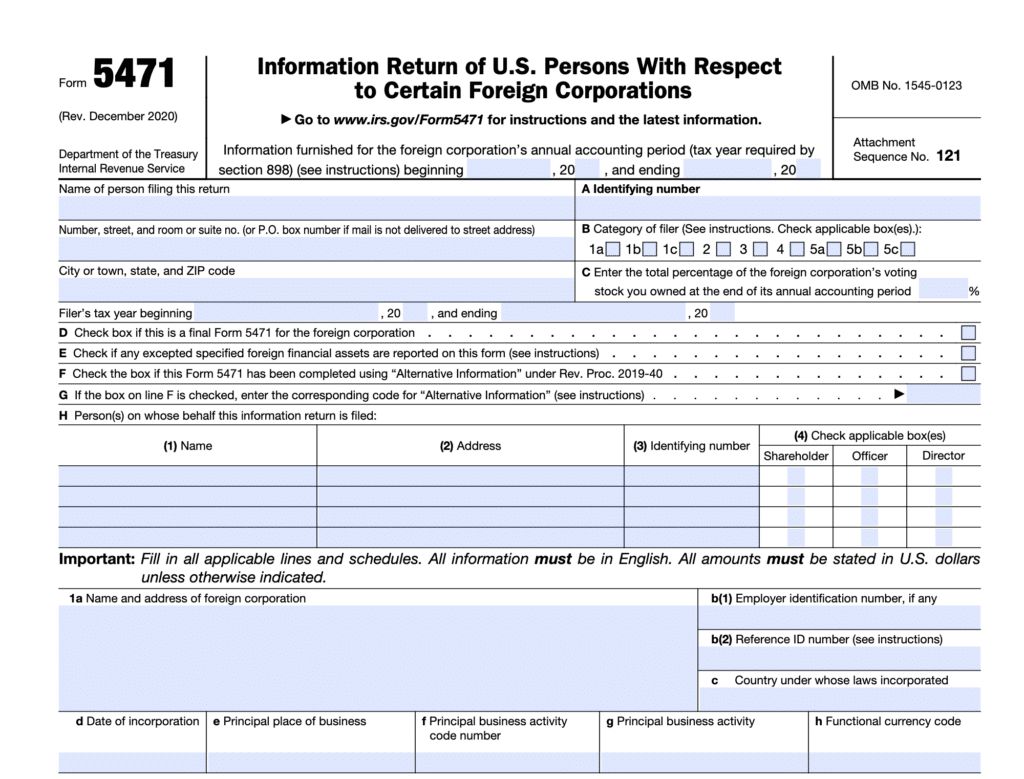

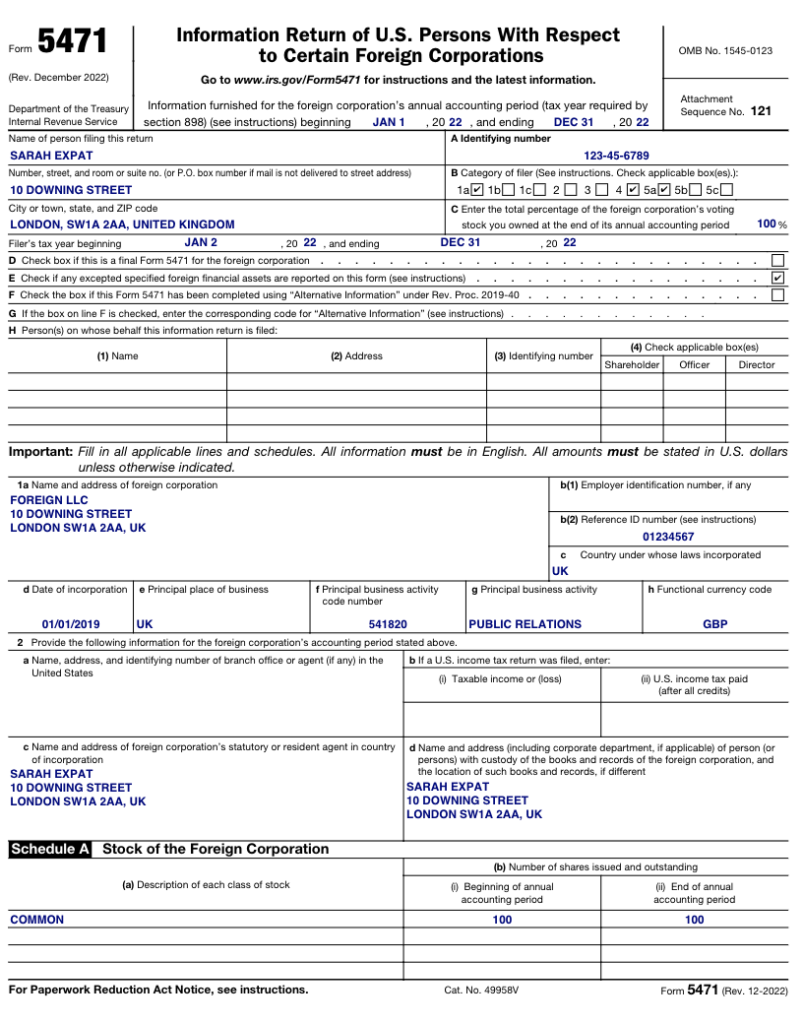

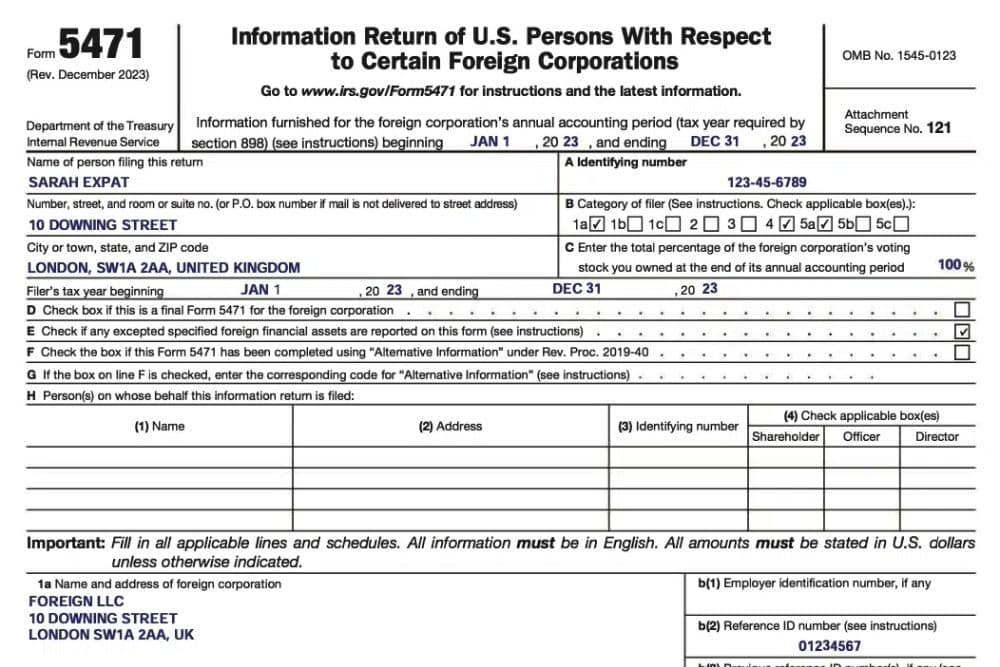

Form 5471 Requirements

Form 5471 Requirements - When translating amounts from functional currency to u.s. Information about form 5471, information return of u.s. Persons with respect to certain foreign corporations, including recent updates, related. Dollars, you must use the method specified. Reporting exchange rates on form 5471.

Persons with respect to certain foreign corporations, including recent updates, related. When translating amounts from functional currency to u.s. Dollars, you must use the method specified. Information about form 5471, information return of u.s. Reporting exchange rates on form 5471.

Dollars, you must use the method specified. Persons with respect to certain foreign corporations, including recent updates, related. Reporting exchange rates on form 5471. Information about form 5471, information return of u.s. When translating amounts from functional currency to u.s.

Form 5471 IRS Foreign Reporting International Tax RJS LAW

Information about form 5471, information return of u.s. Persons with respect to certain foreign corporations, including recent updates, related. When translating amounts from functional currency to u.s. Reporting exchange rates on form 5471. Dollars, you must use the method specified.

IRS Form 5471 Instructions CFC Tax Reporting for U.S. Persons

Persons with respect to certain foreign corporations, including recent updates, related. Information about form 5471, information return of u.s. When translating amounts from functional currency to u.s. Dollars, you must use the method specified. Reporting exchange rates on form 5471.

Form 5471 Filing Requirements with Your Expat Taxes

When translating amounts from functional currency to u.s. Information about form 5471, information return of u.s. Reporting exchange rates on form 5471. Persons with respect to certain foreign corporations, including recent updates, related. Dollars, you must use the method specified.

Simplified Form 5471 Key Facts and Requirements

Dollars, you must use the method specified. Information about form 5471, information return of u.s. Persons with respect to certain foreign corporations, including recent updates, related. Reporting exchange rates on form 5471. When translating amounts from functional currency to u.s.

