Due Diligence Tax Form

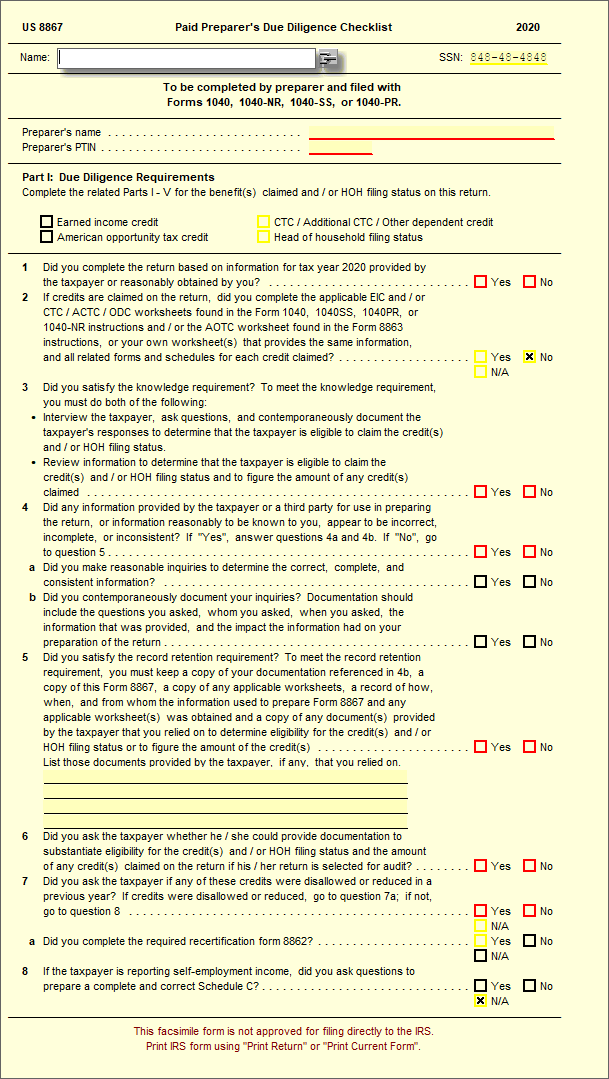

Due Diligence Tax Form - Form 8867 is used by paid preparers of federal income tax returns or claims involving certain credits and filing statuses to meet due. Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american. How many years have you claimed the american.

Form 8867 is used by paid preparers of federal income tax returns or claims involving certain credits and filing statuses to meet due. How many years have you claimed the american. Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american.

Form 8867 is used by paid preparers of federal income tax returns or claims involving certain credits and filing statuses to meet due. Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american. How many years have you claimed the american.

