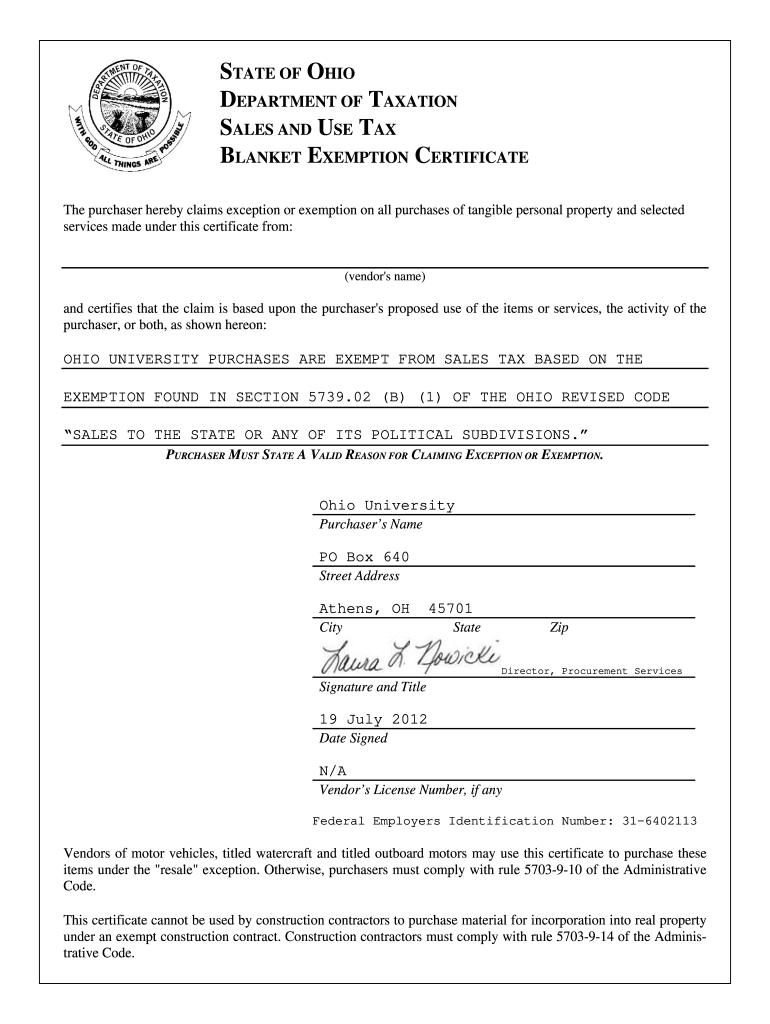

Formblanket Tax Exempt Form Ohio

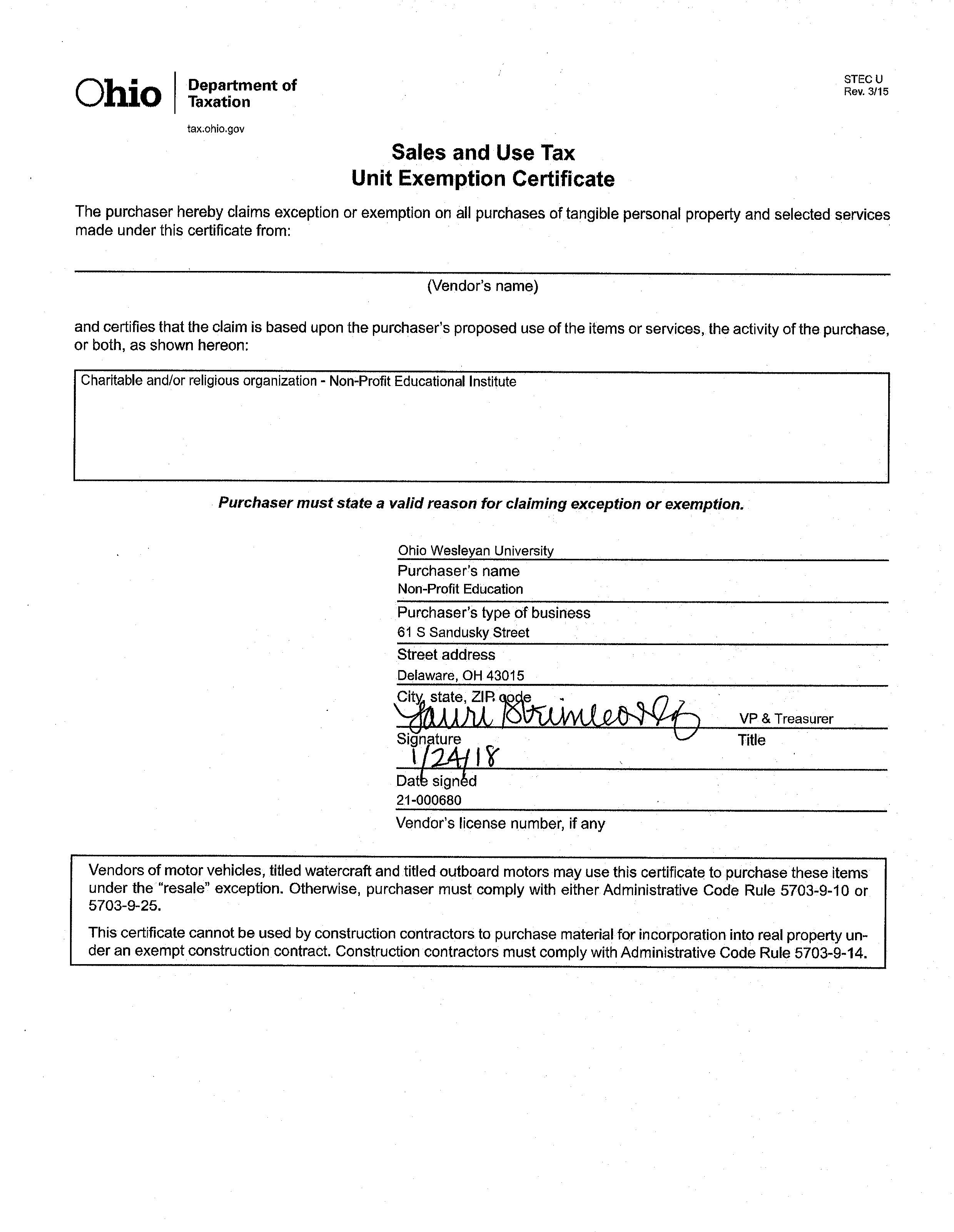

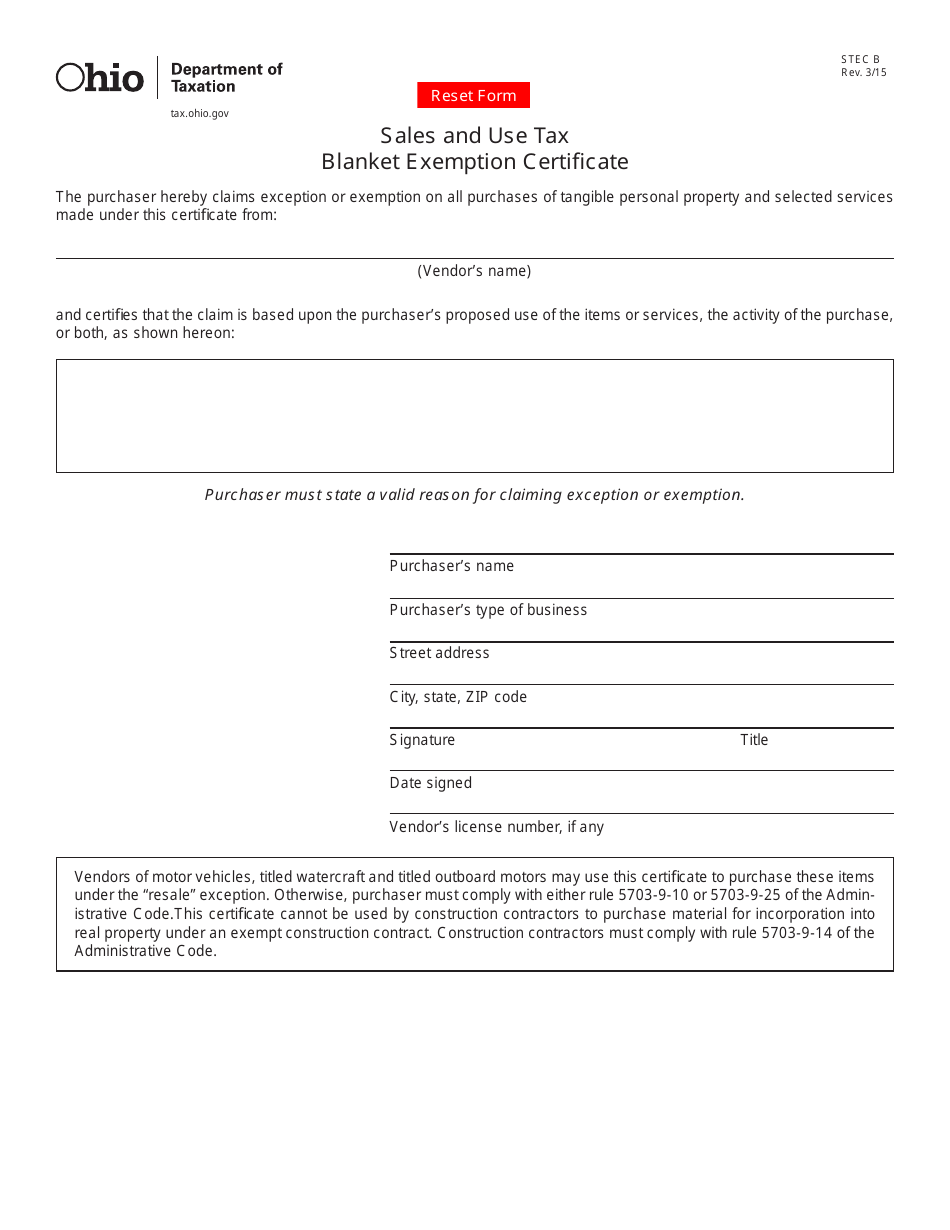

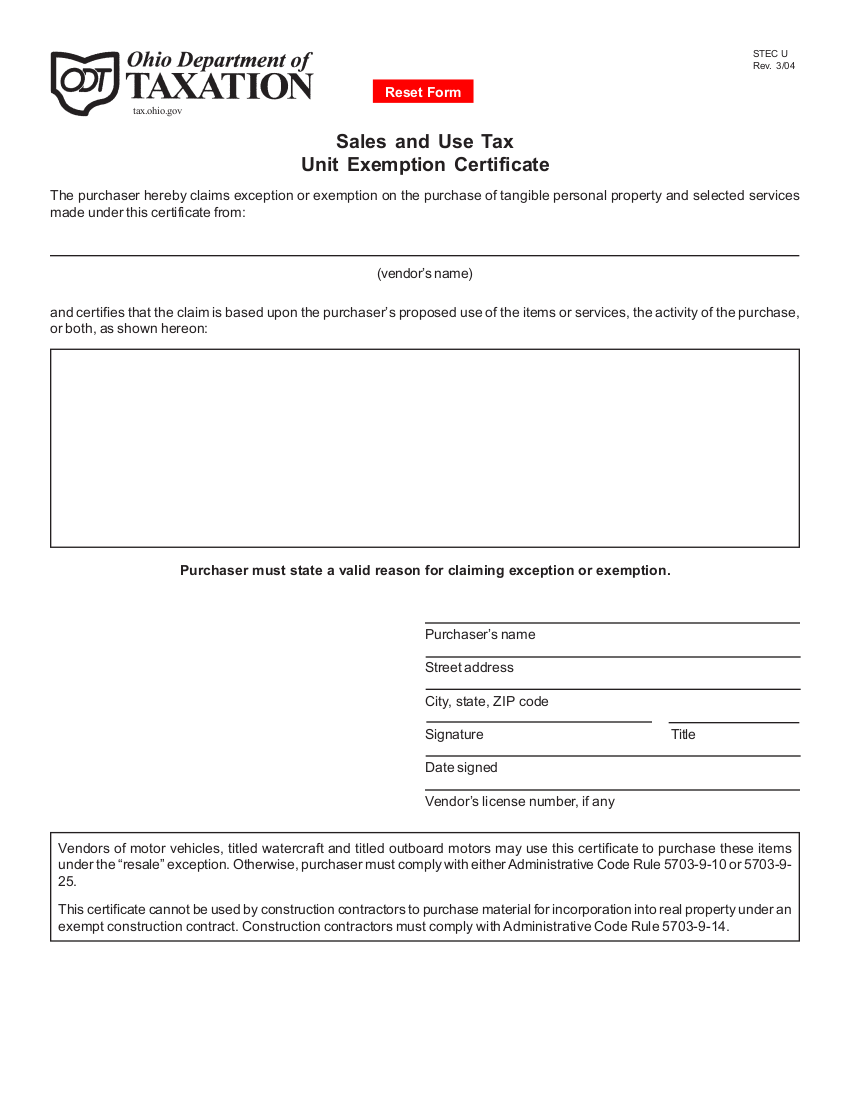

Formblanket Tax Exempt Form Ohio - Sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property. This exemption certificate is used to claim exemption or exception on a. The purpose of the ohio sales and use tax blanket exemption certificate is to allow qualified purchasers to claim exemption from sales tax. Use the yellow download button to access. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Vendors of motor vehicles, titled watercraft and titled outboard. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. Purchaser must state a valid reason for claiming exception or exemption.

Sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property. Use the yellow download button to access. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Vendors of motor vehicles, titled watercraft and titled outboard. Purchaser must state a valid reason for claiming exception or exemption. The purpose of the ohio sales and use tax blanket exemption certificate is to allow qualified purchasers to claim exemption from sales tax. This exemption certificate is used to claim exemption or exception on a.

Use the yellow download button to access. Vendors of motor vehicles, titled watercraft and titled outboard. Sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Purchaser must state a valid reason for claiming exception or exemption. This exemption certificate is used to claim exemption or exception on a. The purpose of the ohio sales and use tax blanket exemption certificate is to allow qualified purchasers to claim exemption from sales tax.

Printable Ohio Tax Exempt Form Printable Forms Free Online

Vendors of motor vehicles, titled watercraft and titled outboard. Use the yellow download button to access. This exemption certificate is used to claim exemption or exception on a. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. Sales and use tax unit exemption certifi cate the purchaser hereby claims.

