Columbus Ohio Income Tax Forms

Columbus Ohio Income Tax Forms - Taxpayers who owe $200 or more in tax for the current tax year (part a line 8) are required to make quarterly estimated tax payments. For options to obtain paper forms from the ohio department of taxation: Payments can be made on crisp (crisp.columbus.gov) or. Declaration and estimated tax payments must be made separately from your tax return. We strongly recommend you file and pay with our new online tax portal, crisp. It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). We strongly recommend you file and pay with our new online tax portal, crisp. It is quick, secure and convenient! It is quick, secure and convenient!

Declaration and estimated tax payments must be made separately from your tax return. We strongly recommend you file and pay with our new online tax portal, crisp. It is quick, secure and convenient! For options to obtain paper forms from the ohio department of taxation: Taxpayers who owe $200 or more in tax for the current tax year (part a line 8) are required to make quarterly estimated tax payments. We strongly recommend you file and pay with our new online tax portal, crisp. It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal, crisp. Click here to download paper forms; Payments can be made on crisp (crisp.columbus.gov) or.

It is quick, secure and convenient! Taxpayers who owe $200 or more in tax for the current tax year (part a line 8) are required to make quarterly estimated tax payments. It is quick, secure and convenient! It is quick, secure and convenient! It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal, crisp. We strongly recommend you file and pay with our new online tax portal, crisp. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). Payments can be made on crisp (crisp.columbus.gov) or. Click here to download paper forms;

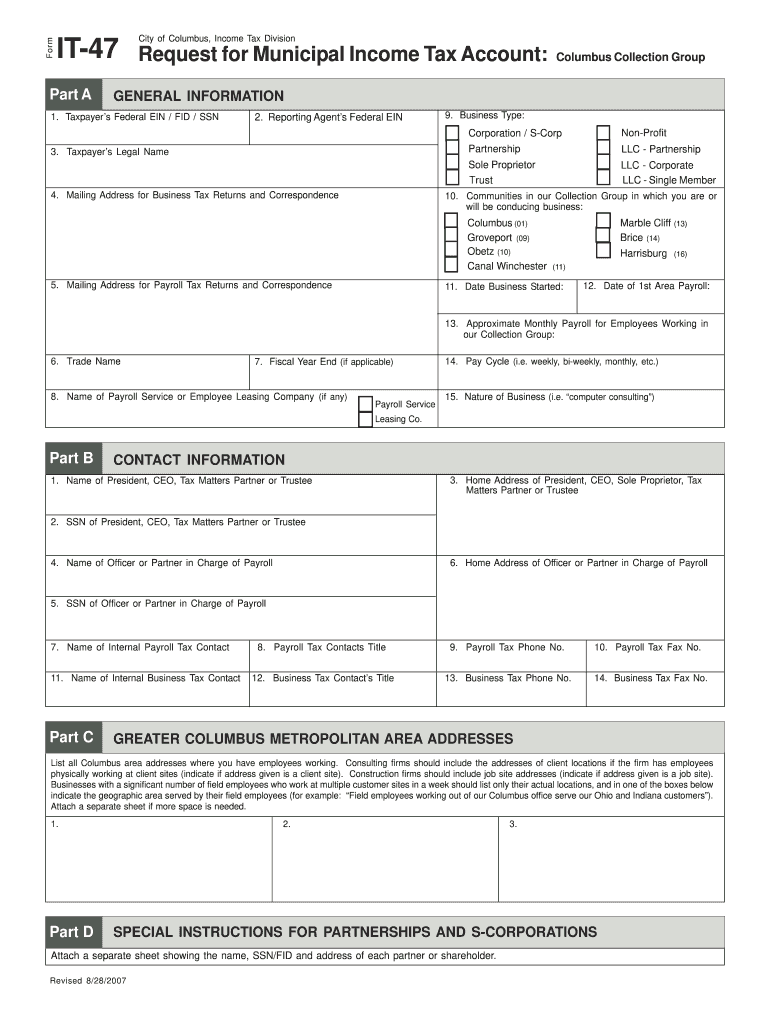

Form it 47 Request for Municipal Tax Account Columbus Tax

We strongly recommend you file and pay with our new online tax portal, crisp. It is quick, secure and convenient! Click here to download paper forms; It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov).

