Can Form 1310 Be Filed Electronically

Can Form 1310 Be Filed Electronically - Actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. Refer to the form 1310 instructions to see if the qualifications are met to file the return without including form 1310. If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the. Prior to ultratax 2021, the. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. If required to file form 1310, the eligibility to file electronically is dependent upon the entries made on the form.

If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the. Prior to ultratax 2021, the. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. If required to file form 1310, the eligibility to file electronically is dependent upon the entries made on the form. Refer to the form 1310 instructions to see if the qualifications are met to file the return without including form 1310. Actually, if you are the court appointed executor or personal representative, you do not have to file form 1310.

Refer to the form 1310 instructions to see if the qualifications are met to file the return without including form 1310. Actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. Prior to ultratax 2021, the. If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the. If required to file form 1310, the eligibility to file electronically is dependent upon the entries made on the form. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,.

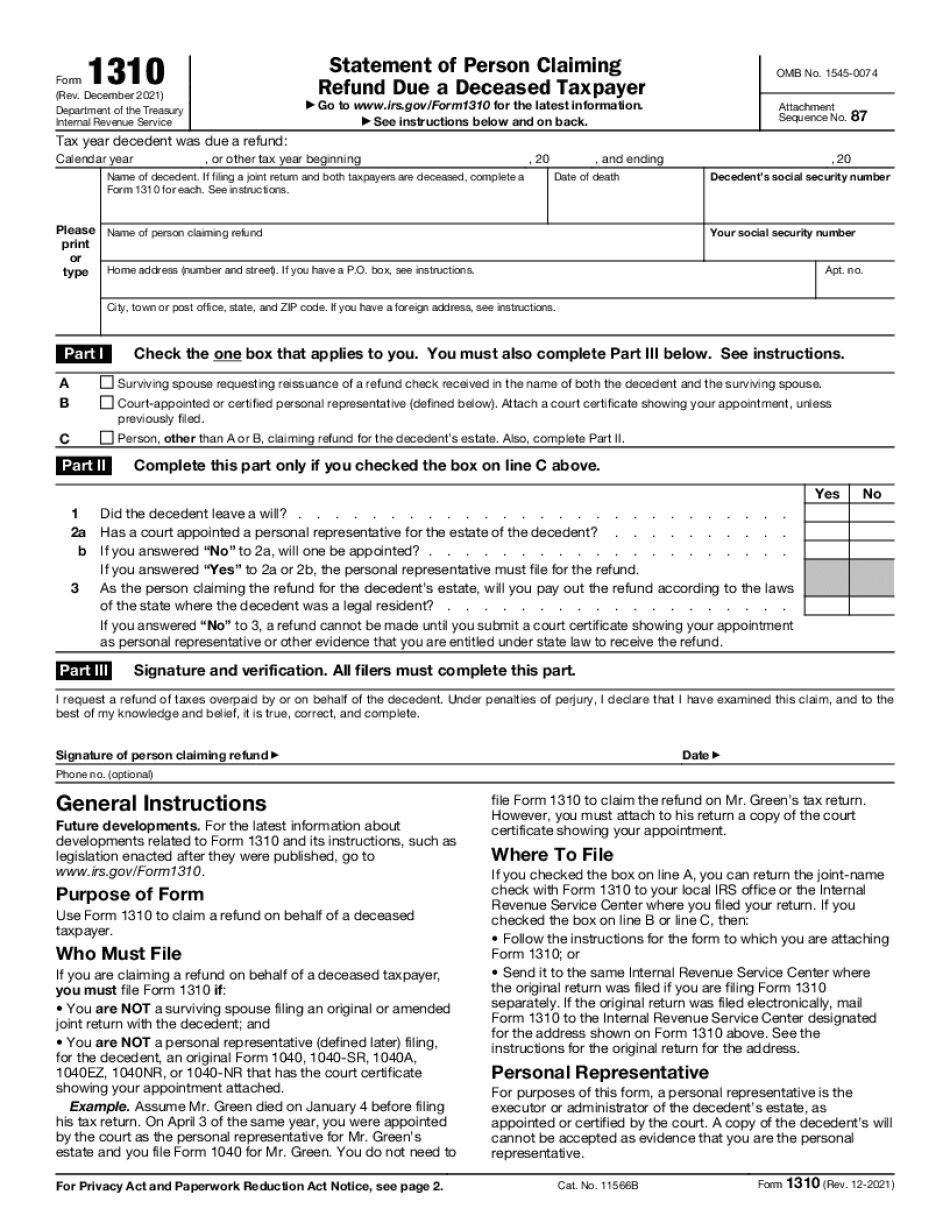

Form 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Refer to the form 1310 instructions to see if the qualifications are met to file the return without including form 1310. Prior to ultratax 2021, the. If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for.

