If A Lien Is Not On Property What Happens

If A Lien Is Not On Property What Happens - A tax liens sale is what a county does to try to collect unpaid real estate taxes on homes, businesses and land. But the lien will normally need to be. But that obligation is owed to the. The quick answer to your question is that yes, the insurance company would be required to pay the lienholder. The law does not require that liens be removed before title to property can be sold or transferred.

But the lien will normally need to be. A tax liens sale is what a county does to try to collect unpaid real estate taxes on homes, businesses and land. But that obligation is owed to the. The quick answer to your question is that yes, the insurance company would be required to pay the lienholder. The law does not require that liens be removed before title to property can be sold or transferred.

But the lien will normally need to be. But that obligation is owed to the. A tax liens sale is what a county does to try to collect unpaid real estate taxes on homes, businesses and land. The quick answer to your question is that yes, the insurance company would be required to pay the lienholder. The law does not require that liens be removed before title to property can be sold or transferred.

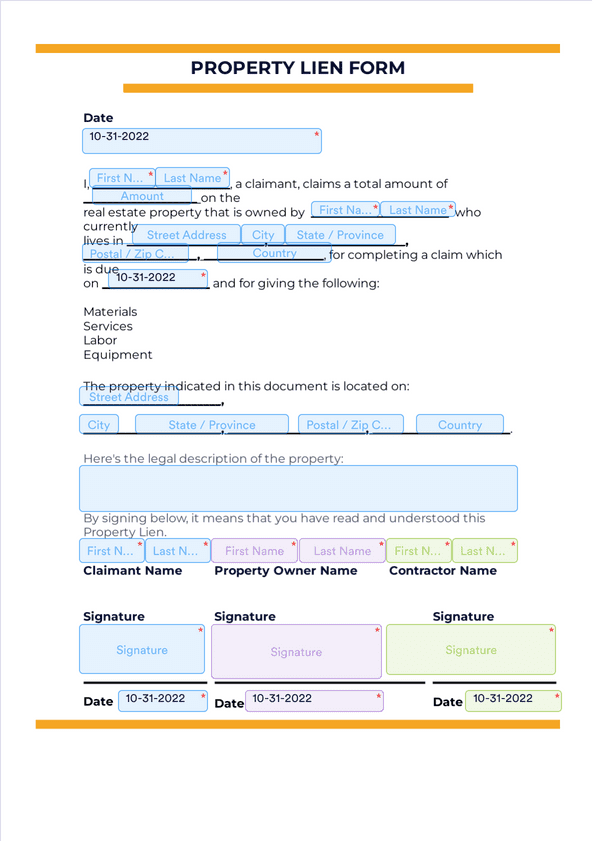

Property Lien Form Sign Templates Jotform

A tax liens sale is what a county does to try to collect unpaid real estate taxes on homes, businesses and land. The quick answer to your question is that yes, the insurance company would be required to pay the lienholder. But the lien will normally need to be. But that obligation is owed to the. The law does not.

