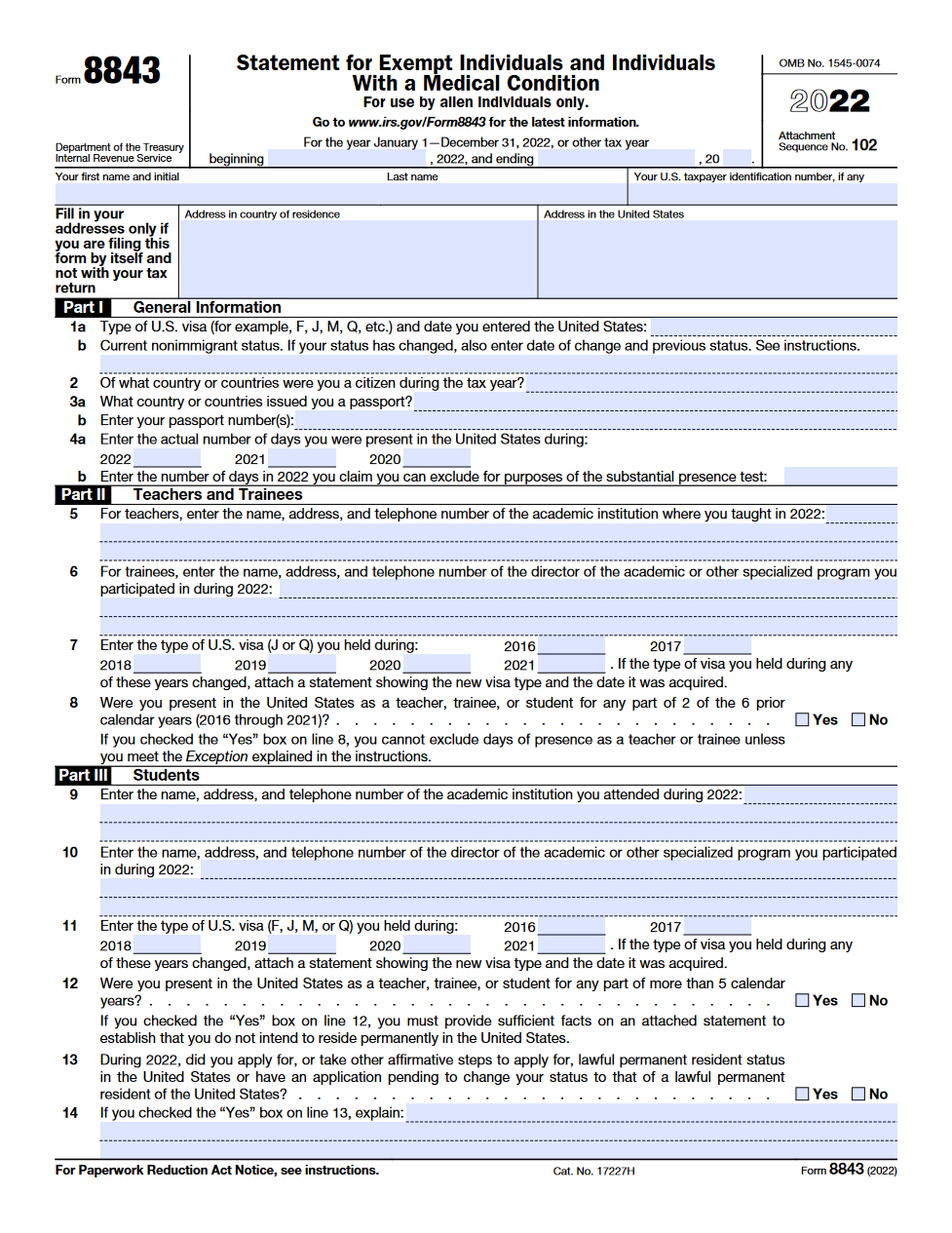

Form 8843 Æ›¸ÃÆ–¹

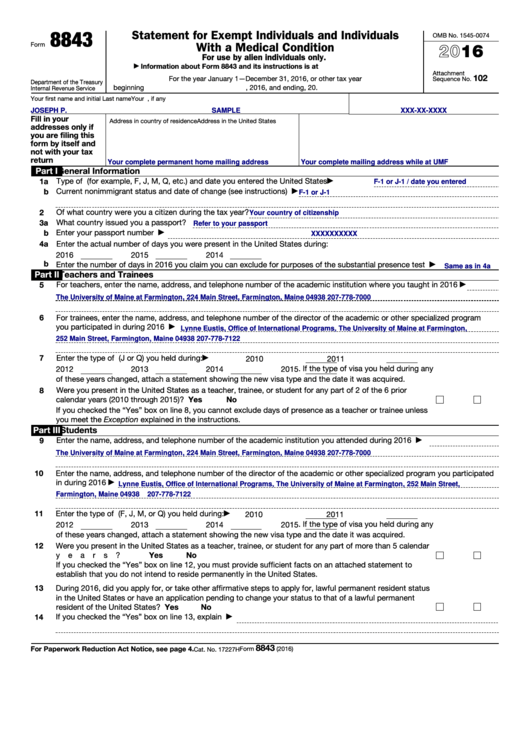

Form 8843 Æ›¸ÃÆ–¹ - Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for. It is an informational statement required by the irs for nonresidents for tax purposes. Tax calculations due to exempt status or a medical condition. Form 8843 is not a u.s. If you exclude days of presence in the united states because you fall into any of the following categories, you must file a fully. It is an informational statement required by the irs for. What is a form 8843 and who must file one? Form 8843 is not a u.s. Tax calculations due to exempt status or a medical condition. I am an international student and i need to file form 8843 with the irs, but after step 1 it says based on the information you provided.

Form 8843 is not a u.s. If you exclude days of presence in the united states because you fall into any of the following categories, you must file a fully. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for. I am an international student and i need to file form 8843 with the irs, but after step 1 it says based on the information you provided. Tax calculations due to exempt status or a medical condition. It is an informational statement required by the irs for. It is an informational statement required by the irs for nonresidents for tax purposes. Tax calculations due to exempt status or a medical condition. Form 8843 is not a u.s.

Form 8843 is not a u.s. Tax calculations due to exempt status or a medical condition. If you exclude days of presence in the united states because you fall into any of the following categories, you must file a fully. Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for. Form 8843 is not a u.s. I am an international student and i need to file form 8843 with the irs, but after step 1 it says based on the information you provided. It is an informational statement required by the irs for. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. What is a form 8843 and who must file one? It is an informational statement required by the irs for nonresidents for tax purposes.