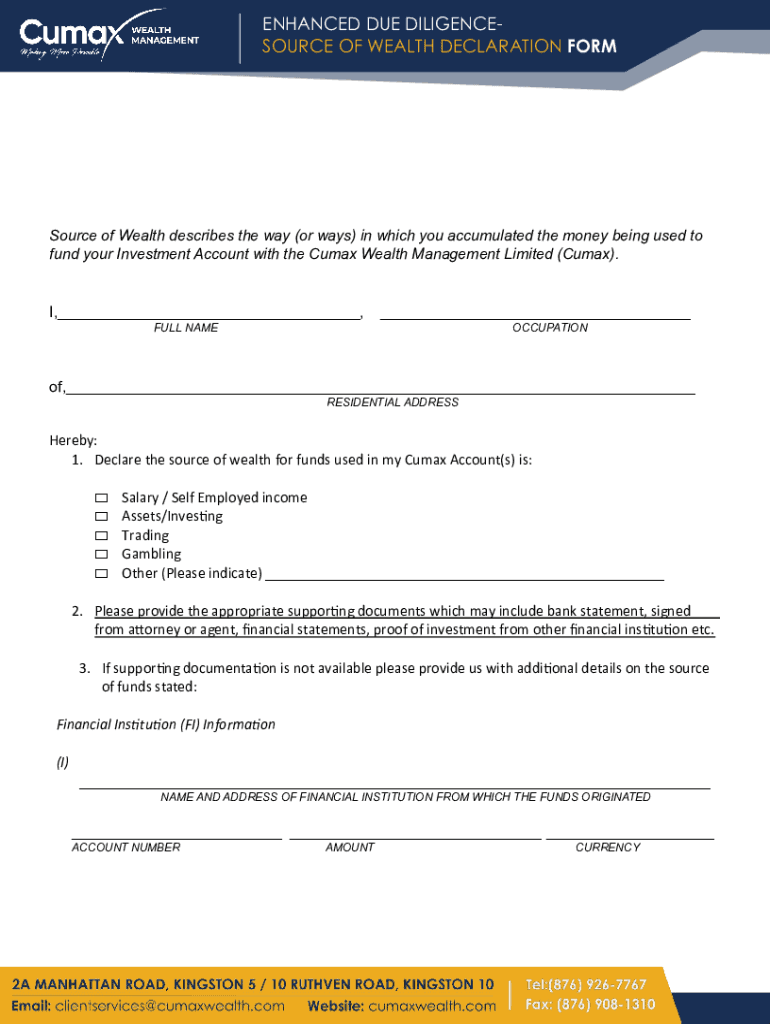

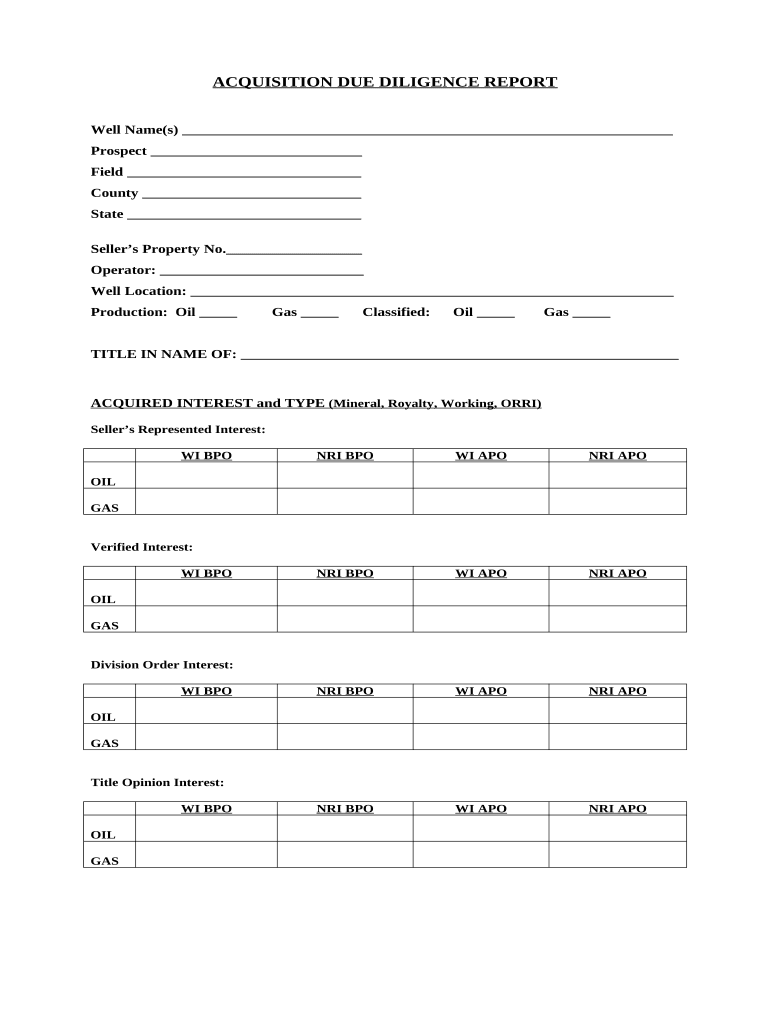

Fillable Online Enhanced Due Diligence Source of Wealth Declaration

Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american. Form 8867 is used by paid preparers of federal income tax returns or claims involving certain credits and filing statuses to meet due. How many years have you claimed the american.

Due Diligence Checklist Template Word Template 1 Resume Examples

How many years have you claimed the american. Form 8867 is used by paid preparers of federal income tax returns or claims involving certain credits and filing statuses to meet due. Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american.

Draft of Form for Expanded Preparer Due Diligence Released by IRS

Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american. Form 8867 is used by paid preparers of federal income tax returns or claims involving certain credits and filing statuses to meet due. How many years have you claimed the american.

