Irs Name Change Ein

Irs Name Change Ein - In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc. You need a new ein, in general, when you change your entity’s ownership or structure. When you file your business taxes, the irs uses your ein and business name to identify your business. You don’t need a new ein if you just. If you decide to change. In some situations a name change may require a new employer identification number (ein) or a final return.

In some situations a name change may require a new employer identification number (ein) or a final return. You need a new ein, in general, when you change your entity’s ownership or structure. When you file your business taxes, the irs uses your ein and business name to identify your business. You don’t need a new ein if you just. If you decide to change. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc.

You need a new ein, in general, when you change your entity’s ownership or structure. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc. You don’t need a new ein if you just. When you file your business taxes, the irs uses your ein and business name to identify your business. In some situations a name change may require a new employer identification number (ein) or a final return. If you decide to change.

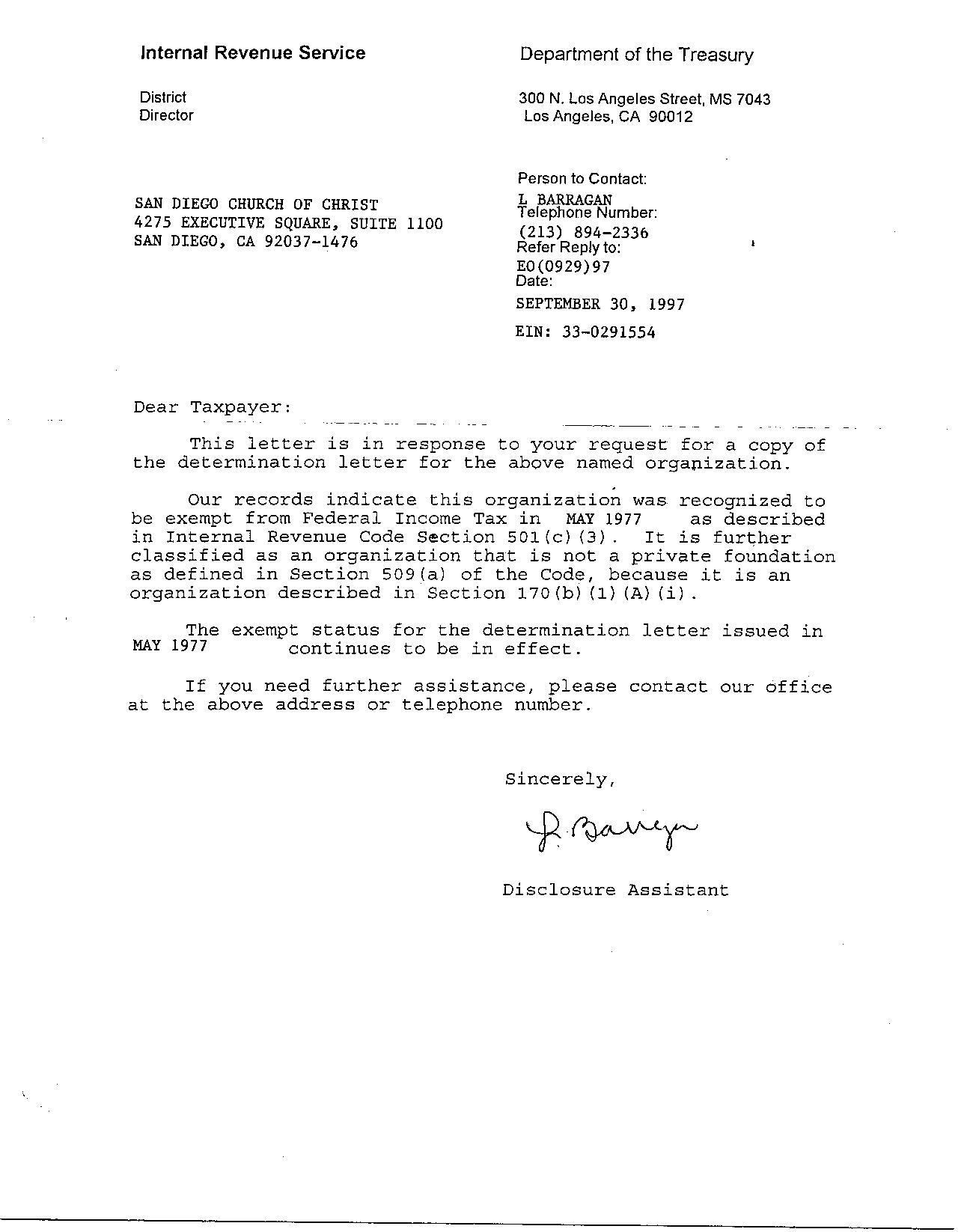

Irs Get Ein Letter

You don’t need a new ein if you just. If you decide to change. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc. When you file your business taxes, the irs uses your ein and business name to identify your business. You need.

