Change Name On Federal Tax Id

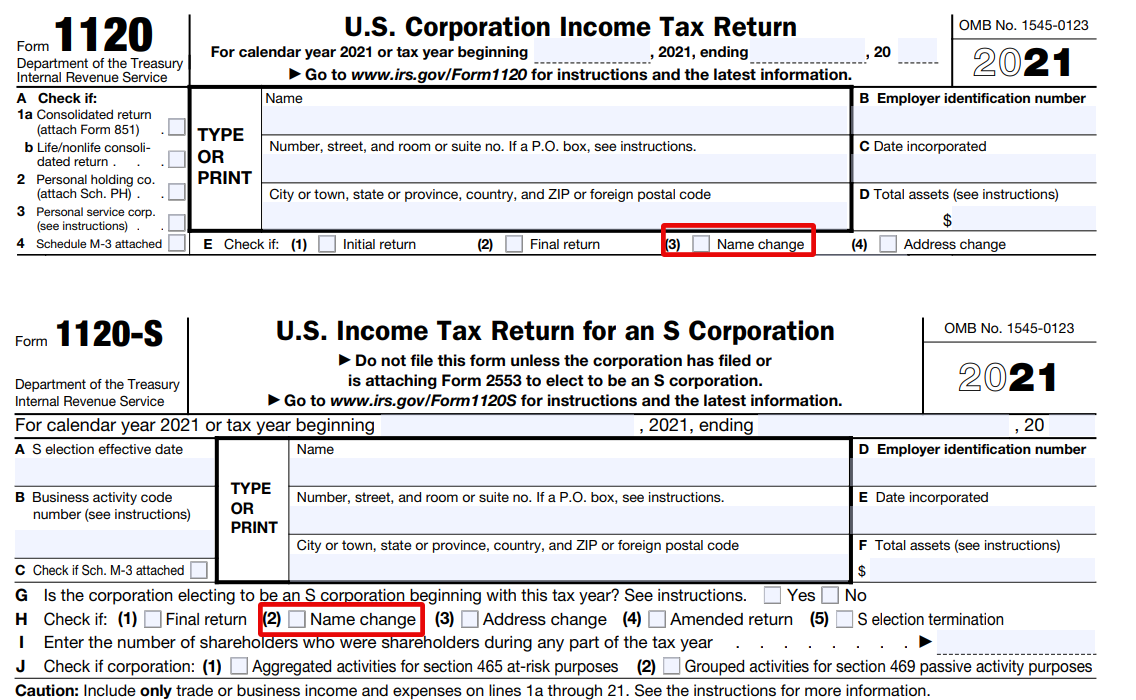

Change Name On Federal Tax Id - Every name on your tax return must match social security administration records. There are a few different methods of changing the name associated with a federal ein depending on business type. Changing the name and address associated with your tax id involves a little paperwork and a certified copy of your marriage license or other. The irs says it is critical to update names with the. The specific action required may vary depending on. Business owners and other authorized individuals can submit a name change for their business. You need a new ein, in general, when you change your entity’s ownership or structure. You don’t need a new ein if you just.

You don’t need a new ein if you just. Business owners and other authorized individuals can submit a name change for their business. You need a new ein, in general, when you change your entity’s ownership or structure. There are a few different methods of changing the name associated with a federal ein depending on business type. Changing the name and address associated with your tax id involves a little paperwork and a certified copy of your marriage license or other. The irs says it is critical to update names with the. Every name on your tax return must match social security administration records. The specific action required may vary depending on.

Every name on your tax return must match social security administration records. Changing the name and address associated with your tax id involves a little paperwork and a certified copy of your marriage license or other. The specific action required may vary depending on. The irs says it is critical to update names with the. You don’t need a new ein if you just. There are a few different methods of changing the name associated with a federal ein depending on business type. Business owners and other authorized individuals can submit a name change for their business. You need a new ein, in general, when you change your entity’s ownership or structure.

How to Change your LLC Name with the IRS? LLC University®

You don’t need a new ein if you just. The specific action required may vary depending on. There are a few different methods of changing the name associated with a federal ein depending on business type. You need a new ein, in general, when you change your entity’s ownership or structure. The irs says it is critical to update names.

