Form 8889 Sample

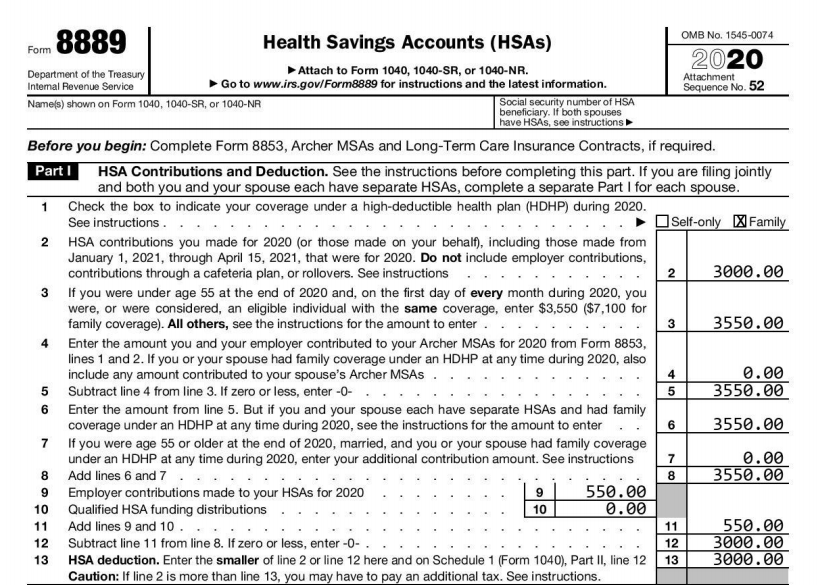

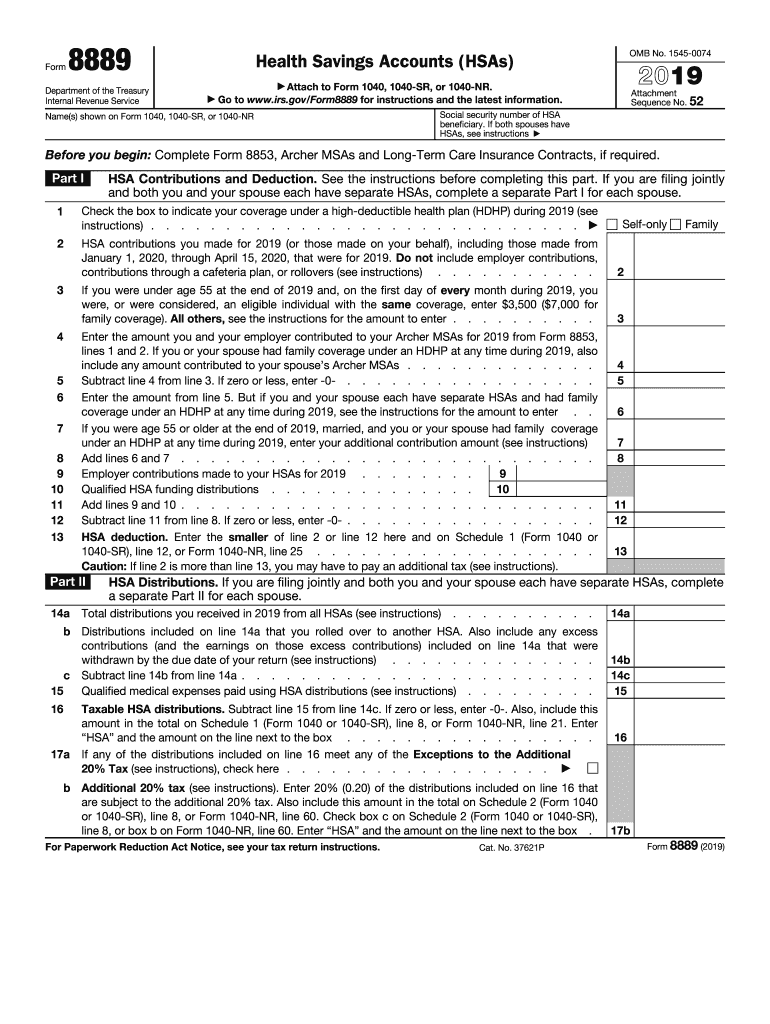

Form 8889 Sample - If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account (hsa) to lower their. This is a distribution from a health flexible spending arrangement (fsa) or health. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. Report health savings account (hsa) contributions (including those made on your behalf and employer.

