Dekalb County Tax Lien Sale

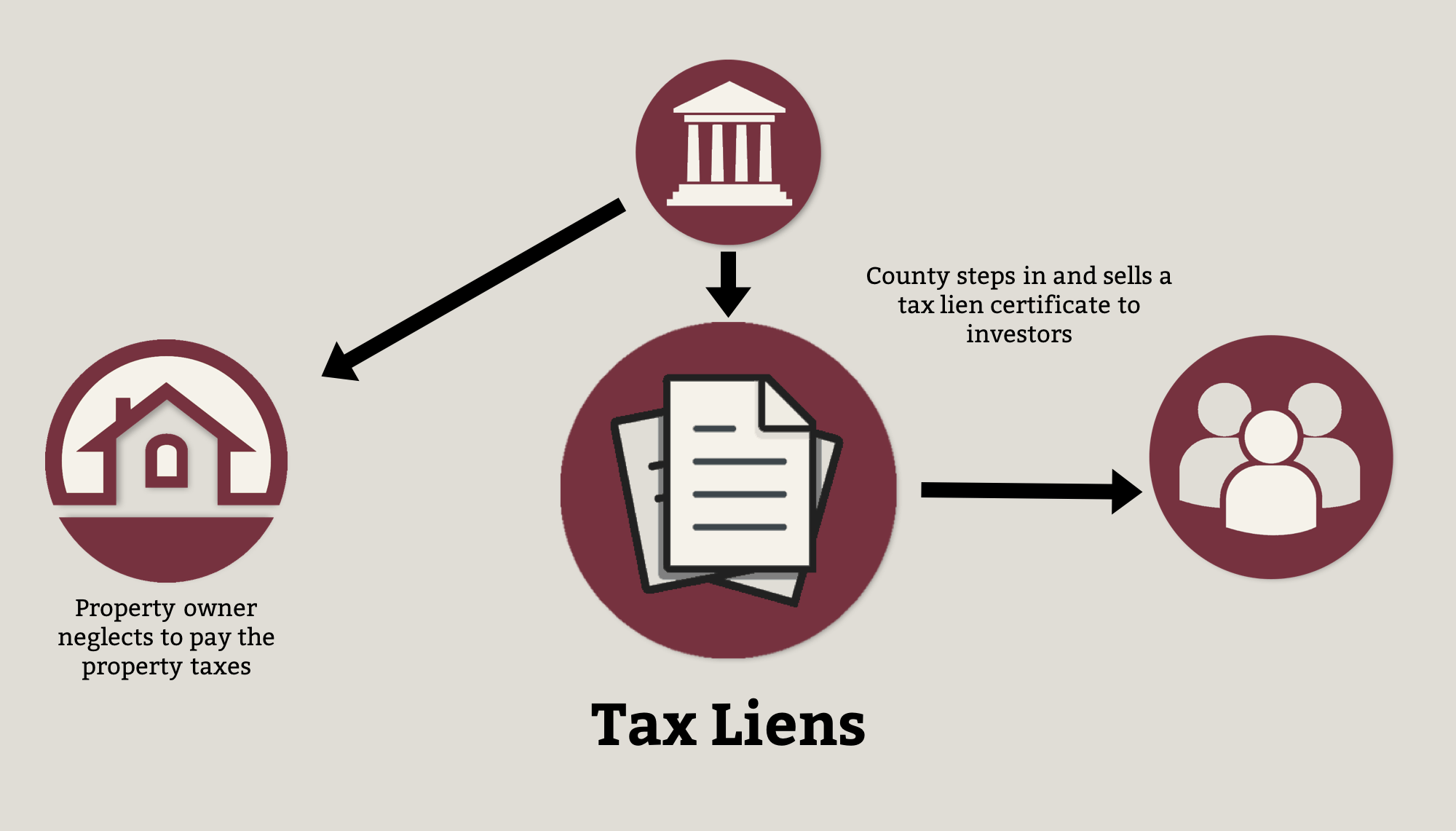

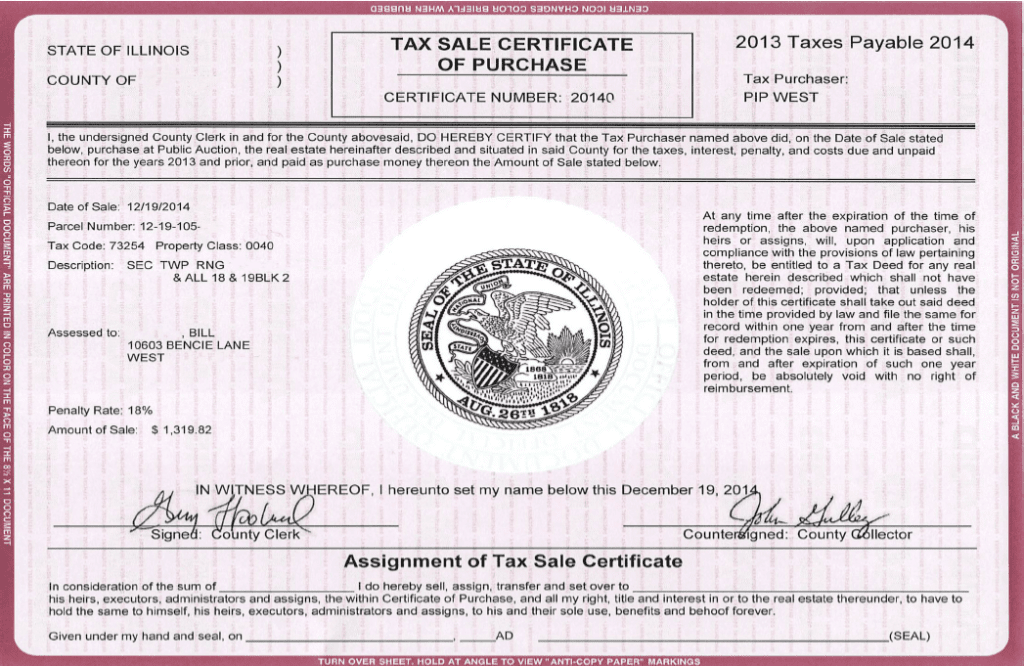

Dekalb County Tax Lien Sale - The tax commissioner's office in dekalb county, georgia, conducts tax sales on a regular basis, specifically on the first tuesday of each month. If a tax sale is scheduled, an auction of the property taxes is conducted in front of the dekalb county. Delinquent tax tax sale listing excess funds tax credit card icons property tax online payment forms accepted debit / credit fee = 2.35% e. The current tax sale listing is available as a downloadable csv file and can be viewed at the property information page. The tax sale list is printed in a general. When they become delinquent for two or more years, by law, the collector must offer for sale. When is the next tax sale? Find out the conditions, procedures, and rights of tax deed. Tax sale date parcel id map ref tax sale id owner address tenant defendant levy type lien book page levy date min year max year total. When a parcel goes to tax sale the minimum bid that is required will be the total of all of the delinquencies, the tax sale fee and the current.

When a parcel goes to tax sale the minimum bid that is required will be the total of all of the delinquencies, the tax sale fee and the current. Learn how tax liens are attached, executed, and sold in dekalb county, georgia. Delinquent tax tax sale listing excess funds tax credit card icons property tax online payment forms accepted debit / credit fee = 2.35% e. The tax commissioner's office in dekalb county, georgia, conducts tax sales on a regular basis, specifically on the first tuesday of each month. Find out the conditions, procedures, and rights of tax deed. When is the next tax sale? Tax sale date parcel id map ref tax sale id