Buying Tax Lien Properties In Texas

Buying Tax Lien Properties In Texas - Smart homebuyers and savvy investors looking for rich. This comprehensive guide will take you through the ins and outs of the texas property tax sale process, the differences between tax liens and tax deeds,. The homeowner retains the right. In texas, properties with tax liens are offered for sale to the public by the county commissioner. Texas, currently has 2,419 tax liens and 28,853 other distressed listings available as of january 6. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at.

The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. Smart homebuyers and savvy investors looking for rich. The homeowner retains the right. This comprehensive guide will take you through the ins and outs of the texas property tax sale process, the differences between tax liens and tax deeds,. Texas, currently has 2,419 tax liens and 28,853 other distressed listings available as of january 6. In texas, properties with tax liens are offered for sale to the public by the county commissioner.

This comprehensive guide will take you through the ins and outs of the texas property tax sale process, the differences between tax liens and tax deeds,. In texas, properties with tax liens are offered for sale to the public by the county commissioner. Smart homebuyers and savvy investors looking for rich. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. Texas, currently has 2,419 tax liens and 28,853 other distressed listings available as of january 6. The homeowner retains the right.

Tax Lien Properties In Montana Brightside Tax Relief

Smart homebuyers and savvy investors looking for rich. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. This comprehensive guide will take you through the ins and outs of the texas property tax sale process, the differences between tax liens and tax deeds,..

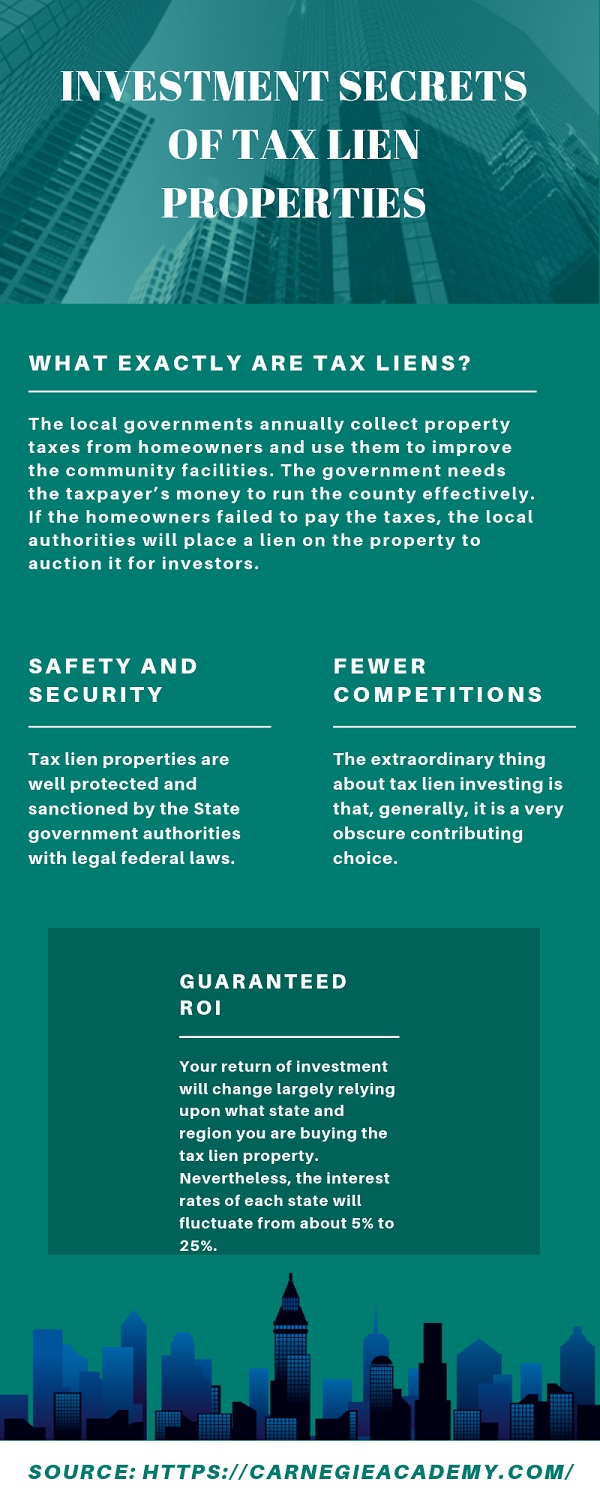

Investment Secrets of Tax Lien Properties Latest Infographics

In texas, properties with tax liens are offered for sale to the public by the county commissioner. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. This comprehensive guide will take you through the ins and outs of the texas property tax sale.

What to Look For When Buying Tax Deeds Tax Lien Certificate School

This comprehensive guide will take you through the ins and outs of the texas property tax sale process, the differences between tax liens and tax deeds,. In texas, properties with tax liens are offered for sale to the public by the county commissioner. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of.

Tax Lien Properties Texas Real Estate Tax Lien Investing for Beginners

In texas, properties with tax liens are offered for sale to the public by the county commissioner. Smart homebuyers and savvy investors looking for rich. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. This comprehensive guide will take you through the ins.

Buying Tax Lien Properties Key Benefits and Simple Process

This comprehensive guide will take you through the ins and outs of the texas property tax sale process, the differences between tax liens and tax deeds,. In texas, properties with tax liens are offered for sale to the public by the county commissioner. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of.

Causes and Process of Buying Tax Lien Properties PDF

Texas, currently has 2,419 tax liens and 28,853 other distressed listings available as of january 6. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. This comprehensive guide will take you through the ins and outs of the texas property tax sale process,.

Advantages & Disadvantages of Buying Tax Lien Properties

In texas, properties with tax liens are offered for sale to the public by the county commissioner. The homeowner retains the right. Texas, currently has 2,419 tax liens and 28,853 other distressed listings available as of january 6. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue.

Tax Lien Properties Texas Real Estate Tax Lien Investing for Beginners

In texas, properties with tax liens are offered for sale to the public by the county commissioner. The homeowner retains the right. Smart homebuyers and savvy investors looking for rich. This comprehensive guide will take you through the ins and outs of the texas property tax sale process, the differences between tax liens and tax deeds,. Texas, currently has 2,419.

Tax Lien Properties Texas Real Estate Tax Lien Investing for Beginners

The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. The homeowner retains the right. Smart homebuyers and savvy investors looking for rich. This comprehensive guide will take you through the ins and outs of the texas property tax sale process, the differences between.

The Demand for Tax Lien Properties Tax, Demand, Property

Texas, currently has 2,419 tax liens and 28,853 other distressed listings available as of january 6. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. Smart homebuyers and savvy investors looking for rich. This comprehensive guide will take you through the ins and.

In Texas, Properties With Tax Liens Are Offered For Sale To The Public By The County Commissioner.

The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. This comprehensive guide will take you through the ins and outs of the texas property tax sale process, the differences between tax liens and tax deeds,. The homeowner retains the right. Texas, currently has 2,419 tax liens and 28,853 other distressed listings available as of january 6.