Income Tax Relief

Income Tax Relief - Prepare and file your federal income tax return for free. Must file a 2020 tax return to claim,. The relief applies to the failure to file penalty. Irs has several online resources to help taxpayers. The penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal income tax return is filed late. Please let us know immediately. Latest updates on coronavirus tax relief penalty relief for certain 2019 and 2020 returns. If your spouse made errors on your joint tax return and you didn't know about it, you may qualify for tax relief for spouses. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a recovery rebate credit for tax year 2020 or 2021.

Latest updates on coronavirus tax relief penalty relief for certain 2019 and 2020 returns. The relief applies to the failure to file penalty. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a recovery rebate credit for tax year 2020 or 2021. Irs has several online resources to help taxpayers. Must file a 2020 tax return to claim,. If your spouse made errors on your joint tax return and you didn't know about it, you may qualify for tax relief for spouses. Please let us know immediately. Prepare and file your federal income tax return for free. The penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal income tax return is filed late.

The relief applies to the failure to file penalty. If your spouse made errors on your joint tax return and you didn't know about it, you may qualify for tax relief for spouses. Must file a 2020 tax return to claim,. Please let us know immediately. Prepare and file your federal income tax return for free. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a recovery rebate credit for tax year 2020 or 2021. Latest updates on coronavirus tax relief penalty relief for certain 2019 and 2020 returns. Irs has several online resources to help taxpayers. The penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal income tax return is filed late.

Personal Tax Relief Malaysia Y.A. 2023 L & Co Accountants

Latest updates on coronavirus tax relief penalty relief for certain 2019 and 2020 returns. Must file a 2020 tax return to claim,. If your spouse made errors on your joint tax return and you didn't know about it, you may qualify for tax relief for spouses. The penalty is typically assessed at a rate of 5% per month, up to.

Window to Enjoy Tax Reliefs Closing CN Advisory

Please let us know immediately. The relief applies to the failure to file penalty. The penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal income tax return is filed late. If your spouse made errors on your joint tax return and you didn't know about it, you may.

Tax Relief 2023 Malaysia Printable Forms Free Online

The relief applies to the failure to file penalty. Prepare and file your federal income tax return for free. Latest updates on coronavirus tax relief penalty relief for certain 2019 and 2020 returns. If your spouse made errors on your joint tax return and you didn't know about it, you may qualify for tax relief for spouses. Please let us.

Tax Debt Relief Tax Assistance Group

The relief applies to the failure to file penalty. The penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal income tax return is filed late. Prepare and file your federal income tax return for free. Latest updates on coronavirus tax relief penalty relief for certain 2019 and 2020.