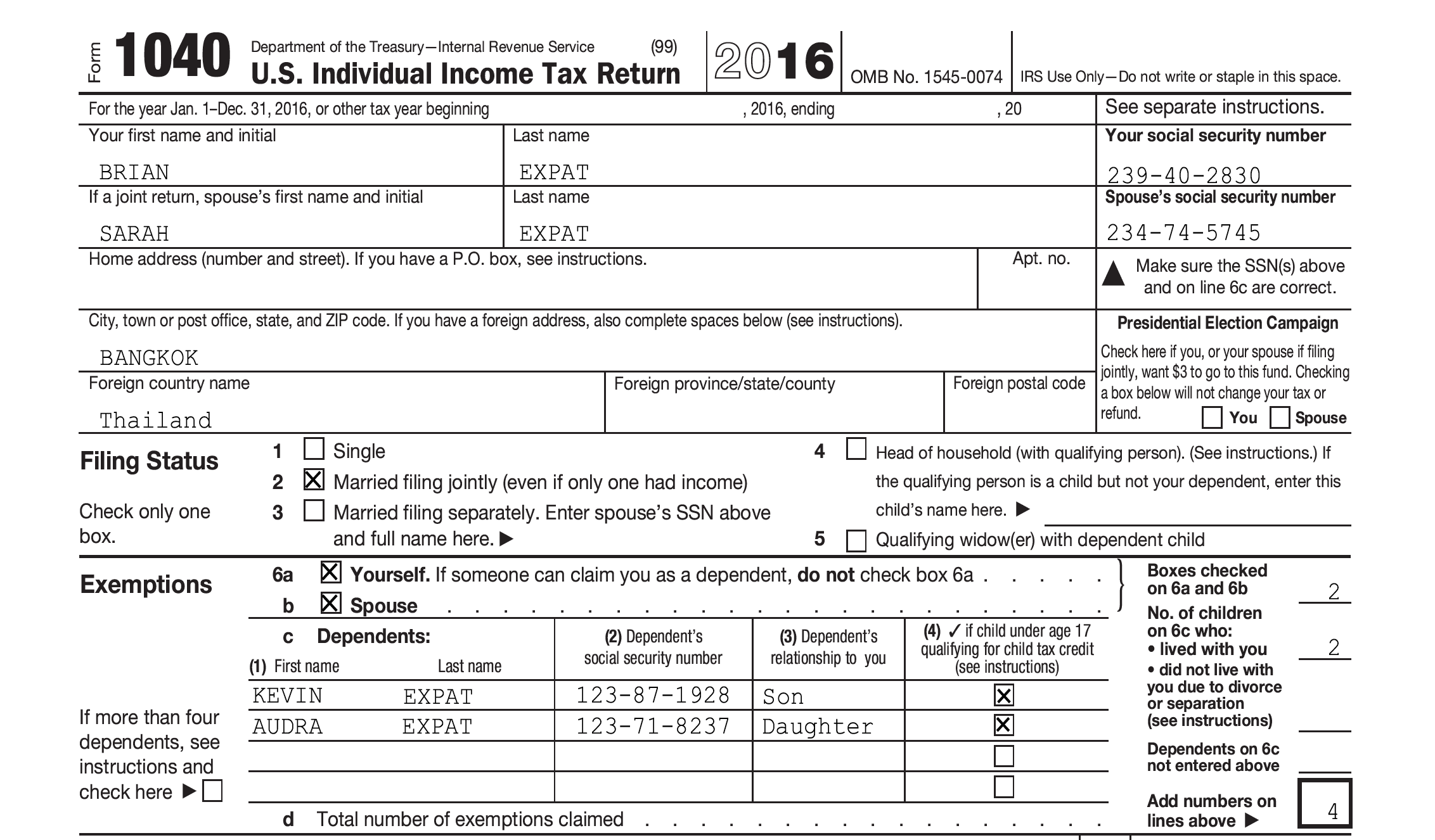

Fillable Itin Form Printable Forms Free Online

Prior to ultratax 2021, the. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the. Refer to the form 1310 instructions to see if the qualifications are met to file the return without including form.