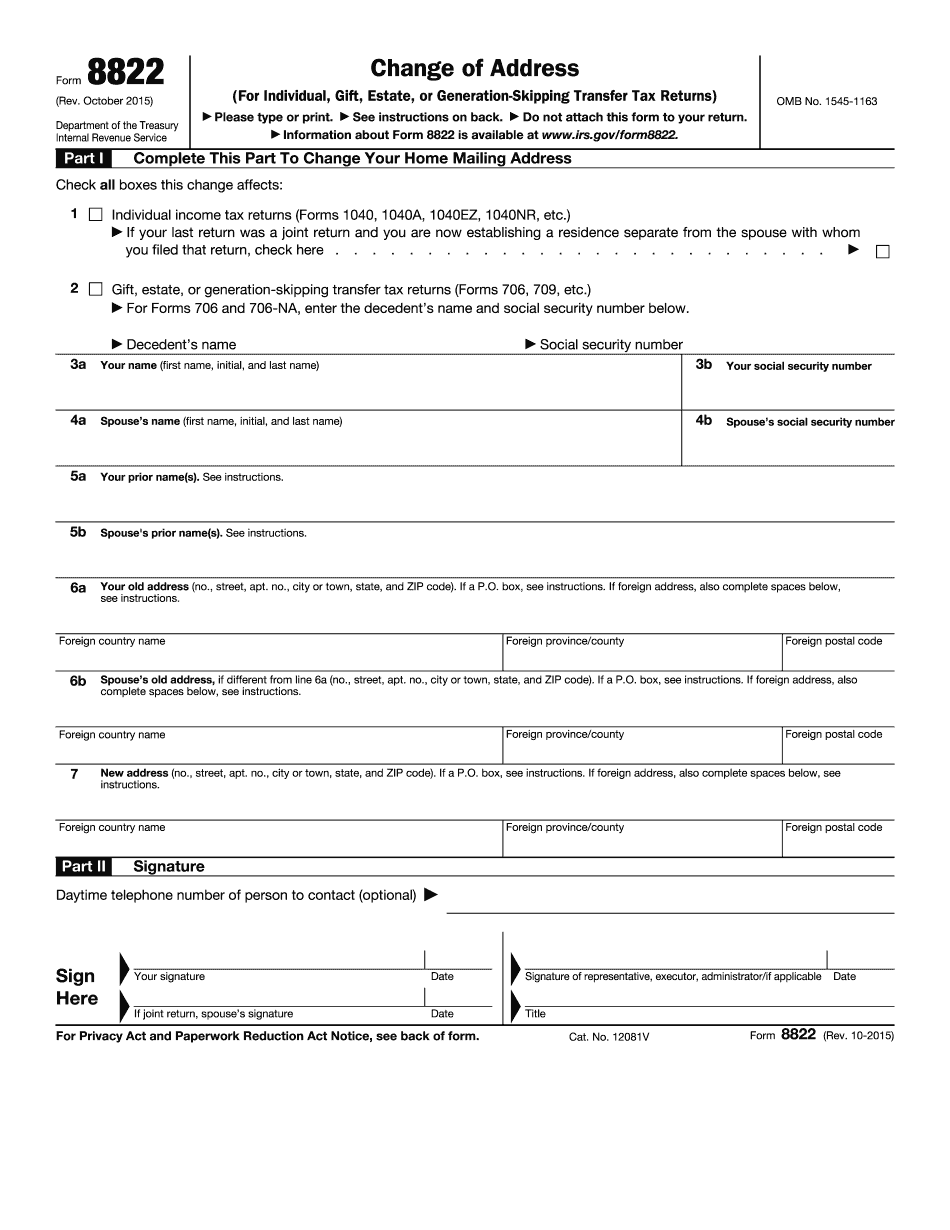

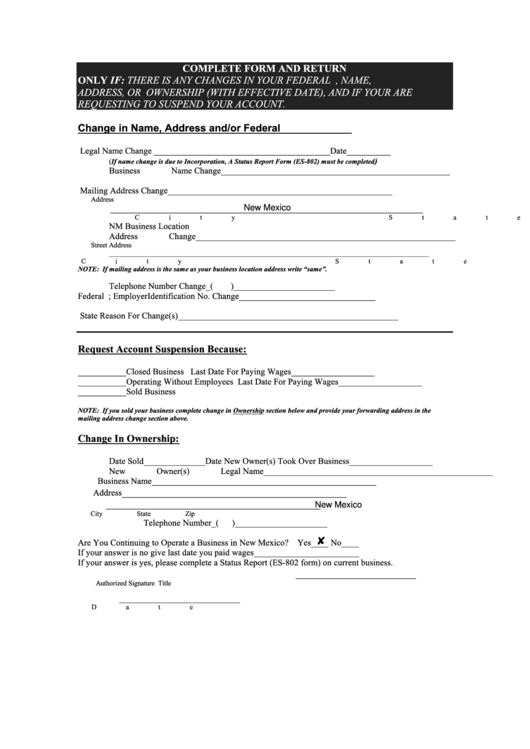

irs name change form Fill Online, Printable, Fillable Blank form

Changing the name and address associated with your tax id involves a little paperwork and a certified copy of your marriage license or other. There are a few different methods of changing the name associated with a federal ein depending on business type. You don’t need a new ein if you just. Business owners and other authorized individuals can submit.

