City Of Olympia B O Tax Form

City Of Olympia B O Tax Form - Anyone doing business in olympia must have an active business license and file an olympia b&o tax return at least annually. Olympia levies utility taxes or other municipal taxes on various business activities. The sales tax is a tax on retail. When you file an olympia b&o tax return, enter business revenue in olympia under each appropriate classification. Total tax penalty (% times total tax).00100.00200.00100.00100.00100 day of city treasurer po box 2009 olympia, wa. Visit their website for a list of city b&o tax rates. The municipal research and services center provides information about city b&o taxes. The b&o tax is a tax on the gross receipts of a business, minus any applicable deductions. Utility taxes and other taxes are due quarterly.

Olympia levies utility taxes or other municipal taxes on various business activities. Visit their website for a list of city b&o tax rates. Utility taxes and other taxes are due quarterly. The b&o tax is a tax on the gross receipts of a business, minus any applicable deductions. The municipal research and services center provides information about city b&o taxes. The sales tax is a tax on retail. Anyone doing business in olympia must have an active business license and file an olympia b&o tax return at least annually. When you file an olympia b&o tax return, enter business revenue in olympia under each appropriate classification. Total tax penalty (% times total tax).00100.00200.00100.00100.00100 day of city treasurer po box 2009 olympia, wa.

Olympia levies utility taxes or other municipal taxes on various business activities. When you file an olympia b&o tax return, enter business revenue in olympia under each appropriate classification. Utility taxes and other taxes are due quarterly. Total tax penalty (% times total tax).00100.00200.00100.00100.00100 day of city treasurer po box 2009 olympia, wa. The municipal research and services center provides information about city b&o taxes. The sales tax is a tax on retail. Visit their website for a list of city b&o tax rates. The b&o tax is a tax on the gross receipts of a business, minus any applicable deductions. Anyone doing business in olympia must have an active business license and file an olympia b&o tax return at least annually.

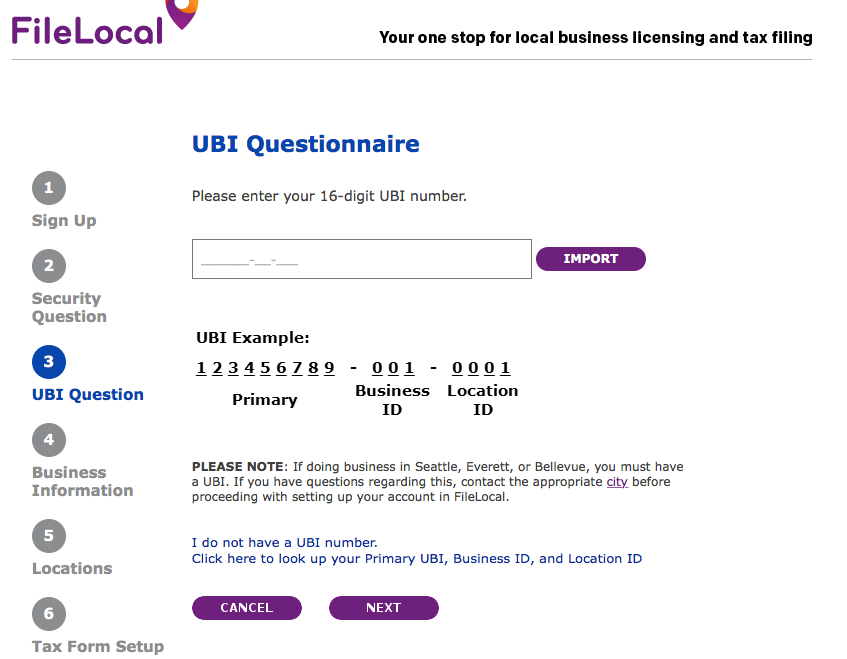

Meet FileLocal Seattle's New Portal for License Renewal and B & O Tax

Utility taxes and other taxes are due quarterly. The b&o tax is a tax on the gross receipts of a business, minus any applicable deductions. Anyone doing business in olympia must have an active business license and file an olympia b&o tax return at least annually. The municipal research and services center provides information about city b&o taxes. Olympia levies.