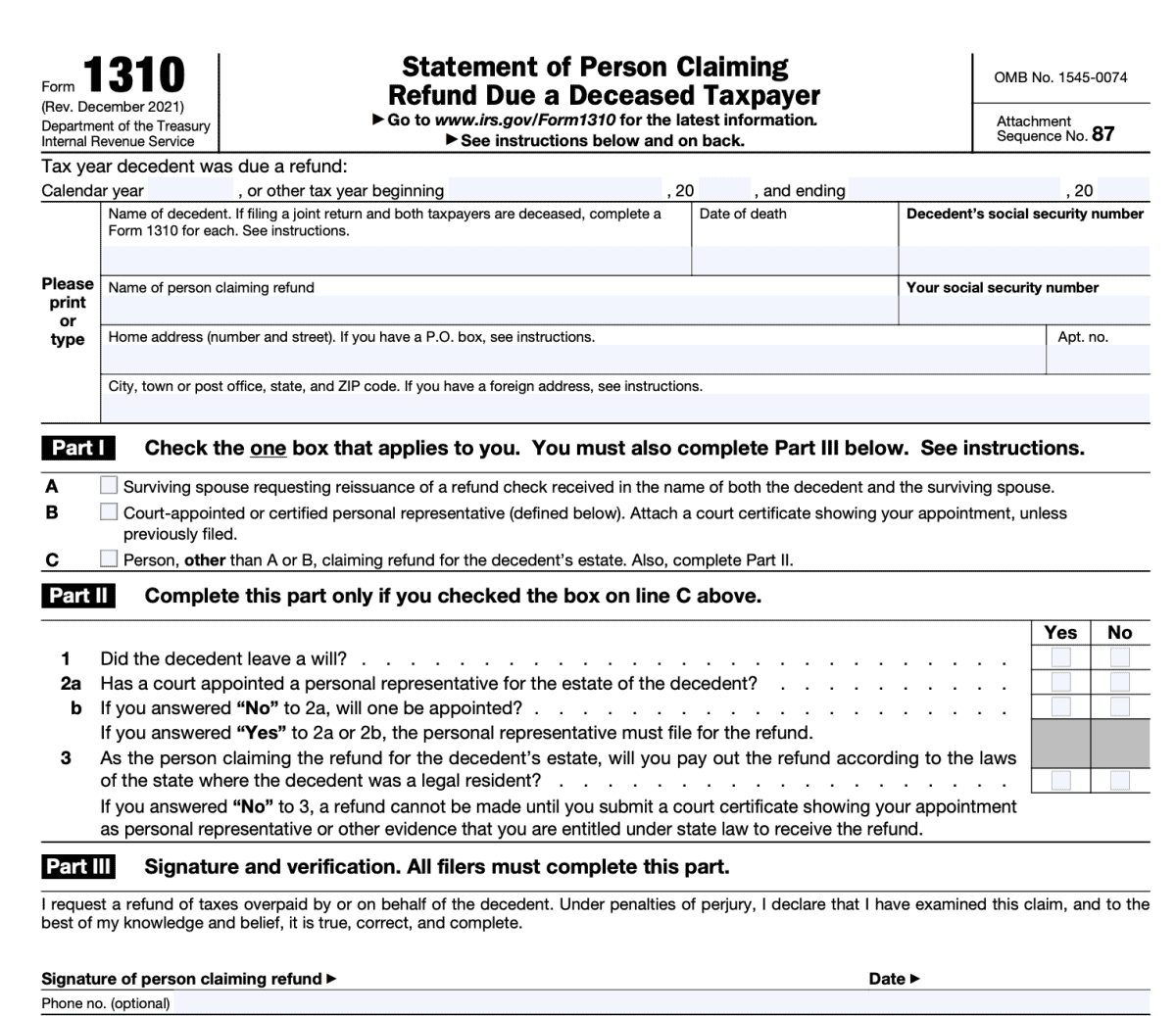

Irs Form 1310 Printable

If required to file form 1310, the eligibility to file electronically is dependent upon the entries made on the form. Refer to the form 1310 instructions to see if the qualifications are met to file the return without including form 1310. Actually, if you are the court appointed executor or personal representative, you do not have to file form 1310..

Which IRS Form Can Be Filed Electronically?

If required to file form 1310, the eligibility to file electronically is dependent upon the entries made on the form. Actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Refer to the form 1310.

