Can You Convert An Inherited Ira To A Roth

Can You Convert An Inherited Ira To A Roth - Learn how inherited ira conversions work. Unfortunately, if you’re not a surviving spouse, you can’t directly convert an inherited traditional ira into an inherited roth ira. However, there can be strategies to help get some or all of the. When you inherit an ira from a person other than your spouse, you cannot directly convert it into a roth ira. You can’t convert an inherited ira to a roth ira unless you are inheriting the ira from your late spouse. If you inherited the ira from someone other than your spouse, you cannot directly convert the inherited ira to a roth ira[3]. This means the question of taking an rmd before. This article will help you understand your.

This means the question of taking an rmd before. This article will help you understand your. However, there can be strategies to help get some or all of the. You can’t convert an inherited ira to a roth ira unless you are inheriting the ira from your late spouse. If you inherited the ira from someone other than your spouse, you cannot directly convert the inherited ira to a roth ira[3]. When you inherit an ira from a person other than your spouse, you cannot directly convert it into a roth ira. Learn how inherited ira conversions work. Unfortunately, if you’re not a surviving spouse, you can’t directly convert an inherited traditional ira into an inherited roth ira.

You can’t convert an inherited ira to a roth ira unless you are inheriting the ira from your late spouse. If you inherited the ira from someone other than your spouse, you cannot directly convert the inherited ira to a roth ira[3]. Learn how inherited ira conversions work. However, there can be strategies to help get some or all of the. Unfortunately, if you’re not a surviving spouse, you can’t directly convert an inherited traditional ira into an inherited roth ira. This means the question of taking an rmd before. When you inherit an ira from a person other than your spouse, you cannot directly convert it into a roth ira. This article will help you understand your.

Can you convert a 529 to a Roth IRA? YouTube

This means the question of taking an rmd before. Learn how inherited ira conversions work. Unfortunately, if you’re not a surviving spouse, you can’t directly convert an inherited traditional ira into an inherited roth ira. When you inherit an ira from a person other than your spouse, you cannot directly convert it into a roth ira. If you inherited the.

Can you convert an inherited IRA into a Roth? Josh Jalinski answers

When you inherit an ira from a person other than your spouse, you cannot directly convert it into a roth ira. This means the question of taking an rmd before. Learn how inherited ira conversions work. Unfortunately, if you’re not a surviving spouse, you can’t directly convert an inherited traditional ira into an inherited roth ira. If you inherited the.

Can You Put An Inherited Ira Into A Trust Printable Templates

Unfortunately, if you’re not a surviving spouse, you can’t directly convert an inherited traditional ira into an inherited roth ira. This article will help you understand your. You can’t convert an inherited ira to a roth ira unless you are inheriting the ira from your late spouse. This means the question of taking an rmd before. However, there can be.

Can I convert an inherited IRA to a Roth IRA?

Learn how inherited ira conversions work. If you inherited the ira from someone other than your spouse, you cannot directly convert the inherited ira to a roth ira[3]. However, there can be strategies to help get some or all of the. When you inherit an ira from a person other than your spouse, you cannot directly convert it into a.

Ira Limits 2025 Married Joshua Hutton

You can’t convert an inherited ira to a roth ira unless you are inheriting the ira from your late spouse. If you inherited the ira from someone other than your spouse, you cannot directly convert the inherited ira to a roth ira[3]. When you inherit an ira from a person other than your spouse, you cannot directly convert it into.