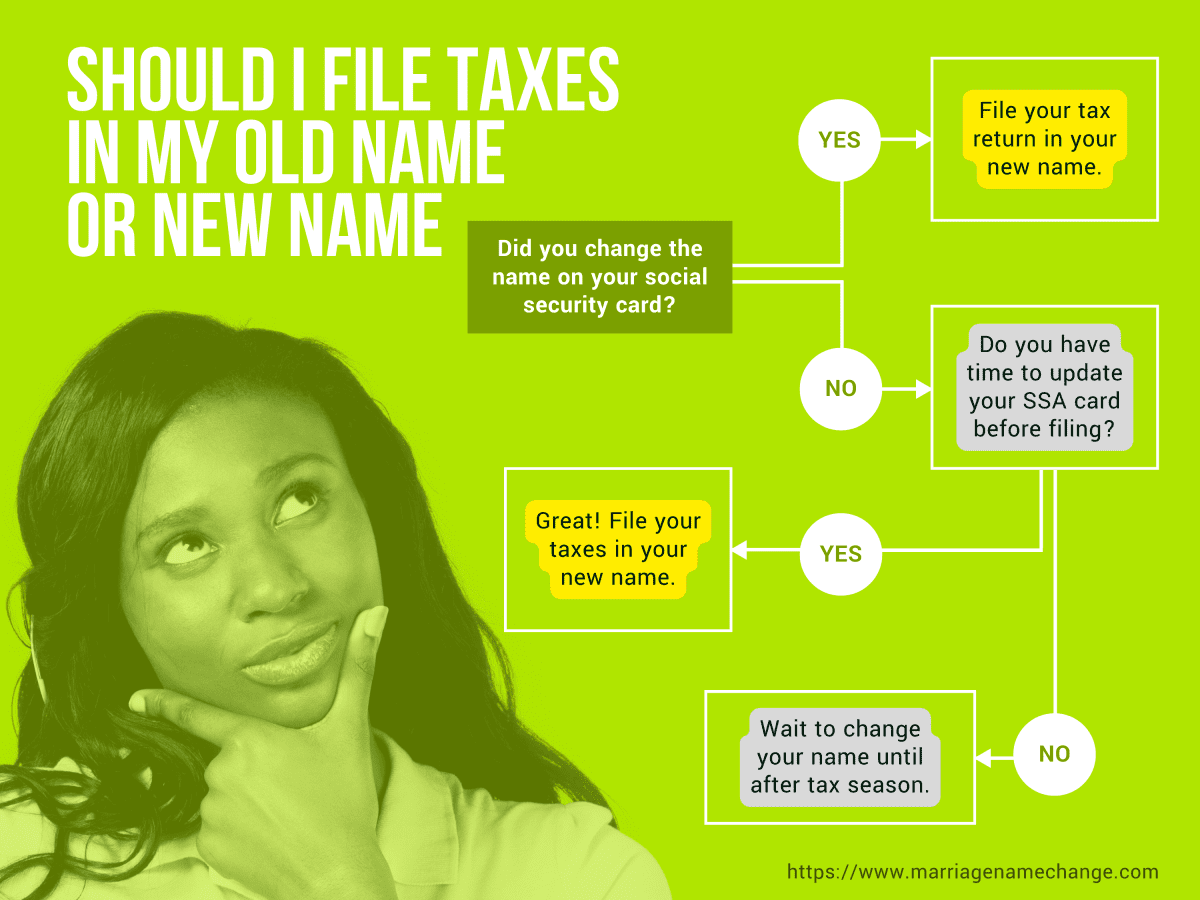

IRS Name Change for Married Taxpayers in 2023 Marriage Name Change

Every name on your tax return must match social security administration records. Business owners and other authorized individuals can submit a name change for their business. Changing the name and address associated with your tax id involves a little paperwork and a certified copy of your marriage license or other. There are a few different methods of changing the name.

