Inheritance Tax Waiver Form California

Inheritance Tax Waiver Form California - Is there a california inheritance tax waiver form? How the real property was. This form is to be used only for estates of decedents who died on or after june 8, 1982 and before january 1, 2005. This means that beneficiaries inheriting assets from a decedent who was a. Find out how to file a return, request a. California does not impose a state inheritance tax. The return is due and. However, if the gift or inheritance later produces income, you will. If you received a gift or inheritance, do not include it in your income. You may be thinking of a exemption from reassessment for real property taxes.

If you received a gift or inheritance, do not include it in your income. California does not have an inheritance tax, estate tax, or gift tax. However, california residents are subject to federal laws governing gifts during. This means that beneficiaries inheriting assets from a decedent who was a. How the real property was. You may be thinking of a exemption from reassessment for real property taxes. Learn about the history and current status of california estate tax, inheritance tax, and gift tax. California does not have an estate tax. California does not impose a state inheritance tax. Find out how to file a return, request a.

California does not impose a state inheritance tax. You may be thinking of a exemption from reassessment for real property taxes. Find out how to file a return, request a. The return is due and. California does not have an inheritance tax, estate tax, or gift tax. California does not have an estate tax. This means that beneficiaries inheriting assets from a decedent who was a. However, if the gift or inheritance later produces income, you will. In california, there is no requirement for an inheritance tax waiver form, a legal. How the real property was.