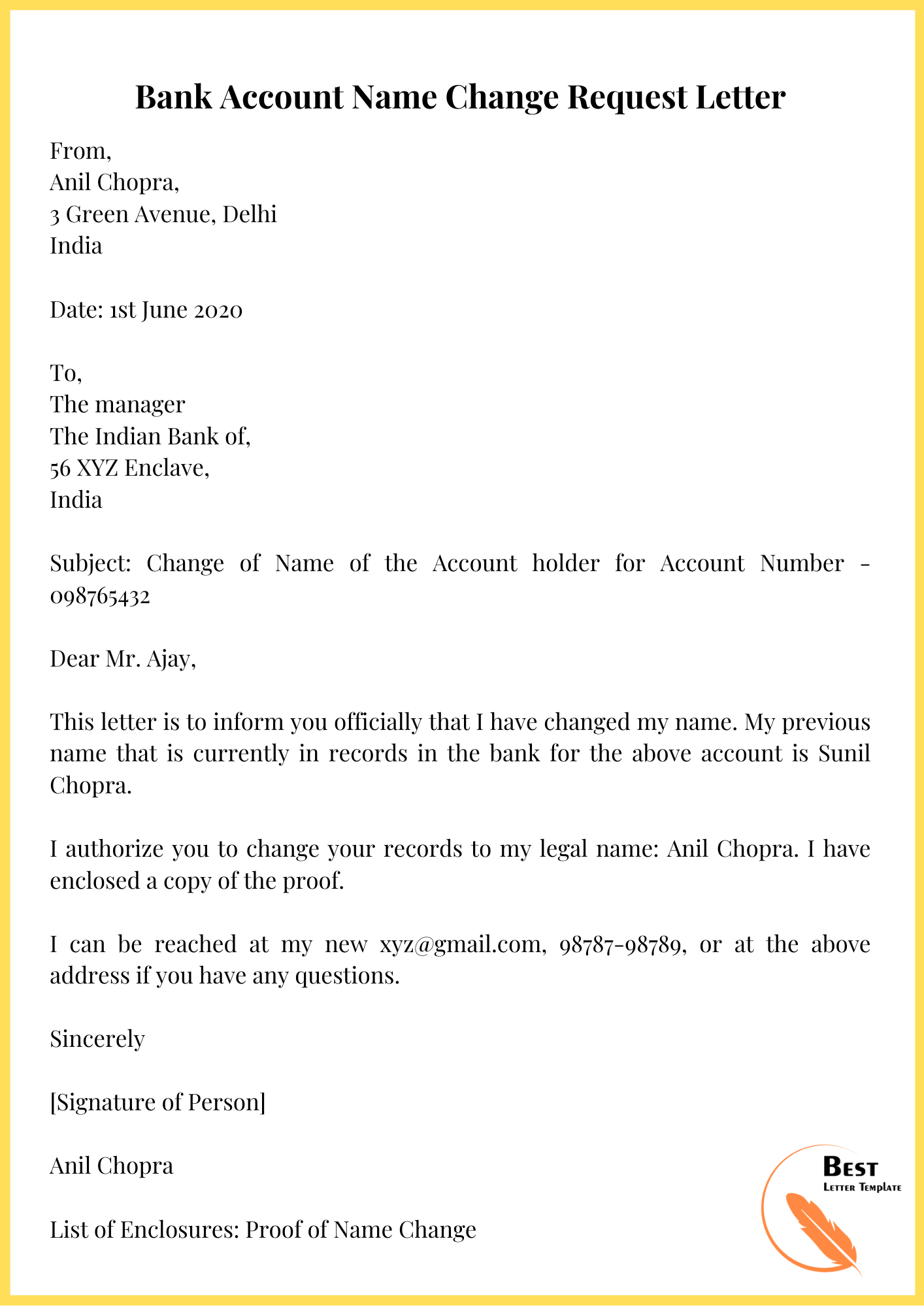

Ein Name Change Letter Template

You need a new ein, in general, when you change your entity’s ownership or structure. In some situations a name change may require a new employer identification number (ein) or a final return. You don’t need a new ein if you just. When you file your business taxes, the irs uses your ein and business name to identify your business..