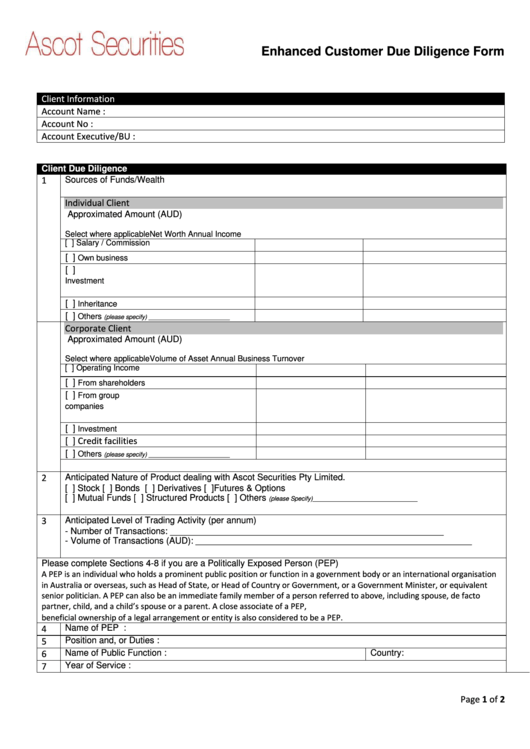

Enhanced Customer Due Diligence Form printable pdf download

Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american. How many years have you claimed the american. Form 8867 is used by paid preparers of federal income tax returns or claims involving certain credits and filing statuses to meet due.

6 Essential Facts About the Importance of Due Diligence in Accounting

Form 8867 is used by paid preparers of federal income tax returns or claims involving certain credits and filing statuses to meet due. How many years have you claimed the american. Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american.

Paid Preparer's Due Diligence Checklist Form 8867 YouTube

Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american. Form 8867 is used by paid preparers of federal income tax returns or claims involving certain credits and filing statuses to meet due. How many years have you claimed the american.

