Employeeportia Grant Is An Employee Who Is Paid Monthly

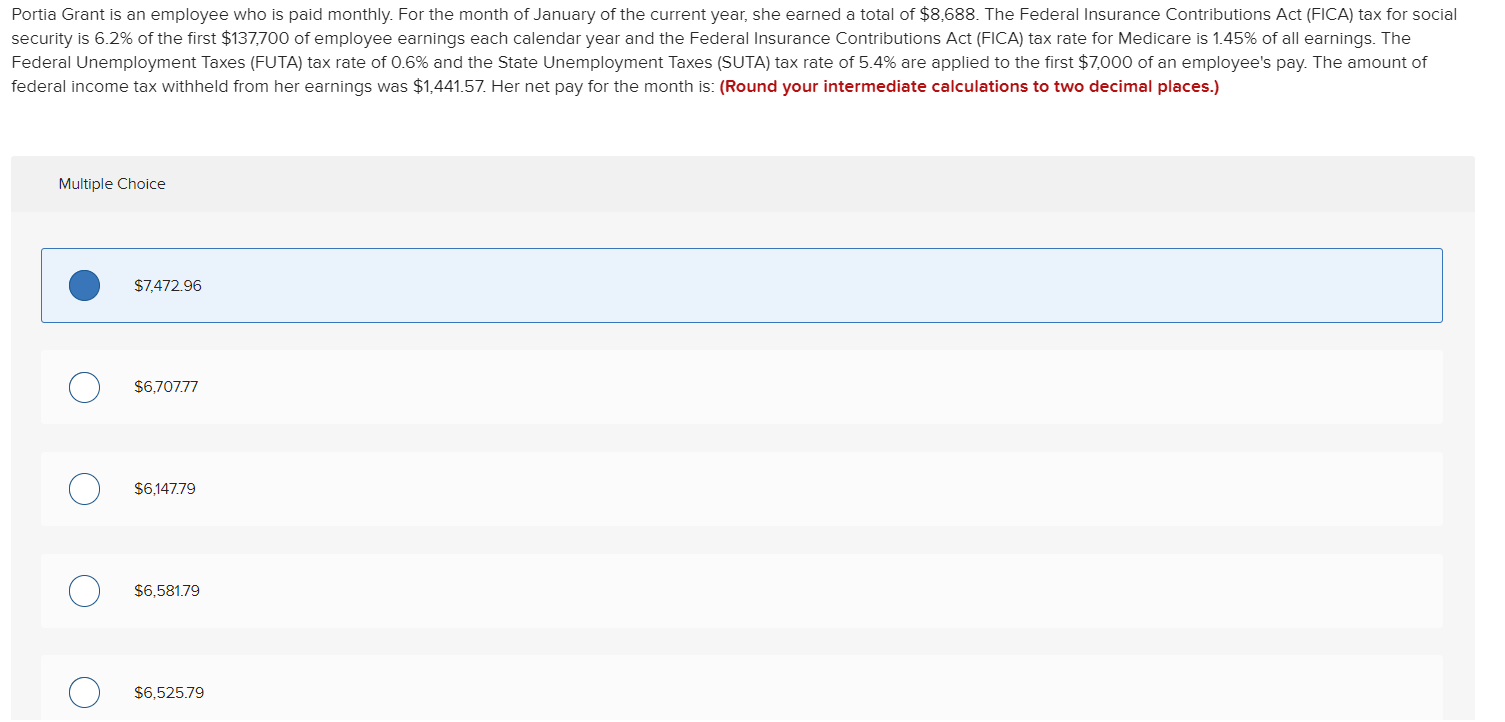

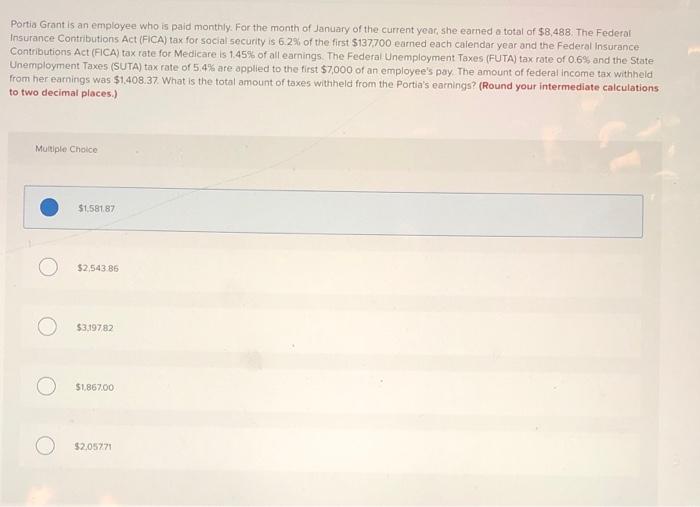

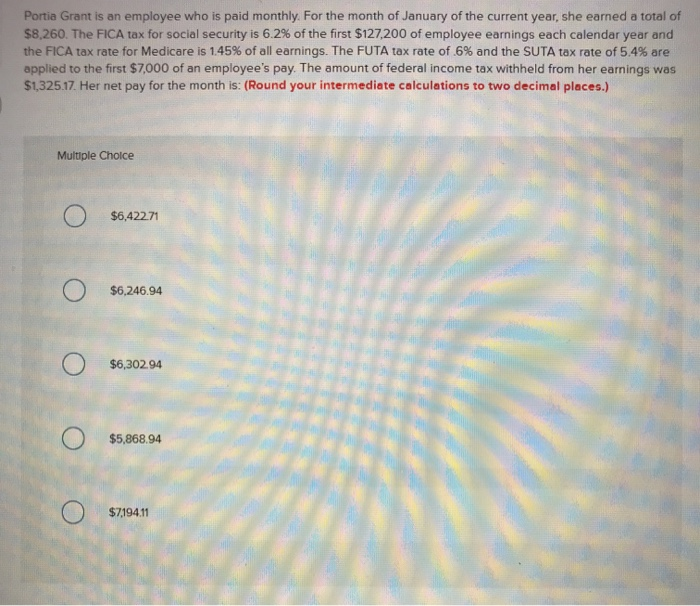

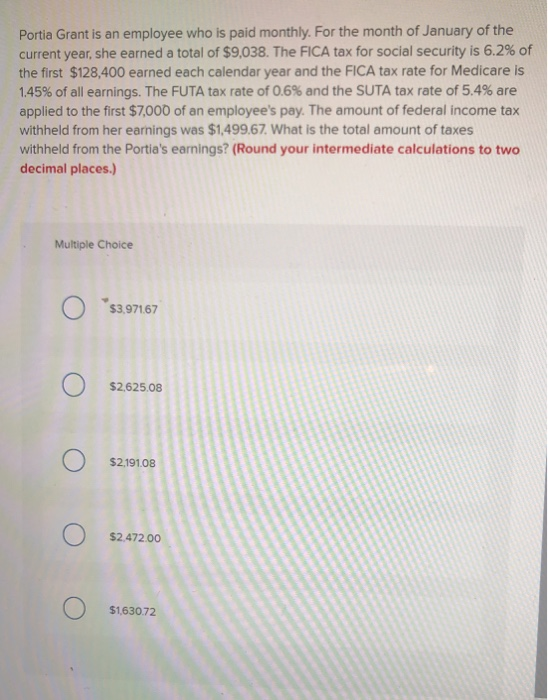

Employeeportia Grant Is An Employee Who Is Paid Monthly - The suta tax rate of 5.4% is applied to the first $7,000 of an employee's pay. To calculate portia grant's net pay for the month, we need to subtract all the taxes from her gross pay. Since portia's monthly earnings of $8,338 are more than. For the month of january of the current year, she earned a total of $8,638. For the month of january of the current year, she earned a total of $8,438. Portia grant is an employee who is paid monthly. Portia grant is an employee who is paid monthly. The fica tax for social. To calculate portia's net pay for the month, we need to subtract all the taxes from her gross earnings. First, we calculate the fica taxes for.

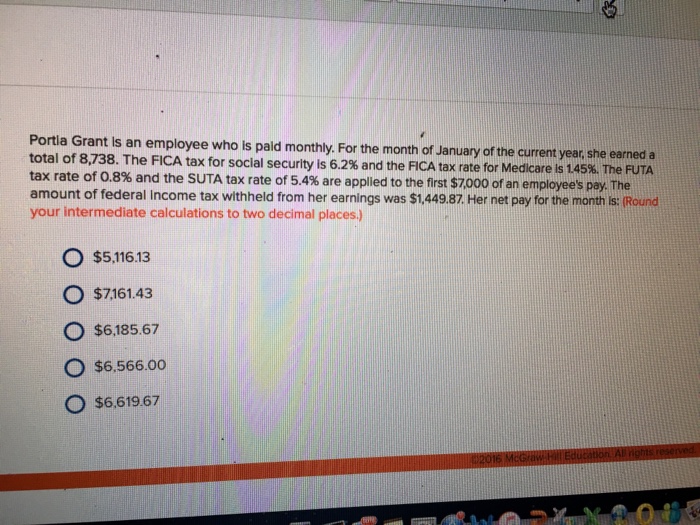

For the month of january of the current year, she earned a total of $8,638. To calculate portia grant's net pay for the month, we need to subtract all the taxes from her gross pay. First, we calculate the fica taxes for. For the month of january of the current year, she earned a total of 8,538. Portia grant is an employee who is paid monthly. The suta tax rate of 5.4% is applied to the first $7,000 of an employee's pay. To calculate portia's net pay for the month, we need to subtract all the taxes from her gross earnings. Portia grant is an employee who is paid monthly. The fica tax for social. For the month of january of the current year, she earned a total of $8,438.

To calculate portia's net pay for the month, we need to subtract all the taxes from her gross earnings. For the month of january of the current year, she earned a total of $8,638. Portia grant is an employee who is paid monthly. To calculate portia grant's net pay for the month, we need to subtract all the taxes from her gross pay. Portia grant is an employee who is paid monthly. Calculate fica taxes first, we. Since portia's monthly earnings of $8,338 are more than. First, we calculate the fica taxes for. Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of $8,438.

Member Success Valerie A. Grant Published in the Journal of the Grant

For the month of january of the current year, she earned a total of $8,438. The suta tax rate of 5.4% is applied to the first $7,000 of an employee's pay. Portia grant is an employee who is paid monthly. First, we calculate the fica taxes for. To calculate portia grant's net pay for the month, we need to subtract.

Solved Portia Grant is an employee who is paid monthly. For

To calculate portia's net pay for the month, we need to subtract all the taxes from her gross earnings. Since portia's monthly earnings of $8,338 are more than. Portia grant is an employee who is paid monthly. Portia grant is an employee who is paid monthly. Calculate fica taxes first, we.

Solved Portia Grant is an employee who is paid monthly. For

Portia grant is an employee who is paid monthly. Calculate fica taxes first, we. Portia grant is an employee who is paid monthly. First, we calculate the fica taxes for. Since portia's monthly earnings of $8,338 are more than.

Mark III Employee Benefits City of Lynchburg Employee Benefits Page

To calculate portia's net pay for the month, we need to subtract all the taxes from her gross earnings. Calculate fica taxes first, we. The fica tax for social. Since portia's monthly earnings of $8,338 are more than. To calculate portia grant's net pay for the month, we need to subtract all the taxes from her gross pay.

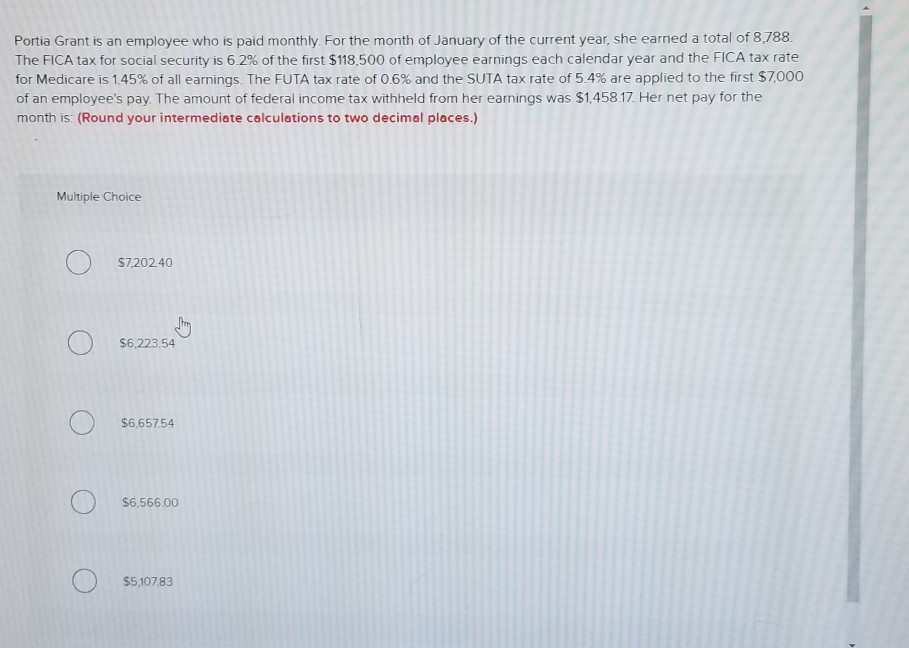

GRANT OF EXECUTIVE ALLOWANCE 1.5 TIMES OF THE MONTHLY BASIC PAY

The fica tax for social. Portia grant is an employee who is paid monthly. First, we calculate the fica taxes for. For the month of january of the current year, she earned a total of $8,438. Calculate fica taxes first, we.

Solved Portia Grant is an employee who is paid monthly. For

Portia grant is an employee who is paid monthly. Since portia's monthly earnings of $8,338 are more than. Portia grant is an employee who is paid monthly. The suta tax rate of 5.4% is applied to the first $7,000 of an employee's pay. For the month of january of the current year, she earned a total of 8,538.

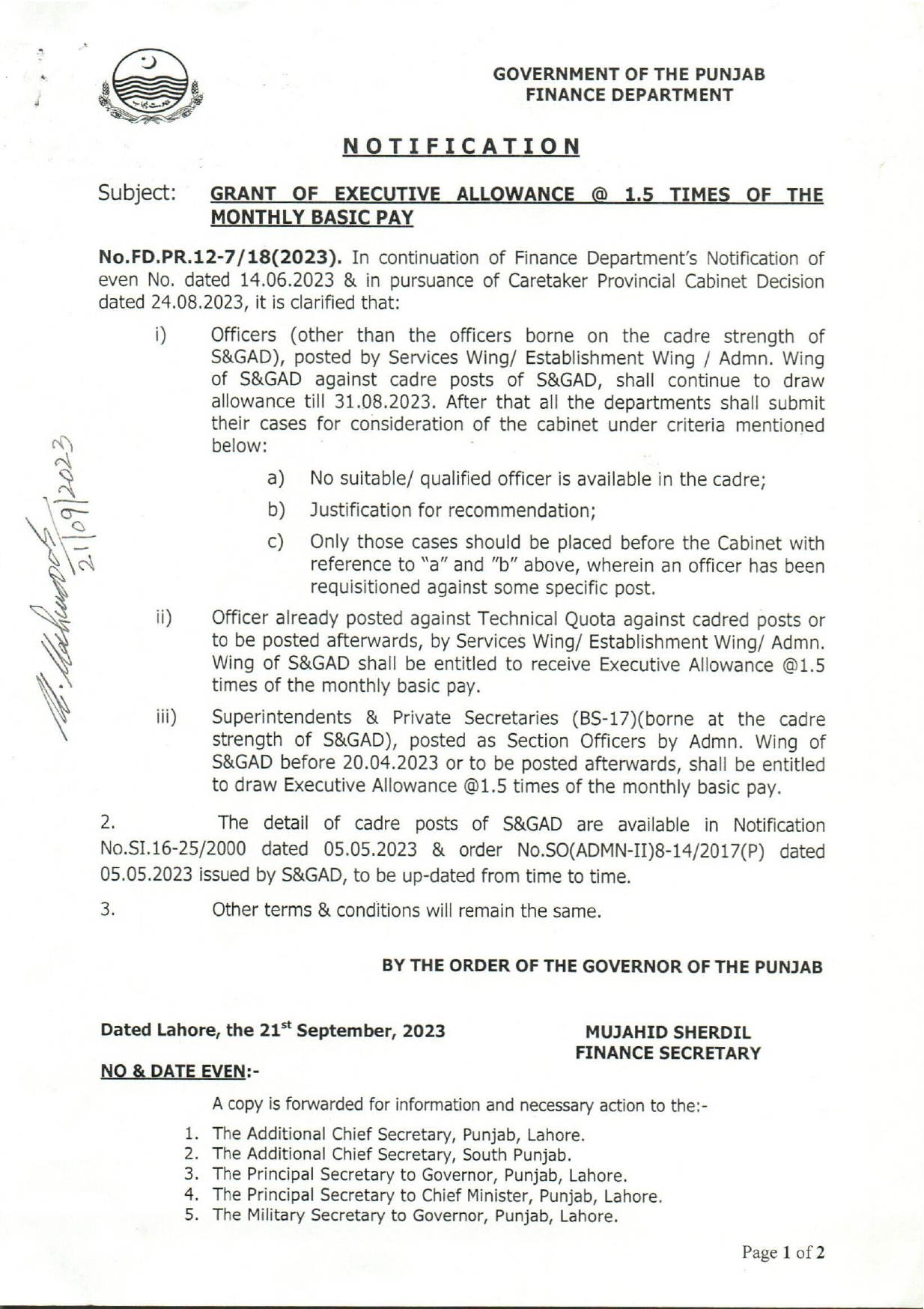

Solved Portia Grant Is an employee who Is paid monthly. For

To calculate portia grant's net pay for the month, we need to subtract all the taxes from her gross pay. Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of $8,260. Portia grant is an employee who is paid monthly. Calculate fica taxes first, we.

Solved Portia Grant is an employee who is paid monthly For

First, we calculate the fica taxes for. Portia grant is an employee who is paid monthly. Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of 8,538. For the month of january of the current year, she earned a total of $8,260.

Employee Benefits Slide Employee Management Kit Presentation

Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of 8,538. For the month of january of the current year, she earned a total of $8,438. To calculate portia grant's net pay for the month, we need to subtract all the taxes from her gross pay. Calculate.

Solved Portia Grant is an employee who is paid monthly. For

First, we calculate the fica taxes for. For the month of january of the current year, she earned a total of 8,538. Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of $8,638. Since portia's monthly earnings of $8,338 are more than.

For The Month Of January Of The Current Year, She Earned A Total Of $8,638.

The fica tax for social. For the month of january of the current year, she earned a total of $8,438. For the month of january of the current year, she earned a total of $8,260. Since portia's monthly earnings of $8,338 are more than.

Portia Grant Is An Employee Who Is Paid Monthly.

Portia grant is an employee who is paid monthly. First, we calculate the fica taxes for. The suta tax rate of 5.4% is applied to the first $7,000 of an employee's pay. For the month of january of the current year, she earned a total of 8,538.

Calculate Fica Taxes First, We.

To calculate portia grant's net pay for the month, we need to subtract all the taxes from her gross pay. To calculate portia's net pay for the month, we need to subtract all the taxes from her gross earnings. Portia grant is an employee who is paid monthly. Portia grant is an employee who is paid monthly.