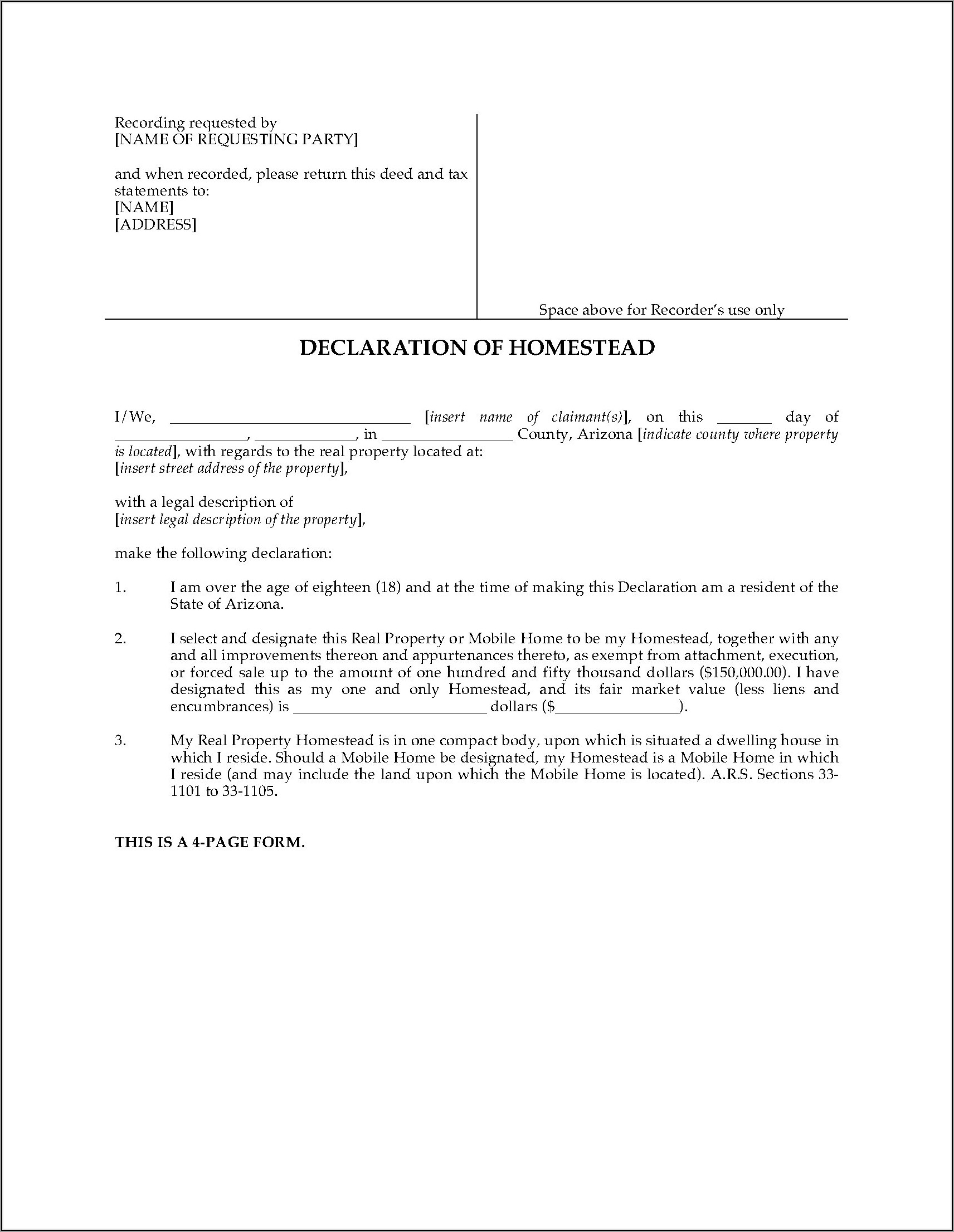

Inheritance Tax Waiver Form Az Form Resume Examples N8VZwyM2we

You may be thinking of a exemption from reassessment for real property taxes. California does not have an inheritance tax, estate tax, or gift tax. However, if the gift or inheritance later produces income, you will. California does not impose a state inheritance tax. The return is due and.