Discover Olympia Washington A Pacific Northwest Adventure

Visit their website for a list of city b&o tax rates. Olympia levies utility taxes or other municipal taxes on various business activities. The b&o tax is a tax on the gross receipts of a business, minus any applicable deductions. The sales tax is a tax on retail. When you file an olympia b&o tax return, enter business revenue in.

b&o tax form Good It Webzine Photographic Exhibit

The b&o tax is a tax on the gross receipts of a business, minus any applicable deductions. Utility taxes and other taxes are due quarterly. The sales tax is a tax on retail. Olympia levies utility taxes or other municipal taxes on various business activities. When you file an olympia b&o tax return, enter business revenue in olympia under each.

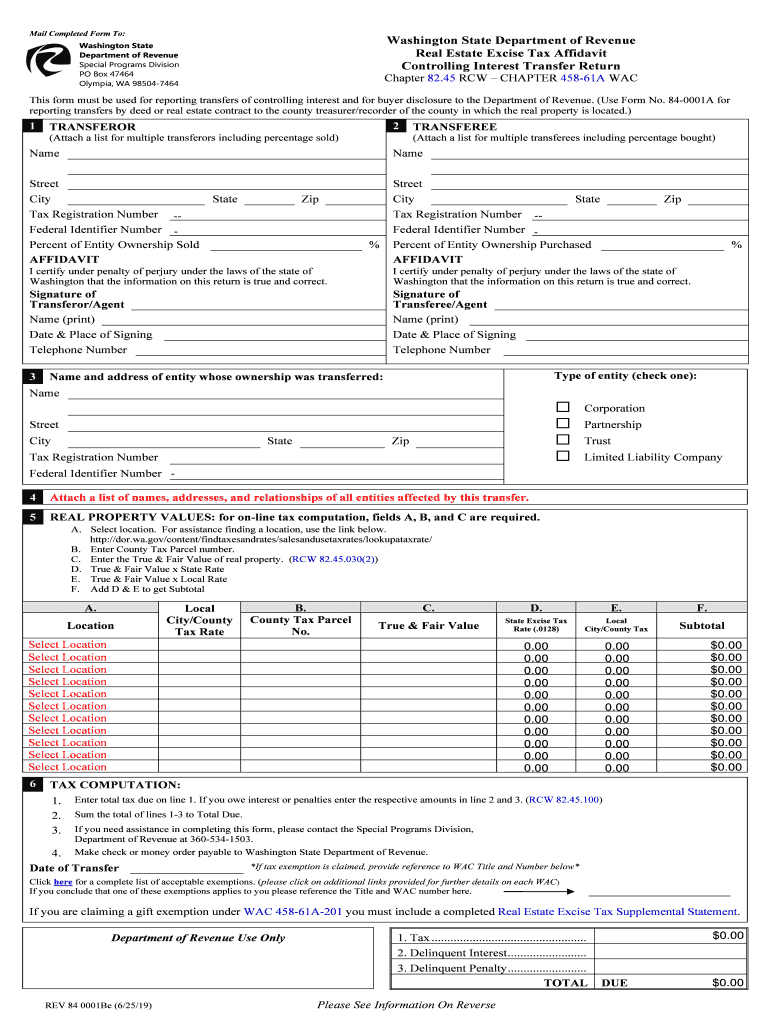

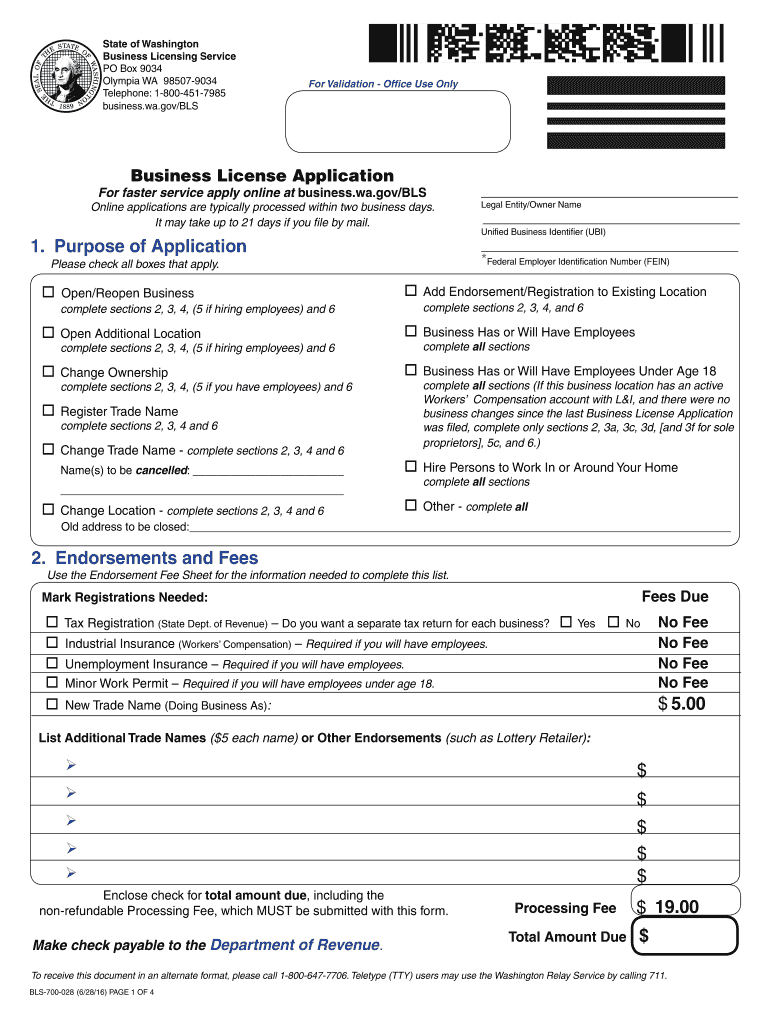

Fillable US Washington Tax Forms Samples to Complete Fill Out and