owner address tenant defendant levy type lien book page levy date min year max year total. The current tax sale listing is available as a downloadable csv file and can be viewed at the property information page. If a tax sale is scheduled, an auction of the property taxes is conducted in front of the dekalb county. The tax sale list is printed in a general.

Tax sale date parcel id map ref tax sale id owner address tenant defendant levy type lien book page levy date min year max year total. The tax sale list is printed in a general. When a parcel goes to tax sale the minimum bid that is required will be the total of all of the delinquencies, the tax sale fee and the current. The tax commissioner's office in dekalb county, georgia, conducts tax sales on a regular basis, specifically on the first tuesday of each month. Learn how tax liens are attached, executed, and sold in dekalb county, georgia. Delinquent tax tax sale listing excess funds tax credit card icons property tax online payment forms accepted debit / credit fee = 2.35% e. If a tax sale is scheduled, an auction of the property taxes is conducted in front of the dekalb county. The current tax sale listing is available as a downloadable csv file and can be viewed at the property information page. When they become delinquent for two or more years, by law, the collector must offer for sale. Find out the conditions, procedures, and rights of tax deed.

Suffolk County Tax Lien Sale 2024 Marne Sharona

If a tax sale is scheduled, an auction of the property taxes is conducted in front of the dekalb county. The tax sale list is printed in a general. When they become delinquent for two or more years, by law, the collector must offer for sale. Find out the conditions, procedures, and rights of tax deed. Learn how tax liens.