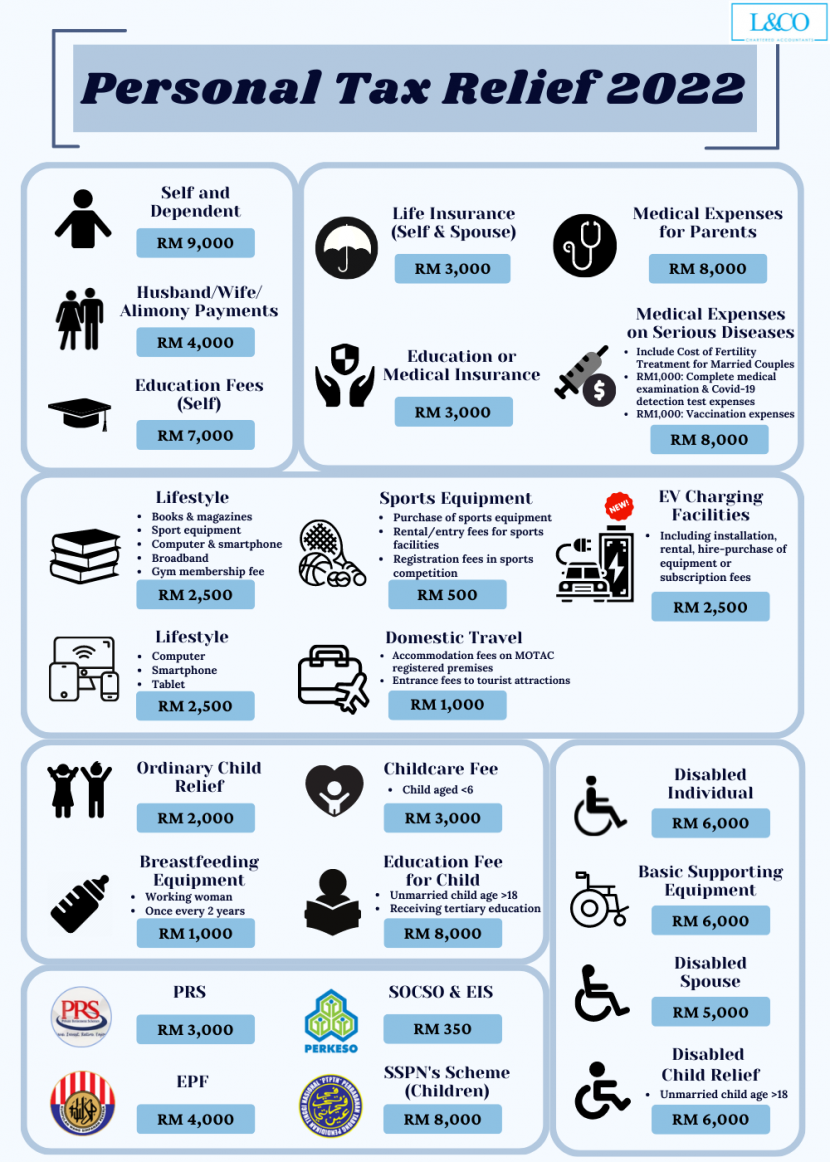

Personal Tax Relief 2022 L & Co Accountants

Latest updates on coronavirus tax relief penalty relief for certain 2019 and 2020 returns. Prepare and file your federal income tax return for free. The relief applies to the failure to file penalty. Please let us know immediately. If your spouse made errors on your joint tax return and you didn't know about it, you may qualify for tax relief.

New Additions Tax Relief for The Year of Assessment 2020 CXL

The penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal income tax return is filed late. Prepare and file your federal income tax return for free. Please let us know immediately. Must file a 2020 tax return to claim,. The relief applies to the failure to file penalty.

9 Ways to Maximise Tax Relief for Family Caregivers in 2023

Irs has several online resources to help taxpayers. The penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal income tax return is filed late. Latest updates on coronavirus tax relief penalty relief for certain 2019 and 2020 returns. Please let us know immediately. Must file a 2020 tax.

Personal Tax Relief Malaysia 2023 (YA 2022) The Updated list of

Irs has several online resources to help taxpayers. Prepare and file your federal income tax return for free. If your spouse made errors on your joint tax return and you didn't know about it, you may qualify for tax relief for spouses. Please let us know immediately. Must file a 2020 tax return to claim,.

YA 2022 individual tax relief claims summary AdrianYeo

Must file a 2020 tax return to claim,. Irs has several online resources to help taxpayers. The relief applies to the failure to file penalty. If your spouse made errors on your joint tax return and you didn't know about it, you may qualify for tax relief for spouses. Latest updates on coronavirus tax relief penalty relief for certain 2019.

10 Essential Documents Required for Tax Return Filing in

Latest updates on coronavirus tax relief penalty relief for certain 2019 and 2020 returns. Prepare and file your federal income tax return for free. Irs has several online resources to help taxpayers. Please let us know immediately. The relief applies to the failure to file penalty.

The Penalty Is Typically Assessed At A Rate Of 5% Per Month, Up To 25% Of The Unpaid Tax When A Federal Income Tax Return Is Filed Late.

If your spouse made errors on your joint tax return and you didn't know about it, you may qualify for tax relief for spouses. Must file a 2020 tax return to claim,. Irs has several online resources to help taxpayers. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a recovery rebate credit for tax year 2020 or 2021.

Please Let Us Know Immediately.

The relief applies to the failure to file penalty. Prepare and file your federal income tax return for free. Latest updates on coronavirus tax relief penalty relief for certain 2019 and 2020 returns.