Illinois Property Lien

Illinois Property Lien - The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. Liens and claims are the two legal actions used to collect the amount received by aabd clients. If a creditor (such as a lender or contractor) or government agency receives a judgment for unpaid debts or fines, a lien will be filed. A lien can be filed on any real property you own. How does a creditor go about getting a judgment lien in. Property liens in illinois are vital for securing creditors’ interests in a debtor’s property, ensuring debts are settled before any sale or. Explore the intricacies of property liens in illinois, including their types, impacts on ownership, and essential steps for clearing. In illinois, a judgment lien can be attached to real estate only, not to personal property.

Property liens in illinois are vital for securing creditors’ interests in a debtor’s property, ensuring debts are settled before any sale or. If a creditor (such as a lender or contractor) or government agency receives a judgment for unpaid debts or fines, a lien will be filed. In illinois, a judgment lien can be attached to real estate only, not to personal property. The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. Explore the intricacies of property liens in illinois, including their types, impacts on ownership, and essential steps for clearing. Liens and claims are the two legal actions used to collect the amount received by aabd clients. A lien can be filed on any real property you own. How does a creditor go about getting a judgment lien in.

If a creditor (such as a lender or contractor) or government agency receives a judgment for unpaid debts or fines, a lien will be filed. How does a creditor go about getting a judgment lien in. A lien can be filed on any real property you own. Explore the intricacies of property liens in illinois, including their types, impacts on ownership, and essential steps for clearing. In illinois, a judgment lien can be attached to real estate only, not to personal property. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. Property liens in illinois are vital for securing creditors’ interests in a debtor’s property, ensuring debts are settled before any sale or. The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and. Liens and claims are the two legal actions used to collect the amount received by aabd clients.

