Florida Tax Liens

Florida Tax Liens - Enter a stipulated payment agreement. Pay the amount in full. All procedures of this tax sale are in accordance with florida statutes. The purpose of this page, is to consolidate the information for you and to help you better understand the florida delinquent process. To resolve your tax liability, you must do one of the following: Florida, currently has 185,709 tax liens and 43,283 other distressed listings available as of january 2. Welcome to the florida tax sale portal hosted by visualgov. The tax certificate sales are held. The annual tax certificate sale is a public sale of tax liens on delinquent real property taxes. Rather, it is a lien imposed on the property by payment of the delinquent taxes.

The purpose of this page, is to consolidate the information for you and to help you better understand the florida delinquent process. The annual tax certificate sale is a public sale of tax liens on delinquent real property taxes. Pay the amount in full. The tax certificate sales are held. According to florida law, the tax collector must. Welcome to the florida tax sale portal hosted by visualgov. Rather, it is a lien imposed on the property by payment of the delinquent taxes. A tax lien certificate, or tax certificate is not a purchase of property; To resolve your tax liability, you must do one of the following: Provide information to prove the amount on the warrant is not due.

Rather, it is a lien imposed on the property by payment of the delinquent taxes. Provide information to prove the amount on the warrant is not due. Enter a stipulated payment agreement. A tax lien certificate, or tax certificate is not a purchase of property; Welcome to the florida tax sale portal hosted by visualgov. According to florida law, the tax collector must. Florida, currently has 185,709 tax liens and 43,283 other distressed listings available as of january 2. The tax certificate sales are held. The annual tax certificate sale is a public sale of tax liens on delinquent real property taxes. Pay the amount in full.

Tax Liens and Deeds Live Class Pips Path

Provide information to prove the amount on the warrant is not due. The purpose of this page, is to consolidate the information for you and to help you better understand the florida delinquent process. Pay the amount in full. The annual tax certificate sale is a public sale of tax liens on delinquent real property taxes. Welcome to the florida.

TAX LIENS & TAX DEEDS EXPLAINED! Each year Florida has 254 counties

The tax certificate sales are held. Enter a stipulated payment agreement. According to florida law, the tax collector must. Florida, currently has 185,709 tax liens and 43,283 other distressed listings available as of january 2. A tax lien certificate, or tax certificate is not a purchase of property;

Investing In Tax Liens Alts.co

The purpose of this page, is to consolidate the information for you and to help you better understand the florida delinquent process. Rather, it is a lien imposed on the property by payment of the delinquent taxes. The tax certificate sales are held. Provide information to prove the amount on the warrant is not due. A tax lien certificate, or.

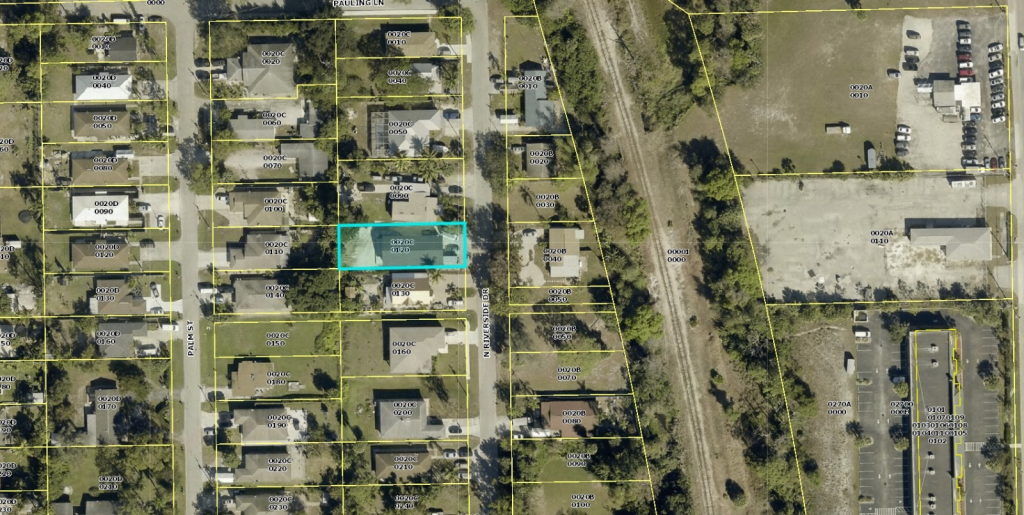

Tax Liens Emanuel Use Case Florida

A tax lien certificate, or tax certificate is not a purchase of property; The annual tax certificate sale is a public sale of tax liens on delinquent real property taxes. Provide information to prove the amount on the warrant is not due. Rather, it is a lien imposed on the property by payment of the delinquent taxes. Enter a stipulated.

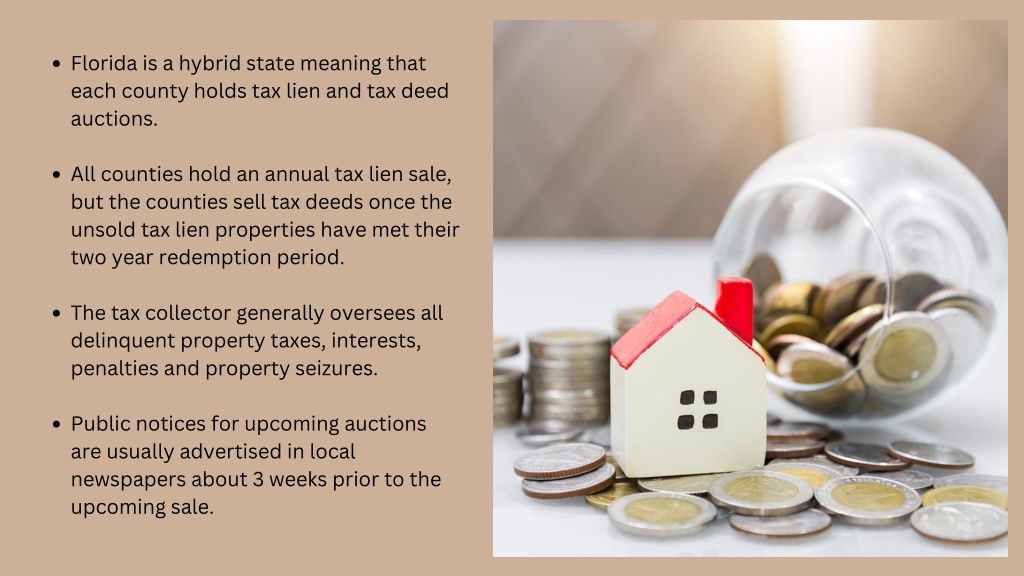

PPT Florida Tax Liens & Deeds PowerPoint Presentation, free download

Welcome to the florida tax sale portal hosted by visualgov. Provide information to prove the amount on the warrant is not due. The purpose of this page, is to consolidate the information for you and to help you better understand the florida delinquent process. Pay the amount in full. The annual tax certificate sale is a public sale of tax.

What Is A Tax Lien? Atlanta Tax Lawyer Alyssa Maloof Whatley

According to florida law, the tax collector must. All procedures of this tax sale are in accordance with florida statutes. The annual tax certificate sale is a public sale of tax liens on delinquent real property taxes. The tax certificate sales are held. A tax lien certificate, or tax certificate is not a purchase of property;

PPT Florida Tax Liens & Deeds PowerPoint Presentation, free download

Pay the amount in full. The tax certificate sales are held. The annual tax certificate sale is a public sale of tax liens on delinquent real property taxes. Rather, it is a lien imposed on the property by payment of the delinquent taxes. Enter a stipulated payment agreement.

Download Florida Tax Liens How to Find Liens on Property for great Tax

The purpose of this page, is to consolidate the information for you and to help you better understand the florida delinquent process. The annual tax certificate sale is a public sale of tax liens on delinquent real property taxes. Provide information to prove the amount on the warrant is not due. Welcome to the florida tax sale portal hosted by.

Tax Liens Emanuel Use Case Florida

Welcome to the florida tax sale portal hosted by visualgov. Rather, it is a lien imposed on the property by payment of the delinquent taxes. The tax certificate sales are held. According to florida law, the tax collector must. Provide information to prove the amount on the warrant is not due.

PPT Florida Tax Liens & Deeds PowerPoint Presentation, free download

Pay the amount in full. To resolve your tax liability, you must do one of the following: Rather, it is a lien imposed on the property by payment of the delinquent taxes. According to florida law, the tax collector must. Florida, currently has 185,709 tax liens and 43,283 other distressed listings available as of january 2.

The Tax Certificate Sales Are Held.

Rather, it is a lien imposed on the property by payment of the delinquent taxes. Florida, currently has 185,709 tax liens and 43,283 other distressed listings available as of january 2. The purpose of this page, is to consolidate the information for you and to help you better understand the florida delinquent process. A tax lien certificate, or tax certificate is not a purchase of property;

Enter A Stipulated Payment Agreement.

All procedures of this tax sale are in accordance with florida statutes. To resolve your tax liability, you must do one of the following: Provide information to prove the amount on the warrant is not due. Welcome to the florida tax sale portal hosted by visualgov.

Pay The Amount In Full.

The annual tax certificate sale is a public sale of tax liens on delinquent real property taxes. According to florida law, the tax collector must.