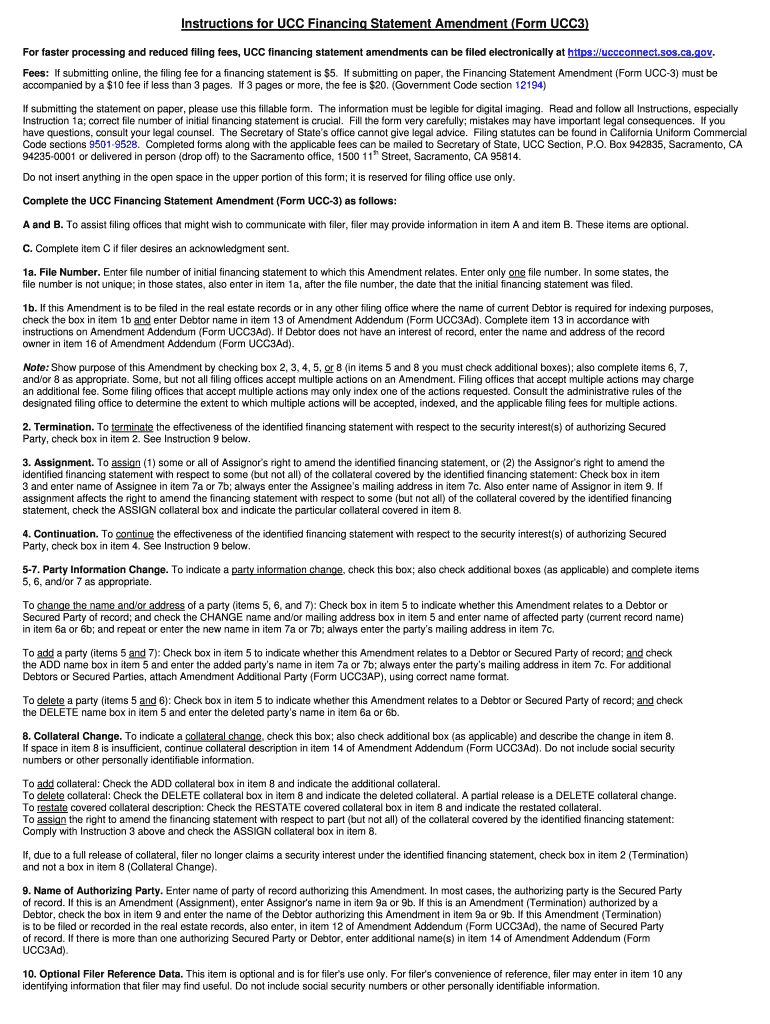

For Faster Processing and Reduced Filing Fees, UCC Financing Statement

If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the. If required to file form 1310, the eligibility to file electronically is dependent upon the entries made on the form. Actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. Prior to.

For Now, IRS Okays ESignatures On Tax Forms That Can’t Be Filed

Actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. Prior to ultratax 2021, the. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the. If.