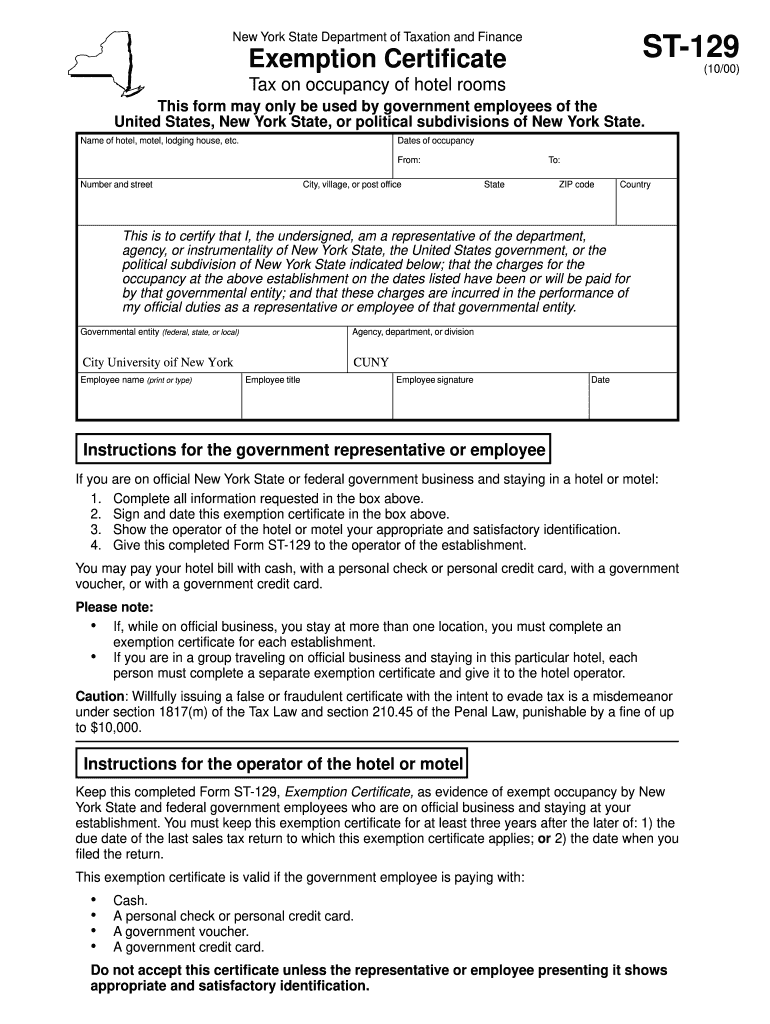

Ohio Tax Exempt Form Printable Printable Forms Free Online

The purpose of the ohio sales and use tax blanket exemption certificate is to allow qualified purchasers to claim exemption from sales tax. Sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property. Purchaser must state a valid reason for claiming exception or exemption. Vendors of motor vehicles,.

Ohio Sales Tax Blanket Exemption Form 2021

This exemption certificate is used to claim exemption or exception on a. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. Use the yellow download button to access. Vendors of motor vehicles, titled watercraft and titled outboard. The purpose of the ohio sales and use tax blanket exemption certificate.

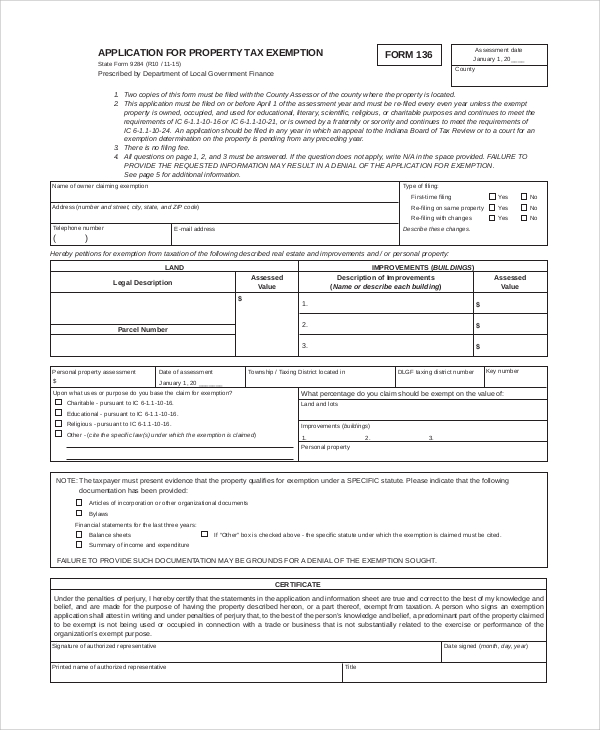

Ohio Tax Exempt Form Welder Service

This exemption certificate is used to claim exemption or exception on a. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. The purpose of the ohio sales and use tax blanket exemption certificate is to allow qualified purchasers to claim exemption from sales tax. Use the yellow download button.

Alabama State Sales And Use Tax Certificate Of Exemption Form Ste 1

Vendors of motor vehicles, titled watercraft and titled outboard. Sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property. The purpose of the ohio sales and use tax blanket exemption certificate is to allow qualified purchasers to claim exemption from sales tax. The purchaser hereby claims exception or.