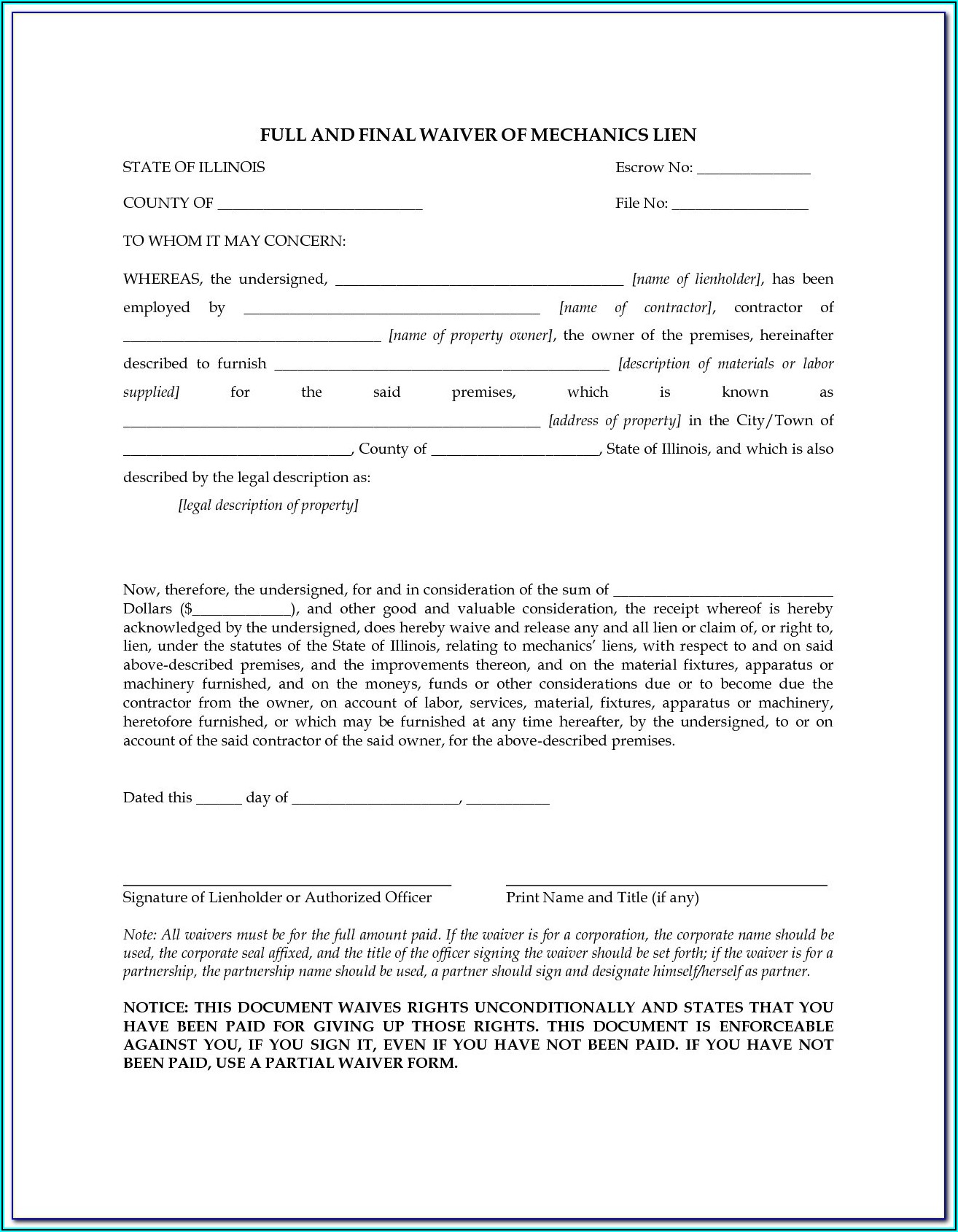

Inheritance Tax Waiver Form New York State Form Resume Examples

Is there a california inheritance tax waiver form? However, if the gift or inheritance later produces income, you will. Learn about the history and current status of california estate tax, inheritance tax, and gift tax. California does not have an estate tax. California does not impose a state inheritance tax.