Utility taxes and other taxes are due quarterly. Olympia levies utility taxes or other municipal taxes on various business activities. The municipal research and services center provides information about city b&o taxes. The b&o tax is a tax on the gross receipts of a business, minus any applicable deductions. Total tax penalty (% times total tax).00100.00200.00100.00100.00100 day of city treasurer.

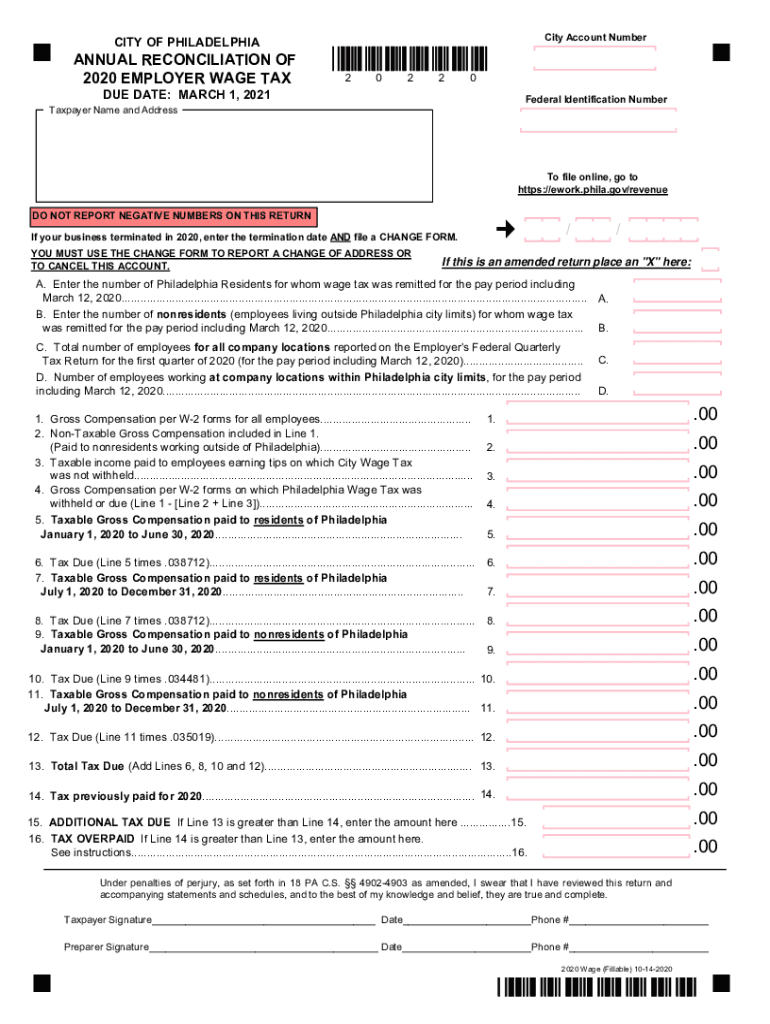

PA Annual Reconciliation Of Employer Wage Tax City Of Philadelphia

Total tax penalty (% times total tax).00100.00200.00100.00100.00100 day of city treasurer po box 2009 olympia, wa. The b&o tax is a tax on the gross receipts of a business, minus any applicable deductions. Anyone doing business in olympia must have an active business license and file an olympia b&o tax return at least annually. The municipal research and services center.

