Harris County Tax Lien Search

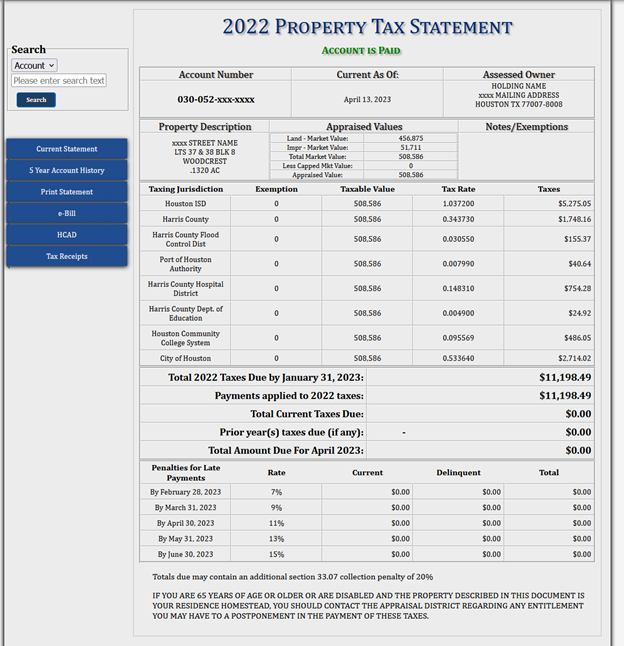

Harris County Tax Lien Search - The following websites contain information on delinquent properties to be sold at tax sale: If you have trouble searching by name, please use. Child support, criminal bureau, etc. The tax office accepts full and partial payment of property taxes online. Assumed names, county civil court, probate court, marriage license. Notice of levy on real estate: Search database for marriages licenses. You may view your current harris county tax office account online at www.hctax.net. Letter estate tax closing letter: Upon payment in full, the release of lien document will be created and sent to the payee and then should be promptly filed with harris county real.

Child support, criminal bureau, etc. The following websites contain information on delinquent properties to be sold at tax sale: Include your property address, account number, the property owner’s email address, and phone number. You may view your current harris county tax office account online at www.hctax.net. Notice of levy on real estate: Assumed names, county civil court, probate court, marriage license. The tax office accepts full and partial payment of property taxes online. Upon payment in full, the release of lien document will be created and sent to the payee and then should be promptly filed with harris county real. Search database for marriages licenses. Letter estate tax closing letter:

Child support, criminal bureau, etc. Upon payment in full, the release of lien document will be created and sent to the payee and then should be promptly filed with harris county real. Include your property address, account number, the property owner’s email address, and phone number. If you have trouble searching by name, please use. Search database for marriages licenses. Letter estate tax closing letter: The harris county attorney's office currently collects. You may view your current harris county tax office account online at www.hctax.net. Notice of levy on real estate: The following websites contain information on delinquent properties to be sold at tax sale:

