Colorado Senior Property Tax Exemption Form

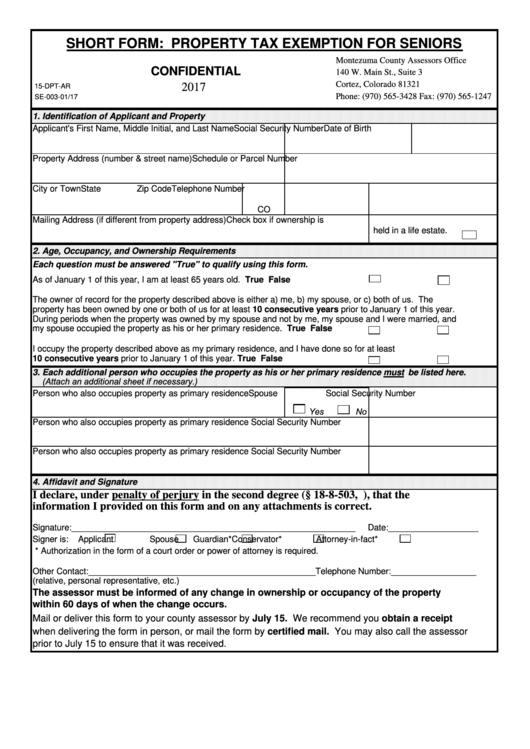

Colorado Senior Property Tax Exemption Form - Senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and the surviving spouses of. Explore the attached documents for more information regarding the senior property tax exemption! Senior citizens in colorado property tax exemption. Senior exemption application form for applicants confined to a nursing home, surviving spouses or whose property is owned by a trust or. A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified. The senior property tax exemption is available to senior citizens and the surviving. We recommend you obtain a receipt when delivering the form in person, or mail the. Mail or deliver this form to your county assessor by july 15.

We recommend you obtain a receipt when delivering the form in person, or mail the. Senior citizens in colorado property tax exemption. Mail or deliver this form to your county assessor by july 15. Senior exemption application form for applicants confined to a nursing home, surviving spouses or whose property is owned by a trust or. A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified. The senior property tax exemption is available to senior citizens and the surviving. Senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and the surviving spouses of. A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. Explore the attached documents for more information regarding the senior property tax exemption!

Explore the attached documents for more information regarding the senior property tax exemption! Mail or deliver this form to your county assessor by july 15. Senior exemption application form for applicants confined to a nursing home, surviving spouses or whose property is owned by a trust or. The senior property tax exemption is available to senior citizens and the surviving. We recommend you obtain a receipt when delivering the form in person, or mail the. Senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and the surviving spouses of. Senior citizens in colorado property tax exemption. A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified. A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified.