Suffolk County Tax Lien Sale 2024 Marne Sharona

When a parcel goes to tax sale the minimum bid that is required will be the total of all of the delinquencies, the tax sale fee and the current. Delinquent tax tax sale listing excess funds tax credit card icons property tax online payment forms accepted debit / credit fee = 2.35% e. Learn how tax liens are attached, executed,.

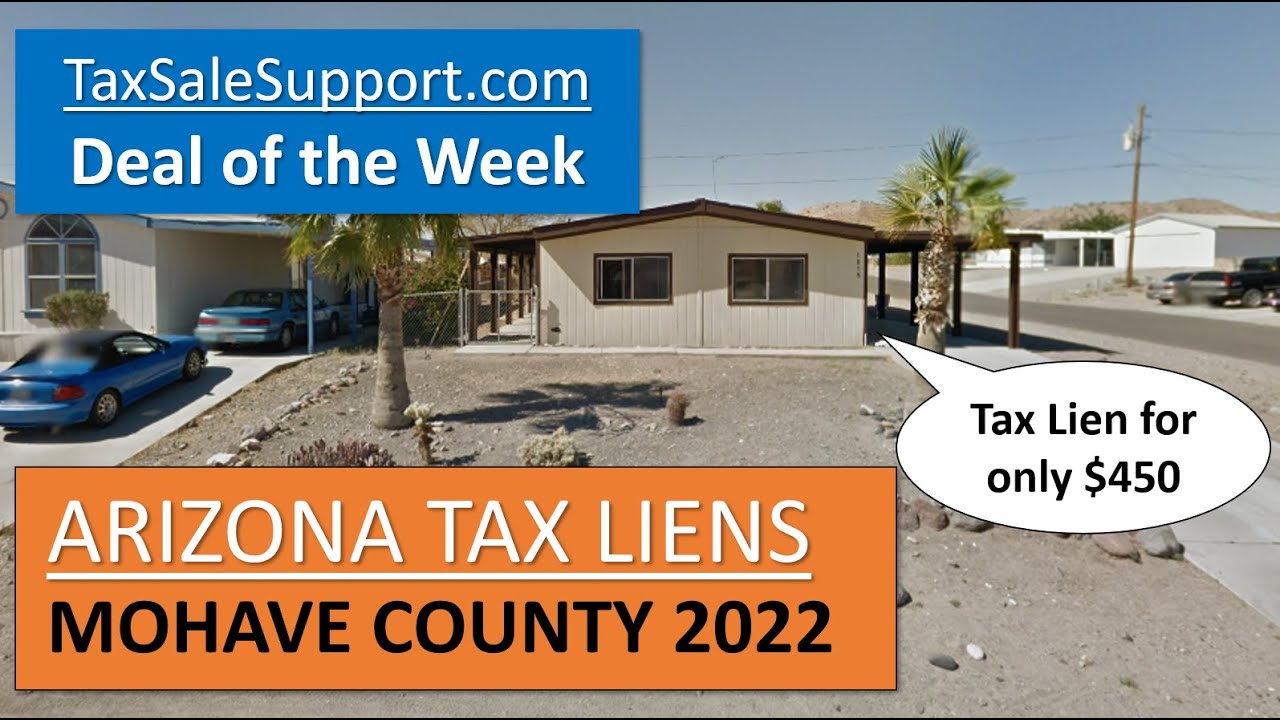

Mohave County Tax Lien Sale 2024 Dore Nancey

If a tax sale is scheduled, an auction of the property taxes is conducted in front of the dekalb county. When is the next tax sale? The current tax sale listing is available as a downloadable csv file and can be viewed at the property information page. Tax sale date parcel id map ref tax sale id owner address tenant.

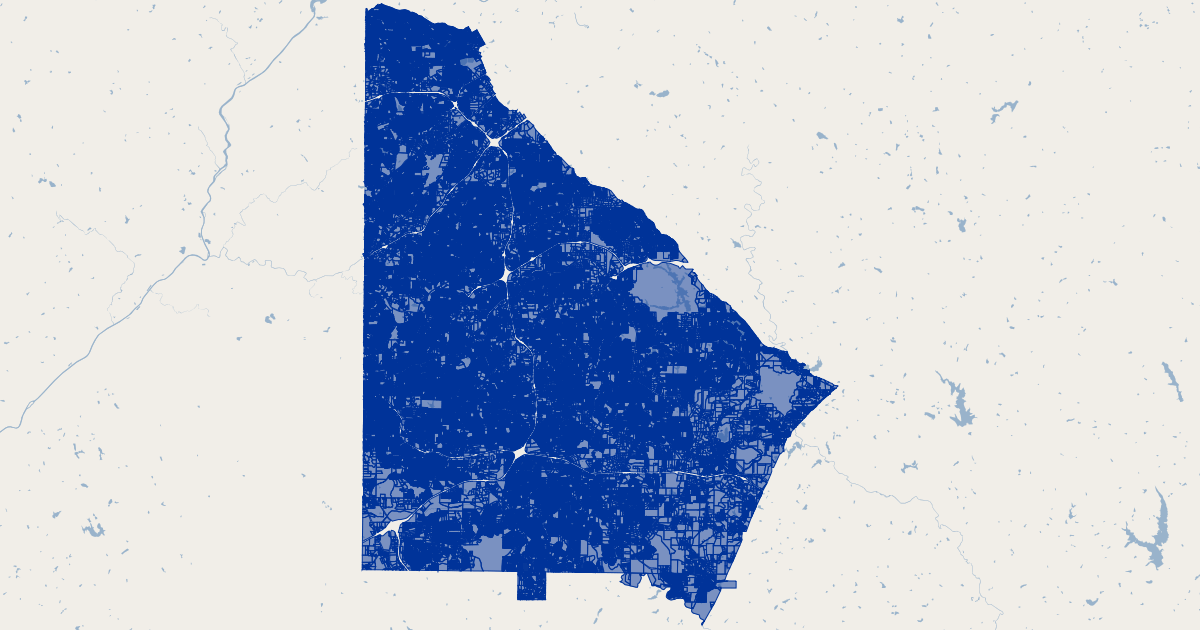

DeKalb County, GA Tax Parcels GIS Map Data DeKalb County,

Find out the conditions, procedures, and rights of tax deed. The tax commissioner's office in dekalb county, georgia, conducts tax sales on a regular basis, specifically on the first tuesday of each month. Tax sale date parcel id map ref tax sale id owner address tenant defendant levy type lien book page levy date min year max year total. Delinquent.

Charles County Tax Lien Sale 2024 Bryna Marleah

When they become delinquent for two or more years, by law, the collector must offer for sale. When is the next tax sale? Find out the conditions, procedures, and rights of tax deed. Tax sale date parcel id map ref tax sale id owner address tenant defendant levy type lien book page levy date min year max year total. When.

Default Notice For Lien Judgement by Acquiescence JR Affordable

The current tax sale listing is available as a downloadable csv file and can be viewed at the property information page. When a parcel goes to tax sale the minimum bid that is required will be the total of all of the delinquencies, the tax sale fee and the current. The tax sale list is printed in a general. Learn.

Mohave County Tax Lien Sale 2024 Dore Nancey

Delinquent tax tax sale listing excess funds tax credit card icons property tax online payment forms accepted debit / credit fee = 2.35% e. Learn how tax liens are attached, executed, and sold in dekalb county, georgia. The tax commissioner's office in dekalb county, georgia, conducts tax sales on a regular basis, specifically on the first tuesday of each month..

Mohave County Tax Lien Sale 2024 Dore Nancey

The tax commissioner's office in dekalb county, georgia, conducts tax sales on a regular basis, specifically on the first tuesday of each month. Find out the conditions, procedures, and rights of tax deed. When they become delinquent for two or more years, by law, the collector must offer for sale. The tax sale list is printed in a general. Learn.

Charles County Tax Lien Sale 2024 Bryna Marleah

If a tax sale is scheduled, an auction of the property taxes is conducted in front of the dekalb county. The tax commissioner's office in dekalb county, georgia, conducts tax sales on a regular basis, specifically on the first tuesday of each month. When they become delinquent for two or more years, by law, the collector must offer for sale..

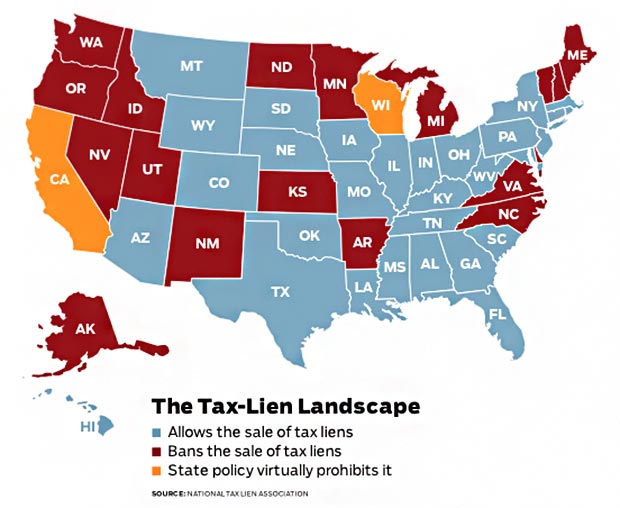

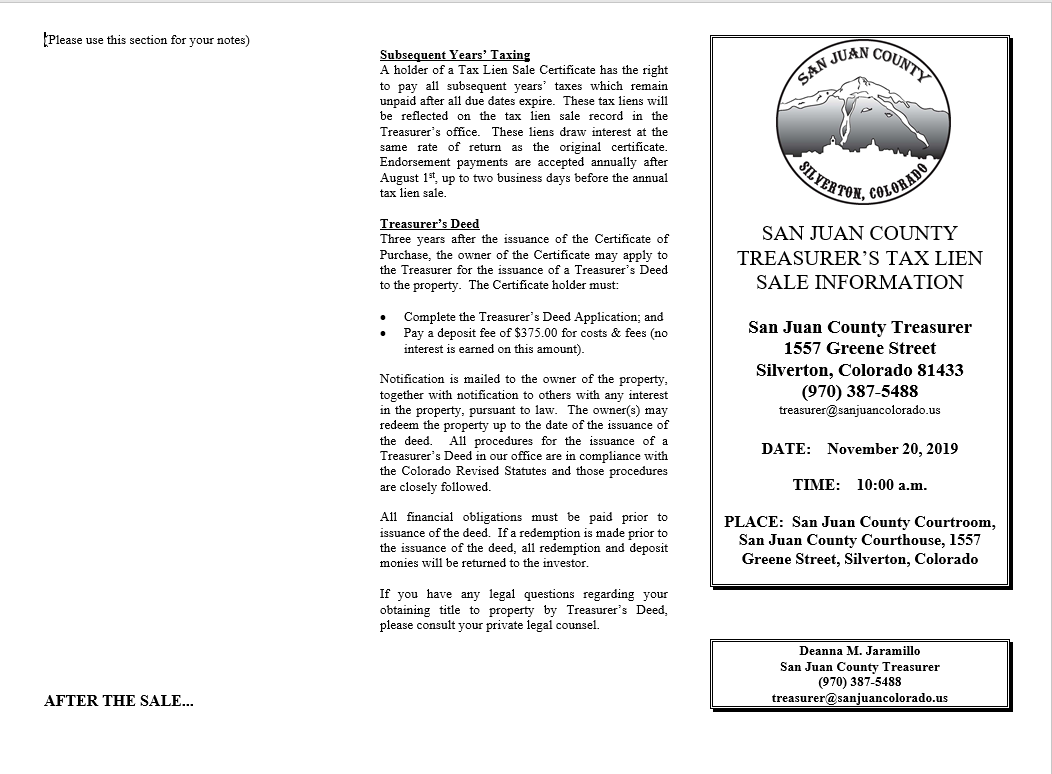

Tax Lien Sale San Juan County

The tax sale list is printed in a general. When is the next tax sale? Delinquent tax tax sale listing excess funds tax credit card icons property tax online payment forms accepted debit / credit fee = 2.35% e. When a parcel goes to tax sale the minimum bid that is required will be the total of all of the.

Find Out The Conditions, Procedures, And Rights Of Tax Deed.

Learn how tax liens are attached, executed, and sold in dekalb county, georgia. Tax sale date parcel id map ref tax sale id owner address tenant defendant levy type lien book page levy date min year max year total. When is the next tax sale? Delinquent tax tax sale listing excess funds tax credit card icons property tax online payment forms accepted debit / credit fee = 2.35% e.

The Tax Commissioner's Office In Dekalb County, Georgia, Conducts Tax Sales On A Regular Basis, Specifically On The First Tuesday Of Each Month.

If a tax sale is scheduled, an auction of the property taxes is conducted in front of the dekalb county. When they become delinquent for two or more years, by law, the collector must offer for sale. The current tax sale listing is available as a downloadable csv file and can be viewed at the property information page. When a parcel goes to tax sale the minimum bid that is required will be the total of all of the delinquencies, the tax sale fee and the current.