Report health savings account (hsa) contributions (including those made on your behalf and employer. This is a distribution from a health flexible spending arrangement (fsa) or health. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account (hsa) to lower their. If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return.

This is a distribution from a health flexible spending arrangement (fsa) or health. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account (hsa) to lower their. If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. Report health savings account (hsa) contributions (including those made on your behalf and employer.

Form 8889 2023 Printable Forms Free Online

Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account (hsa) to lower their. This is a distribution from a health flexible spending arrangement (fsa) or health. If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. Report health savings account.

Irs Form 8889 For 2024 Carol Aundrea

This is a distribution from a health flexible spending arrangement (fsa) or health. If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. Report health savings.

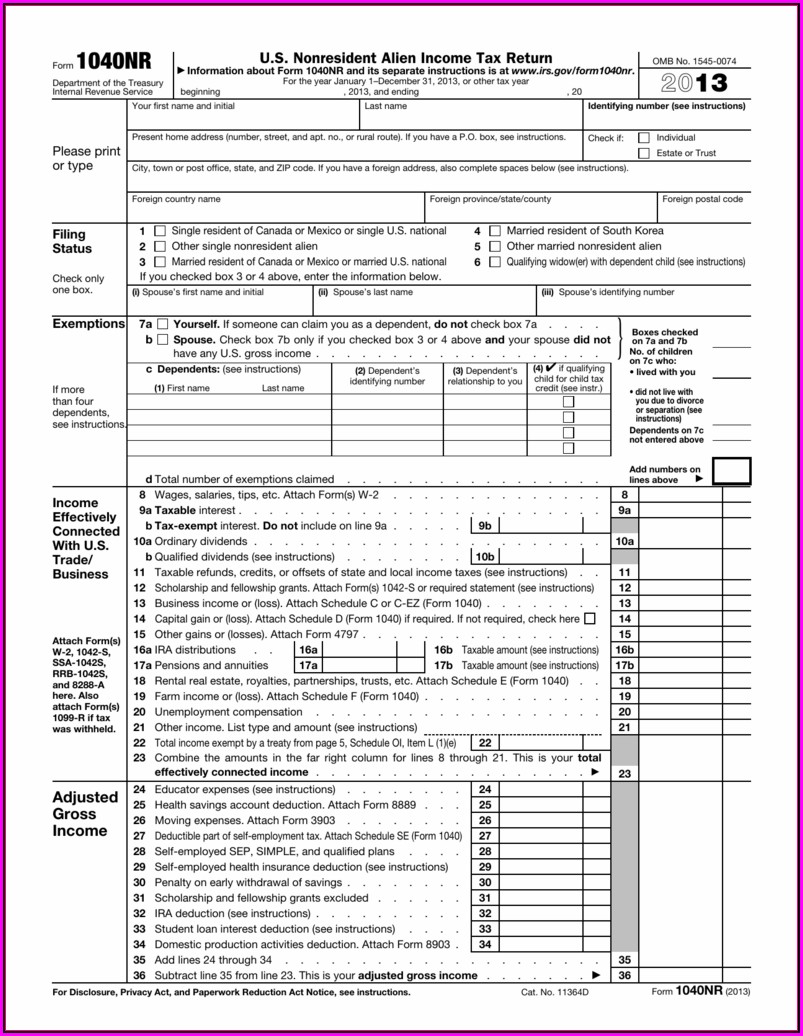

Irs Form 8889 Instructions 2013 Form Resume Examples goVLq1N2va

Report health savings account (hsa) contributions (including those made on your behalf and employer. If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account (hsa) to lower their. This is a.