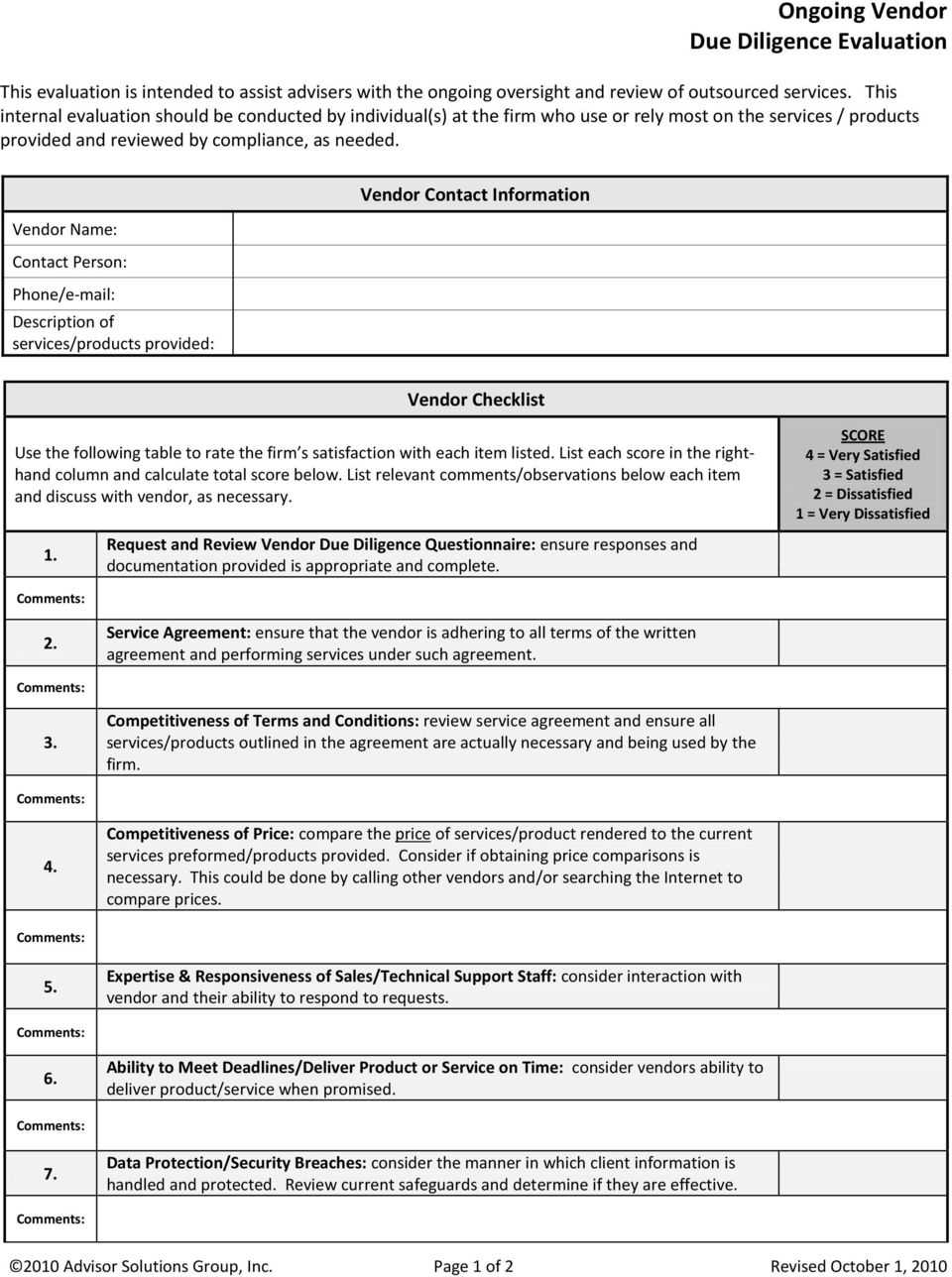

Vendor Due Diligence Report Template Business.fromgrandma.best

How many years have you claimed the american. Form 8867 is used by paid preparers of federal income tax returns or claims involving certain credits and filing statuses to meet due. Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american.

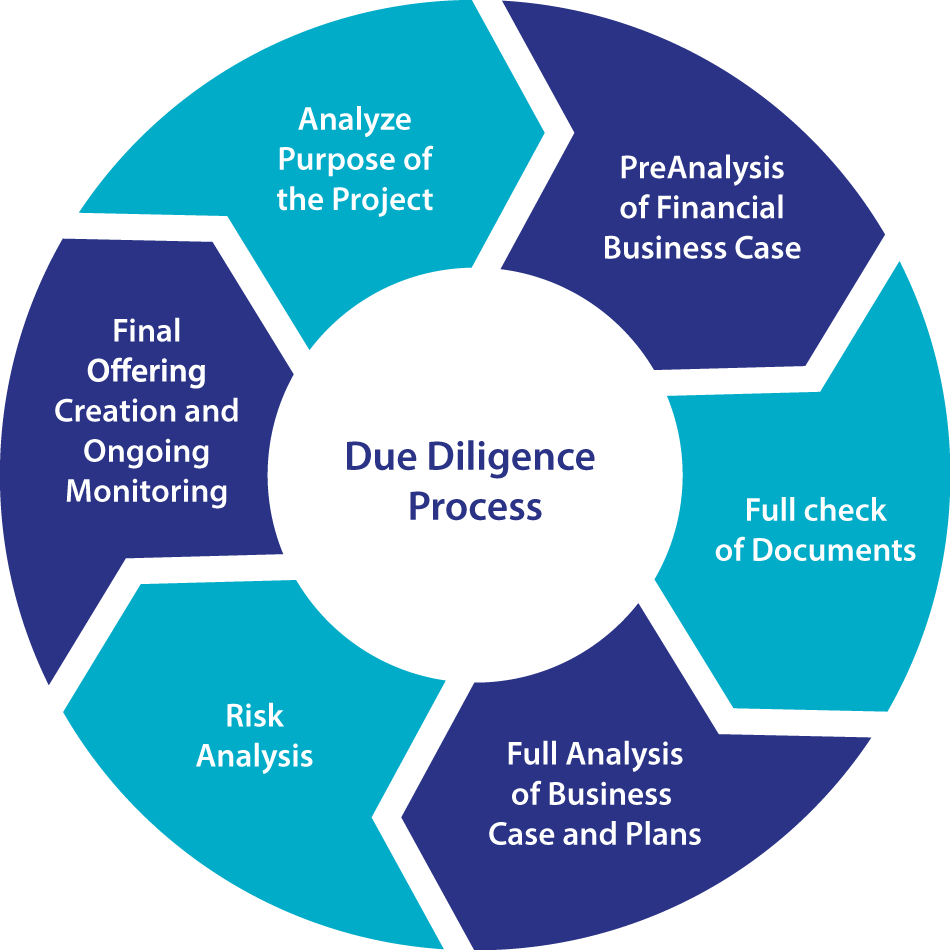

Due Diligence Atomic Fund Medium

Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american. Form 8867 is used by paid preparers of federal income tax returns or claims involving certain credits and filing statuses to meet due. How many years have you claimed the american.

Financial due diligence report deloitte pdf Fill out & sign online

How many years have you claimed the american. Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american. Form 8867 is used by paid preparers of federal income tax returns or claims involving certain credits and filing statuses to meet due.

8867 Paid Preparer's Due Diligence Checklist UltimateTax Solution

How many years have you claimed the american. Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american. Form 8867 is used by paid preparers of federal income tax returns or claims involving certain credits and filing statuses to meet due.

Form 8867 Is Used By Paid Preparers Of Federal Income Tax Returns Or Claims Involving Certain Credits And Filing Statuses To Meet Due.

Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american. How many years have you claimed the american.