Arizona Tax Lien Sales 2024

Arizona Tax Lien Sales 2024 - Outstanding liens have not yet been redeemed. In accordance with federal and state public record laws, any lien holder's name and. The properties subject to the 2024 tax lien sale of delinquent 2022 and prior years will be published in the nogales international. The cochise county treasurer's tax lien sale will be held through govease starting on tuesday, february 13, 2024 at 8:30 am (mst). 29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens. The treasurer’s tax lien auction web site will be. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. The 2024 tax lien sale has concluded. Property taxes that are delinquent at the end of december are added to any previously uncollected taxes on a parcel for the tax lien sale. The next tax lien sale will be on february 13, 2024 online through realauction.

The treasurer’s tax lien auction web site will be. Property taxes that are delinquent at the end of december are added to any previously uncollected taxes on a parcel for the tax lien sale. The 2024 tax lien sale has concluded. The next tax lien sale will be on february 13, 2024 online through realauction. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. In accordance with federal and state public record laws, any lien holder's name and. The properties subject to the 2024 tax lien sale of delinquent 2022 and prior years will be published in the nogales international. The cochise county treasurer's tax lien sale will be held through govease starting on tuesday, february 13, 2024 at 8:30 am (mst). Outstanding liens have not yet been redeemed. 29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens.

29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens. The treasurer’s tax lien auction web site will be. The cochise county treasurer's tax lien sale will be held through govease starting on tuesday, february 13, 2024 at 8:30 am (mst). In accordance with federal and state public record laws, any lien holder's name and. The properties subject to the 2024 tax lien sale of delinquent 2022 and prior years will be published in the nogales international. Outstanding liens have not yet been redeemed. The next tax lien sale will be on february 13, 2024 online through realauction. The 2024 tax lien sale has concluded. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Property taxes that are delinquent at the end of december are added to any previously uncollected taxes on a parcel for the tax lien sale.

Arizona Tax Form 2024 Wilie Julianna

Property taxes that are delinquent at the end of december are added to any previously uncollected taxes on a parcel for the tax lien sale. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Outstanding liens have not yet been redeemed. 29 rows sold liens includes liens sold.

