County Clerk Of Courts Tax Liens

County Clerk Of Courts Tax Liens - We will issue a tax lien release once your unsecured property tax bill is paid in full. If you have paid your bill in full and have not received. State tax liens the ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a variety of taxes, including. Governmental liens & judgments survive the issuance of the tax deed and are satisfied to the fullest extent possible with any overbid monies. The application for tax deed file is then transferred to the clerk of the circuit court for processing and subsequent tax deed sale. State tax liens the ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a variety of taxes, including. If you would like to make a claim please complete a claim to surplus proceeds form and return it to the clerk of courts office.

If you would like to make a claim please complete a claim to surplus proceeds form and return it to the clerk of courts office. We will issue a tax lien release once your unsecured property tax bill is paid in full. State tax liens the ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a variety of taxes, including. If you have paid your bill in full and have not received. The application for tax deed file is then transferred to the clerk of the circuit court for processing and subsequent tax deed sale. State tax liens the ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a variety of taxes, including. Governmental liens & judgments survive the issuance of the tax deed and are satisfied to the fullest extent possible with any overbid monies.

We will issue a tax lien release once your unsecured property tax bill is paid in full. If you would like to make a claim please complete a claim to surplus proceeds form and return it to the clerk of courts office. Governmental liens & judgments survive the issuance of the tax deed and are satisfied to the fullest extent possible with any overbid monies. If you have paid your bill in full and have not received. The application for tax deed file is then transferred to the clerk of the circuit court for processing and subsequent tax deed sale. State tax liens the ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a variety of taxes, including. State tax liens the ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a variety of taxes, including.

Tax Deeds St. Johns County Clerk of Court

If you would like to make a claim please complete a claim to surplus proceeds form and return it to the clerk of courts office. If you have paid your bill in full and have not received. Governmental liens & judgments survive the issuance of the tax deed and are satisfied to the fullest extent possible with any overbid monies..

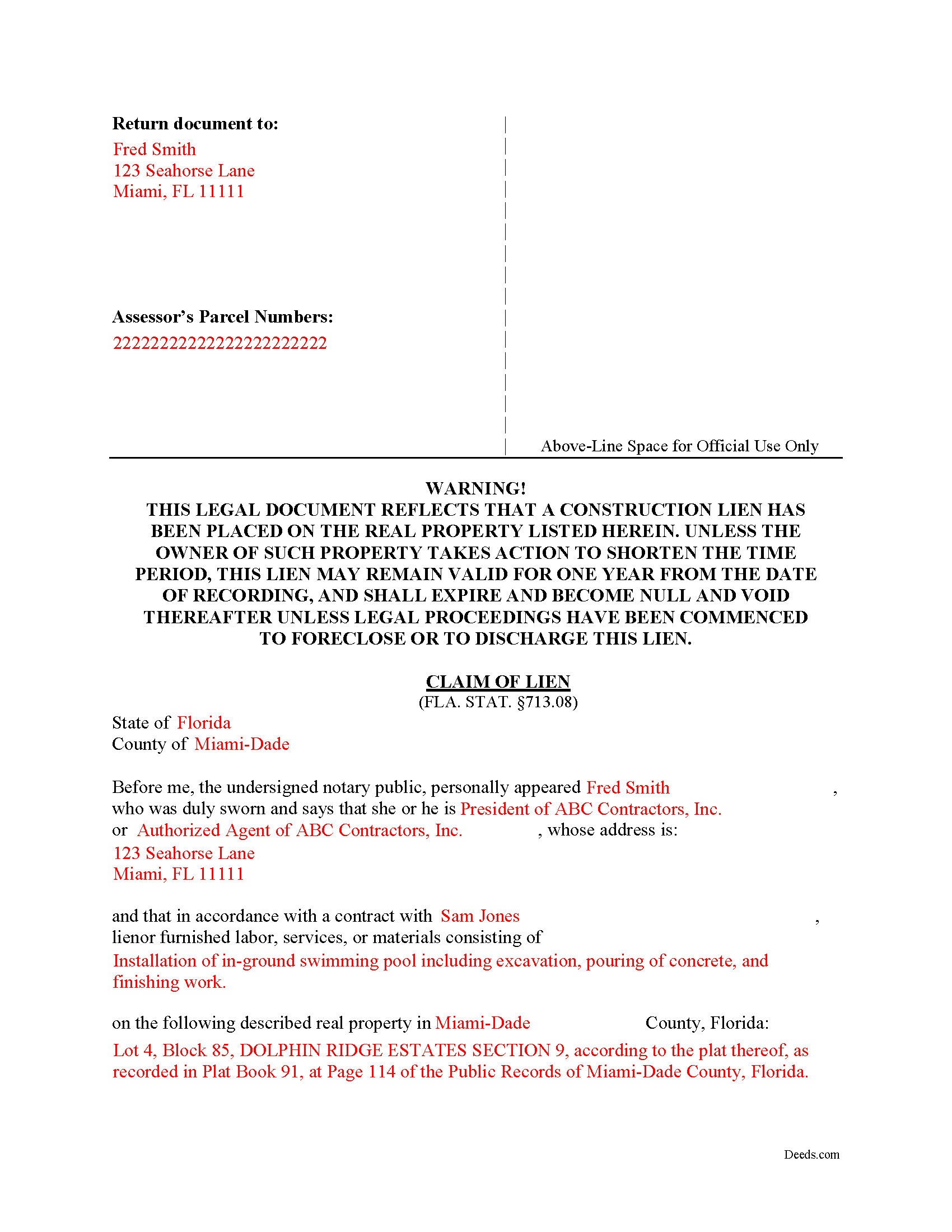

Claim of lien seminole county clerk of courts by preseven66 Issuu

The application for tax deed file is then transferred to the clerk of the circuit court for processing and subsequent tax deed sale. We will issue a tax lien release once your unsecured property tax bill is paid in full. If you have paid your bill in full and have not received. If you would like to make a claim.

Hillsborough County Claim of Lien Form Florida

We will issue a tax lien release once your unsecured property tax bill is paid in full. State tax liens the ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a variety of taxes, including. If you have paid your bill in full and have not received. State tax liens the ohio.

What is a Tax Lien Certificate? How do they Work Explained! YouTube

The application for tax deed file is then transferred to the clerk of the circuit court for processing and subsequent tax deed sale. If you have paid your bill in full and have not received. State tax liens the ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a variety of taxes,.

Free class on property assessments, collections and disputes to be

If you would like to make a claim please complete a claim to surplus proceeds form and return it to the clerk of courts office. We will issue a tax lien release once your unsecured property tax bill is paid in full. State tax liens the ohio department of taxation files judgment liens in the clerk of courts office to.

Lien Info Franklin County Clerk of Courts

If you would like to make a claim please complete a claim to surplus proceeds form and return it to the clerk of courts office. Governmental liens & judgments survive the issuance of the tax deed and are satisfied to the fullest extent possible with any overbid monies. State tax liens the ohio department of taxation files judgment liens in.

St. Johns Clerk and Comptroller Releases Guide for Tracking Tax Dollars

If you would like to make a claim please complete a claim to surplus proceeds form and return it to the clerk of courts office. If you have paid your bill in full and have not received. Governmental liens & judgments survive the issuance of the tax deed and are satisfied to the fullest extent possible with any overbid monies..

Recording Cost St. Johns County Clerk of Court

The application for tax deed file is then transferred to the clerk of the circuit court for processing and subsequent tax deed sale. Governmental liens & judgments survive the issuance of the tax deed and are satisfied to the fullest extent possible with any overbid monies. If you have paid your bill in full and have not received. We will.

eFiling and ePay Instructions Clerk of Courts

The application for tax deed file is then transferred to the clerk of the circuit court for processing and subsequent tax deed sale. Governmental liens & judgments survive the issuance of the tax deed and are satisfied to the fullest extent possible with any overbid monies. State tax liens the ohio department of taxation files judgment liens in the clerk.

Lee County unclaimed money Clerk of Court has 300,000 waiting to be

We will issue a tax lien release once your unsecured property tax bill is paid in full. Governmental liens & judgments survive the issuance of the tax deed and are satisfied to the fullest extent possible with any overbid monies. If you have paid your bill in full and have not received. State tax liens the ohio department of taxation.

If You Would Like To Make A Claim Please Complete A Claim To Surplus Proceeds Form And Return It To The Clerk Of Courts Office.

State tax liens the ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a variety of taxes, including. The application for tax deed file is then transferred to the clerk of the circuit court for processing and subsequent tax deed sale. If you have paid your bill in full and have not received. Governmental liens & judgments survive the issuance of the tax deed and are satisfied to the fullest extent possible with any overbid monies.

State Tax Liens The Ohio Department Of Taxation Files Judgment Liens In The Clerk Of Courts Office To Recover Revenue For A Variety Of Taxes, Including.

We will issue a tax lien release once your unsecured property tax bill is paid in full.