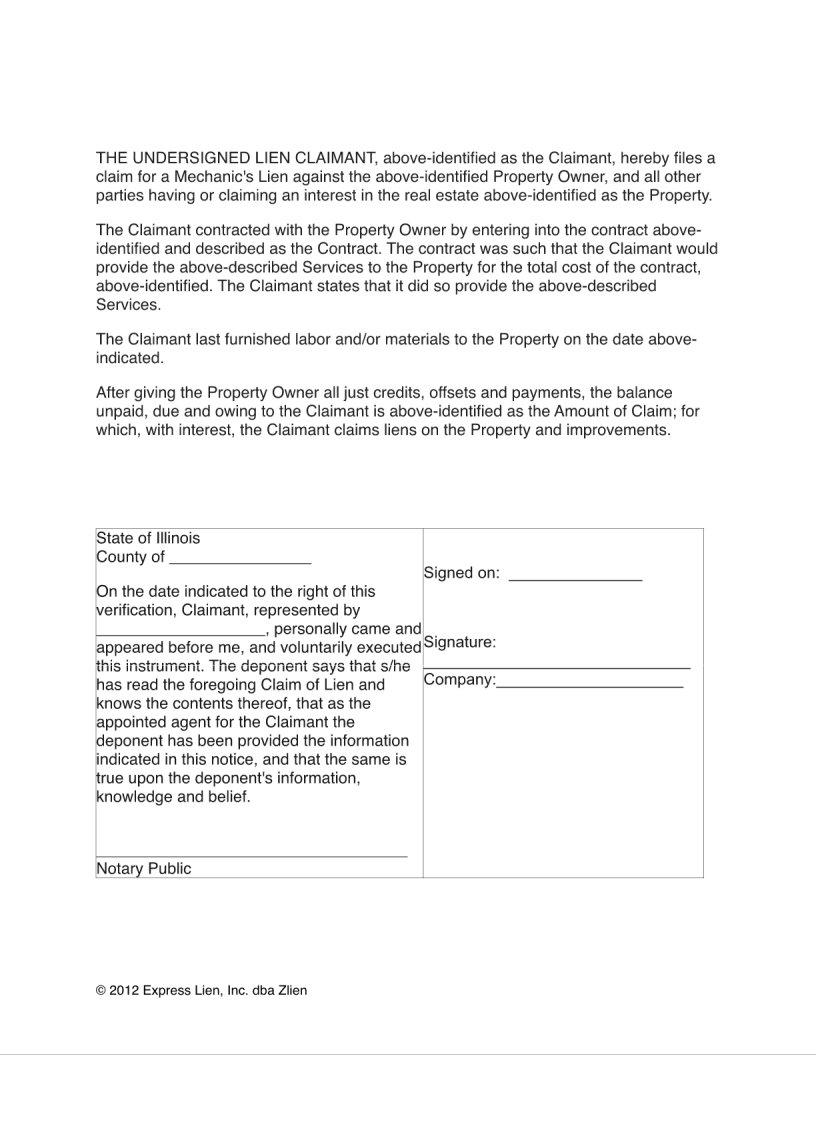

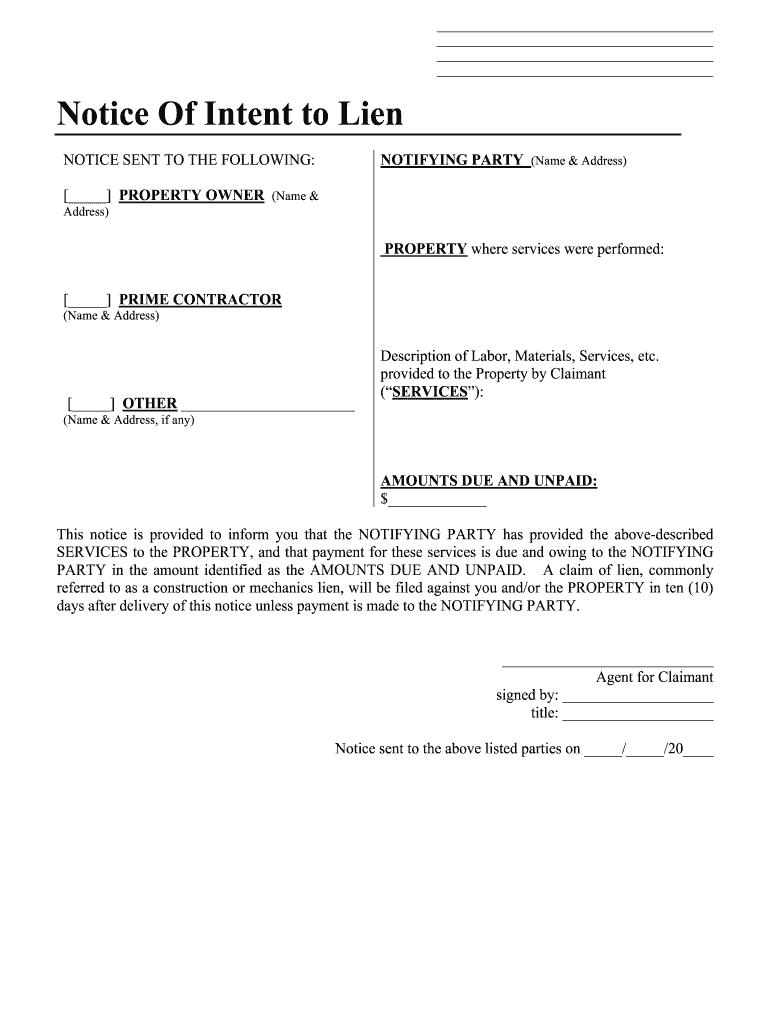

Illinois Notice Lien Form ≡ Fill Out Printable PDF Forms Online

The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. In illinois, a judgment lien can be attached to real estate only, not to personal.

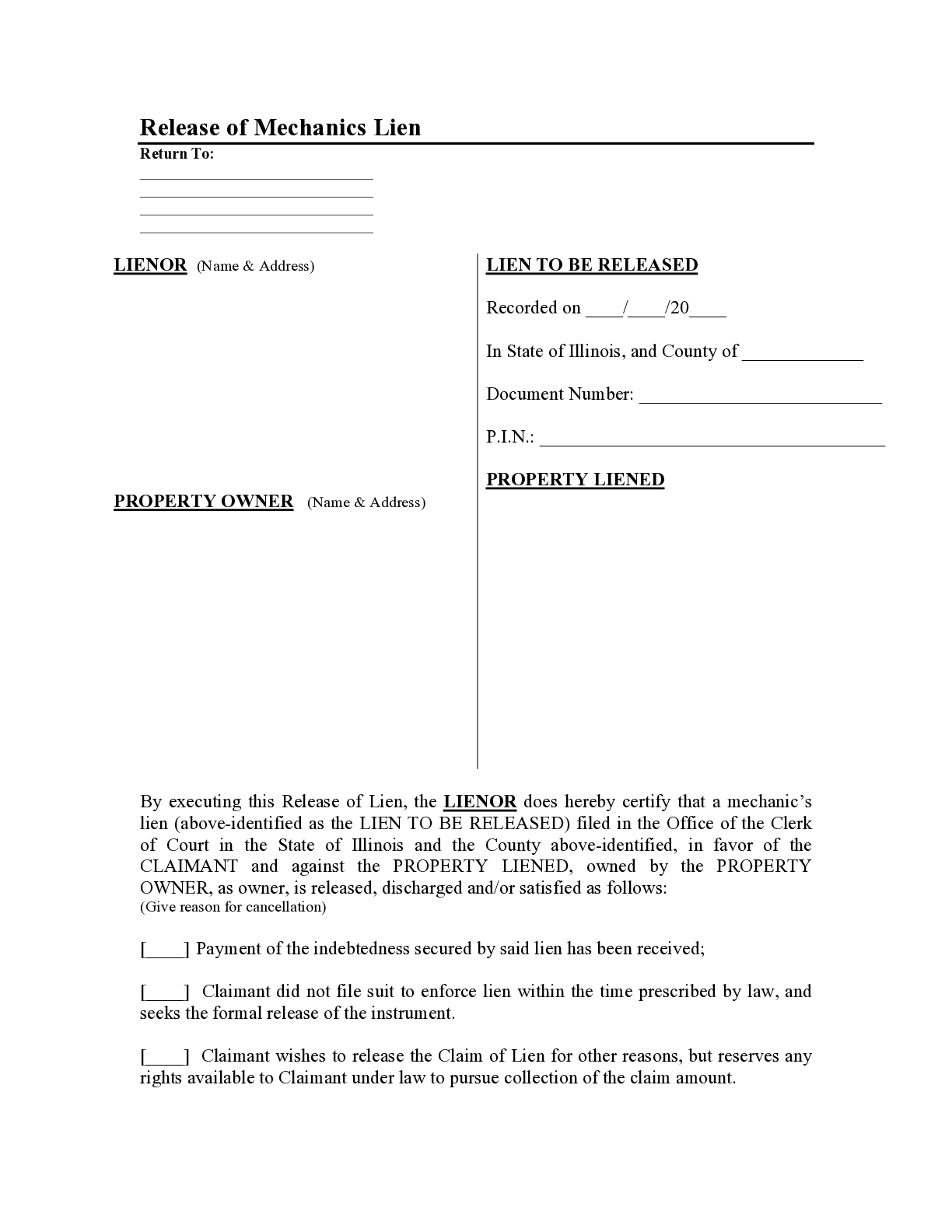

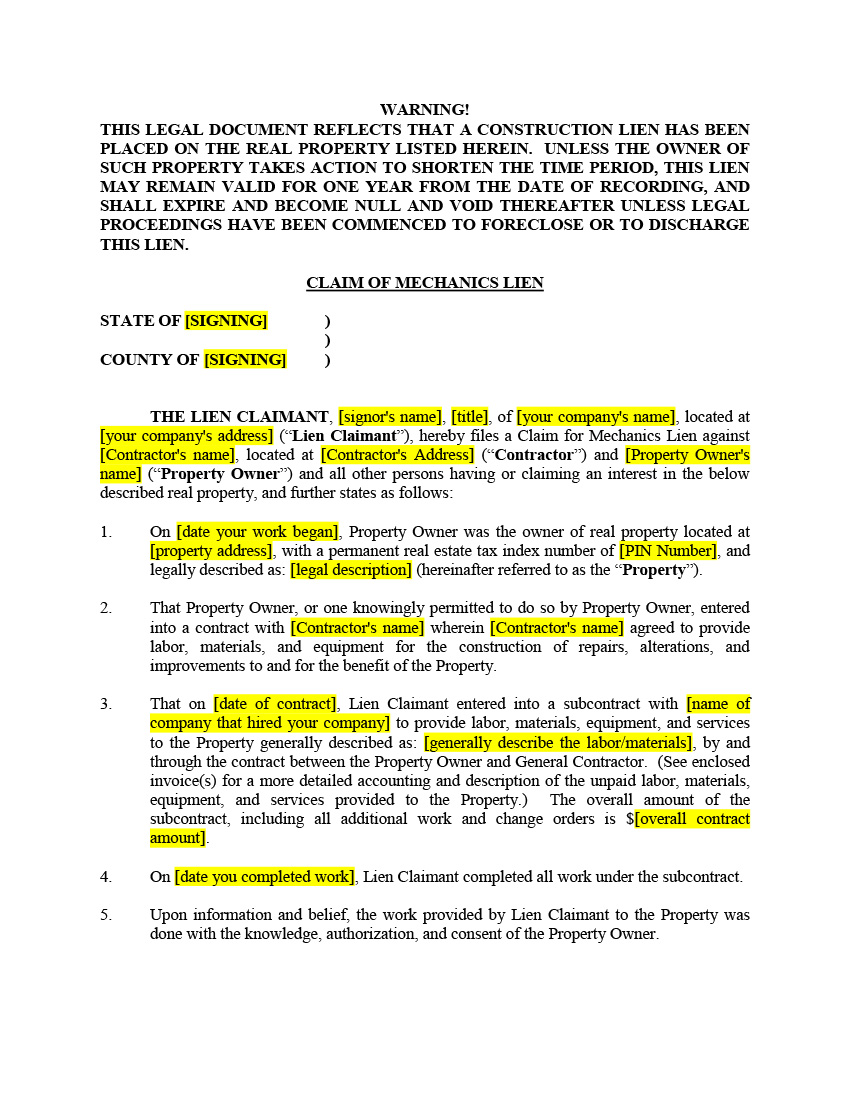

Illinois Mechanics Lien Release Form Free Template

How does a creditor go about getting a judgment lien in. Explore the intricacies of property liens in illinois, including their types, impacts on ownership, and essential steps for clearing. A lien can be filed on any real property you own. Property liens in illinois are vital for securing creditors’ interests in a debtor’s property, ensuring debts are settled before.

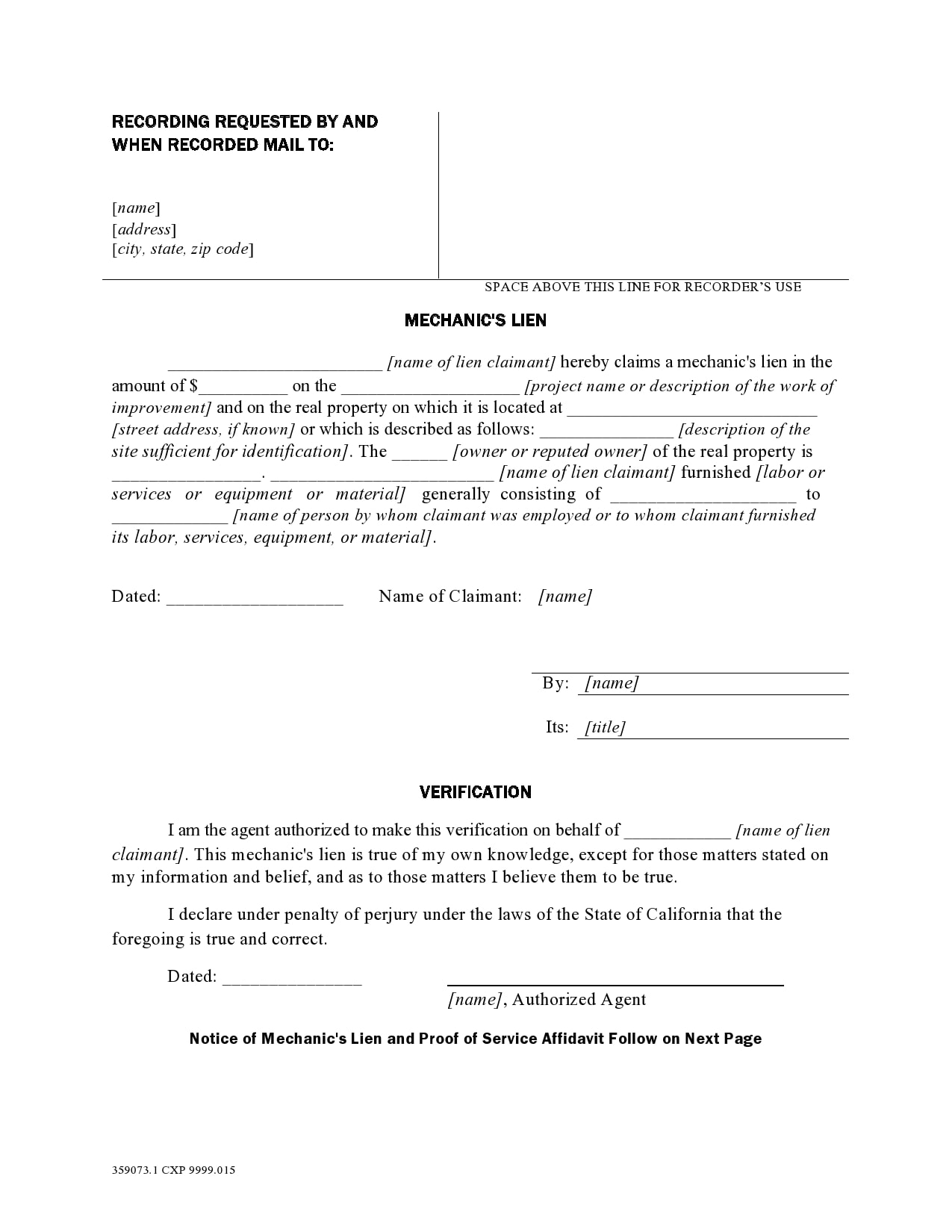

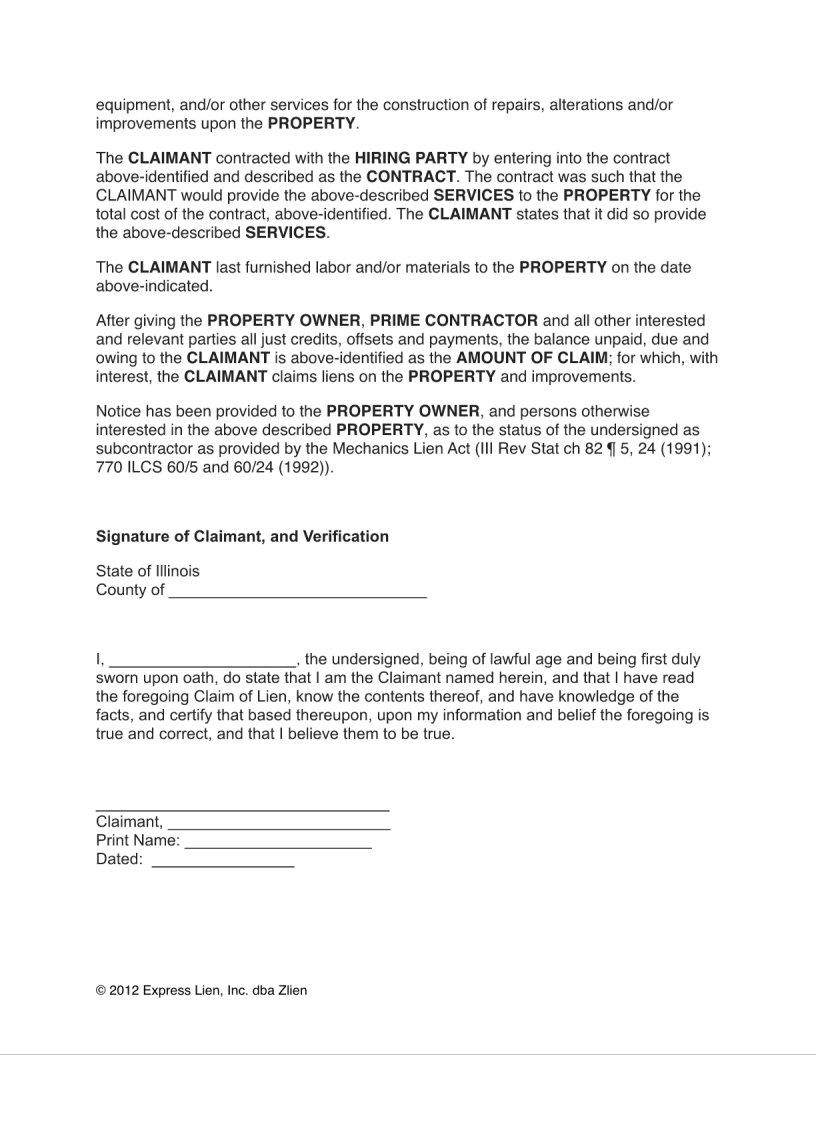

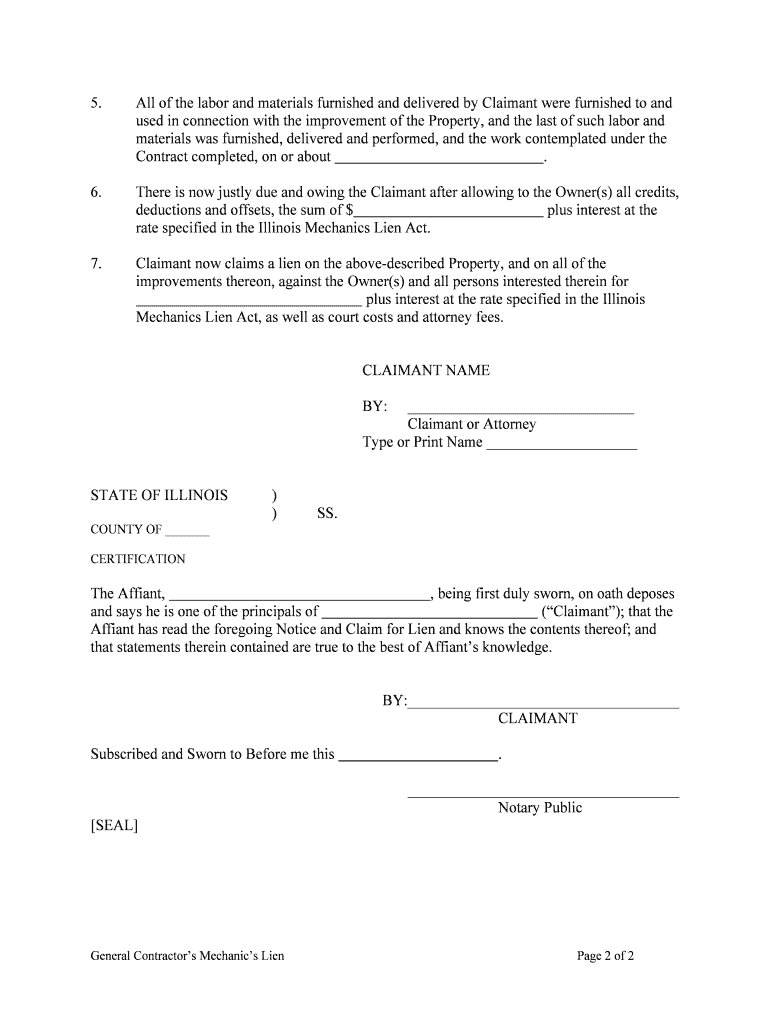

30 Free Mechanics Lien Forms (All States) TemplateArchive

In illinois, a judgment lien can be attached to real estate only, not to personal property. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property.

Federal tax lien on foreclosed property laderdriver

The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and. A lien can be filed on any real property you own. In illinois, a judgment lien can be attached to real estate only, not to personal property. In illinois, filing a lien is a simple.

Lien Template Free

In illinois, a judgment lien can be attached to real estate only, not to personal property. If a creditor (such as a lender or contractor) or government agency receives a judgment for unpaid debts or fines, a lien will be filed. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal.

Notice Of Intent To Lien Illinois Pdf Fill Online, Printable

If a creditor (such as a lender or contractor) or government agency receives a judgment for unpaid debts or fines, a lien will be filed. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. The liens included in the state tax lien registry are liens filed by idor or.

Release Lien Fill and Sign Printable Template Online US Legal Forms

In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. How does a creditor go about getting a judgment lien in. In illinois, a judgment lien can be attached to real estate only, not to personal property. Property liens in illinois are vital for securing creditors’ interests in a debtor’s.