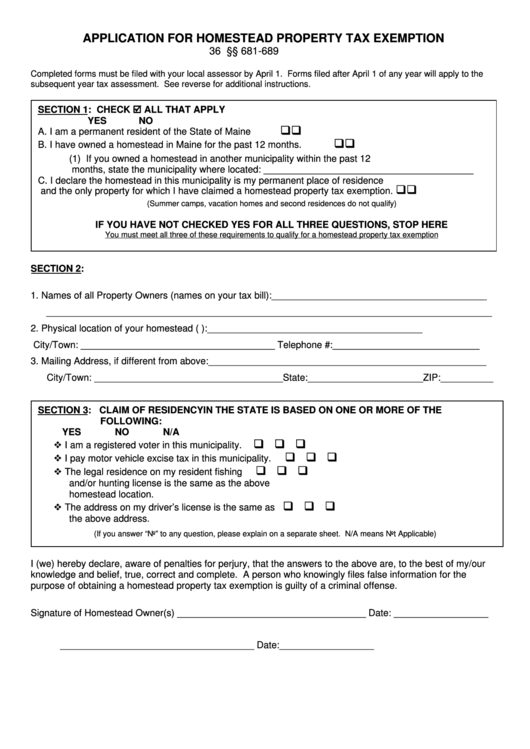

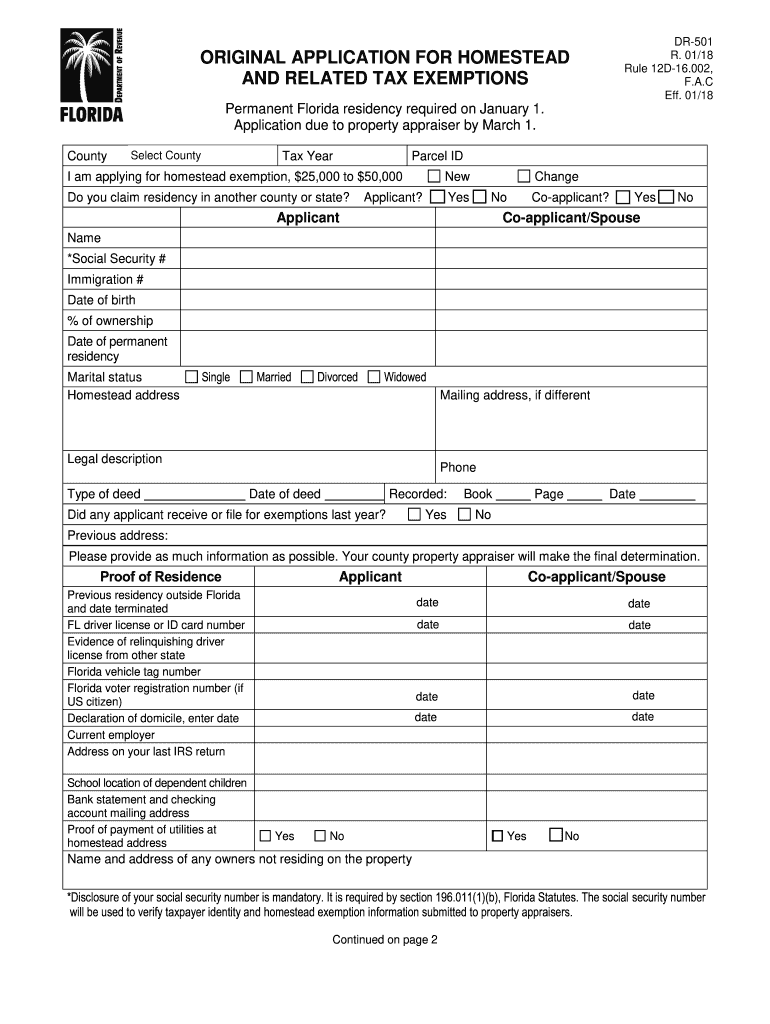

Free Printable Homestead Tax Form Printable Forms Free Online

We recommend you obtain a receipt when delivering the form in person, or mail the. Explore the attached documents for more information regarding the senior property tax exemption! The senior property tax exemption is available to senior citizens and the surviving. Senior exemption application form for applicants confined to a nursing home, surviving spouses or whose property is owned by.

How Much Is The Tax Exemption For 2024 Alisa Florida

Explore the attached documents for more information regarding the senior property tax exemption! The senior property tax exemption is available to senior citizens and the surviving. Mail or deliver this form to your county assessor by july 15. We recommend you obtain a receipt when delivering the form in person, or mail the. Senior citizens in colorado property tax exemption.

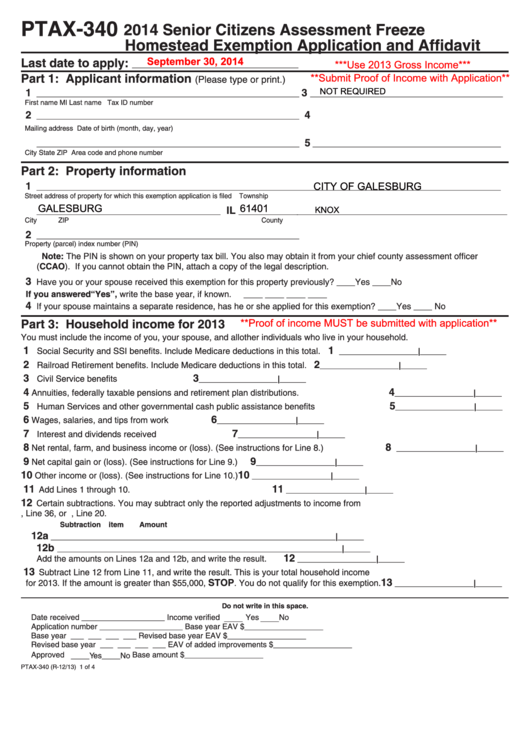

2020 Colorado Senior Property Tax Exemption Funded

Mail or deliver this form to your county assessor by july 15. Senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and the surviving spouses of. A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. The senior property tax exemption is available to senior.

