Form 15H India

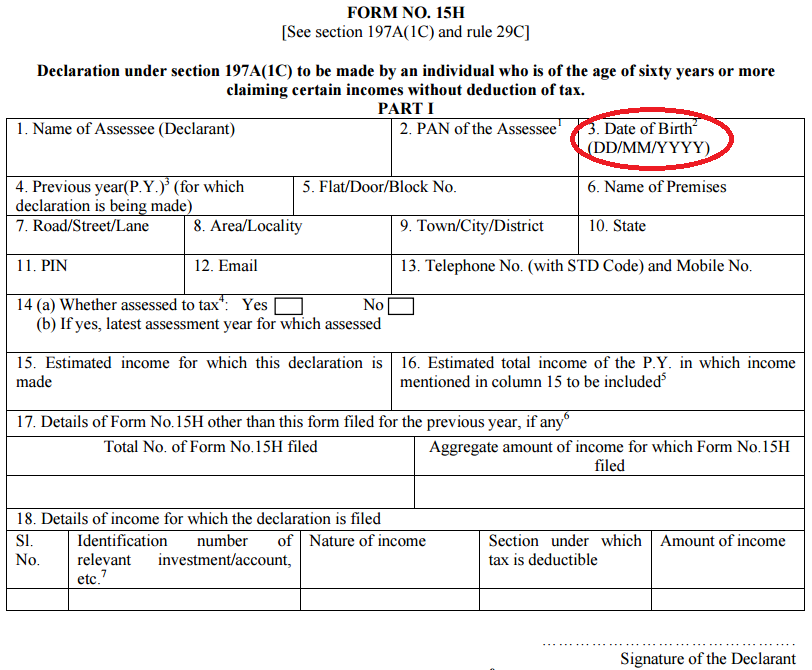

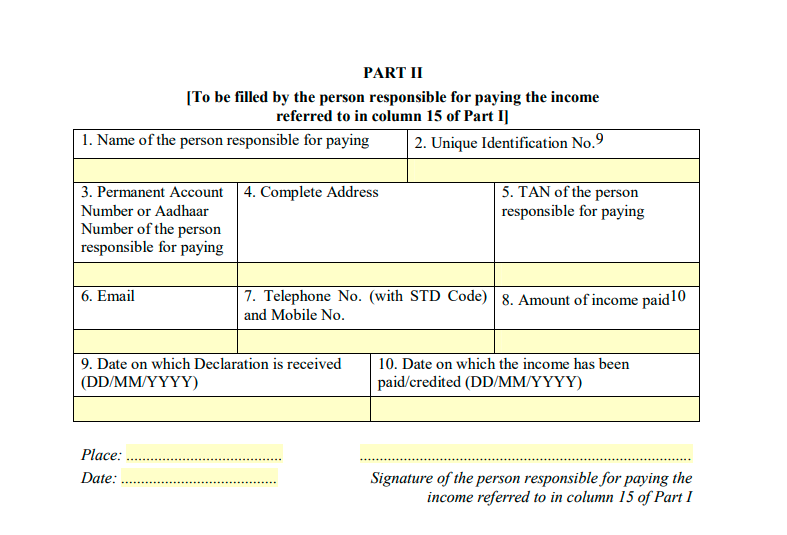

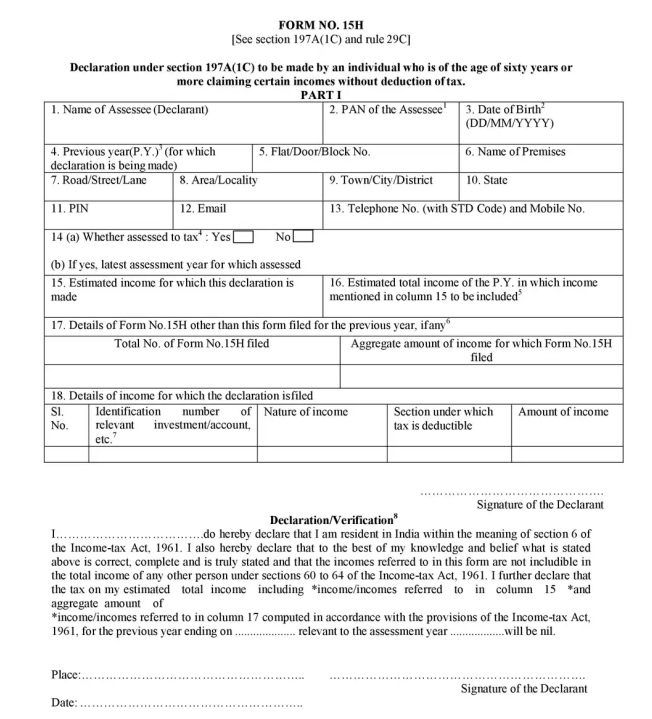

Form 15H India - 15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty. Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain. Signature of the declarant form no. In case any declaration(s) in form no. 15h [see section 197a(1c) and nile 29c] declaration under section 197a(1c) to be made by an individual. 15h is filed before filing this declaration during the previous year, mention the total number of such form.

15h is filed before filing this declaration during the previous year, mention the total number of such form. 15h [see section 197a(1c) and nile 29c] declaration under section 197a(1c) to be made by an individual. 15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty. Signature of the declarant form no. In case any declaration(s) in form no. Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain.

Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain. 15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty. Signature of the declarant form no. 15h is filed before filing this declaration during the previous year, mention the total number of such form. In case any declaration(s) in form no. 15h [see section 197a(1c) and nile 29c] declaration under section 197a(1c) to be made by an individual.