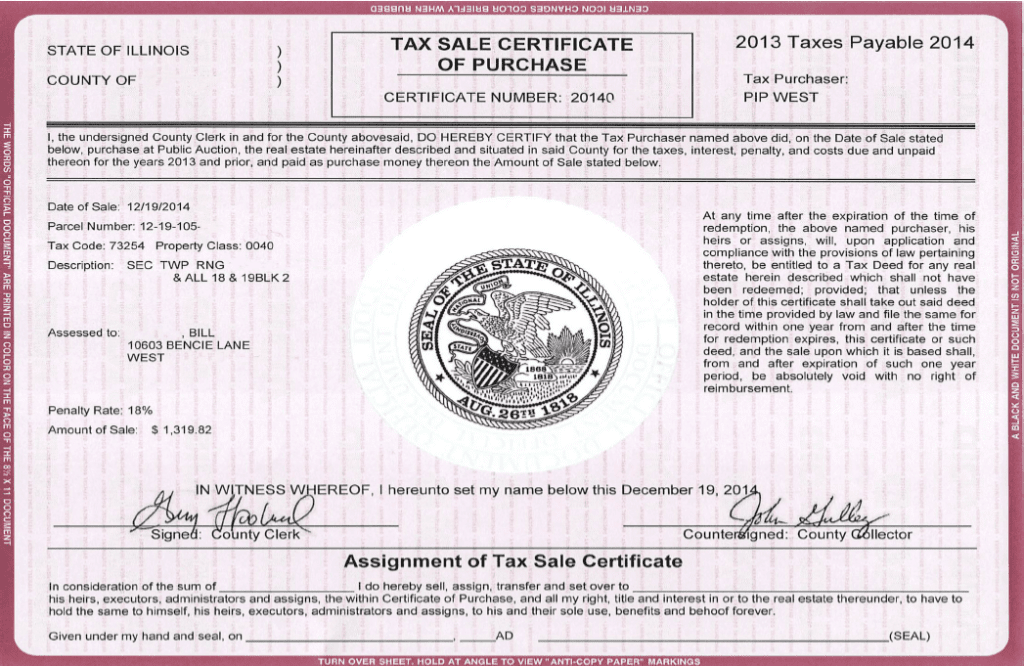

Florida County Held Tax Lien Certificates Tax Lien Foreclosure

Include your property address, account number, the property owner’s email address, and phone number. Notice of levy on real estate: The harris county attorney's office currently collects. The tax office accepts full and partial payment of property taxes online. If you have trouble searching by name, please use.

Mohave County Tax Lien Sale 2024 Dore Nancey

You may view your current harris county tax office account online at www.hctax.net. The tax office accepts full and partial payment of property taxes online. Child support, criminal bureau, etc. Search database for marriages licenses. The following websites contain information on delinquent properties to be sold at tax sale:

Anne Arundel County Tax Lien Certificates prosecution2012

Notice of levy on real estate: Child support, criminal bureau, etc. If you have trouble searching by name, please use. Letter estate tax closing letter: You may view your current harris county tax office account online at www.hctax.net.

Property Tax Lien Search Nationwide Title Insurance

If you have trouble searching by name, please use. Letter estate tax closing letter: The tax office accepts full and partial payment of property taxes online. The harris county attorney's office currently collects. You may view your current harris county tax office account online at www.hctax.net.

Harris County Property Tax Website

The tax office accepts full and partial payment of property taxes online. Upon payment in full, the release of lien document will be created and sent to the payee and then should be promptly filed with harris county real. Notice of levy on real estate: Assumed names, county civil court, probate court, marriage license. The harris county attorney's office currently.

maricopa county tax lien map Leslee Simms

The following websites contain information on delinquent properties to be sold at tax sale: You may view your current harris county tax office account online at www.hctax.net. Notice of levy on real estate: Include your property address, account number, the property owner’s email address, and phone number. The tax office accepts full and partial payment of property taxes online.

Suffolk County Tax Lien Sale 2024 Marne Sharona

Child support, criminal bureau, etc. The following websites contain information on delinquent properties to be sold at tax sale: Upon payment in full, the release of lien document will be created and sent to the payee and then should be promptly filed with harris county real. If you have trouble searching by name, please use. You may view your current.

Suffolk County Tax Lien Auction 2024 Valli Isabelle

The following websites contain information on delinquent properties to be sold at tax sale: Include your property address, account number, the property owner’s email address, and phone number. Assumed names, county civil court, probate court, marriage license. Upon payment in full, the release of lien document will be created and sent to the payee and then should be promptly filed.

What Is a Tax Lien? Definition & Impact on Credit TheStreet

Child support, criminal bureau, etc. If you have trouble searching by name, please use. Assumed names, county civil court, probate court, marriage license. Search database for marriages licenses. Include your property address, account number, the property owner’s email address, and phone number.

Tax Lien La County Tax Lien

Search database for marriages licenses. If you have trouble searching by name, please use. The tax office accepts full and partial payment of property taxes online. Upon payment in full, the release of lien document will be created and sent to the payee and then should be promptly filed with harris county real. You may view your current harris county.

The Following Websites Contain Information On Delinquent Properties To Be Sold At Tax Sale:

You may view your current harris county tax office account online at www.hctax.net. Upon payment in full, the release of lien document will be created and sent to the payee and then should be promptly filed with harris county real. The tax office accepts full and partial payment of property taxes online. Include your property address, account number, the property owner’s email address, and phone number.

If You Have Trouble Searching By Name, Please Use.

The harris county attorney's office currently collects. Letter estate tax closing letter: Notice of levy on real estate: Assumed names, county civil court, probate court, marriage license.

Child Support, Criminal Bureau, Etc.

Search database for marriages licenses.