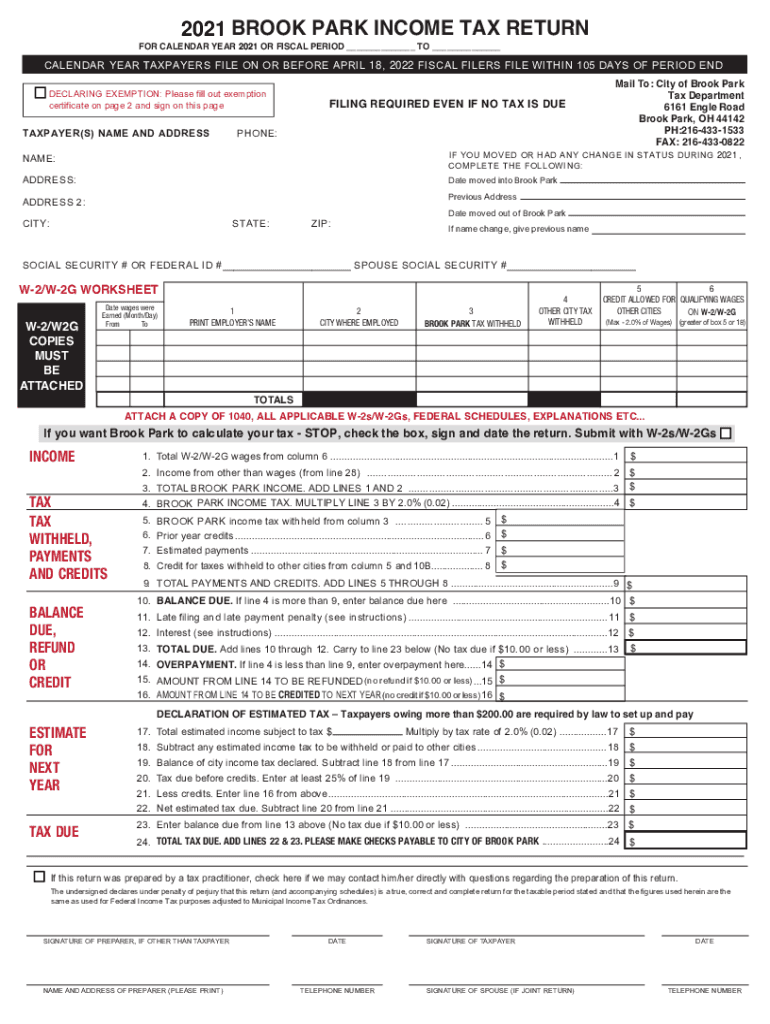

2021 Form OH Brook Park Tax Return Fill Online, Printable

We strongly recommend you file and pay with our new online tax portal, crisp. We strongly recommend you file and pay with our new online tax portal, crisp. Taxpayers who owe $200 or more in tax for the current tax year (part a line 8) are required to make quarterly estimated tax payments. It is quick, secure and convenient! We.