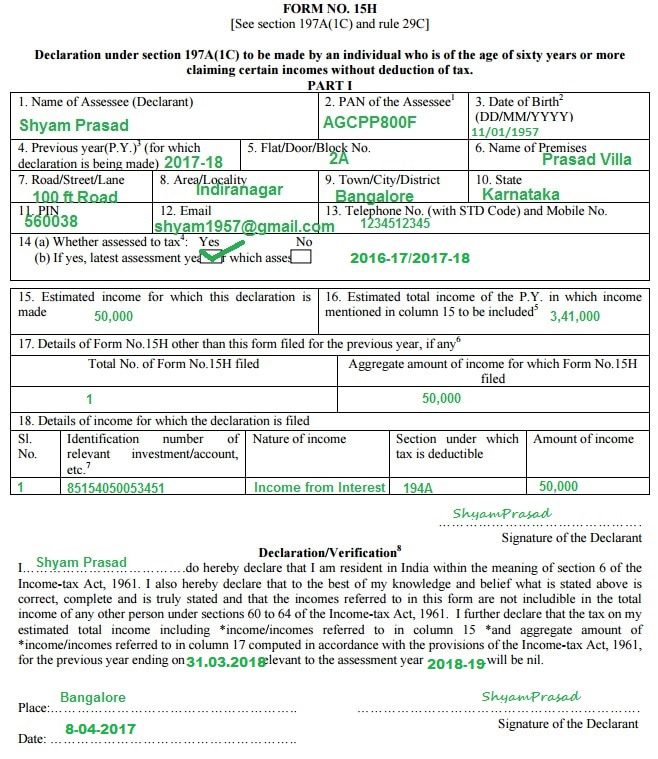

New FORM 15H Applicable PY 201617 Government Finances Payments

15h [see section 197a(1c) and nile 29c] declaration under section 197a(1c) to be made by an individual. In case any declaration(s) in form no. 15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty. 15h is filed before filing this declaration during the previous year, mention.

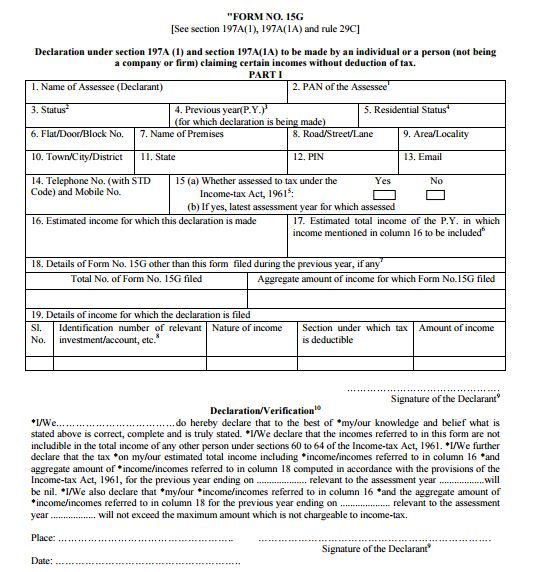

Free Download New Form 15G For Fixed Deposits revizionmortgage

15h [see section 197a(1c) and nile 29c] declaration under section 197a(1c) to be made by an individual. 15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty. Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or.

15h form Fill out & sign online DocHub

Signature of the declarant form no. In case any declaration(s) in form no. 15h is filed before filing this declaration during the previous year, mention the total number of such form. Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain. 15h [see section 197a(1c) and rule 29c].

Form 15H (Save TDS on Interest How to Fill & Download

15h is filed before filing this declaration during the previous year, mention the total number of such form. 15h [see section 197a(1c) and nile 29c] declaration under section 197a(1c) to be made by an individual. Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain. In case any.

Form 15G and Form 15H Save TDS on Interest

15h [see section 197a(1c) and nile 29c] declaration under section 197a(1c) to be made by an individual. 15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty. In case any declaration(s) in form no. 15h is filed before filing this declaration during the previous year, mention.

Download Form 15h For Pf Withdrawal 2023 Printable Forms Free Online

15h is filed before filing this declaration during the previous year, mention the total number of such form. In case any declaration(s) in form no. Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain. 15h [see section 197a(1c) and nile 29c] declaration under section 197a(1c) to be.

How to Fill Form 15G? How to Fill Form 15H?

Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain. 15h is filed before filing this declaration during the previous year, mention the total number of such form. 15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by an individual who is of.

What is Form 15H? How to Fill & Download Form No. 15H Marg ERP Blog

Signature of the declarant form no. In case any declaration(s) in form no. 15h is filed before filing this declaration during the previous year, mention the total number of such form. 15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty. Declaration under section 197a(1c) to.

Form 15G and Form 15H Save TDS on Interest

15h [see section 197a(1c) and nile 29c] declaration under section 197a(1c) to be made by an individual. In case any declaration(s) in form no. 15h is filed before filing this declaration during the previous year, mention the total number of such form. Signature of the declarant form no. Declaration under section 197a(1c) to be made by an individual who is.

Form No 15H Declaration under section 197A(1C) to be made by an

15h [see section 197a(1c) and nile 29c] declaration under section 197a(1c) to be made by an individual. Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain. 15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the.

15H [See Section 197A(1C) And Rule 29C] Declaration Under Section 197A(1C) To Be Made By An Individual Who Is Of The Age Of Sixty.

Signature of the declarant form no. In case any declaration(s) in form no. 15h is filed before filing this declaration during the previous year, mention the total number of such form. Declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain.