Does Irs File A Tax Lien With An Installment Agreement

Does Irs File A Tax Lien With An Installment Agreement - Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. Learn more about the four different types of installment. It is just a matter of. When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. The irs allows taxpayers to pay off tax debt through an installment agreement.

Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. Learn more about the four different types of installment. When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. It is just a matter of. Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. The irs allows taxpayers to pay off tax debt through an installment agreement.

Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. Learn more about the four different types of installment. The irs allows taxpayers to pay off tax debt through an installment agreement. It is just a matter of. When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car.

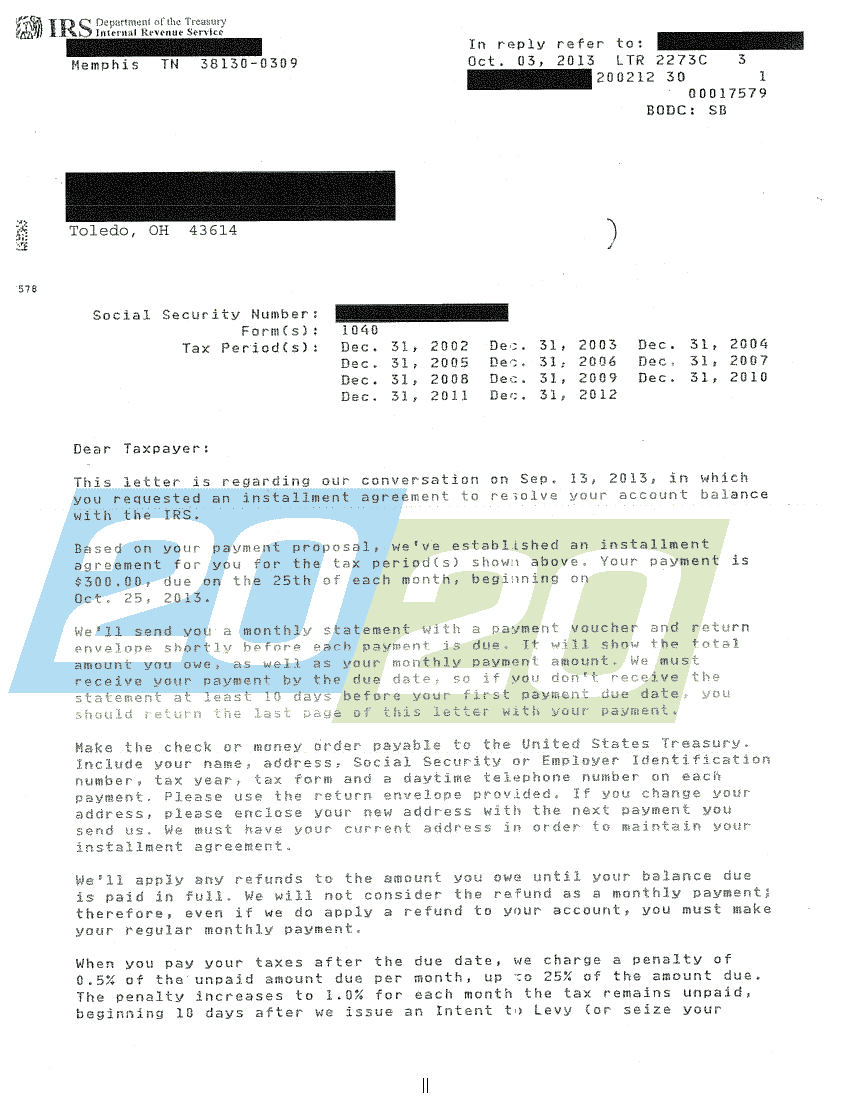

What Do Know If My Installment Agreement Was Rejected; IRS Just Sent Me

When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. The irs allows taxpayers to pay off tax debt through an installment agreement. Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. Learn more about the four different types of.

When Does the IRS File a Tax Lien? — Fortress Tax Relief

When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. Learn more about the four different types of installment. It is just a matter of. The irs allows taxpayers to pay off tax debt through an installment agreement. Installment agreements can get tax liens withdrawn, improve your credit score and.

IRS Installment Agreement Types How Can It Help You

Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. The irs allows taxpayers to pay off tax debt through an installment agreement. Learn more about the four different types of installment..

