Federal Tax Lien Search Florida

Federal Tax Lien Search Florida - The lien protects the government’s. Financial records, including but not limited to federal income tax returns, wage and earnings statements, and sworn statements of gross income; You can search our database by: Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. Pay the amount in full. A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. Enter a stipulated payment agreement. To resolve your tax liability, you must do one of the following: The place of inquiry for a federal tax lien in florida depends on the type of property (real or personal) and the type of debtor.

You can search our database by: Detail by lien document number; The lien protects the government’s. The place of inquiry for a federal tax lien in florida depends on the type of property (real or personal) and the type of debtor. Pay the amount in full. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. Enter a stipulated payment agreement. To resolve your tax liability, you must do one of the following: Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years. Financial records, including but not limited to federal income tax returns, wage and earnings statements, and sworn statements of gross income;

The place of inquiry for a federal tax lien in florida depends on the type of property (real or personal) and the type of debtor. Enter a stipulated payment agreement. You can search our database by: You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. The lien protects the government’s. To resolve your tax liability, you must do one of the following: Pay the amount in full. Financial records, including but not limited to federal income tax returns, wage and earnings statements, and sworn statements of gross income; A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years.

Federal tax lien on foreclosed property laderdriver

Financial records, including but not limited to federal income tax returns, wage and earnings statements, and sworn statements of gross income; Detail by lien document number; To resolve your tax liability, you must do one of the following: You can search our database by: The place of inquiry for a federal tax lien in florida depends on the type of.

Free Federal Tax Lien Search Enter Any Name To Begin

A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. Detail by lien document number; You can search our database by: Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years. The place of inquiry for a federal tax.

How to Remove a Federal Tax Lien Heartland Tax Solutions

Enter a stipulated payment agreement. Pay the amount in full. You can search our database by: To resolve your tax liability, you must do one of the following: Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years.

What Is a Tax Lien? Definition & Impact on Credit TheStreet

You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. The place of inquiry for a federal tax lien in florida depends on the type of property (real or personal) and the type of debtor. The lien protects the government’s. Pay the amount in full..

Federal Tax Lien February 2017

You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. The lien protects the government’s. Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years. Enter a stipulated payment agreement. Detail by lien document number;

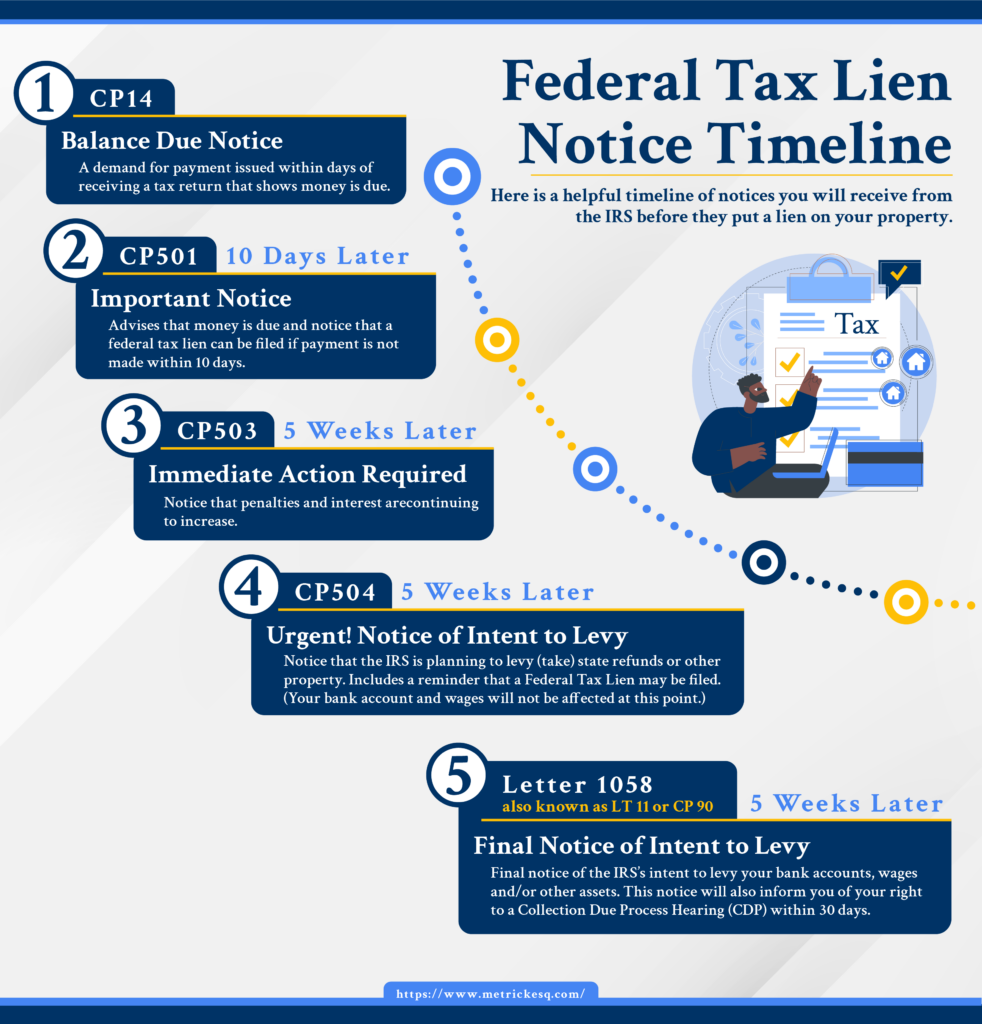

Federal Tax Lien Notice Timeline Ira J. Metrick, Esq.

Enter a stipulated payment agreement. A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. Financial records, including but not limited to federal income tax returns, wage and earnings statements, and sworn statements of gross income; The place of inquiry for a federal tax lien in florida depends.

Search Tax Lien Records

To resolve your tax liability, you must do one of the following: Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years. Financial records, including but not limited to federal income tax returns, wage and earnings statements, and sworn statements of gross income; Detail by lien document number; Pay the amount.

IRS Tax Lien vs. NY Tax Warrant [ 6 FAQs ]

Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years. A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. Enter a stipulated payment agreement. You can search for a federal tax lien at the recorder's office in the.

Federal Tax Lien Definition

The lien protects the government’s. Enter a stipulated payment agreement. Pay the amount in full. Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years. The place of inquiry for a federal tax lien in florida depends on the type of property (real or personal) and the type of debtor.

Federal Tax Lien Federal Tax Lien On Foreclosed Property

Pay the amount in full. The place of inquiry for a federal tax lien in florida depends on the type of property (real or personal) and the type of debtor. A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. To resolve your tax liability, you must do.

Financial Records, Including But Not Limited To Federal Income Tax Returns, Wage And Earnings Statements, And Sworn Statements Of Gross Income;

Detail by lien document number; Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years. Pay the amount in full. A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt.

To Resolve Your Tax Liability, You Must Do One Of The Following:

You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. The place of inquiry for a federal tax lien in florida depends on the type of property (real or personal) and the type of debtor. You can search our database by: The lien protects the government’s.

![IRS Tax Lien vs. NY Tax Warrant [ 6 FAQs ]](https://taxproblemlawcenter.com/wp-content/uploads/2020/11/Travel_269-1024x1024.jpg)

/tax-lien-497446038-d3fe1b94273f4700ad75e4fa45f0fda9.jpg)