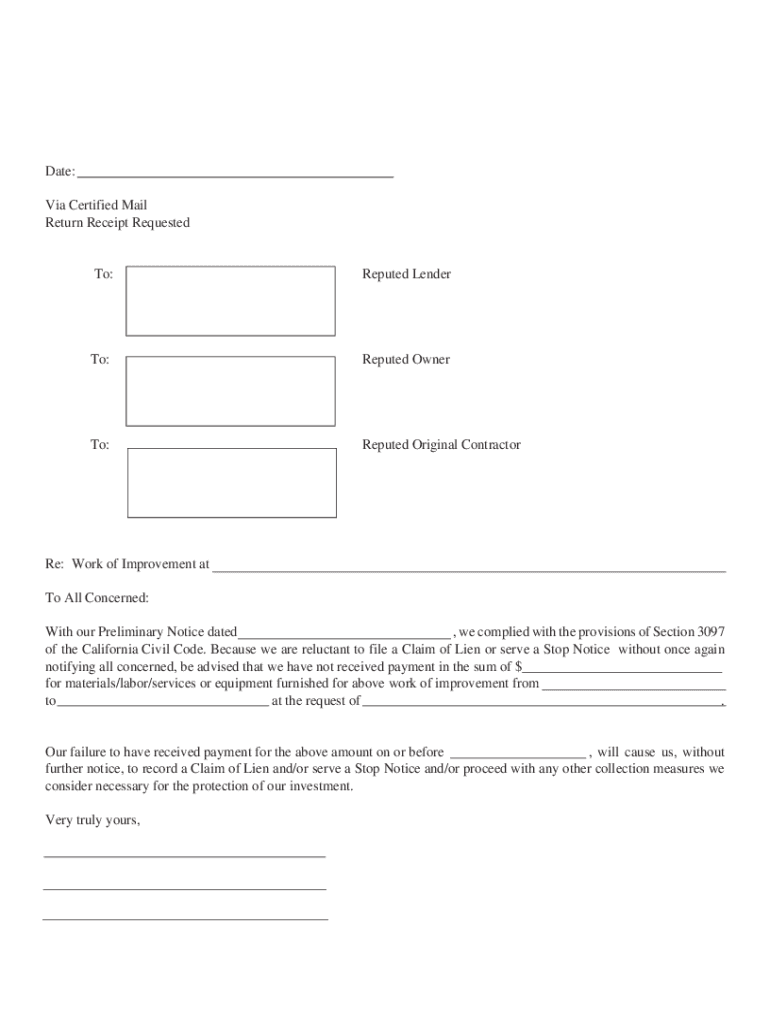

Understanding What Happens After You File a Lien Levelset

The law does not require that liens be removed before title to property can be sold or transferred. A tax liens sale is what a county does to try to collect unpaid real estate taxes on homes, businesses and land. But the lien will normally need to be. But that obligation is owed to the. The quick answer to your.

What Happens When A Lien Expires BuildOps

The quick answer to your question is that yes, the insurance company would be required to pay the lienholder. A tax liens sale is what a county does to try to collect unpaid real estate taxes on homes, businesses and land. The law does not require that liens be removed before title to property can be sold or transferred. But.

Sample Letter Of Intent To Lien Property Images and Photos finder

A tax liens sale is what a county does to try to collect unpaid real estate taxes on homes, businesses and land. The law does not require that liens be removed before title to property can be sold or transferred. But the lien will normally need to be. The quick answer to your question is that yes, the insurance company.

Property Lien Form Texas Form example download

A tax liens sale is what a county does to try to collect unpaid real estate taxes on homes, businesses and land. The law does not require that liens be removed before title to property can be sold or transferred. But the lien will normally need to be. But that obligation is owed to the. The quick answer to your.

What happens when a lien is placed on your home in Utah?

But that obligation is owed to the. A tax liens sale is what a county does to try to collect unpaid real estate taxes on homes, businesses and land. The quick answer to your question is that yes, the insurance company would be required to pay the lienholder. The law does not require that liens be removed before title to.

How Long Does a Lien Stay On Your Property? Hauseit® NY & FL

But the lien will normally need to be. But that obligation is owed to the. The quick answer to your question is that yes, the insurance company would be required to pay the lienholder. The law does not require that liens be removed before title to property can be sold or transferred. A tax liens sale is what a county.

What happens if I have a Judgment Lien on a property? Ultimate

The quick answer to your question is that yes, the insurance company would be required to pay the lienholder. But the lien will normally need to be. The law does not require that liens be removed before title to property can be sold or transferred. A tax liens sale is what a county does to try to collect unpaid real.

What Happens If I Have A Lien On My House? » FL Home Buyers

The quick answer to your question is that yes, the insurance company would be required to pay the lienholder. But that obligation is owed to the. But the lien will normally need to be. The law does not require that liens be removed before title to property can be sold or transferred. A tax liens sale is what a county.

Property Lien Title Fill Online, Printable, Fillable, Blank pdfFiller

A tax liens sale is what a county does to try to collect unpaid real estate taxes on homes, businesses and land. But that obligation is owed to the. But the lien will normally need to be. The law does not require that liens be removed before title to property can be sold or transferred. The quick answer to your.

The Law Does Not Require That Liens Be Removed Before Title To Property Can Be Sold Or Transferred.

But that obligation is owed to the. But the lien will normally need to be. The quick answer to your question is that yes, the insurance company would be required to pay the lienholder. A tax liens sale is what a county does to try to collect unpaid real estate taxes on homes, businesses and land.