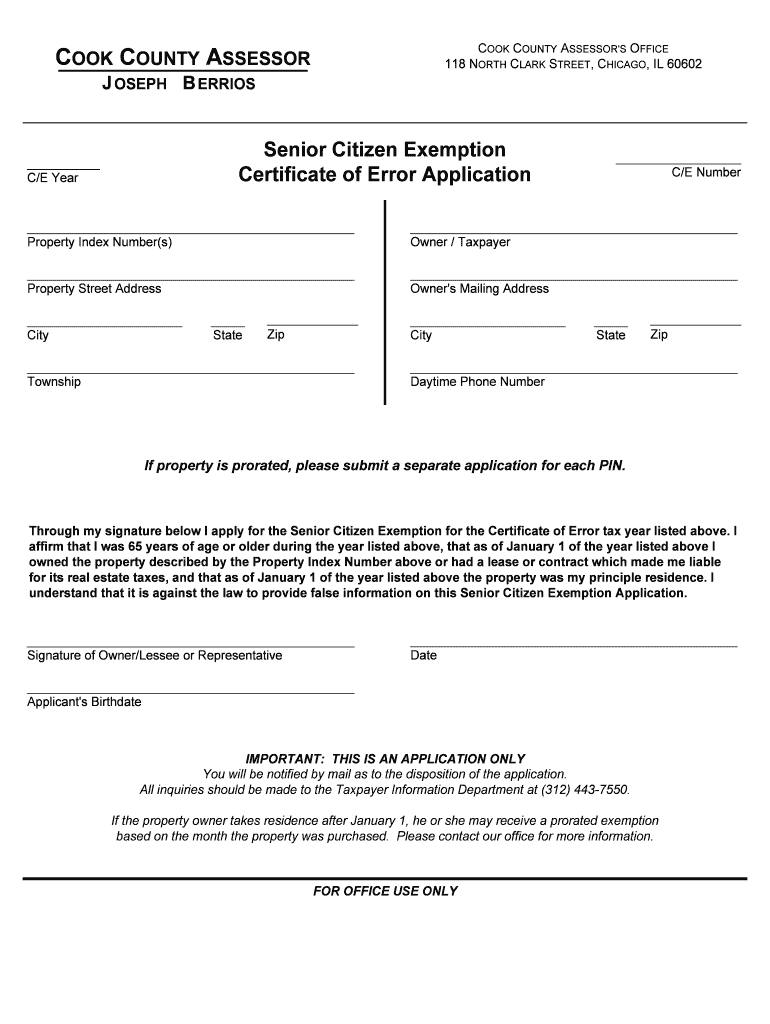

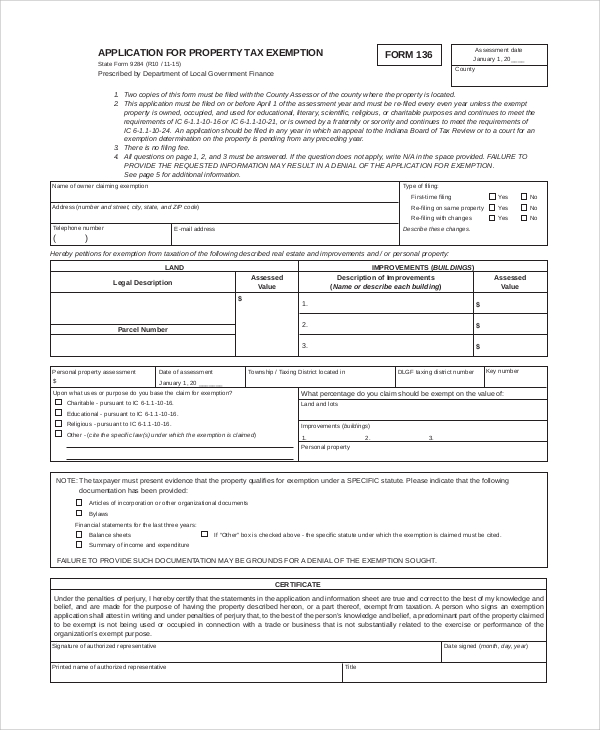

Fillable 201 Taxpayer Exemption Application Cook County Assessor

A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. Mail or deliver this form to your county assessor by july 15. The senior property tax exemption is available to senior citizens and the surviving. A property tax exemption is available to qualifying senior citizens and the surviving spouses of those.

Colorado Homestead Exemption 2024 Ynes Amelita

Senior exemption application form for applicants confined to a nursing home, surviving spouses or whose property is owned by a trust or. Senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and the surviving spouses of. A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously.

Hillsborough County Homestead Application 20182024 Form Fill Out and

Explore the attached documents for more information regarding the senior property tax exemption! Senior exemption application form for applicants confined to a nursing home, surviving spouses or whose property is owned by a trust or. Mail or deliver this form to your county assessor by july 15. Senior property tax homestead exemption a property tax exemption is available to qualifying.