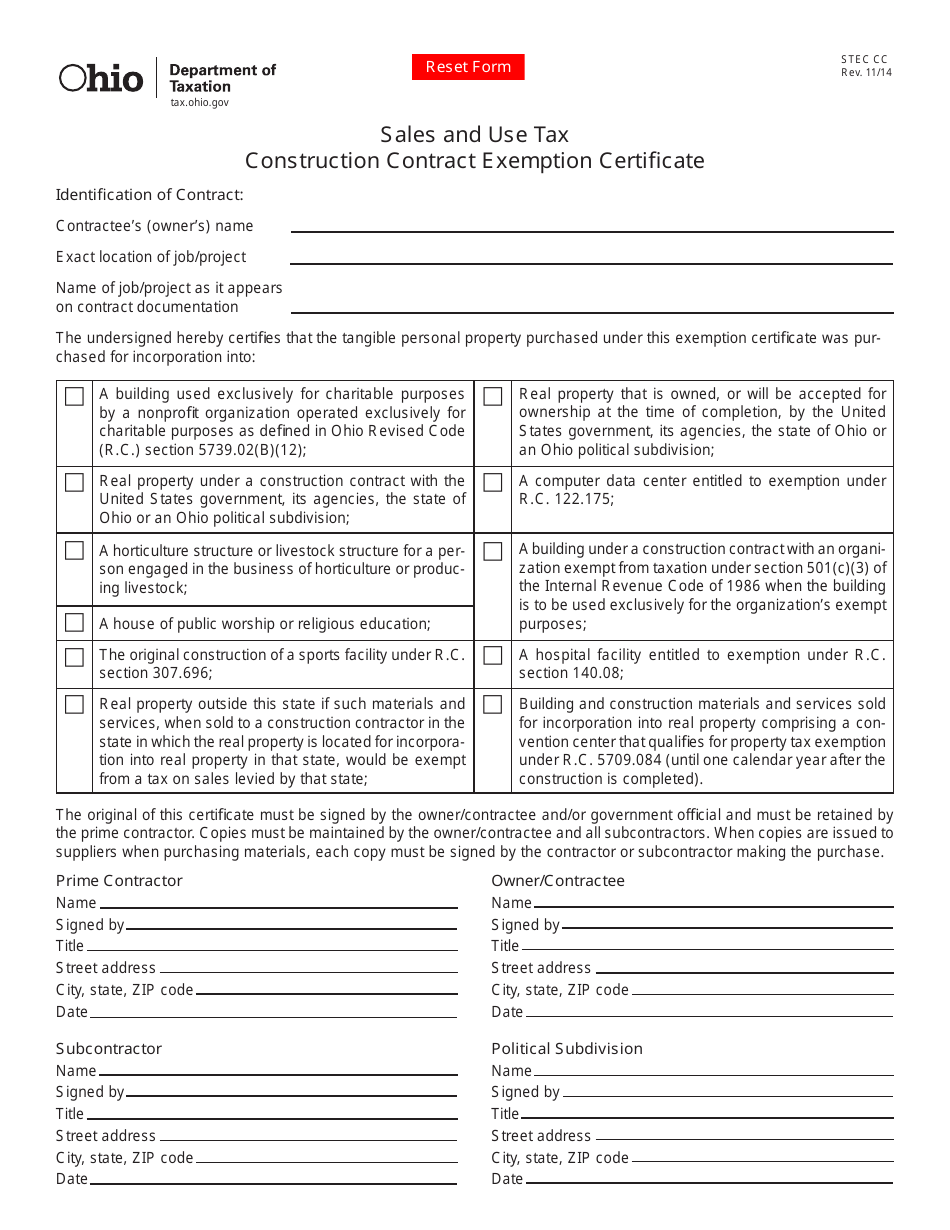

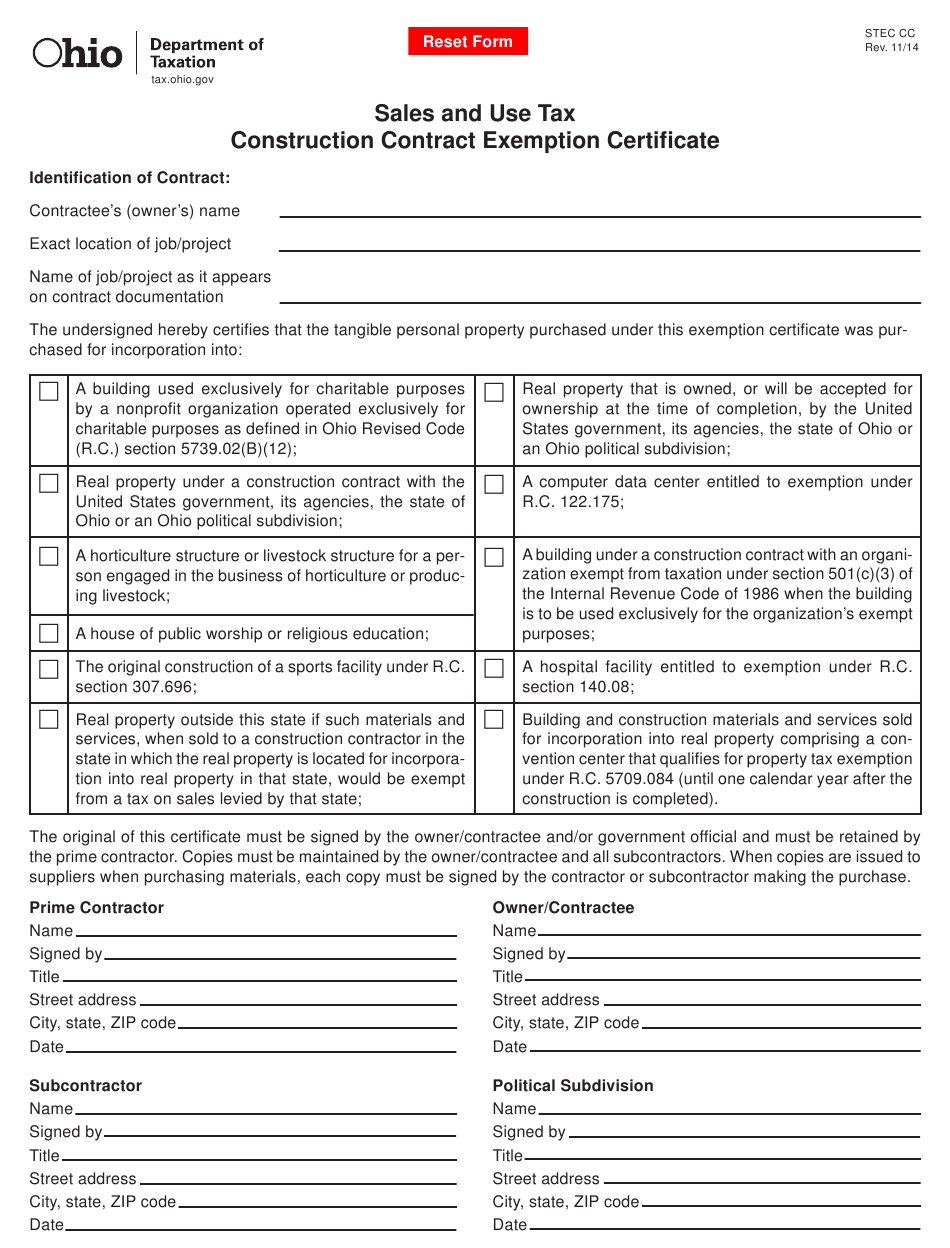

State Of Ohio Contractor Tax Exempt Form

Use the yellow download button to access. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. Sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property. Purchaser must state a valid reason for claiming exception or exemption..

State Of Ohio Tax Exempt Form Fill Online Printable Fillable Blank

Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. Use the yellow download button to access. Sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property. The purchaser hereby claims exception or exemption on all purchases of.

Ohio Tax Exempt Form 2024 2025

The purpose of the ohio sales and use tax blanket exemption certificate is to allow qualified purchasers to claim exemption from sales tax. Purchaser must state a valid reason for claiming exception or exemption. Vendors of motor vehicles, titled watercraft and titled outboard. This exemption certificate is used to claim exemption or exception on a. Use the yellow download button.

Tax Exempt Form 2024 Ohio Fleur Karlie

Vendors of motor vehicles, titled watercraft and titled outboard. The purpose of the ohio sales and use tax blanket exemption certificate is to allow qualified purchasers to claim exemption from sales tax. Sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property. Use the yellow download button to.

Printable State Tax Forms

Sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property. Use the yellow download button to access. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Purchaser must state a valid reason for claiming exception or exemption..

The Purpose Of The Ohio Sales And Use Tax Blanket Exemption Certificate Is To Allow Qualified Purchasers To Claim Exemption From Sales Tax.

Sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property. Purchaser must state a valid reason for claiming exception or exemption. This exemption certificate is used to claim exemption or exception on a. Vendors of motor vehicles, titled watercraft and titled outboard.

Use The Yellow Download Button To Access.

Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this.