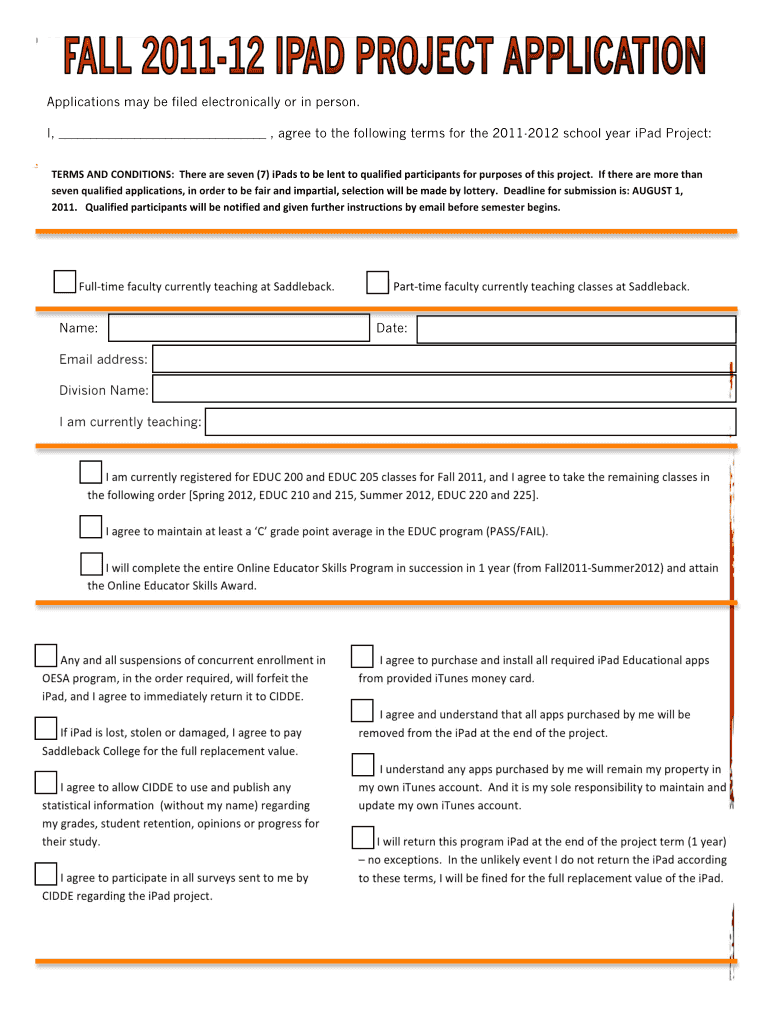

Applications May Be Filed Electronically or in Person I Saddleback Form

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. If required to file form 1310, the eligibility to file electronically is dependent upon the entries made on the form. Refer to the form 1310 instructions to see if the qualifications are met to file the return without including form 1310. If the original.

Irs Form 1310 Printable 2023. Blank Sample to Fill out Online in PDF

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Prior to ultratax 2021, the. If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the. Refer to the form 1310 instructions to see if the qualifications are met to file the return without including form.

How to File IRS Form 1310 Refund Due a Deceased Taxpayer

Prior to ultratax 2021, the. If required to file form 1310, the eligibility to file electronically is dependent upon the entries made on the form. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Actually, if you are the court appointed executor or personal representative, you do not have to file form 1310..

How to EFile Form 990EZ with for 2022 Tax Year? (Form

Prior to ultratax 2021, the. If required to file form 1310, the eligibility to file electronically is dependent upon the entries made on the form. Actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. If the original return was filed electronically, mail form 1310 to the internal revenue service center.

Information About Form 1310, Statement Of Person Claiming Refund Due A Deceased Taxpayer, Including Recent Updates,.

Actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. If required to file form 1310, the eligibility to file electronically is dependent upon the entries made on the form. If the original return was filed electronically, mail form 1310 to the internal revenue service center designated for the. Refer to the form 1310 instructions to see if the qualifications are met to file the return without including form 1310.