Form 5471 Filing Requirements with Your Expat Taxes

Reporting exchange rates on form 5471. Dollars, you must use the method specified. When translating amounts from functional currency to u.s. Information about form 5471, information return of u.s. Persons with respect to certain foreign corporations, including recent updates, related.

Form 5471 Filing Requirements with Your Expat Taxes

When translating amounts from functional currency to u.s. Dollars, you must use the method specified. Persons with respect to certain foreign corporations, including recent updates, related. Information about form 5471, information return of u.s. Reporting exchange rates on form 5471.

Substantial Compliance Form 5471 HTJ Tax

Persons with respect to certain foreign corporations, including recent updates, related. Dollars, you must use the method specified. Reporting exchange rates on form 5471. Information about form 5471, information return of u.s. When translating amounts from functional currency to u.s.

IRS Form 5471 Instructions CFC Tax Reporting for U.S. Persons

Information about form 5471, information return of u.s. Dollars, you must use the method specified. Persons with respect to certain foreign corporations, including recent updates, related. When translating amounts from functional currency to u.s. Reporting exchange rates on form 5471.

Form 5471 Hone Maxwell LLP

Dollars, you must use the method specified. Persons with respect to certain foreign corporations, including recent updates, related. Reporting exchange rates on form 5471. Information about form 5471, information return of u.s. When translating amounts from functional currency to u.s.

Form 5471 2023 2024

Reporting exchange rates on form 5471. Persons with respect to certain foreign corporations, including recent updates, related. When translating amounts from functional currency to u.s. Information about form 5471, information return of u.s. Dollars, you must use the method specified.

Persons With Respect To Certain Foreign Corporations, Including Recent Updates, Related.

When translating amounts from functional currency to u.s. Dollars, you must use the method specified. Information about form 5471, information return of u.s. Reporting exchange rates on form 5471.