Form 8971 Instructions 2022

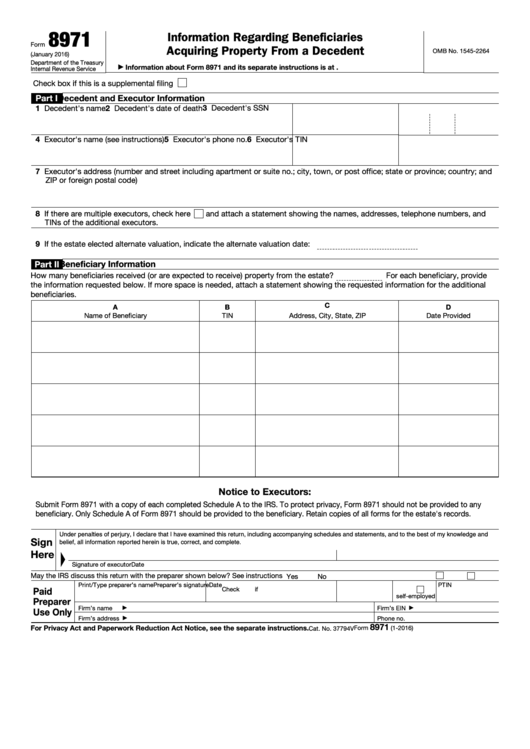

Form 8971 Instructions 2022 - Form 8971, along with a copy of every schedule a, is used to report values to the irs. That form is filed along with a form 706. A form or schedule filed with the irs without entries in. Complete form 8971 and each attached schedule a in its entirety. Do we claim this on our 2022 return? One schedule a is provided to each beneficiary receiving. One schedule a is provided to each. Form 8971, along with a copy of every schedule a, is used to report values to the irs. We received a form 8971 in 2022 for a cash inheritance.

We received a form 8971 in 2022 for a cash inheritance. Form 8971, along with a copy of every schedule a, is used to report values to the irs. A form or schedule filed with the irs without entries in. One schedule a is provided to each. Form 8971, along with a copy of every schedule a, is used to report values to the irs. One schedule a is provided to each beneficiary receiving. Complete form 8971 and each attached schedule a in its entirety. Do we claim this on our 2022 return? That form is filed along with a form 706.

Form 8971, along with a copy of every schedule a, is used to report values to the irs. Do we claim this on our 2022 return? One schedule a is provided to each. Form 8971, along with a copy of every schedule a, is used to report values to the irs. We received a form 8971 in 2022 for a cash inheritance. Complete form 8971 and each attached schedule a in its entirety. One schedule a is provided to each beneficiary receiving. That form is filed along with a form 706. A form or schedule filed with the irs without entries in.

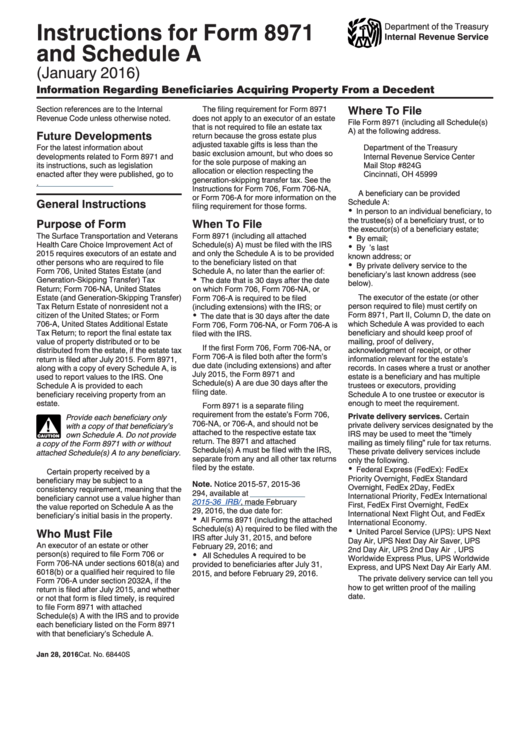

IRS Form 8971 Instructions Reporting a Decedent's Property

A form or schedule filed with the irs without entries in. One schedule a is provided to each beneficiary receiving. That form is filed along with a form 706. Complete form 8971 and each attached schedule a in its entirety. Form 8971, along with a copy of every schedule a, is used to report values to the irs.

IRS Form 15107 Instructions Information Request for a Decedent

Form 8971, along with a copy of every schedule a, is used to report values to the irs. Do we claim this on our 2022 return? Complete form 8971 and each attached schedule a in its entirety. Form 8971, along with a copy of every schedule a, is used to report values to the irs. One schedule a is provided.

IRS Form 8971 Instructions Reporting a Decedent's Property

Form 8971, along with a copy of every schedule a, is used to report values to the irs. One schedule a is provided to each. One schedule a is provided to each beneficiary receiving. Complete form 8971 and each attached schedule a in its entirety. Do we claim this on our 2022 return?

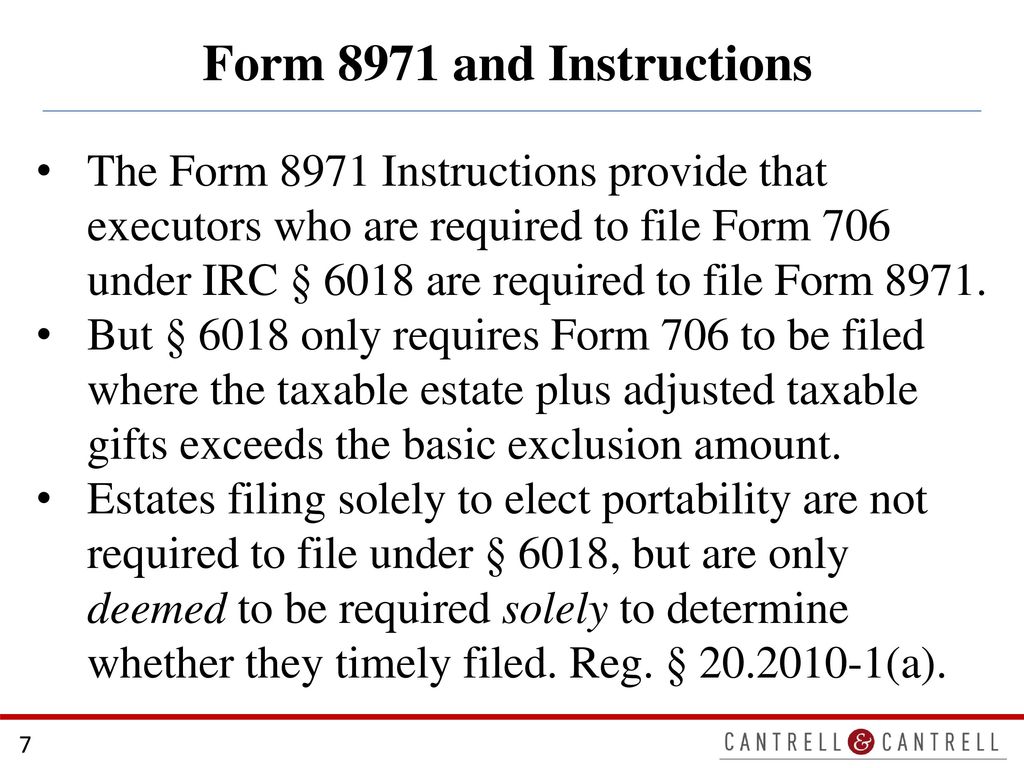

New Basis Reporting Requirements for Estates Meeting Form 8971

Form 8971, along with a copy of every schedule a, is used to report values to the irs. A form or schedule filed with the irs without entries in. Do we claim this on our 2022 return? We received a form 8971 in 2022 for a cash inheritance. One schedule a is provided to each.

IRS Form 8971 Instructions Reporting a Decedent's Property

A form or schedule filed with the irs without entries in. One schedule a is provided to each. Form 8971, along with a copy of every schedule a, is used to report values to the irs. One schedule a is provided to each beneficiary receiving. That form is filed along with a form 706.

IRS Form 8971 walkthrough (Information Regarding Beneficiaries

A form or schedule filed with the irs without entries in. Form 8971, along with a copy of every schedule a, is used to report values to the irs. Do we claim this on our 2022 return? Complete form 8971 and each attached schedule a in its entirety. One schedule a is provided to each beneficiary receiving.

IRS Form 8978 Instructions Reporting Partner's Additional Taxes

One schedule a is provided to each beneficiary receiving. A form or schedule filed with the irs without entries in. That form is filed along with a form 706. Complete form 8971 and each attached schedule a in its entirety. Do we claim this on our 2022 return?

Fillable Form 8971 Information Regarding Beneficiaries Acquiring

One schedule a is provided to each. Form 8971, along with a copy of every schedule a, is used to report values to the irs. One schedule a is provided to each beneficiary receiving. Form 8971, along with a copy of every schedule a, is used to report values to the irs. A form or schedule filed with the irs.

Cantrell & Cantrell, PLLC ppt download

We received a form 8971 in 2022 for a cash inheritance. That form is filed along with a form 706. A form or schedule filed with the irs without entries in. Do we claim this on our 2022 return? Complete form 8971 and each attached schedule a in its entirety.

Instructions For Form 8971 And Schedule A 2016 printable pdf download

That form is filed along with a form 706. We received a form 8971 in 2022 for a cash inheritance. One schedule a is provided to each beneficiary receiving. Complete form 8971 and each attached schedule a in its entirety. Do we claim this on our 2022 return?

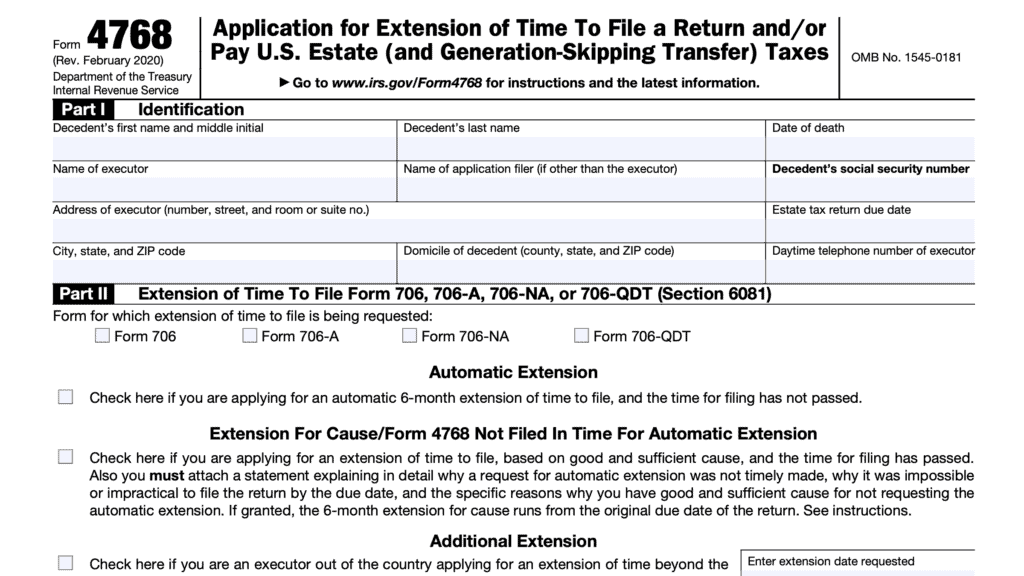

That Form Is Filed Along With A Form 706.

We received a form 8971 in 2022 for a cash inheritance. One schedule a is provided to each beneficiary receiving. Complete form 8971 and each attached schedule a in its entirety. A form or schedule filed with the irs without entries in.

One Schedule A Is Provided To Each.

Form 8971, along with a copy of every schedule a, is used to report values to the irs. Do we claim this on our 2022 return? Form 8971, along with a copy of every schedule a, is used to report values to the irs.