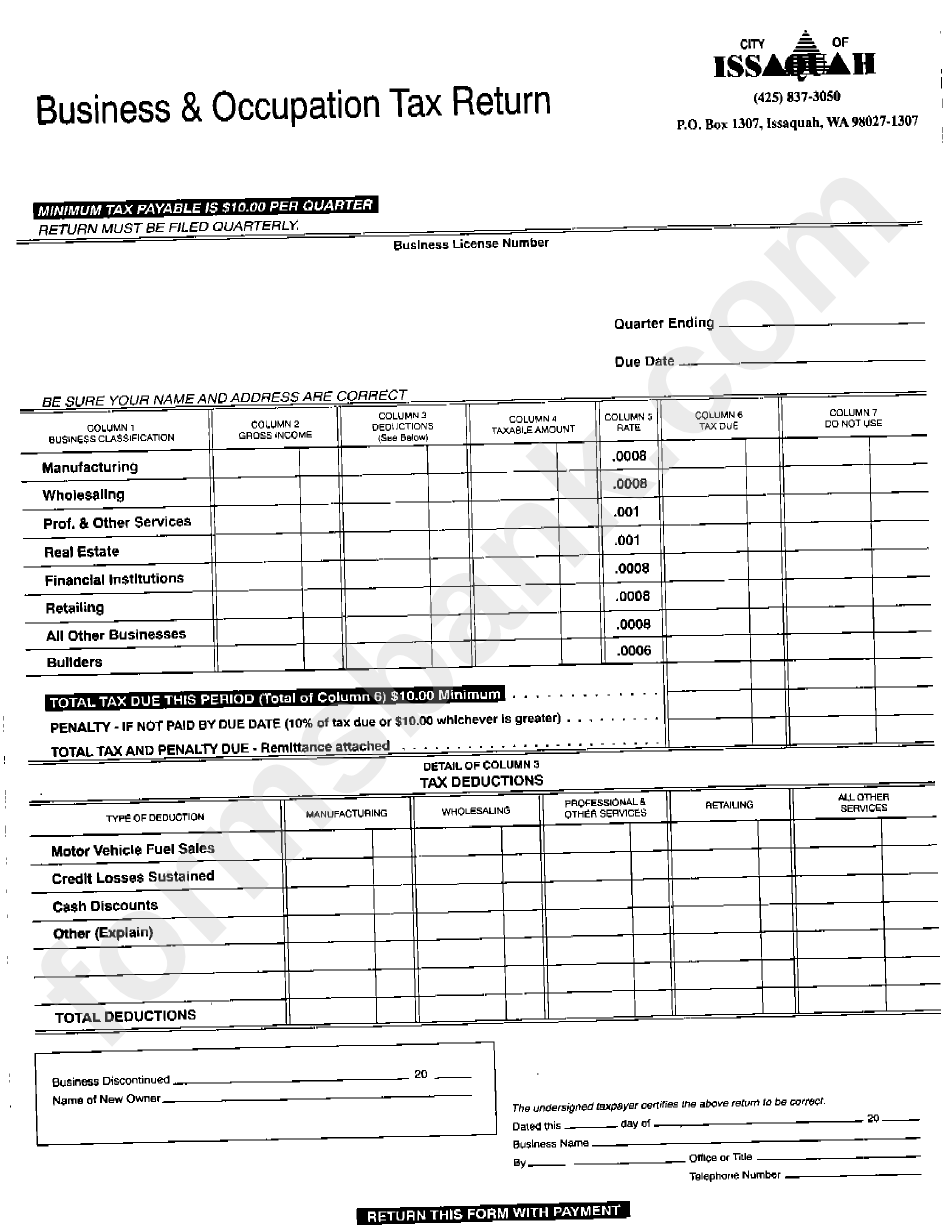

Business And Occupation Tax Return Form printable pdf download

Visit their website for a list of city b&o tax rates. Olympia levies utility taxes or other municipal taxes on various business activities. Utility taxes and other taxes are due quarterly. When you file an olympia b&o tax return, enter business revenue in olympia under each appropriate classification. The municipal research and services center provides information about city b&o taxes.