Irs Business Name Change Letter Template

You don’t need a new ein if you just. If you decide to change. In some situations a name change may require a new employer identification number (ein) or a final return. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc. You need.

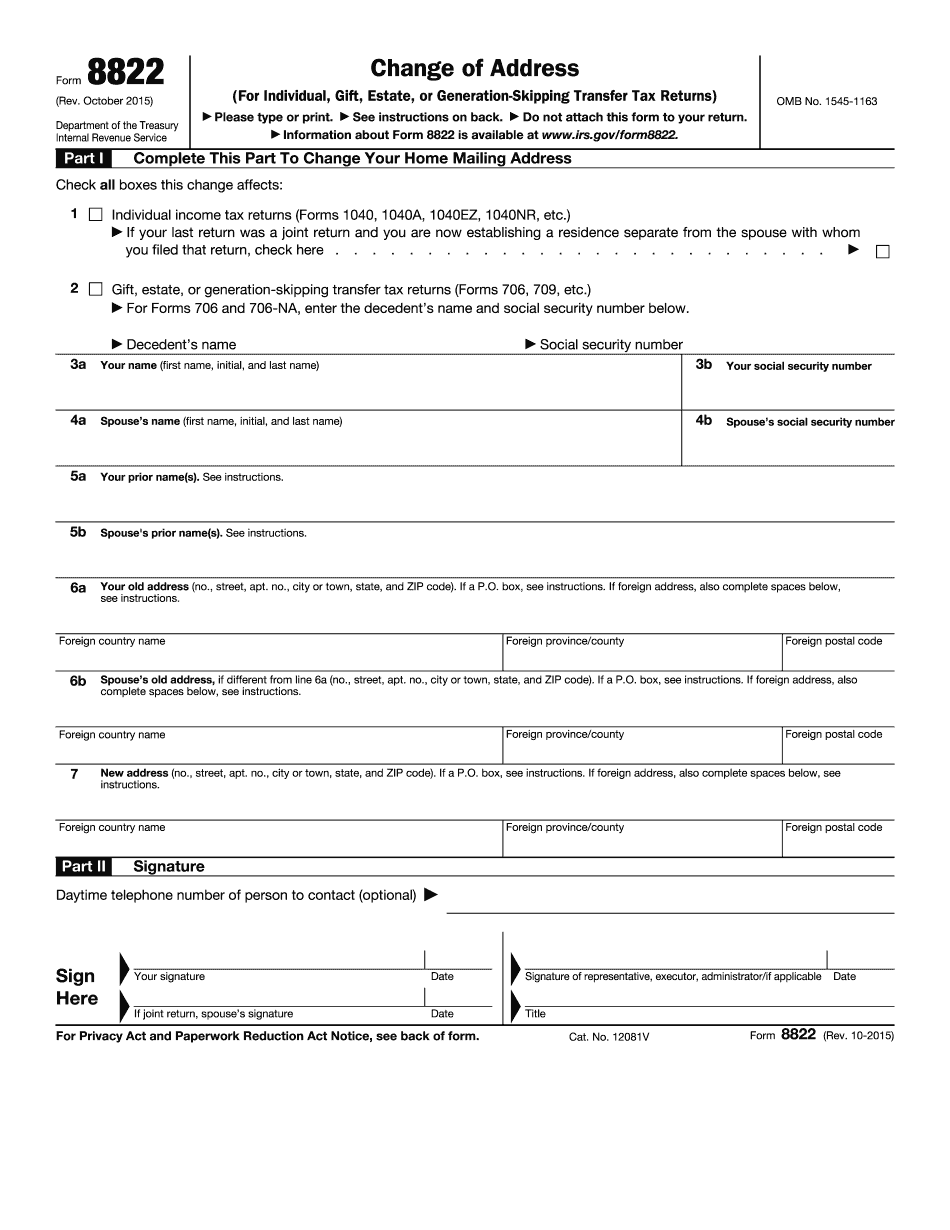

irs name change form Fill Online, Printable, Fillable Blank form

If you decide to change. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc. You don’t need a new ein if you just. You need a new ein, in general, when you change your entity’s ownership or structure. In some situations a name.