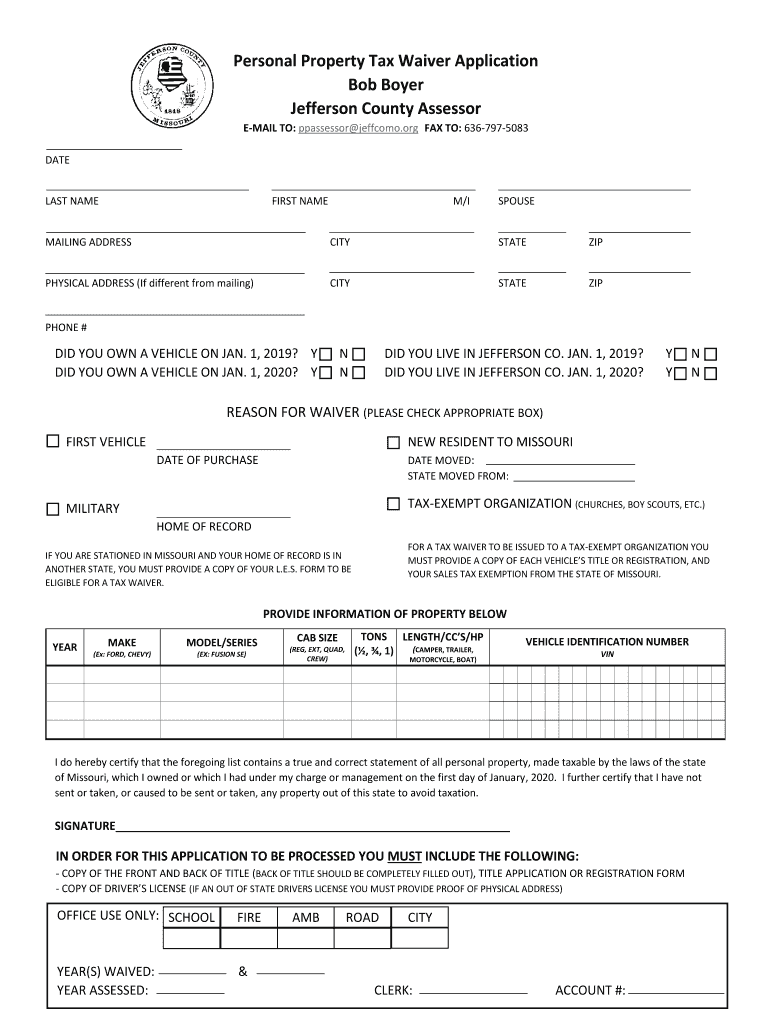

Jefferson county mo real estate taxes Fill out & sign online DocHub

Senior citizens in colorado property tax exemption. Mail or deliver this form to your county assessor by july 15. Senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and the surviving spouses of. We recommend you obtain a receipt when delivering the form in person, or mail the. Explore the attached documents for more.

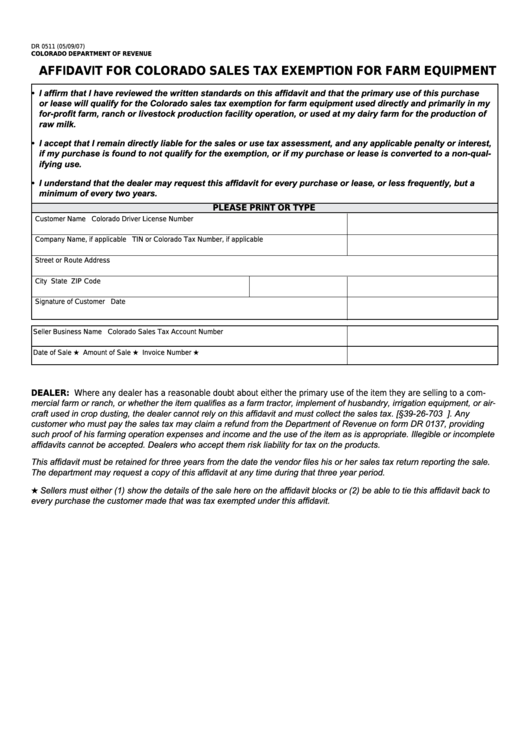

Colorado Sales Tax Exemption Form For Contractors

A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified. Explore the attached documents for more information regarding the senior property tax exemption! Senior citizens in colorado property tax exemption. Senior exemption.

Which States Offer Disabled Veteran Property Tax Exemptions?

Senior citizens in colorado property tax exemption. Mail or deliver this form to your county assessor by july 15. The senior property tax exemption is available to senior citizens and the surviving. A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified. Senior exemption application form for applicants confined to a.

Tax Exempt Form TAX

Explore the attached documents for more information regarding the senior property tax exemption! A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. Senior citizens in colorado property tax exemption. A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified. Senior exemption.

The Senior Property Tax Exemption Is Available To Senior Citizens And The Surviving.

Senior exemption application form for applicants confined to a nursing home, surviving spouses or whose property is owned by a trust or. A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified. Mail or deliver this form to your county assessor by july 15. Senior citizens in colorado property tax exemption.

We Recommend You Obtain A Receipt When Delivering The Form In Person, Or Mail The.

A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. Senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and the surviving spouses of. Explore the attached documents for more information regarding the senior property tax exemption!