Cook County Il Tax Liens

Cook County Il Tax Liens - Use your property index number to see if your property has any sold, forfeited or open taxes. With the case number search, you may use either the. Search >> what if i don't have my pin? To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021 and earlier), please enter your property index. When delinquent or unpaid taxes are sold by the cook county treasurer's office, the clerk's office handles the redemption process,. To search for a certificate of tax lien, you may search by case number or debtor name. Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all local taxing districts in. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois.

To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021 and earlier), please enter your property index. When delinquent or unpaid taxes are sold by the cook county treasurer's office, the clerk's office handles the redemption process,. Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all local taxing districts in. With the case number search, you may use either the. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. To search for a certificate of tax lien, you may search by case number or debtor name. Use your property index number to see if your property has any sold, forfeited or open taxes. Search >> what if i don't have my pin?

With the case number search, you may use either the. Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all local taxing districts in. To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021 and earlier), please enter your property index. To search for a certificate of tax lien, you may search by case number or debtor name. When delinquent or unpaid taxes are sold by the cook county treasurer's office, the clerk's office handles the redemption process,. Search >> what if i don't have my pin? The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Use your property index number to see if your property has any sold, forfeited or open taxes.

Cook County Tax Exemption Form 2022

Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all local taxing districts in. With the case number search, you may use either the. When delinquent or unpaid taxes are sold by the cook county treasurer's office, the clerk's office handles the redemption process,. Use your property index number to see if.

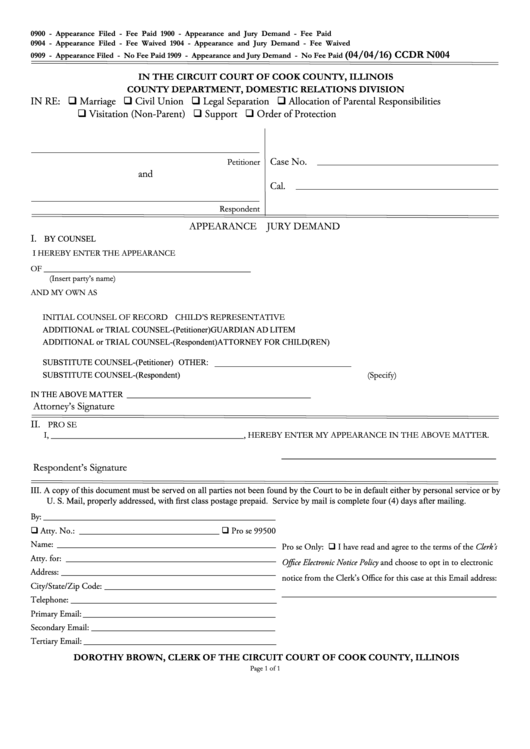

Cook County Il Circuit Court Forms

Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all local taxing districts in. To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021 and earlier), please enter your property index. When delinquent or unpaid taxes are sold by the cook county treasurer's office,.

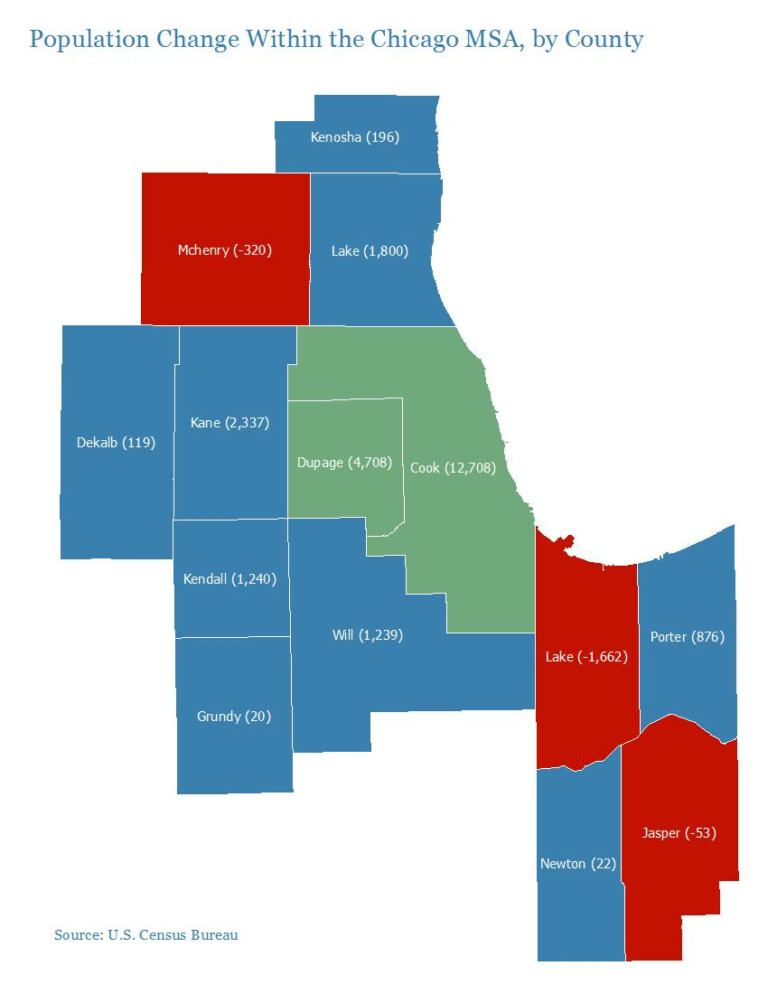

Cook County Map Map Of Cook County United States Of America

When delinquent or unpaid taxes are sold by the cook county treasurer's office, the clerk's office handles the redemption process,. To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021 and earlier), please enter your property index. To search for a certificate of tax lien, you may search by case number or.

Cook County Tax Bills December 2024

To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021 and earlier), please enter your property index. Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all local taxing districts in. When delinquent or unpaid taxes are sold by the cook county treasurer's office,.

Cook County Tax Assessment Forms

Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all local taxing districts in. To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021 and earlier), please enter your property index. The state tax lien registry is an online, statewide system for maintaining notices.

Cook County Assessor's Office Chicago [ Book now ]

To search for a certificate of tax lien, you may search by case number or debtor name. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021.

Cook County Property Tax Rates April 2024

Search >> what if i don't have my pin? With the case number search, you may use either the. When delinquent or unpaid taxes are sold by the cook county treasurer's office, the clerk's office handles the redemption process,. Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all local taxing districts.

Reports Cook County American Rescue Plan

Search >> what if i don't have my pin? The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021 and earlier), please enter your property index. Tax.

Cook County, IL presidential election results, 1984

The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Use your property index number to see if your property has any sold, forfeited or open taxes. Search >> what if i don't have my pin? When delinquent or unpaid taxes are sold by the.

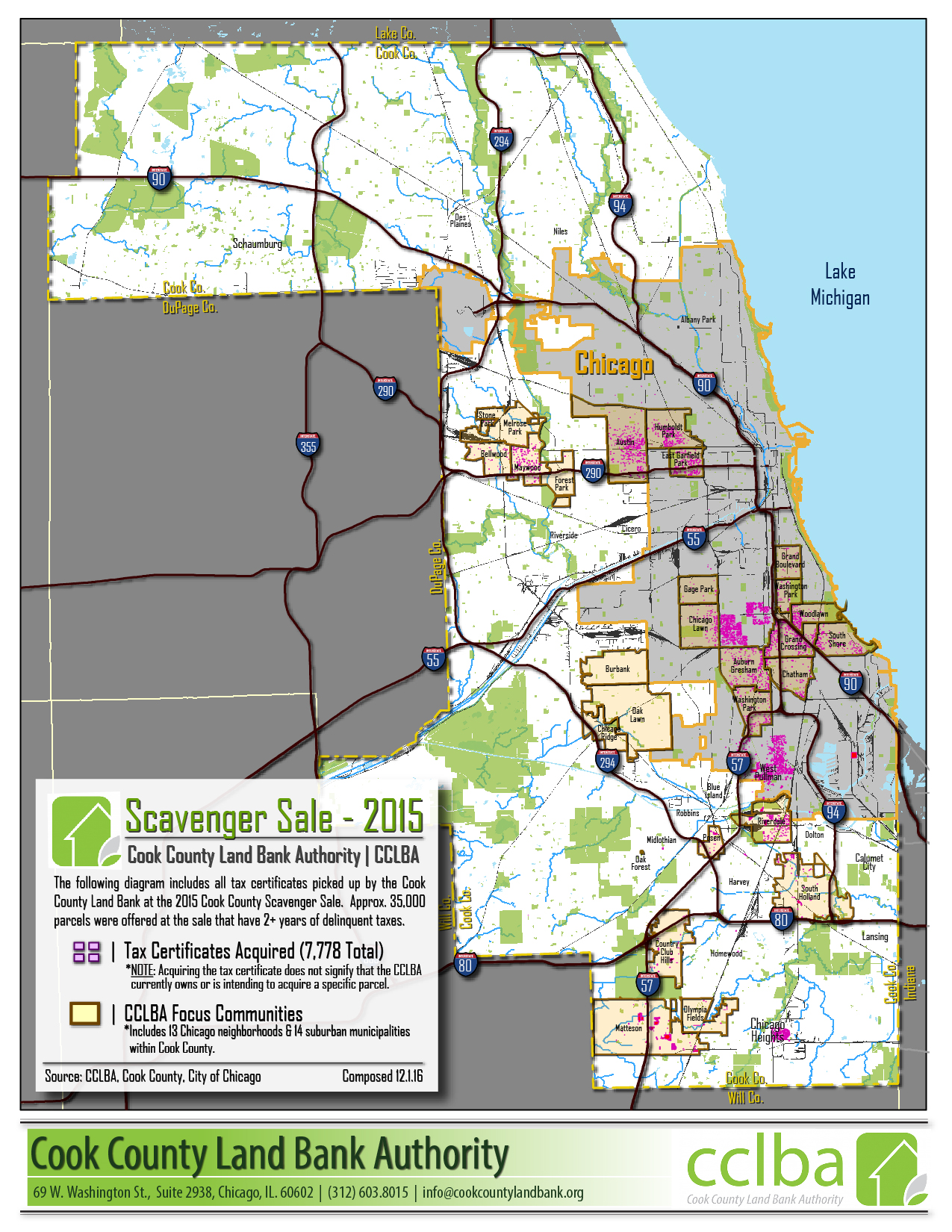

Tax Certificate Program

Search >> what if i don't have my pin? Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all local taxing districts in. To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021 and earlier), please enter your property index. To search for a.

Search >> What If I Don't Have My Pin?

To search for a certificate of tax lien, you may search by case number or debtor name. Use your property index number to see if your property has any sold, forfeited or open taxes. When delinquent or unpaid taxes are sold by the cook county treasurer's office, the clerk's office handles the redemption process,. Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all local taxing districts in.

To See If Your Taxes Have Been Sold, Forfeited Or Open, For Prior Years (Currently Defined As 2021 And Earlier), Please Enter Your Property Index.

The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. With the case number search, you may use either the.