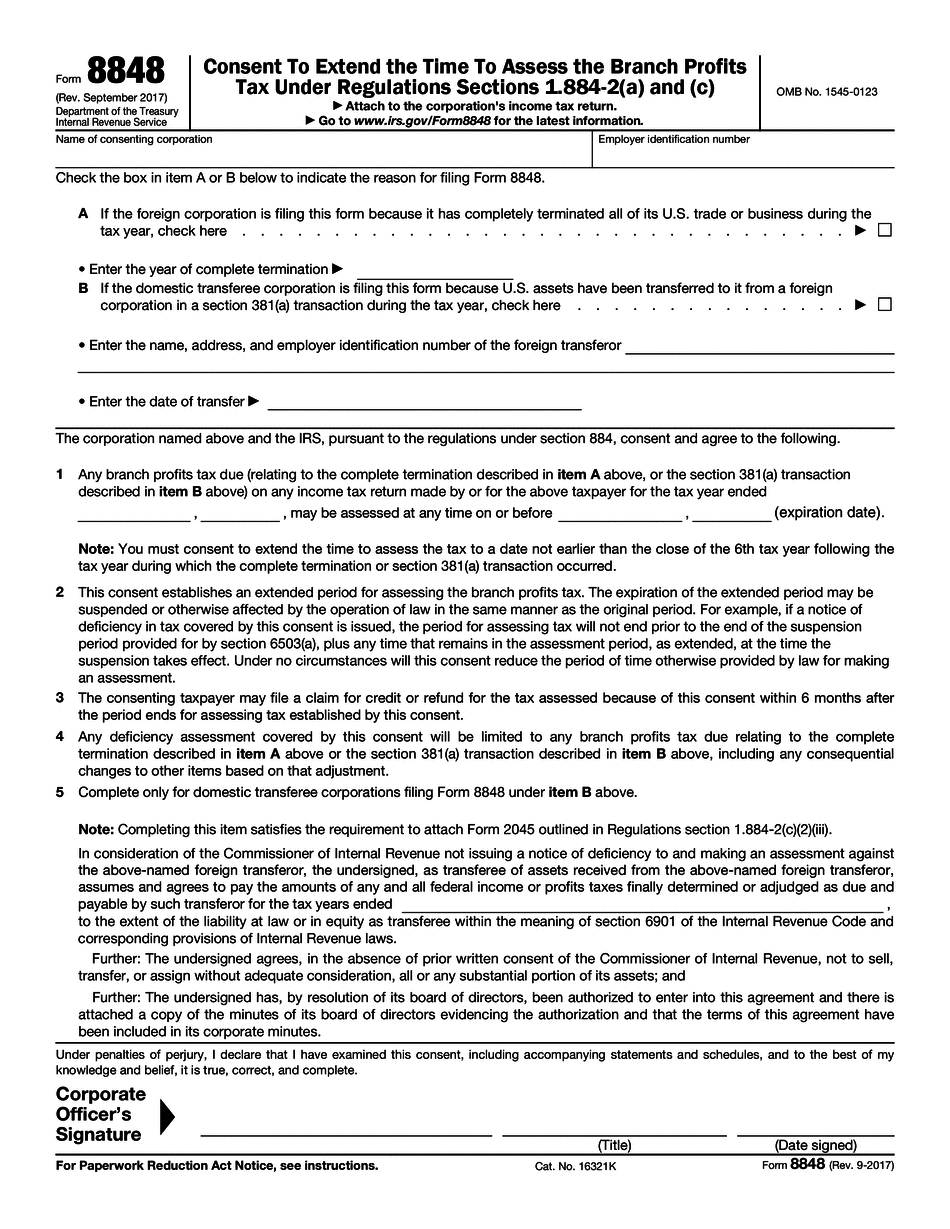

8848 20172024 Form Fill Out and Sign Printable PDF Template

Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. I am an international student and i need to file form 8843 with the irs, but after step 1 it says based on the information you provided. Tax calculations due to exempt status or a medical condition. If you exclude days of presence in.

Top 5 Nonresident Tax Return Mistakes & How to Avoid Them

I am an international student and i need to file form 8843 with the irs, but after step 1 it says based on the information you provided. Tax calculations due to exempt status or a medical condition. What is a form 8843 and who must file one? Form 8843 is not a u.s. Tax calculations due to exempt status or.

Form 8843 Decoded Simplified Tax Filing for NonResidents Abvise

Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for. Form 8843 is not a u.s. It is an informational statement required by the irs for. If you exclude days of presence in the united states because you fall into any of the following categories, you must file a fully..

IRS Form 8843 Editable and Printable Statement to Fill out

It is an informational statement required by the irs for. I am an international student and i need to file form 8843 with the irs, but after step 1 it says based on the information you provided. Tax calculations due to exempt status or a medical condition. Tax calculations due to exempt status or a medical condition. What is a.

Form 8843 Fillable Printable Forms Free Online

Tax calculations due to exempt status or a medical condition. Form 8843 is not a u.s. If you exclude days of presence in the united states because you fall into any of the following categories, you must file a fully. Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for..

Free 2012 8843 Form PDF 99KB 4 Page(s)

Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for. It is an informational statement required by the irs for. If you exclude days of presence in the united states because you fall into any of the following categories, you must file a fully. Tax calculations due to exempt status.

