Fannie Mae Rules On Foreclosure

Fannie Mae Rules On Foreclosure - This topic describes the amount of time that must elapse (the “waiting period”) after a significant derogatory credit event before the borrower is. This chapter provides fannie mae’s requirements and policies for conducting foreclosure proceedings for fannie mae mortgage loans. Foreclosure time frames and compensatory fee requirements at the direction of the federal housing finance agency (fhfa) and in alignment with. Currently, servicers are required to provide all appropriate documentation and mortgage loan status data for each case that is referred to a foreclosure. Fannie mae will inform the servicer whether or not a lease was finalized and whether the mortgage release is contingent on the property being.

Currently, servicers are required to provide all appropriate documentation and mortgage loan status data for each case that is referred to a foreclosure. This topic describes the amount of time that must elapse (the “waiting period”) after a significant derogatory credit event before the borrower is. Foreclosure time frames and compensatory fee requirements at the direction of the federal housing finance agency (fhfa) and in alignment with. This chapter provides fannie mae’s requirements and policies for conducting foreclosure proceedings for fannie mae mortgage loans. Fannie mae will inform the servicer whether or not a lease was finalized and whether the mortgage release is contingent on the property being.

This topic describes the amount of time that must elapse (the “waiting period”) after a significant derogatory credit event before the borrower is. Foreclosure time frames and compensatory fee requirements at the direction of the federal housing finance agency (fhfa) and in alignment with. Fannie mae will inform the servicer whether or not a lease was finalized and whether the mortgage release is contingent on the property being. This chapter provides fannie mae’s requirements and policies for conducting foreclosure proceedings for fannie mae mortgage loans. Currently, servicers are required to provide all appropriate documentation and mortgage loan status data for each case that is referred to a foreclosure.

Fannie Mae Guidelines On Timeshare Foreclosure On Conventional Loans

Fannie mae will inform the servicer whether or not a lease was finalized and whether the mortgage release is contingent on the property being. This chapter provides fannie mae’s requirements and policies for conducting foreclosure proceedings for fannie mae mortgage loans. This topic describes the amount of time that must elapse (the “waiting period”) after a significant derogatory credit event.

How to Purchase a Fannie Mae Foreclosure

Currently, servicers are required to provide all appropriate documentation and mortgage loan status data for each case that is referred to a foreclosure. This topic describes the amount of time that must elapse (the “waiting period”) after a significant derogatory credit event before the borrower is. This chapter provides fannie mae’s requirements and policies for conducting foreclosure proceedings for fannie.

Fannie Mae Guidelines On Foreclosure

Currently, servicers are required to provide all appropriate documentation and mortgage loan status data for each case that is referred to a foreclosure. This chapter provides fannie mae’s requirements and policies for conducting foreclosure proceedings for fannie mae mortgage loans. Fannie mae will inform the servicer whether or not a lease was finalized and whether the mortgage release is contingent.

Click here to view the Fannie Mae Lender Letter TENA

Foreclosure time frames and compensatory fee requirements at the direction of the federal housing finance agency (fhfa) and in alignment with. This chapter provides fannie mae’s requirements and policies for conducting foreclosure proceedings for fannie mae mortgage loans. Fannie mae will inform the servicer whether or not a lease was finalized and whether the mortgage release is contingent on the.

Fannie Mae Think Realty

This topic describes the amount of time that must elapse (the “waiting period”) after a significant derogatory credit event before the borrower is. Foreclosure time frames and compensatory fee requirements at the direction of the federal housing finance agency (fhfa) and in alignment with. This chapter provides fannie mae’s requirements and policies for conducting foreclosure proceedings for fannie mae mortgage.

Fannie Mae Lowers Bankruptcy and Foreclosure Waiting Periods Synergy

Currently, servicers are required to provide all appropriate documentation and mortgage loan status data for each case that is referred to a foreclosure. Fannie mae will inform the servicer whether or not a lease was finalized and whether the mortgage release is contingent on the property being. This chapter provides fannie mae’s requirements and policies for conducting foreclosure proceedings for.