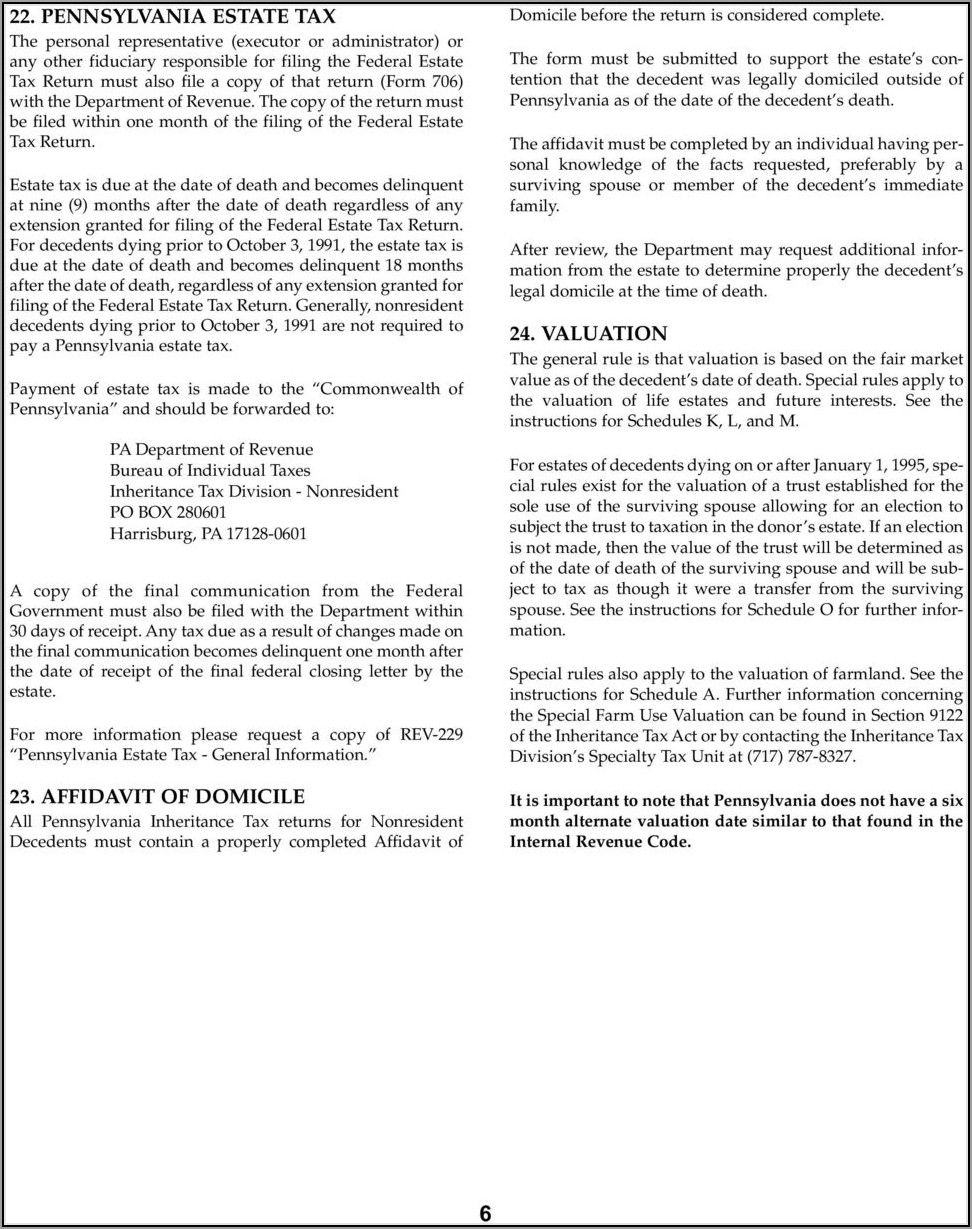

Inheritance Tax Waiver Form Pa Form Resume Examples kLYrL0326a

If you received a gift or inheritance, do not include it in your income. The return is due and. This means that beneficiaries inheriting assets from a decedent who was a. California does not impose a state inheritance tax. Is there a california inheritance tax waiver form?

Inheritance Tax Waiver Form Missouri Form Resume Examples P32EdpZVJ8

Find out how to file a return, request a. California does not have an estate tax. Is there a california inheritance tax waiver form? How the real property was. In california, there is no requirement for an inheritance tax waiver form, a legal.

