Employeeemployee Retention Credit Footnote Disclosure Example

Employeeemployee Retention Credit Footnote Disclosure Example - For 2021, the credit can be. Employee retention credit footnote disclosure example you can claim up to $5,000 per worker for 2020. One form of assistance that many entities have applied for is the employee retention tax credit (or the employee retention credit or erc),. Financial reporting & disclosure examples, for guidance on the accounting for ercs. The erc is a fully refundable payroll tax credit for eligible employers up to a maximum of $5,000 for each employee in 2020 or $7,000 per employee. The employee retention credit (erc) is a tax incentive program designed to help businesses retain their employees during.

The erc is a fully refundable payroll tax credit for eligible employers up to a maximum of $5,000 for each employee in 2020 or $7,000 per employee. The employee retention credit (erc) is a tax incentive program designed to help businesses retain their employees during. Financial reporting & disclosure examples, for guidance on the accounting for ercs. For 2021, the credit can be. Employee retention credit footnote disclosure example you can claim up to $5,000 per worker for 2020. One form of assistance that many entities have applied for is the employee retention tax credit (or the employee retention credit or erc),.

The erc is a fully refundable payroll tax credit for eligible employers up to a maximum of $5,000 for each employee in 2020 or $7,000 per employee. One form of assistance that many entities have applied for is the employee retention tax credit (or the employee retention credit or erc),. Financial reporting & disclosure examples, for guidance on the accounting for ercs. For 2021, the credit can be. Employee retention credit footnote disclosure example you can claim up to $5,000 per worker for 2020. The employee retention credit (erc) is a tax incentive program designed to help businesses retain their employees during.