How To Change Owner Name On Ein

Every name on your tax return must match social security administration records. You don’t need a new ein if you just. Business owners and other authorized individuals can submit a name change for their business. Changing the name and address associated with your tax id involves a little paperwork and a certified copy of your marriage license or other. The.

IRS Name Change How to file the IRS 8822 MissNowMrs

Changing the name and address associated with your tax id involves a little paperwork and a certified copy of your marriage license or other. The irs says it is critical to update names with the. There are a few different methods of changing the name associated with a federal ein depending on business type. You need a new ein, in.

Top Irs Name Change Form Templates free to download in PDF format

You don’t need a new ein if you just. You need a new ein, in general, when you change your entity’s ownership or structure. The irs says it is critical to update names with the. Business owners and other authorized individuals can submit a name change for their business. There are a few different methods of changing the name associated.

How to Change Your Business Name A Complete Guide

You don’t need a new ein if you just. There are a few different methods of changing the name associated with a federal ein depending on business type. Every name on your tax return must match social security administration records. Changing the name and address associated with your tax id involves a little paperwork and a certified copy of your.

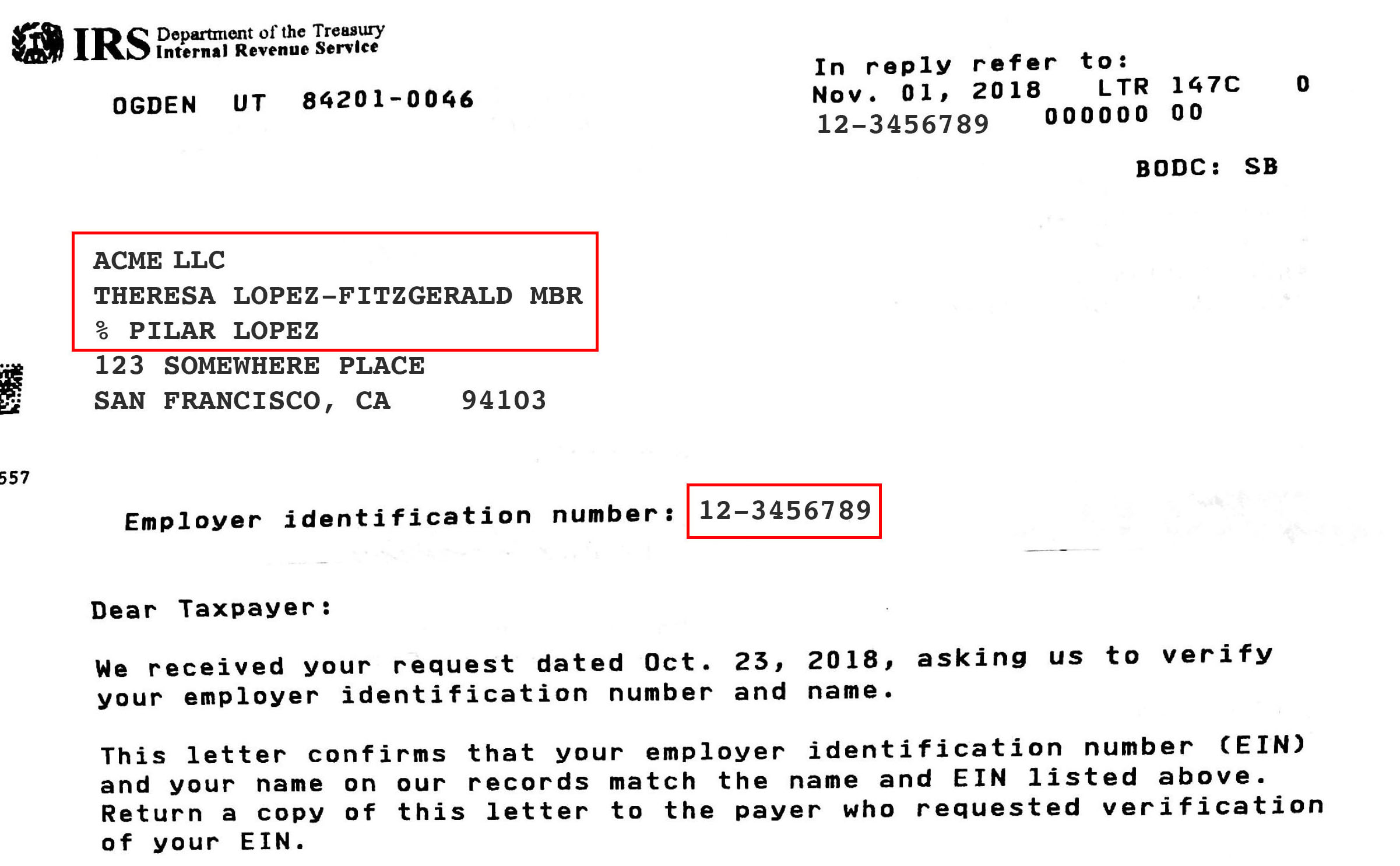

Entering Your US taxpayer Identification Number (TIN) SupplierGATEWAY

Changing the name and address associated with your tax id involves a little paperwork and a certified copy of your marriage license or other. You don’t need a new ein if you just. There are a few different methods of changing the name associated with a federal ein depending on business type. The irs says it is critical to update.

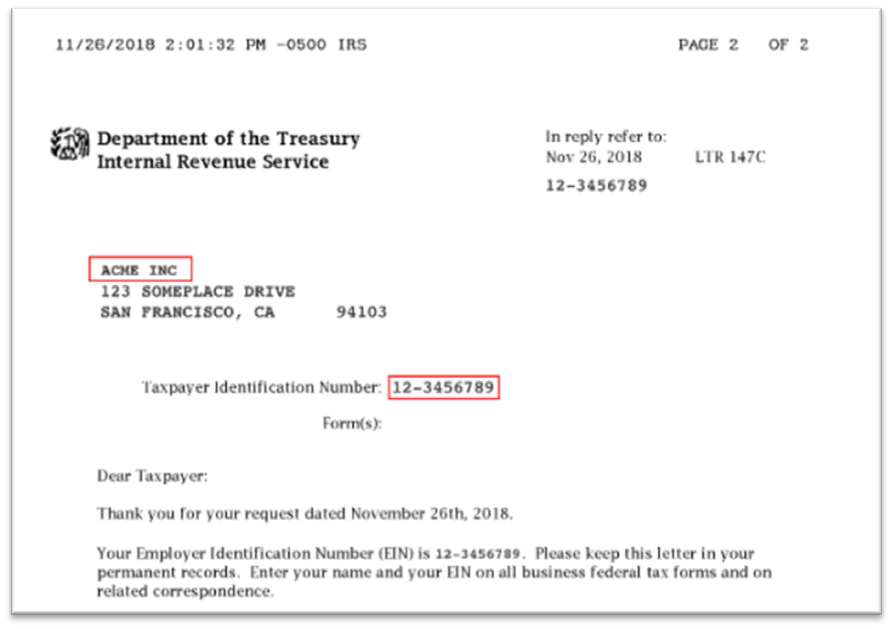

Using IRS documentation as reference when entering business name and

Business owners and other authorized individuals can submit a name change for their business. There are a few different methods of changing the name associated with a federal ein depending on business type. The specific action required may vary depending on. The irs says it is critical to update names with the. You don’t need a new ein if you.