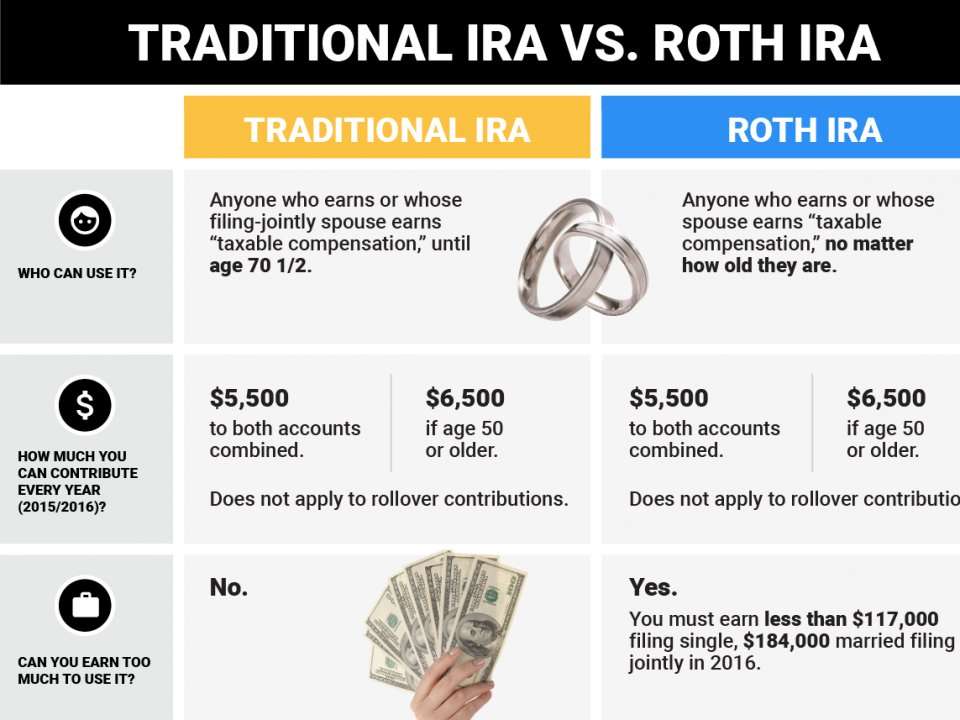

Here are the key differences between a Roth IRA and a traditional IRA

However, there can be strategies to help get some or all of the. This article will help you understand your. When you inherit an ira from a person other than your spouse, you cannot directly convert it into a roth ira. Learn how inherited ira conversions work. This means the question of taking an rmd before.

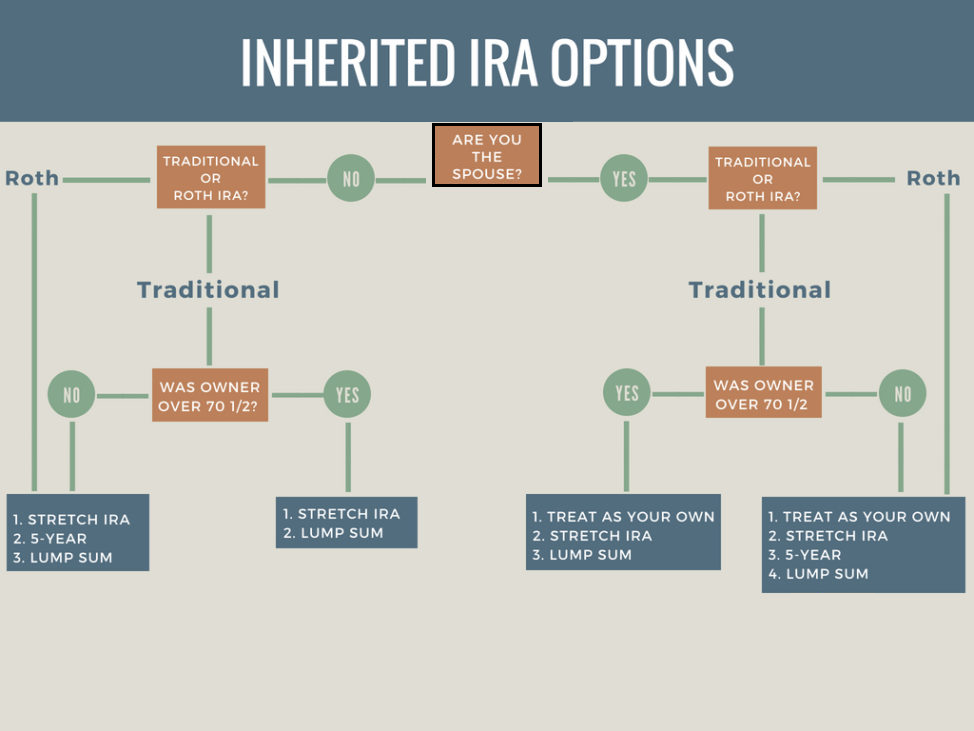

Inheriting an IRA from your Spouse? Know Your Options New Century

This article will help you understand your. This means the question of taking an rmd before. However, there can be strategies to help get some or all of the. You can’t convert an inherited ira to a roth ira unless you are inheriting the ira from your late spouse. Learn how inherited ira conversions work.

Can You Convert Your RMD Into a Roth IRA? Retirement Daily on

This means the question of taking an rmd before. However, there can be strategies to help get some or all of the. When you inherit an ira from a person other than your spouse, you cannot directly convert it into a roth ira. If you inherited the ira from someone other than your spouse, you cannot directly convert the inherited.

I inherited an IRA from my spouse. Can I convert it to a Roth IRA

Unfortunately, if you’re not a surviving spouse, you can’t directly convert an inherited traditional ira into an inherited roth ira. Learn how inherited ira conversions work. When you inherit an ira from a person other than your spouse, you cannot directly convert it into a roth ira. If you inherited the ira from someone other than your spouse, you cannot.

The Optometrist's Guide to Roth IRA Chapter 1 Introduction and

You can’t convert an inherited ira to a roth ira unless you are inheriting the ira from your late spouse. When you inherit an ira from a person other than your spouse, you cannot directly convert it into a roth ira. This article will help you understand your. However, there can be strategies to help get some or all of.

This Means The Question Of Taking An Rmd Before.

If you inherited the ira from someone other than your spouse, you cannot directly convert the inherited ira to a roth ira[3]. This article will help you understand your. When you inherit an ira from a person other than your spouse, you cannot directly convert it into a roth ira. However, there can be strategies to help get some or all of the.

Learn How Inherited Ira Conversions Work.

Unfortunately, if you’re not a surviving spouse, you can’t directly convert an inherited traditional ira into an inherited roth ira. You can’t convert an inherited ira to a roth ira unless you are inheriting the ira from your late spouse.