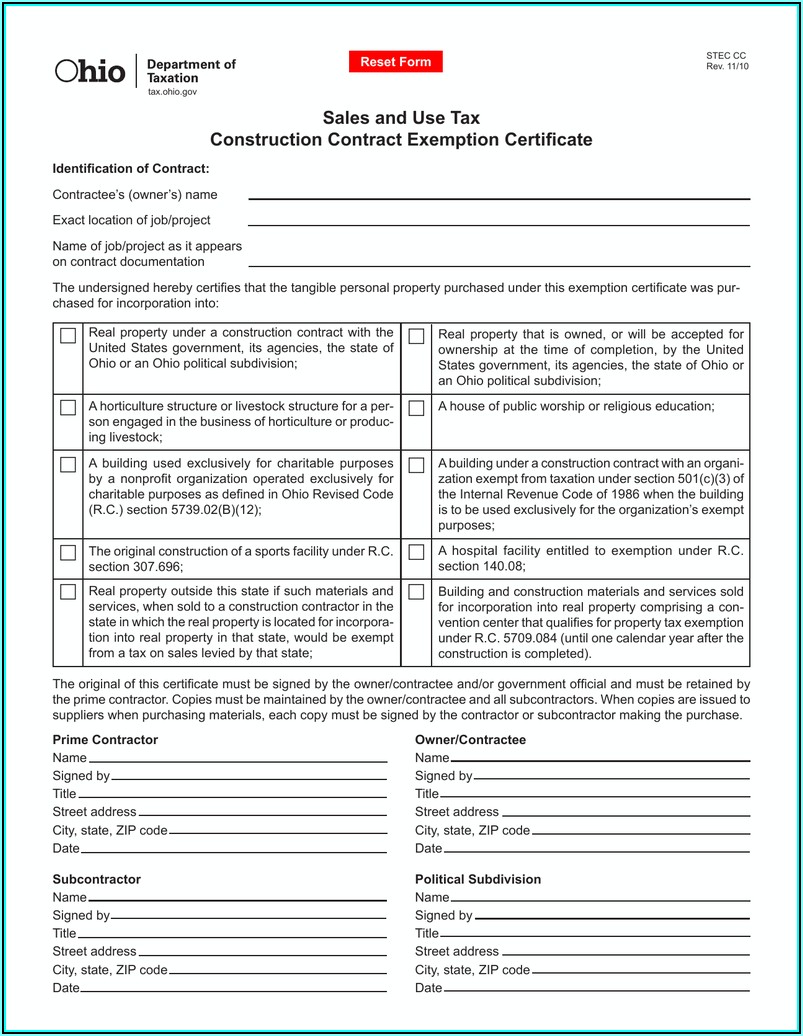

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

This means that beneficiaries inheriting assets from a decedent who was a. This form is to be used only for estates of decedents who died on or after june 8, 1982 and before january 1, 2005. In california, there is no requirement for an inheritance tax waiver form, a legal. Learn about the history and current status of california estate.

20192024 Form NJ L4 Fill Online, Printable, Fillable, Blank pdfFiller

How the real property was. Find out how to file a return, request a. California does not impose a state inheritance tax. Is there a california inheritance tax waiver form? You may be thinking of a exemption from reassessment for real property taxes.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

This means that beneficiaries inheriting assets from a decedent who was a. You may be thinking of a exemption from reassessment for real property taxes. California does not impose a state inheritance tax. California does not have an inheritance tax, estate tax, or gift tax. In california, there is no requirement for an inheritance tax waiver form, a legal.

California inheritance tax waiver form Fill out & sign online DocHub

The return is due and. California does not have an inheritance tax, estate tax, or gift tax. However, if the gift or inheritance later produces income, you will. This means that beneficiaries inheriting assets from a decedent who was a. In california, there is no requirement for an inheritance tax waiver form, a legal.

Fillable Online Inheritance Tax Waiver Form Fillable, Printable

If you received a gift or inheritance, do not include it in your income. California does not impose a state inheritance tax. However, if the gift or inheritance later produces income, you will. Learn about the history and current status of california estate tax, inheritance tax, and gift tax. California does not have an inheritance tax, estate tax, or gift.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

However, california residents are subject to federal laws governing gifts during. California does not have an estate tax. Learn about the history and current status of california estate tax, inheritance tax, and gift tax. Find out how to file a return, request a. California does not impose a state inheritance tax.

California Does Not Impose A State Inheritance Tax.

In california, there is no requirement for an inheritance tax waiver form, a legal. If you received a gift or inheritance, do not include it in your income. This means that beneficiaries inheriting assets from a decedent who was a. Is there a california inheritance tax waiver form?

The Return Is Due And.

However, if the gift or inheritance later produces income, you will. This form is to be used only for estates of decedents who died on or after june 8, 1982 and before january 1, 2005. California does not have an inheritance tax, estate tax, or gift tax. Learn about the history and current status of california estate tax, inheritance tax, and gift tax.

Find Out How To File A Return, Request A.

How the real property was. California does not have an estate tax. However, california residents are subject to federal laws governing gifts during. You may be thinking of a exemption from reassessment for real property taxes.