UNM Tax Form 8843 for Students YouTube

Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for. I am an international student and i need to file form 8843 with the irs, but after step 1 it says based on the information you provided. Tax calculations due to exempt status or a medical condition. What is a.

IRS Form 8843. Statement for Exempt Individuals and Individuals with a

Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for. Tax calculations due to exempt status or a medical condition. If you exclude days of presence in the united states because you fall into any of the following categories, you must file a fully. It is an informational statement required.

Form 8843 2019 PDF

Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for. It is an informational statement required by the irs for nonresidents for tax purposes. Tax calculations due to exempt status or a medical condition. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent..

Form_8843_for_Scholars Government Of The United States United

Tax calculations due to exempt status or a medical condition. Tax calculations due to exempt status or a medical condition. Form 8843 is not a u.s. I am an international student and i need to file form 8843 with the irs, but after step 1 it says based on the information you provided. It is an informational statement required by.

If You Exclude Days Of Presence In The United States Because You Fall Into Any Of The Following Categories, You Must File A Fully.

Form 8843 is not a u.s. Tax calculations due to exempt status or a medical condition. Tax calculations due to exempt status or a medical condition. What is a form 8843 and who must file one?

It Is An Informational Statement Required By The Irs For.

Form 8843 is not a u.s. Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for. It is an informational statement required by the irs for nonresidents for tax purposes. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent.