Dallas Appraisal District Homestead Exemption Form

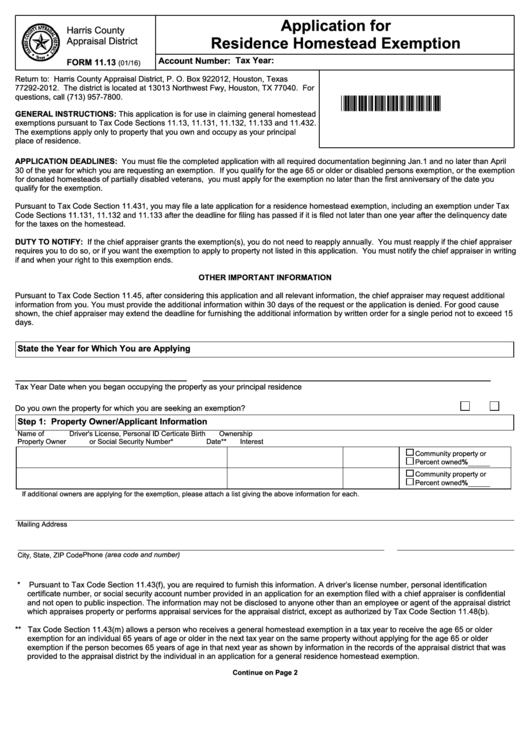

Dallas Appraisal District Homestead Exemption Form - This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131, and §11.432. What if my exemptions are wrong? Contact your local appraisal district. To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. A homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with the county. File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between. How can i find out what my listed exemptions are? To file a homestead exemption, the residence homestead exemption application form is available from the details page of your account.

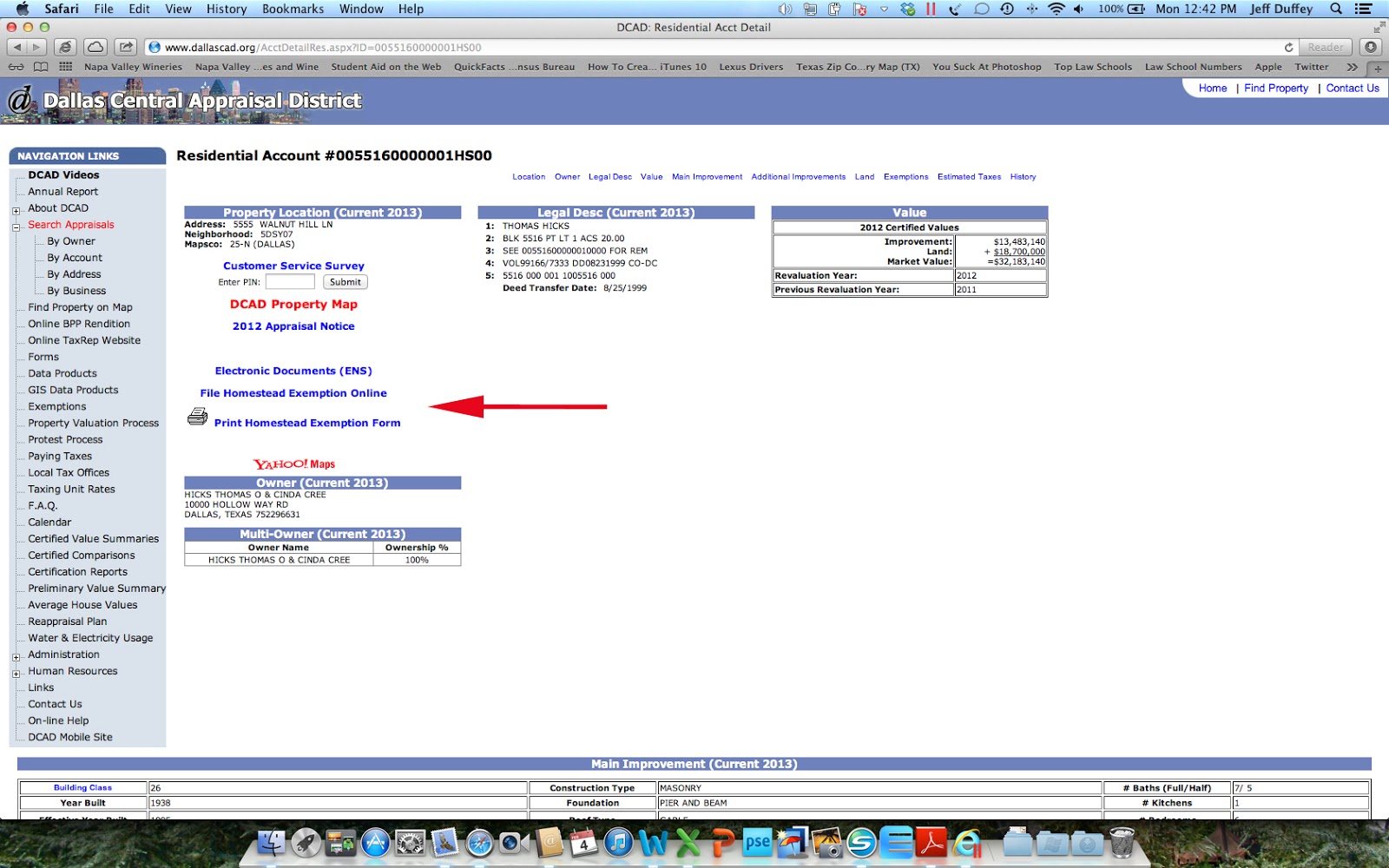

To file a homestead exemption, the residence homestead exemption application form is available from the details page of your account. A homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with the county. To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. How can i find out what my listed exemptions are? File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between. Contact your local appraisal district. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131, and §11.432. A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. What if my exemptions are wrong?

To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. To file a homestead exemption, the residence homestead exemption application form is available from the details page of your account. A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. What if my exemptions are wrong? Contact your local appraisal district. A homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with the county. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131, and §11.432. File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between. How can i find out what my listed exemptions are?

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

What if my exemptions are wrong? This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131, and §11.432. To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. Contact your local appraisal district. File this form and all supporting documentation.

Dallas Homestead Exemption Explained FAQs + How to File

To file a homestead exemption, the residence homestead exemption application form is available from the details page of your account. Contact your local appraisal district. To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. This application is for use in claiming general homestead exemptions pursuant to.

How To File Homestead Exemption 🏠 Dallas County YouTube

File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between. To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. This application is for use in claiming general homestead exemptions pursuant to tax code.

Fillable Online Dallas central appraisal district homestead exemption

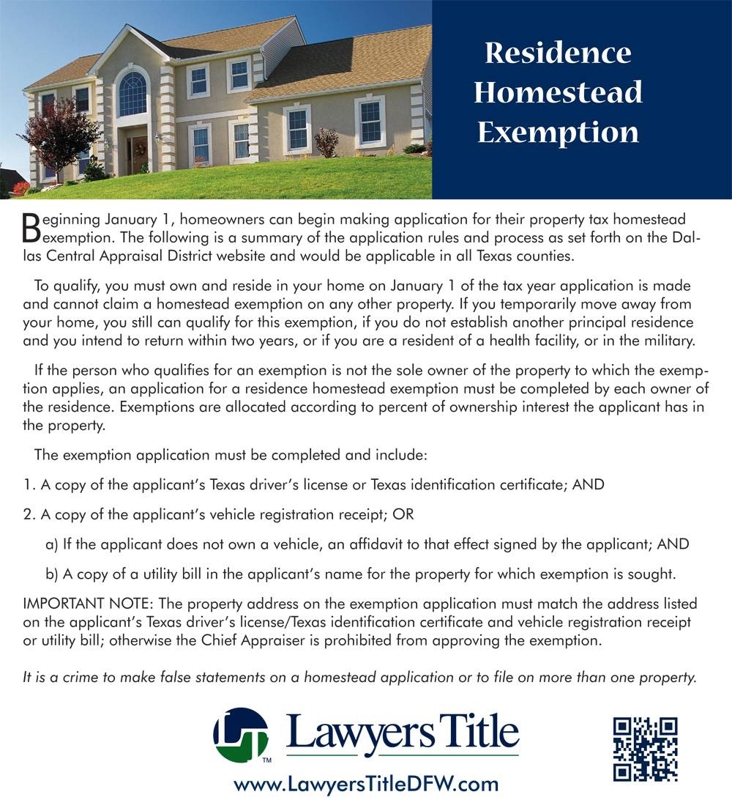

A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. What if my exemptions are wrong? Contact your local appraisal district. A homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with the county. To qualify, you must own and reside in your.

Dallas Real Estate Blog How To File Your Homestead Exemption

A homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with the county. Contact your local appraisal district. To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. A qualified texas homeowner can file for the homestead exemption by.

Fillable Homestead Exemption Harris County Appraisal District

A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. What if my exemptions are wrong? Contact your local appraisal district. How can i find out what my listed exemptions are? To file a homestead exemption, the residence homestead exemption application form is available from the details page of your account.

HECHO! How to Fill out Texas Homestead Exemption 2022 YouTube

To file a homestead exemption, the residence homestead exemption application form is available from the details page of your account. A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. What if my exemptions are wrong? Contact your local appraisal district. A homeowner may receive the over 65 exemption immediately upon.

Texas Homestead Exemption Changes 2012

A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. Contact your local appraisal district. A homeowner may receive the over 65 exemption immediately upon qualification of the.

Dallas Homestead Exemption Explained FAQs + How to File

What if my exemptions are wrong? How can i find out what my listed exemptions are? To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. File this form and all supporting documentation with the appraisal district office in each county in which the property is located.

Fillable Online Dallas county appraisal district homestead exemption

This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131, and §11.432. A homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with the county. To qualify, you must own and reside in your home on january 1 of the year application is made and.

Contact Your Local Appraisal District.

A homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with the county. To file a homestead exemption, the residence homestead exemption application form is available from the details page of your account. To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below.

How Can I Find Out What My Listed Exemptions Are?

File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between. What if my exemptions are wrong? This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131, and §11.432.