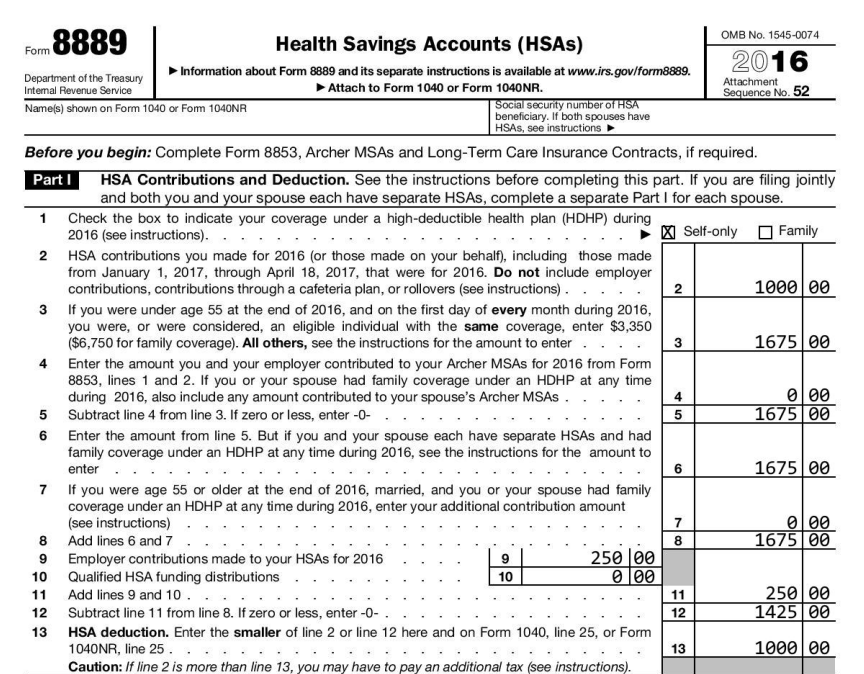

2016 HSA Form 8889 Instructions and Example HSA Edge

If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. This is a distribution from a health flexible spending arrangement (fsa) or health. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. Individual taxpayers with.

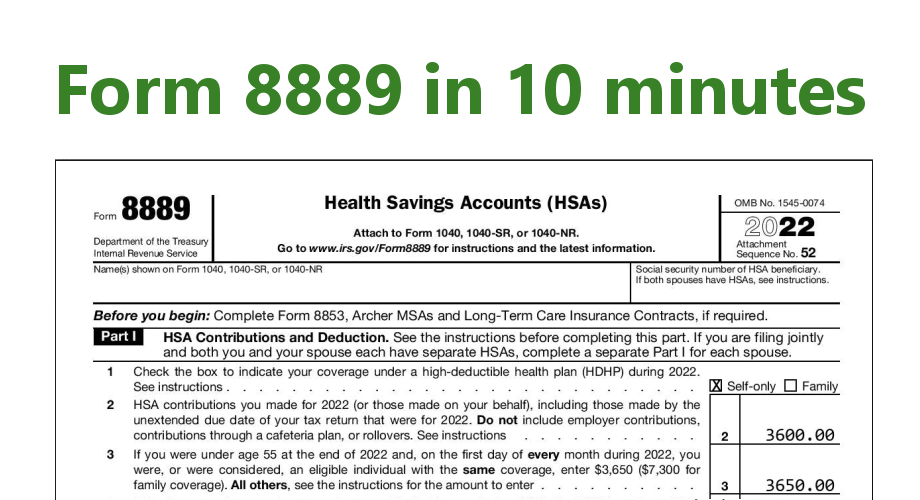

How to file HSA Form 8889 YouTube

Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. This is a distribution from a health flexible spending arrangement (fsa) or health. If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. Individual taxpayers with.

Irs Form 8889 For 2024 Carol Aundrea

Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account (hsa) to lower their. If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. Figure amounts you must include in income and additional tax you may owe if you fail to.

Form Fillable V5 Character Sheet Printable Forms Free Online

This is a distribution from a health flexible spending arrangement (fsa) or health. If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. Report health savings account (hsa) contributions (including those made on your behalf and employer. Individual taxpayers with a high deductible health insurance plan (hdhp).

Fill Free fillable Form 8949 Sales and Other Dispositions of Capital

If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account.

How to file HSA tax Form 8889 Irs Forms, Health Savings Account, Hsa

Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account (hsa) to lower their. Report health savings account (hsa) contributions (including those made on your behalf and employer. If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. This is a.

2019 Form IRS 8889 Fill Online, Printable, Fillable, Blank pdfFiller

Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. This is a distribution from a health flexible spending arrangement (fsa) or health. Report health savings account (hsa) contributions (including those made on your behalf and employer. If you contribute to an hsa, or take a distribution, you need.

If You Contribute To An Hsa, Or Take A Distribution, You Need To Complete And File Irs Form 8889 With Your Tax Return.

Report health savings account (hsa) contributions (including those made on your behalf and employer. This is a distribution from a health flexible spending arrangement (fsa) or health. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account (hsa) to lower their.