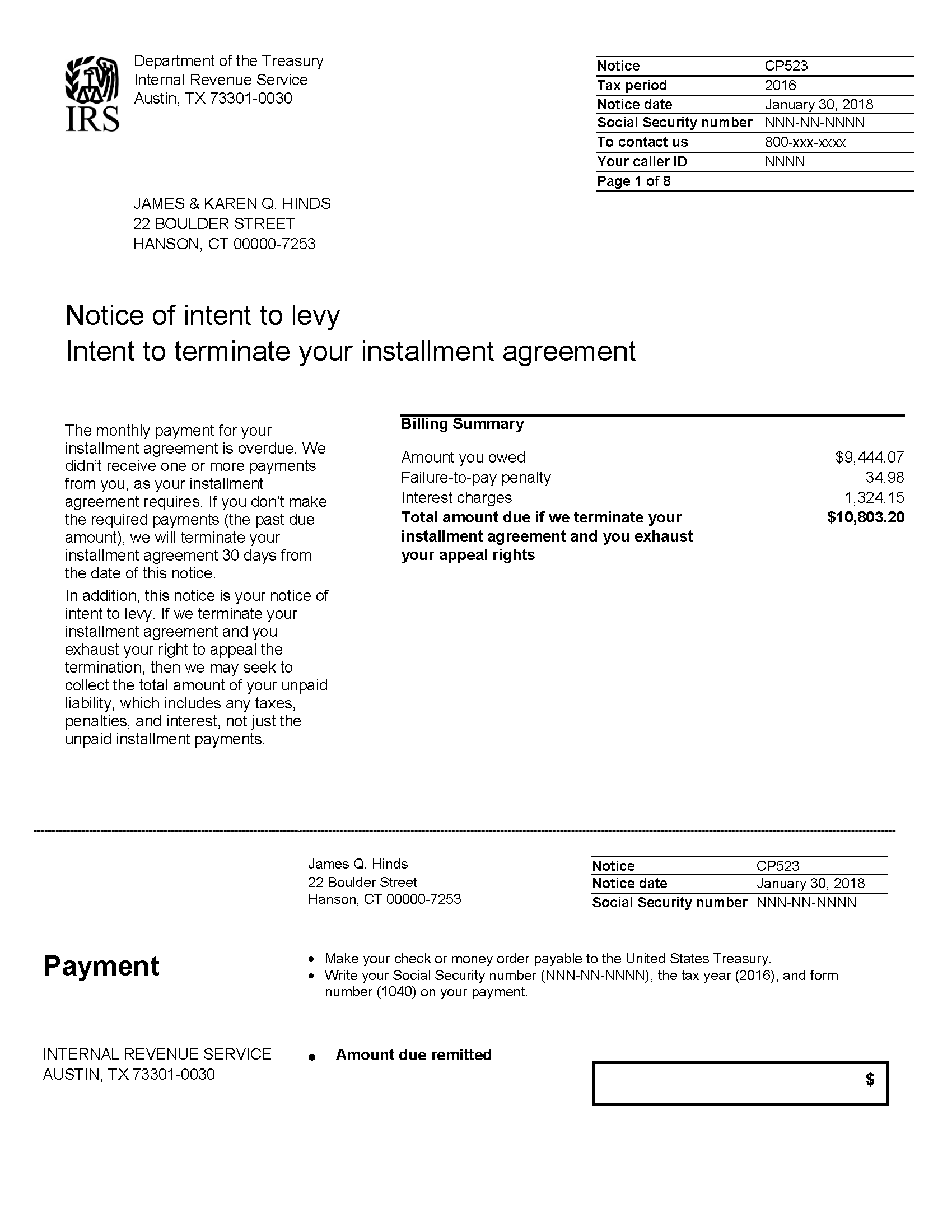

IRS Notice CP523 Intent to Terminate Your Installment Agreement H&R

Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. Learn more about the four different types of installment. When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. It is just a matter of. Irm 5.14.1.4.3, notice of federal tax.

Irs Tax Lien Irs Tax Lien Payment Plan

When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. The irs.

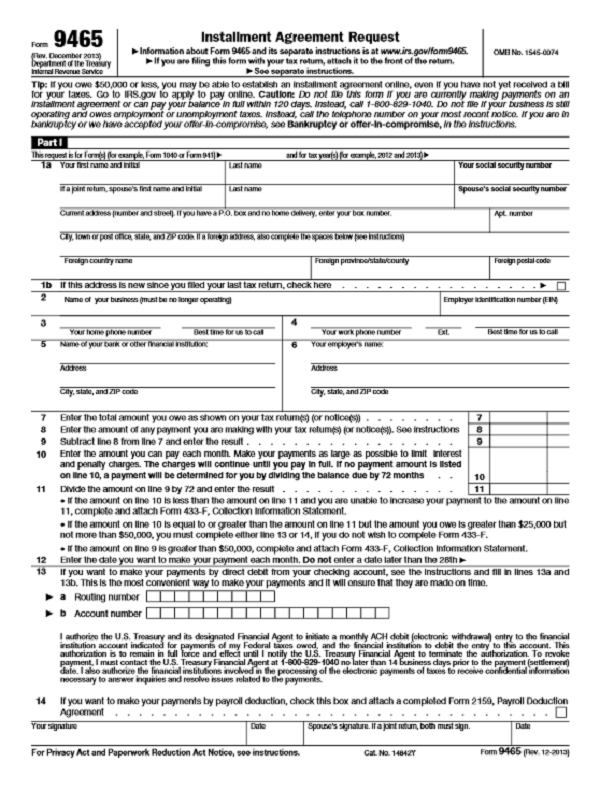

IRS Installment Agreement Form

The irs allows taxpayers to pay off tax debt through an installment agreement. It is just a matter of. Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. Learn more about the four different types of installment. Installment agreements can get tax liens withdrawn, improve your credit score and help.

How to Remove an IRS TAX LIEN from your Credit Report

The irs allows taxpayers to pay off tax debt through an installment agreement. Learn more about the four different types of installment. When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. It is just a matter of. Installment agreements can get tax liens withdrawn, improve your credit score and.

7 Types of IRS Installment Agreements Partial Pay Installment Agreement

It is just a matter of. The irs allows taxpayers to pay off tax debt through an installment agreement. Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. Installment agreements.

How Does the IRS Notify You of a Tax Lien? Rush Tax Resolution

Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. The irs allows taxpayers to pay off tax debt through an installment agreement. It is just a matter of. Learn more.

What To Do When Your IRS Account Is in Jeopardy of Lien or Levy

Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. Learn more about the four different types of installment. The irs allows taxpayers to pay off tax debt through an installment agreement..

The Irs Allows Taxpayers To Pay Off Tax Debt Through An Installment Agreement.

Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. Learn more about the four different types of installment.