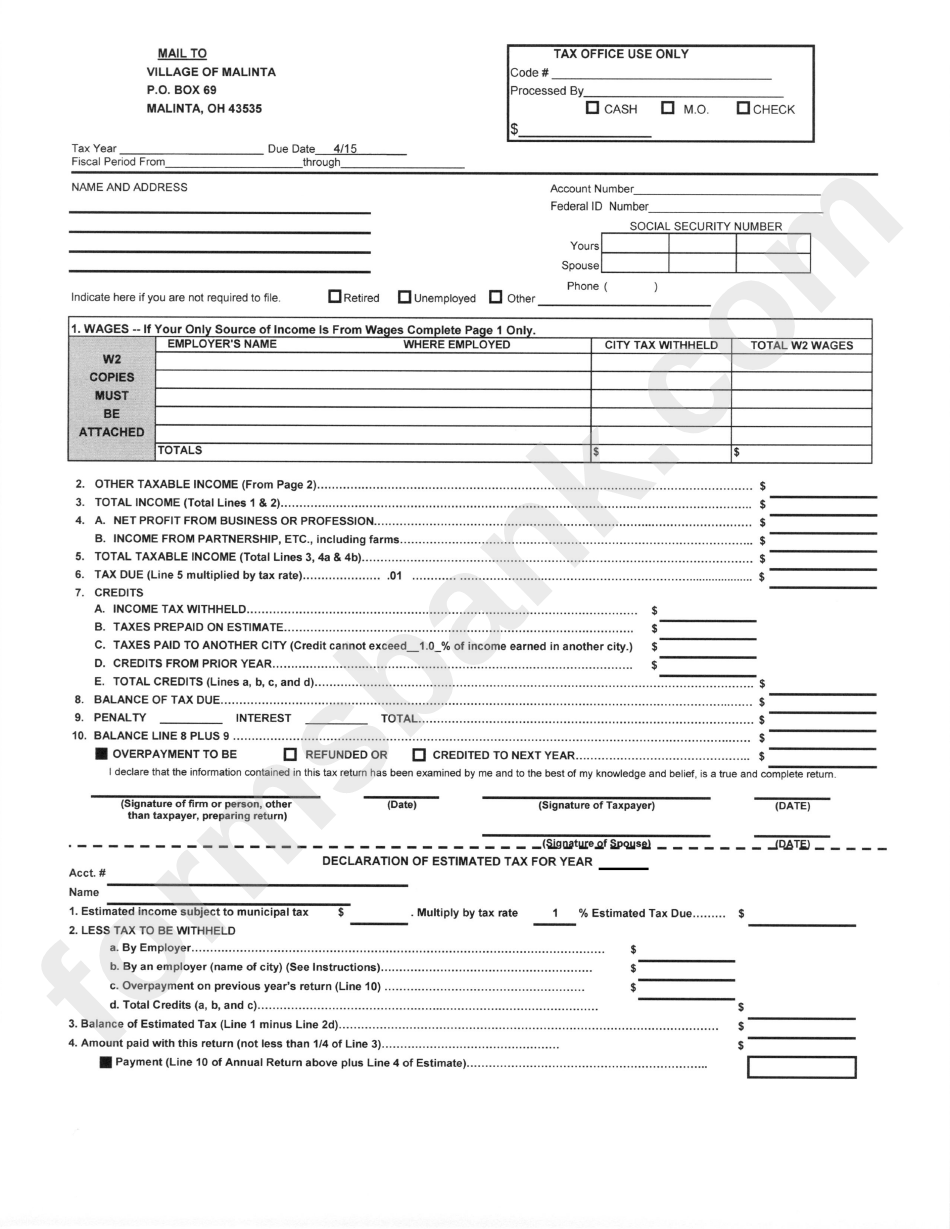

Tax Printable Forms Printable Forms Free Online

It is quick, secure and convenient! Declaration and estimated tax payments must be made separately from your tax return. It is quick, secure and convenient! Taxpayers who owe $200 or more in tax for the current tax year (part a line 8) are required to make quarterly estimated tax payments. For options to obtain paper forms from the ohio department.