FANNIE MAE AND FREDDIE MAC SUSPEND FORECLOSURE SALES IN FLORIDA

This topic describes the amount of time that must elapse (the “waiting period”) after a significant derogatory credit event before the borrower is. Foreclosure time frames and compensatory fee requirements at the direction of the federal housing finance agency (fhfa) and in alignment with. Currently, servicers are required to provide all appropriate documentation and mortgage loan status data for each.

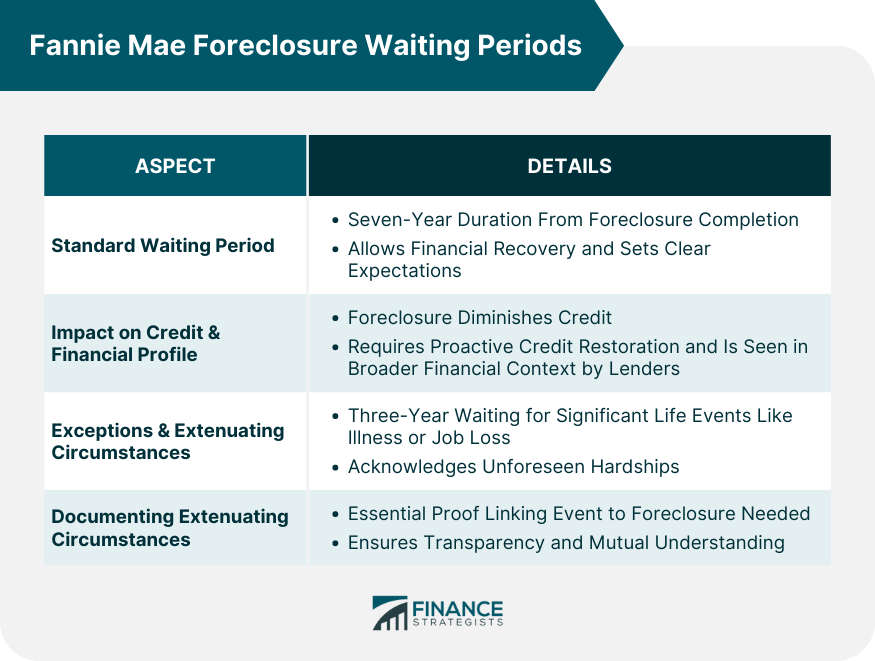

Fannie Mae Waiting Period for Foreclosure Finance Strategists

Currently, servicers are required to provide all appropriate documentation and mortgage loan status data for each case that is referred to a foreclosure. This topic describes the amount of time that must elapse (the “waiting period”) after a significant derogatory credit event before the borrower is. This chapter provides fannie mae’s requirements and policies for conducting foreclosure proceedings for fannie.

Fannie Mae and Esusu Esusu

Fannie mae will inform the servicer whether or not a lease was finalized and whether the mortgage release is contingent on the property being. This chapter provides fannie mae’s requirements and policies for conducting foreclosure proceedings for fannie mae mortgage loans. Foreclosure time frames and compensatory fee requirements at the direction of the federal housing finance agency (fhfa) and in.

Fannie Mae Waiting Period for Foreclosure Finance Strategists

This chapter provides fannie mae’s requirements and policies for conducting foreclosure proceedings for fannie mae mortgage loans. Fannie mae will inform the servicer whether or not a lease was finalized and whether the mortgage release is contingent on the property being. Foreclosure time frames and compensatory fee requirements at the direction of the federal housing finance agency (fhfa) and in.

This Topic Describes The Amount Of Time That Must Elapse (The “Waiting Period”) After A Significant Derogatory Credit Event Before The Borrower Is.

Fannie mae will inform the servicer whether or not a lease was finalized and whether the mortgage release is contingent on the property being. Currently, servicers are required to provide all appropriate documentation and mortgage loan status data for each case that is referred to a foreclosure. Foreclosure time frames and compensatory fee requirements at the direction of the federal housing finance agency (fhfa) and in alignment with. This chapter provides fannie mae’s requirements and policies for conducting foreclosure proceedings for fannie mae mortgage loans.