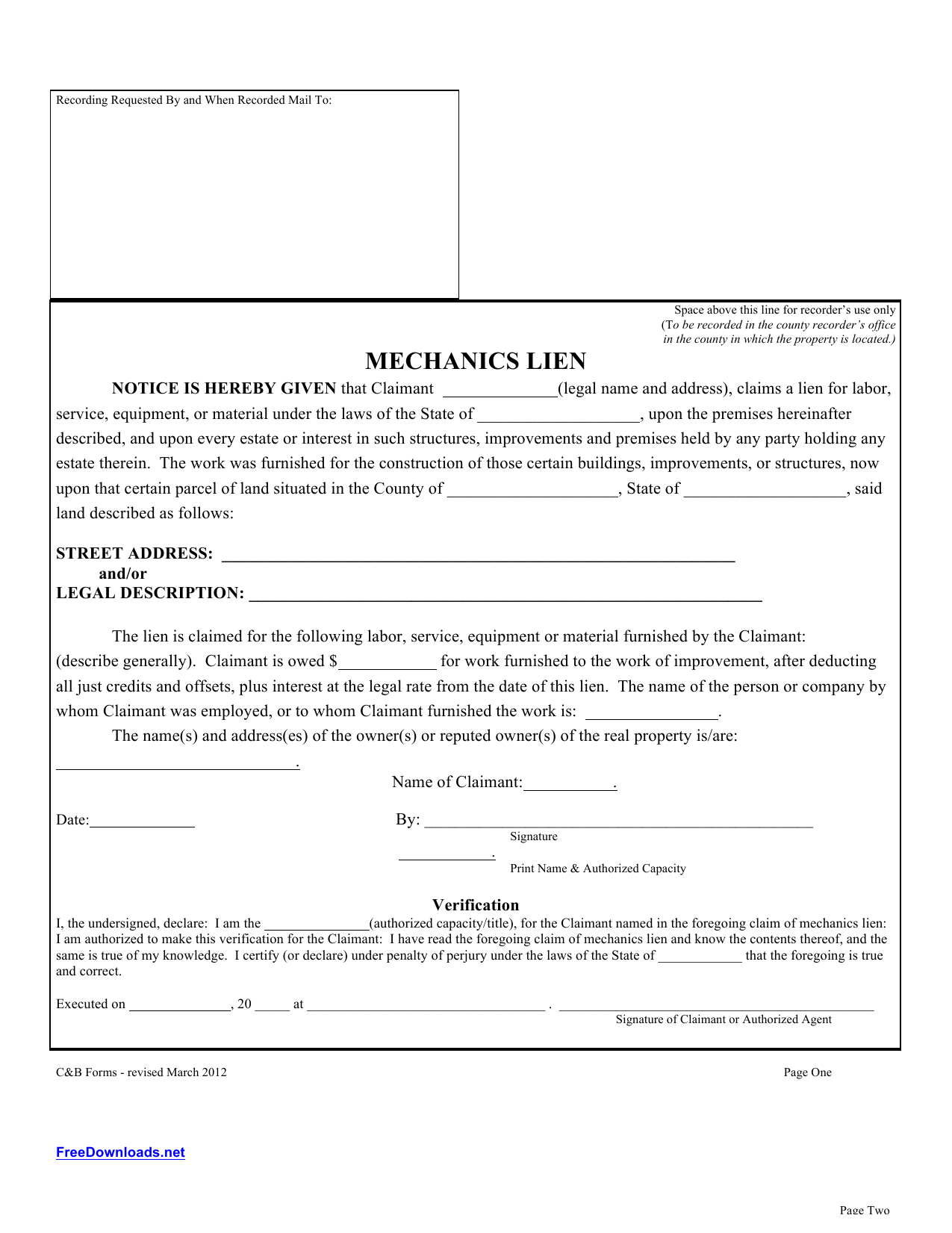

Commercial Illinois Mechanic Lien Forms and Kits

The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and. Liens and claims are the two legal actions used to collect the amount received by aabd clients. In illinois, filing a lien is a simple process, but one that comes with specific time limits for.

Illinois Notice Lien Form ≡ Fill Out Printable PDF Forms Online

How does a creditor go about getting a judgment lien in. In illinois, a judgment lien can be attached to real estate only, not to personal property. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. The liens included in the state tax lien registry are liens filed by.

Illinois Lien Complete with ease airSlate SignNow

How does a creditor go about getting a judgment lien in. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. Liens and claims are the two legal actions used to collect the amount received by aabd clients. Property liens in illinois are vital for securing creditors’ interests in a.

Property Liens In Illinois Are Vital For Securing Creditors’ Interests In A Debtor’s Property, Ensuring Debts Are Settled Before Any Sale Or.

If a creditor (such as a lender or contractor) or government agency receives a judgment for unpaid debts or fines, a lien will be filed. A lien can be filed on any real property you own. In illinois, a judgment lien can be attached to real estate only, not to personal property. Explore the intricacies of property liens in illinois, including their types, impacts on ownership, and essential steps for clearing.

Liens And Claims Are The Two Legal Actions Used To Collect The Amount Received By Aabd Clients.

How does a creditor go about getting a judgment lien in. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and.