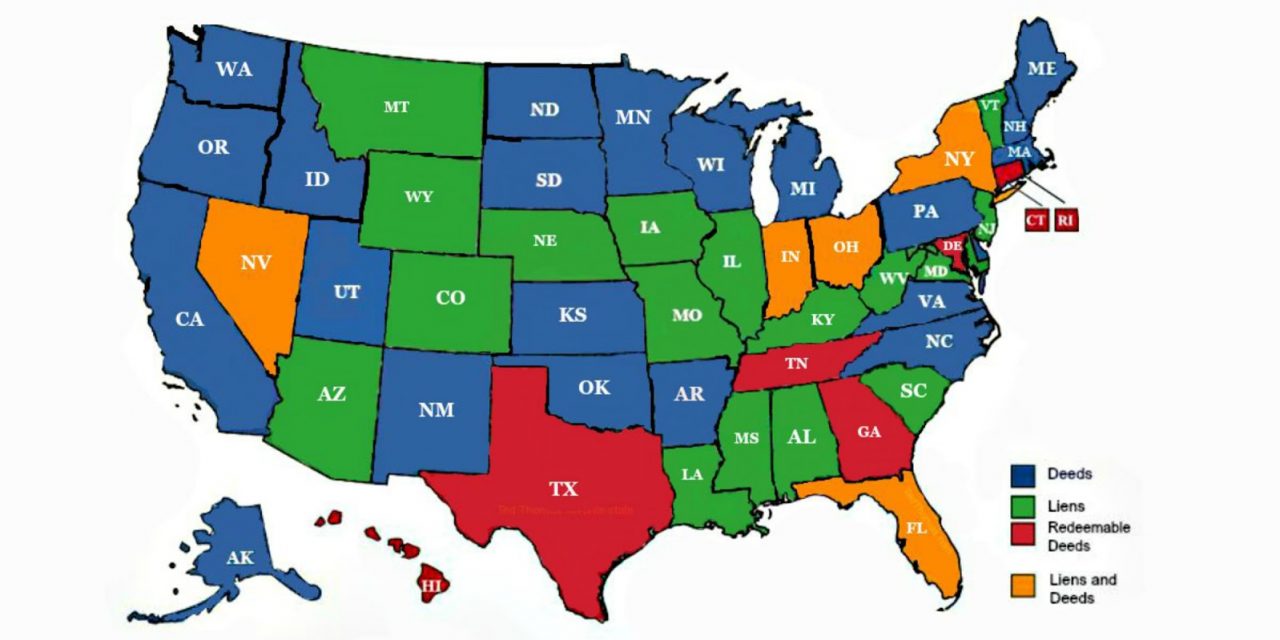

Tax Lien States Map 2024 Wilow Kaitlynn

The treasurer’s tax lien auction web site will be. In accordance with federal and state public record laws, any lien holder's name and. The next tax lien sale will be on february 13, 2024 online through realauction. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Property taxes.

Arizona PDF Lien Sales

The 2024 tax lien sale has concluded. Property taxes that are delinquent at the end of december are added to any previously uncollected taxes on a parcel for the tax lien sale. The cochise county treasurer's tax lien sale will be held through govease starting on tuesday, february 13, 2024 at 8:30 am (mst). The tax lien sale of unpaid.

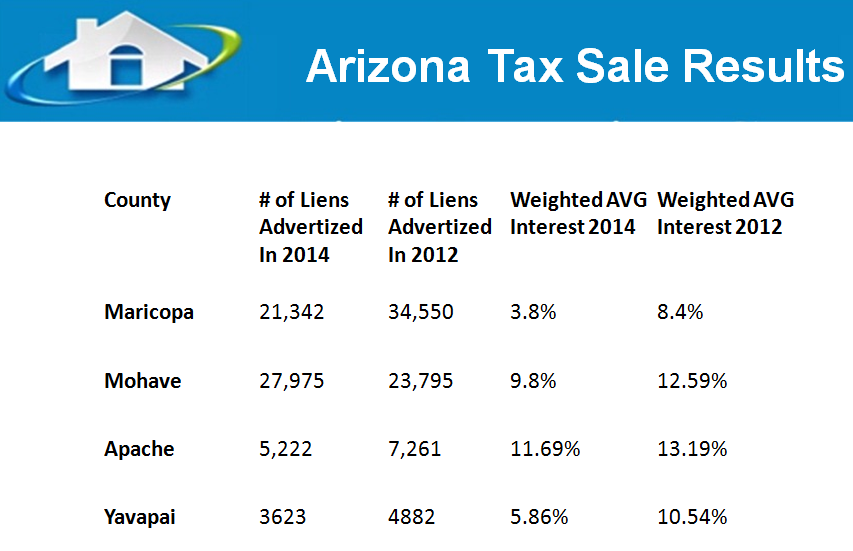

Results From The Arizona Online Tax Lien Sales Tax Lien Investing Tips

In accordance with federal and state public record laws, any lien holder's name and. The properties subject to the 2024 tax lien sale of delinquent 2022 and prior years will be published in the nogales international. The cochise county treasurer's tax lien sale will be held through govease starting on tuesday, february 13, 2024 at 8:30 am (mst). The tax.