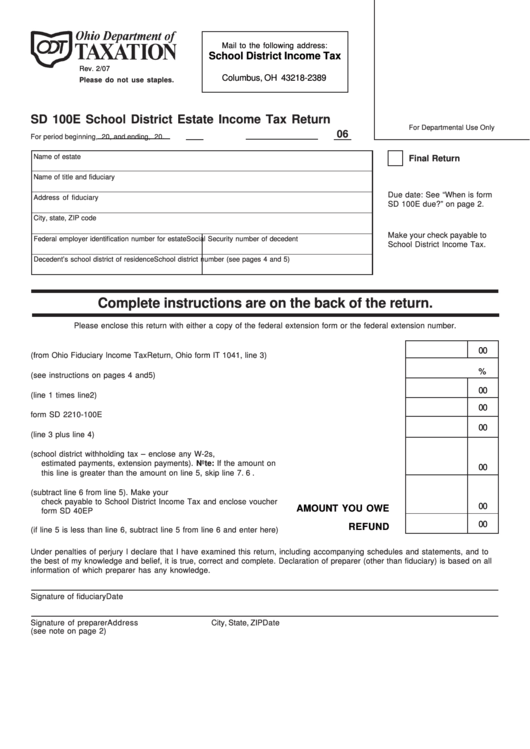

Fillable Form Sd 100e School District Estate Tax Return Form

It is quick, secure and convenient! Taxpayers who owe $200 or more in tax for the current tax year (part a line 8) are required to make quarterly estimated tax payments. We strongly recommend you file and pay with our new online tax portal, crisp. It is quick, secure and convenient! It is quick, secure and convenient!

Ohio tax return individual Fill out & sign online DocHub

Click here to download paper forms; Declaration and estimated tax payments must be made separately from your tax return. It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal, crisp. It is quick, secure and convenient!

Fillable Online City of Columbus Tax Division Instructions for

Taxpayers who owe $200 or more in tax for the current tax year (part a line 8) are required to make quarterly estimated tax payments. Payments can be made on crisp (crisp.columbus.gov) or. We strongly recommend you file and pay with our new online tax portal, crisp. It is quick, secure and convenient! It is quick, secure and convenient!

OH Tax Return Bryan City 20182022 Fill and Sign Printable

Click here to download paper forms; We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). For options to obtain paper forms from the ohio department of taxation: It is quick, secure and convenient! It is quick, secure and convenient!