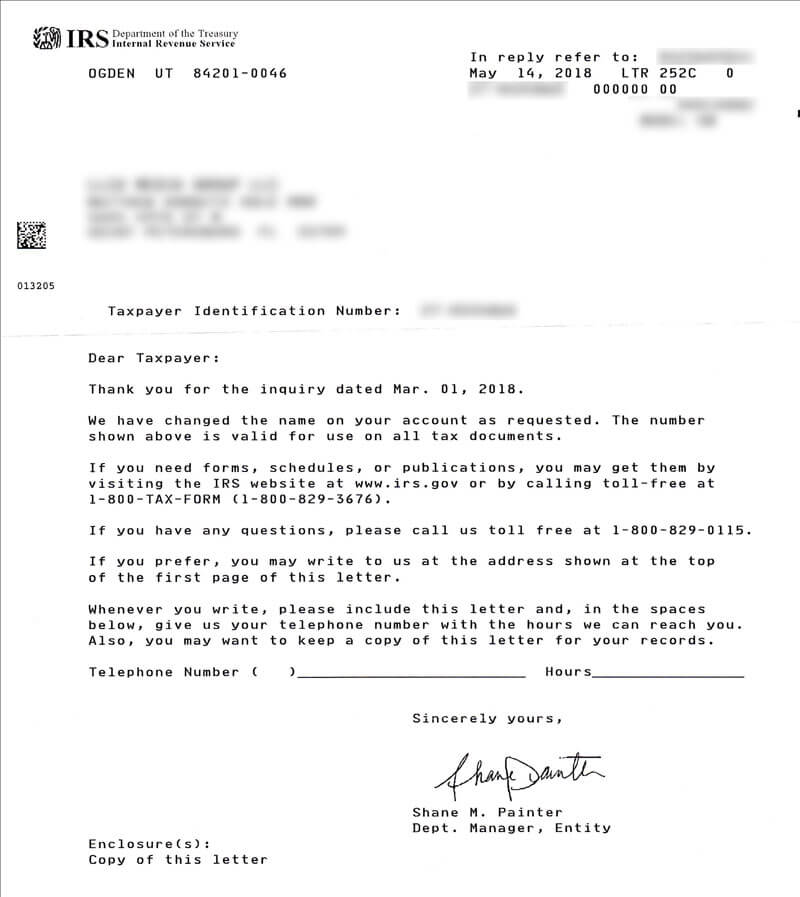

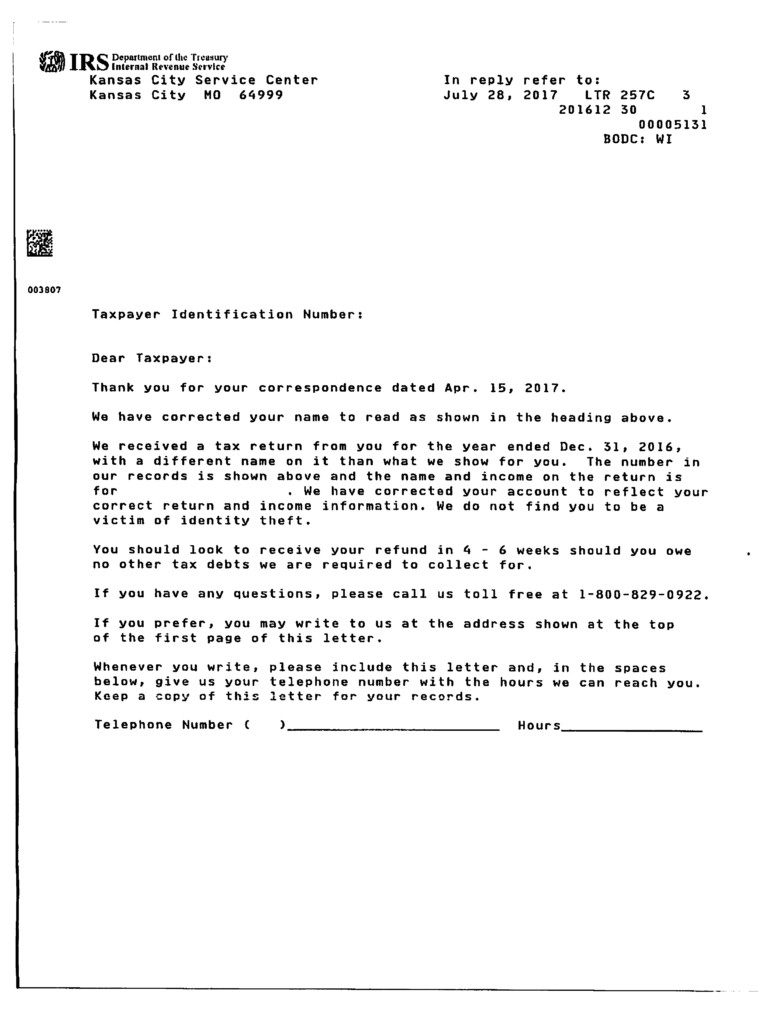

IRS Letter 257C We Corrected Your Name or Taxpayer Identification

There are a few different methods of changing the name associated with a federal ein depending on business type. Every name on your tax return must match social security administration records. You need a new ein, in general, when you change your entity’s ownership or structure. Changing the name and address associated with your tax id involves a little paperwork.

There Are A Few Different Methods Of Changing The Name Associated With A Federal Ein Depending On Business Type.

You need a new ein, in general, when you change your entity’s ownership or structure. The specific action required may vary depending on. Business owners and other authorized individuals can submit a name change for their business. Every name on your tax return must match social security administration records.

You Don’t Need A New Ein If You Just.

Changing the name and address associated with your tax id involves a little paperwork and a certified copy of your marriage license or other. The irs says it is critical to update names with the.