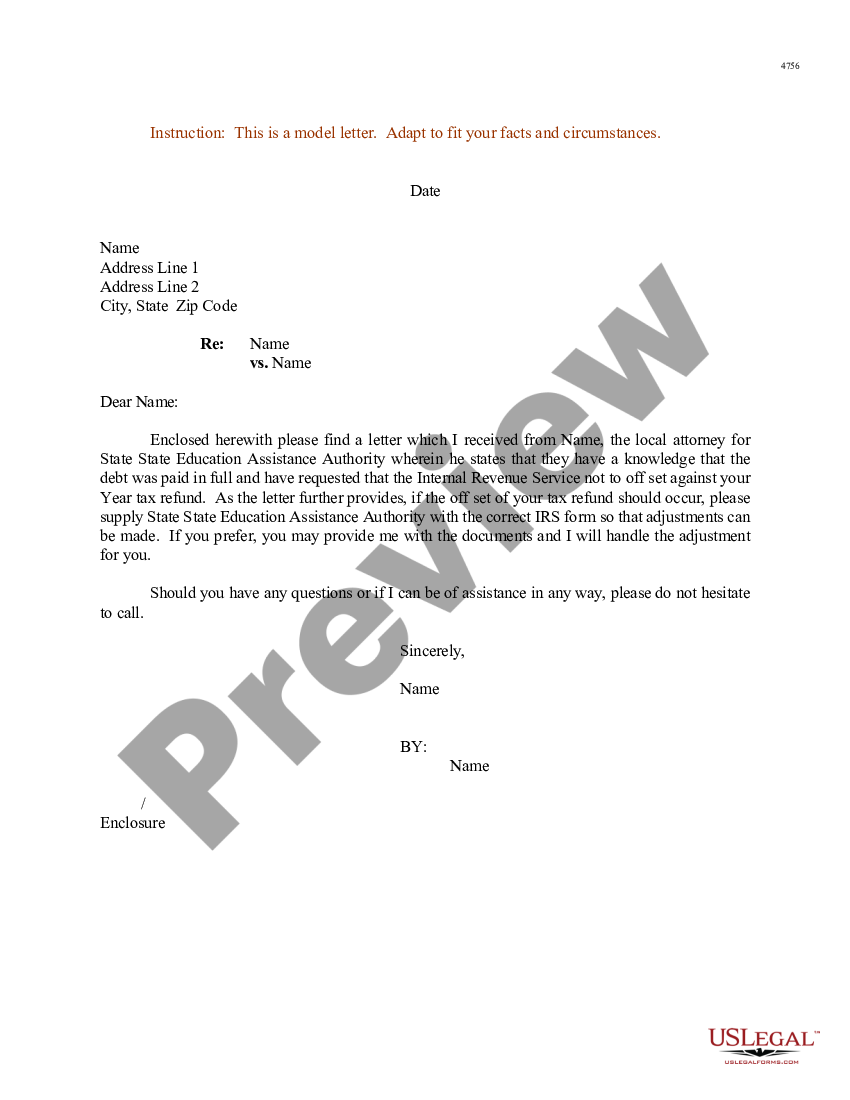

Sample Letter To Irs For Business Name Change US Legal Forms

You don’t need a new ein if you just. In some situations a name change may require a new employer identification number (ein) or a final return. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc. If you decide to change. You need.

38 [pdf] PAYMENT LETTER TO IRS PRINTABLE DOCX ZIP DOWNLOAD

In some situations a name change may require a new employer identification number (ein) or a final return. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc. You don’t need a new ein if you just. If you decide to change. When you.