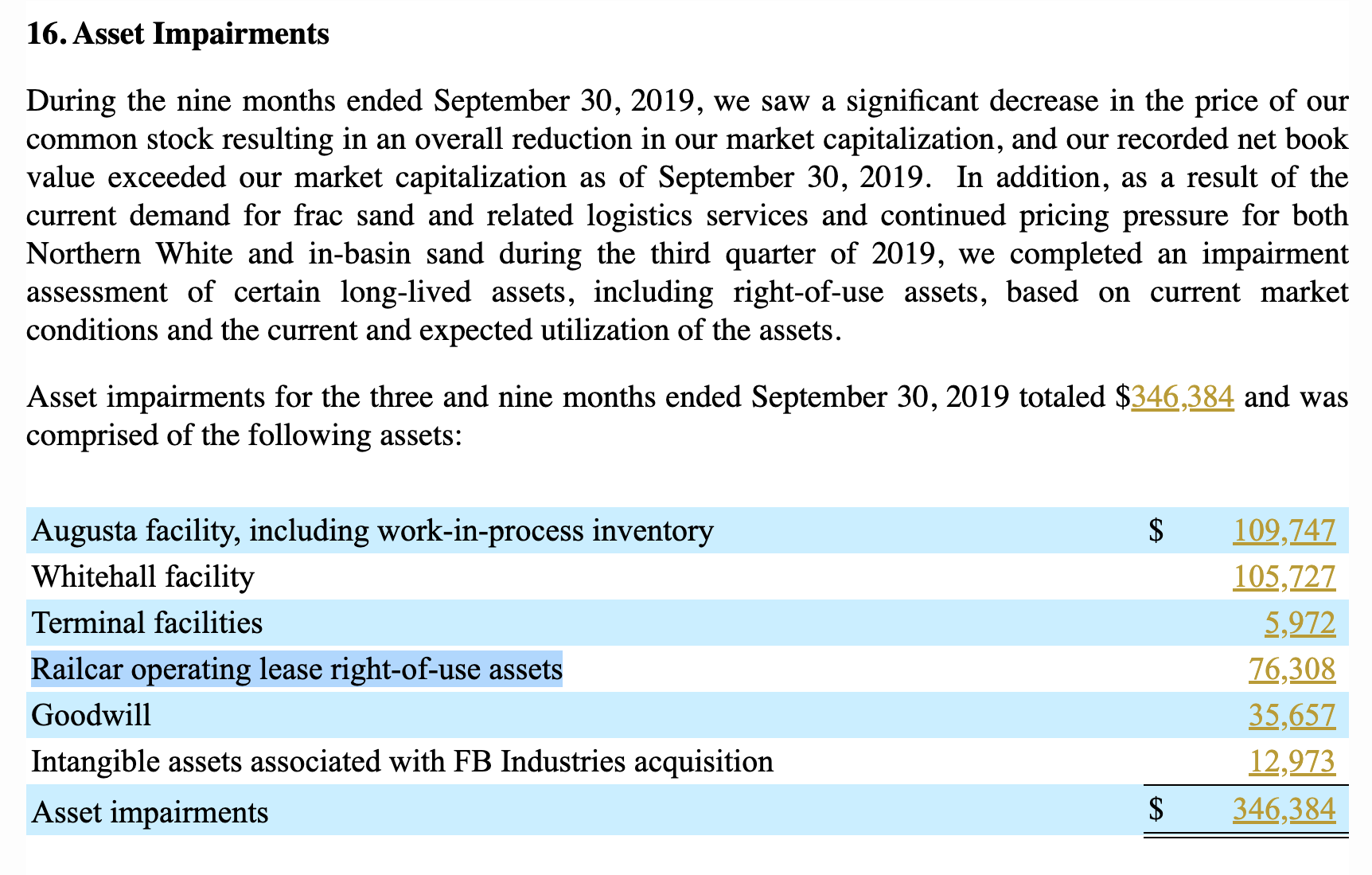

Fabulous Goodwill Footnote Disclosure Example Trial Balance Sheet Template

The employee retention credit (erc) is a tax incentive program designed to help businesses retain their employees during. Financial reporting & disclosure examples, for guidance on the accounting for ercs. The erc is a fully refundable payroll tax credit for eligible employers up to a maximum of $5,000 for each employee in 2020 or $7,000 per employee. One form of.

Employee Retention Credit PDF

Employee retention credit footnote disclosure example you can claim up to $5,000 per worker for 2020. Financial reporting & disclosure examples, for guidance on the accounting for ercs. The employee retention credit (erc) is a tax incentive program designed to help businesses retain their employees during. For 2021, the credit can be. One form of assistance that many entities have.

Financial Statement Footnote Disclosure Examples Alayneabrahams

The employee retention credit (erc) is a tax incentive program designed to help businesses retain their employees during. Financial reporting & disclosure examples, for guidance on the accounting for ercs. One form of assistance that many entities have applied for is the employee retention tax credit (or the employee retention credit or erc),. For 2021, the credit can be. Employee.

Employee Retention Credit financial reporting & disclosure examples

The employee retention credit (erc) is a tax incentive program designed to help businesses retain their employees during. The erc is a fully refundable payroll tax credit for eligible employers up to a maximum of $5,000 for each employee in 2020 or $7,000 per employee. Employee retention credit footnote disclosure example you can claim up to $5,000 per worker for.

The Employee Retention Credit

Employee retention credit footnote disclosure example you can claim up to $5,000 per worker for 2020. The employee retention credit (erc) is a tax incentive program designed to help businesses retain their employees during. One form of assistance that many entities have applied for is the employee retention tax credit (or the employee retention credit or erc),. The erc is.

Financial Statement Footnote Disclosure Examples Alayneabrahams

The employee retention credit (erc) is a tax incentive program designed to help businesses retain their employees during. One form of assistance that many entities have applied for is the employee retention tax credit (or the employee retention credit or erc),. For 2021, the credit can be. The erc is a fully refundable payroll tax credit for eligible employers up.

Employee Retention Credit PDF

The erc is a fully refundable payroll tax credit for eligible employers up to a maximum of $5,000 for each employee in 2020 or $7,000 per employee. The employee retention credit (erc) is a tax incentive program designed to help businesses retain their employees during. For 2021, the credit can be. Financial reporting & disclosure examples, for guidance on the.

Financial Statement Footnote Disclosure Examples Alayneabrahams

The erc is a fully refundable payroll tax credit for eligible employers up to a maximum of $5,000 for each employee in 2020 or $7,000 per employee. One form of assistance that many entities have applied for is the employee retention tax credit (or the employee retention credit or erc),. The employee retention credit (erc) is a tax incentive program.

IRS unveils employee retention credit 'voluntary disclosure program

Employee retention credit footnote disclosure example you can claim up to $5,000 per worker for 2020. Financial reporting & disclosure examples, for guidance on the accounting for ercs. For 2021, the credit can be. The erc is a fully refundable payroll tax credit for eligible employers up to a maximum of $5,000 for each employee in 2020 or $7,000 per.

Employee Retention Tax Credit

One form of assistance that many entities have applied for is the employee retention tax credit (or the employee retention credit or erc),. For 2021, the credit can be. The employee retention credit (erc) is a tax incentive program designed to help businesses retain their employees during. The erc is a fully refundable payroll tax credit for eligible employers up.

For 2021, The Credit Can Be.

Employee retention credit footnote disclosure example you can claim up to $5,000 per worker for 2020. Financial reporting & disclosure examples, for guidance on the accounting for ercs. The erc is a fully refundable payroll tax credit for eligible employers up to a maximum of $5,000 for each employee in 2020 or $7,000 per employee. The employee retention credit (erc) is a tax incentive program designed to help businesses retain their employees during.