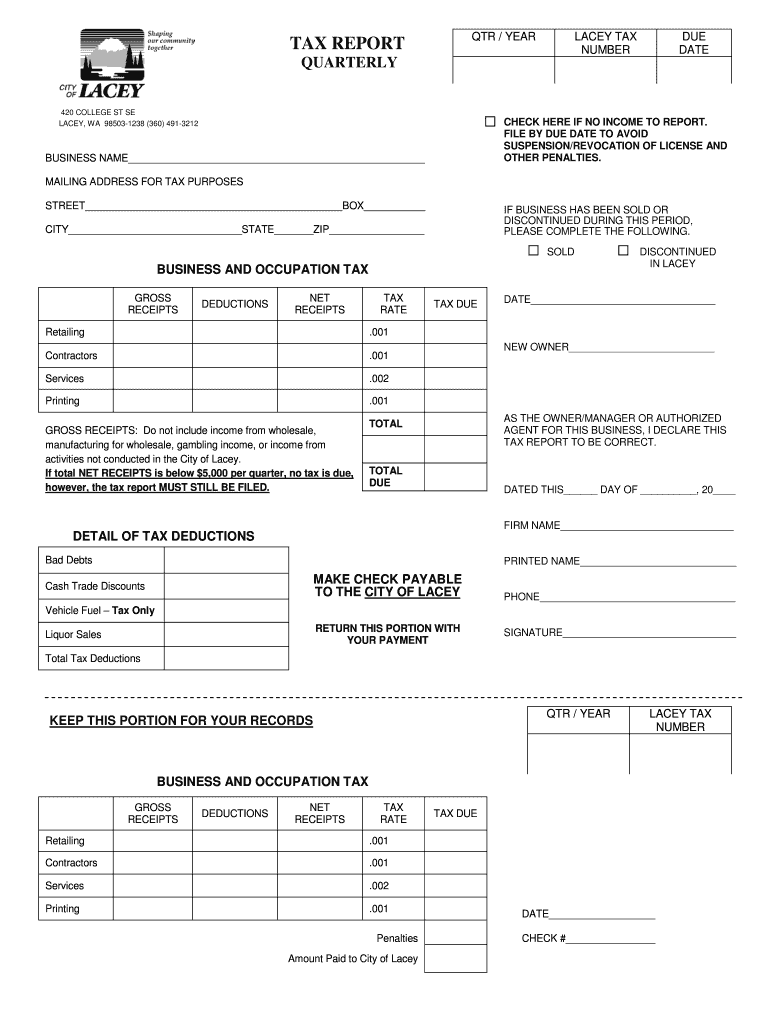

City Of Lacey B O Tax Form Fill Online, Printable, Fillable, Blank

When you file an olympia b&o tax return, enter business revenue in olympia under each appropriate classification. Utility taxes and other taxes are due quarterly. The municipal research and services center provides information about city b&o taxes. Visit their website for a list of city b&o tax rates. Total tax penalty (% times total tax).00100.00200.00100.00100.00100 day of city treasurer po.

Inside Olympia Examining Washington's Tax System TVW

Olympia levies utility taxes or other municipal taxes on various business activities. Total tax penalty (% times total tax).00100.00200.00100.00100.00100 day of city treasurer po box 2009 olympia, wa. Utility taxes and other taxes are due quarterly. The sales tax is a tax on retail. When you file an olympia b&o tax return, enter business revenue in olympia under each appropriate.

1099 Form 2023 Printable Free Pdf One Page

The municipal research and services center provides information about city b&o taxes. Visit their website for a list of city b&o tax rates. The b&o tax is a tax on the gross receipts of a business, minus any applicable deductions. Utility taxes and other taxes are due quarterly. Anyone doing business in olympia must have an active business license and.

2023 Form 1040 Printable Fill Out And Sign Online Dochub Porn Sex Picture

Utility taxes and other taxes are due quarterly. Anyone doing business in olympia must have an active business license and file an olympia b&o tax return at least annually. When you file an olympia b&o tax return, enter business revenue in olympia under each appropriate classification. The municipal research and services center provides information about city b&o taxes. Visit their.

Utility Taxes And Other Taxes Are Due Quarterly.

Anyone doing business in olympia must have an active business license and file an olympia b&o tax return at least annually. When you file an olympia b&o tax return, enter business revenue in olympia under each appropriate classification. Visit their website for a list of city b&o tax rates. The b&o tax is a tax on the gross receipts of a business, minus any applicable deductions.

Total Tax Penalty (% Times Total Tax).00100.00200.00100.00100.00100 Day Of City Treasurer Po Box 2009 Olympia, Wa.

Olympia levies utility taxes or other municipal taxes on various business activities. The sales tax is a tax on retail. The municipal research and services center provides information about city b&o taxes.