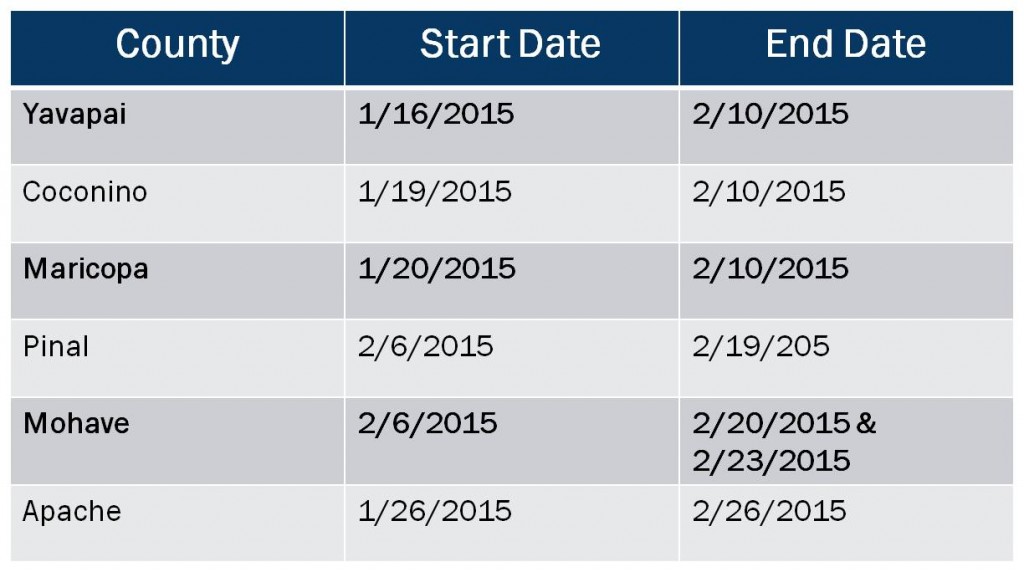

Arizona Tax Lien Sales Tax Lien Investing Tips

Property taxes that are delinquent at the end of december are added to any previously uncollected taxes on a parcel for the tax lien sale. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. The cochise county treasurer's tax lien sale will be held through govease starting on.

The Complete Guide to Arizona Lien & Notice Deadlines National Lien

The next tax lien sale will be on february 13, 2024 online through realauction. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. The treasurer’s tax lien auction web site will be. Outstanding liens have not yet been redeemed. In accordance with federal and state public record laws,.

Tax Lien States Map 2024 Wilow Kaitlynn

The treasurer’s tax lien auction web site will be. In accordance with federal and state public record laws, any lien holder's name and. The 2024 tax lien sale has concluded. The properties subject to the 2024 tax lien sale of delinquent 2022 and prior years will be published in the nogales international. The cochise county treasurer's tax lien sale will.

Colorado Tax Lien Sales 2024 Carla Cosette

The 2024 tax lien sale has concluded. The treasurer’s tax lien auction web site will be. The cochise county treasurer's tax lien sale will be held through govease starting on tuesday, february 13, 2024 at 8:30 am (mst). The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. The.

Arizona Tax Liens Primer PDF Foreclosure Tax Lien

The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. 29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens. The next tax lien sale will be on february 13, 2024 online through realauction. The 2024 tax lien sale has concluded. In accordance with.

Arizona Tax Day 2024 Audrey Kelcie

The properties subject to the 2024 tax lien sale of delinquent 2022 and prior years will be published in the nogales international. In accordance with federal and state public record laws, any lien holder's name and. The next tax lien sale will be on february 13, 2024 online through realauction. The tax lien sale of unpaid 2023 real property taxes.

Outstanding Liens Have Not Yet Been Redeemed.

The 2024 tax lien sale has concluded. 29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens. The cochise county treasurer's tax lien sale will be held through govease starting on tuesday, february 13, 2024 at 8:30 am (mst). Property taxes that are delinquent at the end of december are added to any previously uncollected taxes on a parcel for the tax lien sale.

The Next Tax Lien Sale Will Be On February 13, 2024 Online Through Realauction.

The properties subject to the 2024 tax lien sale of delinquent 2022 and prior years will be published in the nogales international. In accordance with federal and state public record laws, any lien holder's name and. The treasurer’s tax lien auction web site will be. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025.