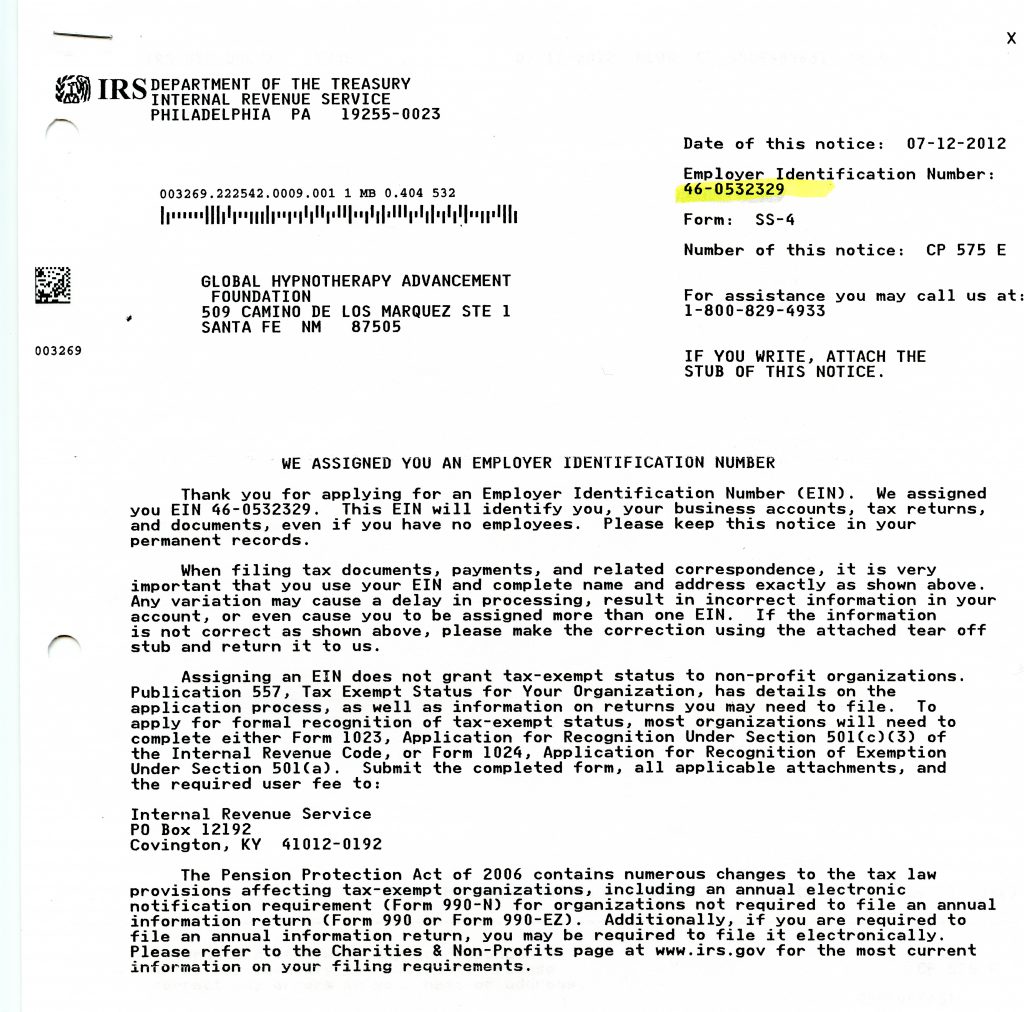

EIN IRS

If you decide to change. You don’t need a new ein if you just. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc. In some situations a name change may require a new employer identification number (ein) or a final return. You need.

Letter To Irs Free Printable Documents

In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc. When you file your business taxes, the irs uses your ein and business name to identify your business. You don’t need a new ein if you just. You need a new ein, in general,.

IRS Change of Address Form 5 Free Templates in PDF, Word, Excel Download

You need a new ein, in general, when you change your entity’s ownership or structure. If you decide to change. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc. In some situations a name change may require a new employer identification number (ein).

IRS LTR 147C EIN PDF

You need a new ein, in general, when you change your entity’s ownership or structure. In some situations a name change may require a new employer identification number (ein) or a final return. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc. When.

You Need A New Ein, In General, When You Change Your Entity’s Ownership Or Structure.

You don’t need a new ein if you just. If you decide to change. When you file your business taxes, the irs uses your ein and business name to identify your business. In some situations a name change may require a new employer identification number (ein) or a final return.