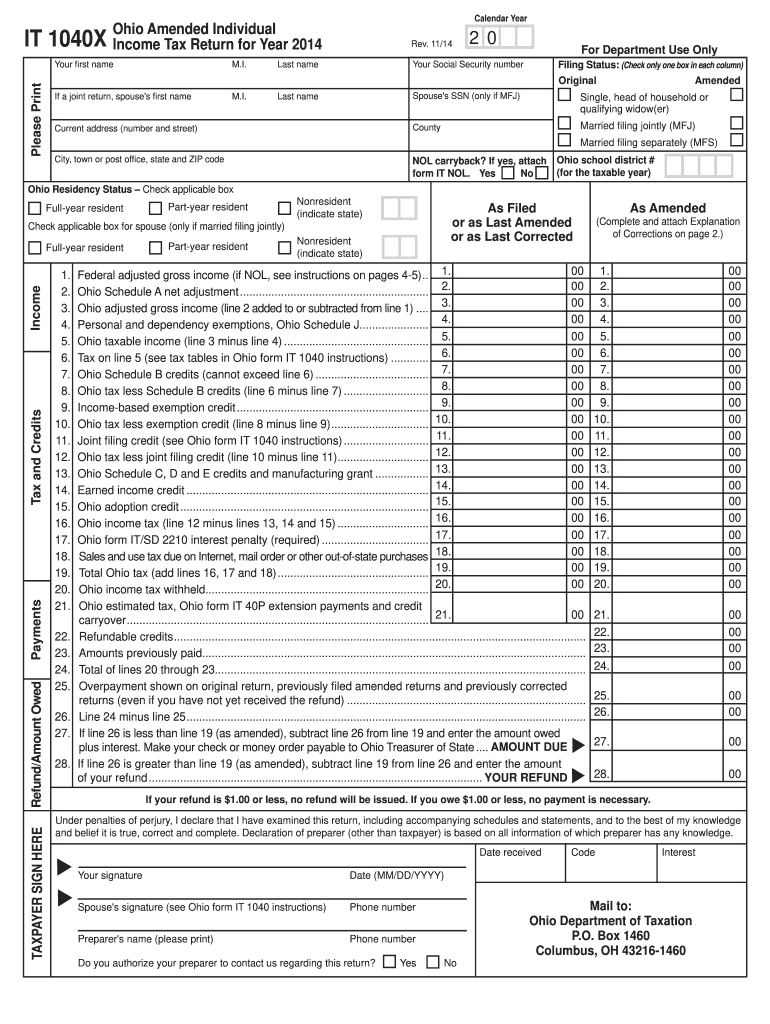

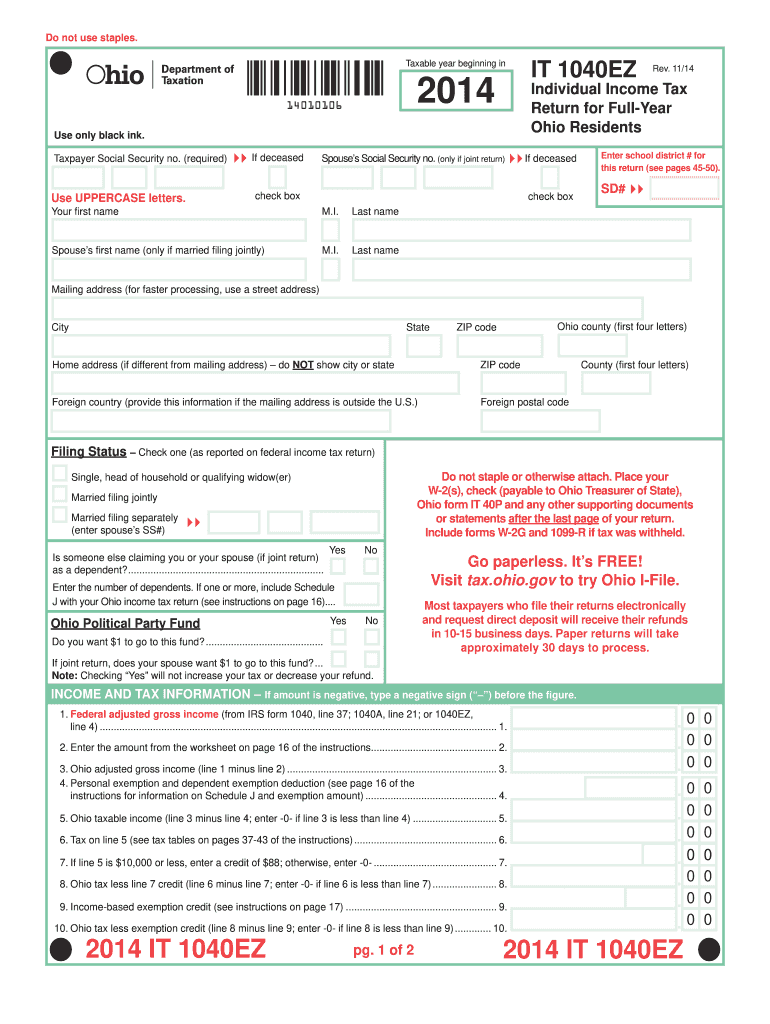

Ohio 00 20142024 Form Fill Out and Sign Printable PDF Template

We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal, crisp. We strongly recommend you file and pay with our new online tax portal, crisp. It is quick, secure and convenient!

2014 ohio tax Fill out & sign online DocHub

We strongly recommend you file and pay with our new online tax portal, crisp. Click here to download paper forms; It is quick, secure and convenient! It is quick, secure and convenient! It is quick, secure and convenient!

Fillable Online tax ohio Ohio Tax Forms 2020 (for Tax Year

Payments can be made on crisp (crisp.columbus.gov) or. It is quick, secure and convenient! It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). We strongly recommend you file and pay with our new online tax portal, crisp.

We Strongly Recommend You File And Pay With Our New Online Tax Portal, Crisp.

Click here to download paper forms; It is quick, secure and convenient! For options to obtain paper forms from the ohio department of taxation: We strongly recommend you file and pay with our new online tax portal, crisp.

We Strongly Recommend You File And Pay With Our New Online Tax Portal, Crisp.

Payments can be made on crisp (crisp.columbus.gov) or. Taxpayers who owe $200 or more in tax for the current tax year (part a line 8) are required to make quarterly estimated tax payments. It is quick, secure and convenient! It is quick, secure and convenient!

Declaration And Estimated Tax Payments Must Be Made Separately From Your Tax Return.

We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). It is quick, secure and convenient!