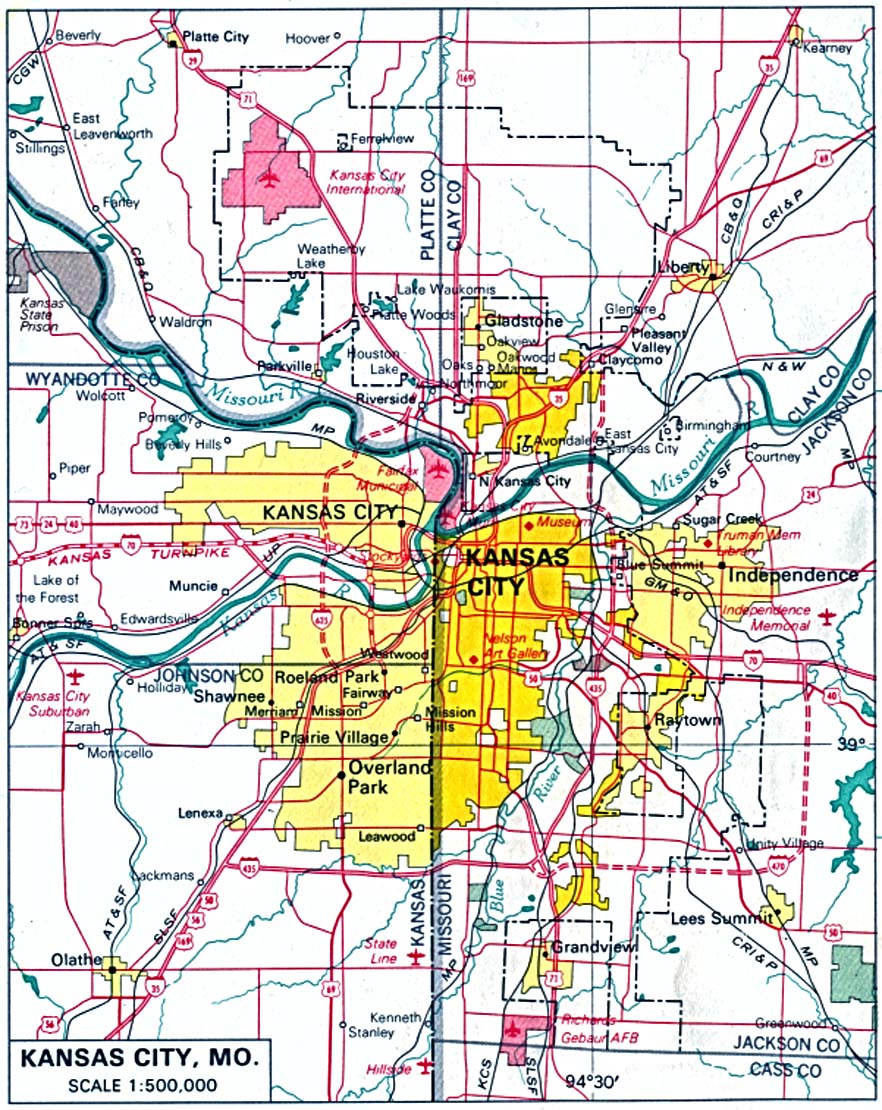

Kansas City Missouri Local Tax

Kansas City Missouri Local Tax - Quick tax is the city’s online tax filing system. We have information on the local income tax rates in 2 localities in missouri. Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,. Ensure you are meeting any federal, state, or local tax requirements for your business. You can click on any city or county for more details, including the. All taxes can be filed and paid online at kcmo.gov/quicktax. Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. Once you sign up, you will be able to submit returns and payments for all tax types. Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to. Generally, the department of revenue collects and distributes only state and local (city, county, and district) sales tax.

Once you sign up, you will be able to submit returns and payments for all tax types. The seller remits state and. Generally, the department of revenue collects and distributes only state and local (city, county, and district) sales tax. You can click on any city or county for more details, including the. Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,. We have information on the local income tax rates in 2 localities in missouri. Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to. Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. Quick tax is the city’s online tax filing system. All taxes can be filed and paid online at kcmo.gov/quicktax.

Quick tax is the city’s online tax filing system. We have information on the local income tax rates in 2 localities in missouri. Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to. Generally, the department of revenue collects and distributes only state and local (city, county, and district) sales tax. All taxes can be filed and paid online at kcmo.gov/quicktax. Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,. You can click on any city or county for more details, including the. The seller remits state and. Ensure you are meeting any federal, state, or local tax requirements for your business.

Kansas City, Missouri The E.W. Scripps Company

You can click on any city or county for more details, including the. All taxes can be filed and paid online at kcmo.gov/quicktax. Generally, the department of revenue collects and distributes only state and local (city, county, and district) sales tax. We have information on the local income tax rates in 2 localities in missouri. Residents of kansas city pay.

Kansas City, Missouri Logo PNG Vector (SVG) Free Download

We have information on the local income tax rates in 2 localities in missouri. Quick tax is the city’s online tax filing system. Ensure you are meeting any federal, state, or local tax requirements for your business. The seller remits state and. Generally, the department of revenue collects and distributes only state and local (city, county, and district) sales tax.

Kansas/Missouri local ceasefire in U.S. tax border war? Tax Justice

Quick tax is the city’s online tax filing system. Once you sign up, you will be able to submit returns and payments for all tax types. Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. We have information on the local income tax.

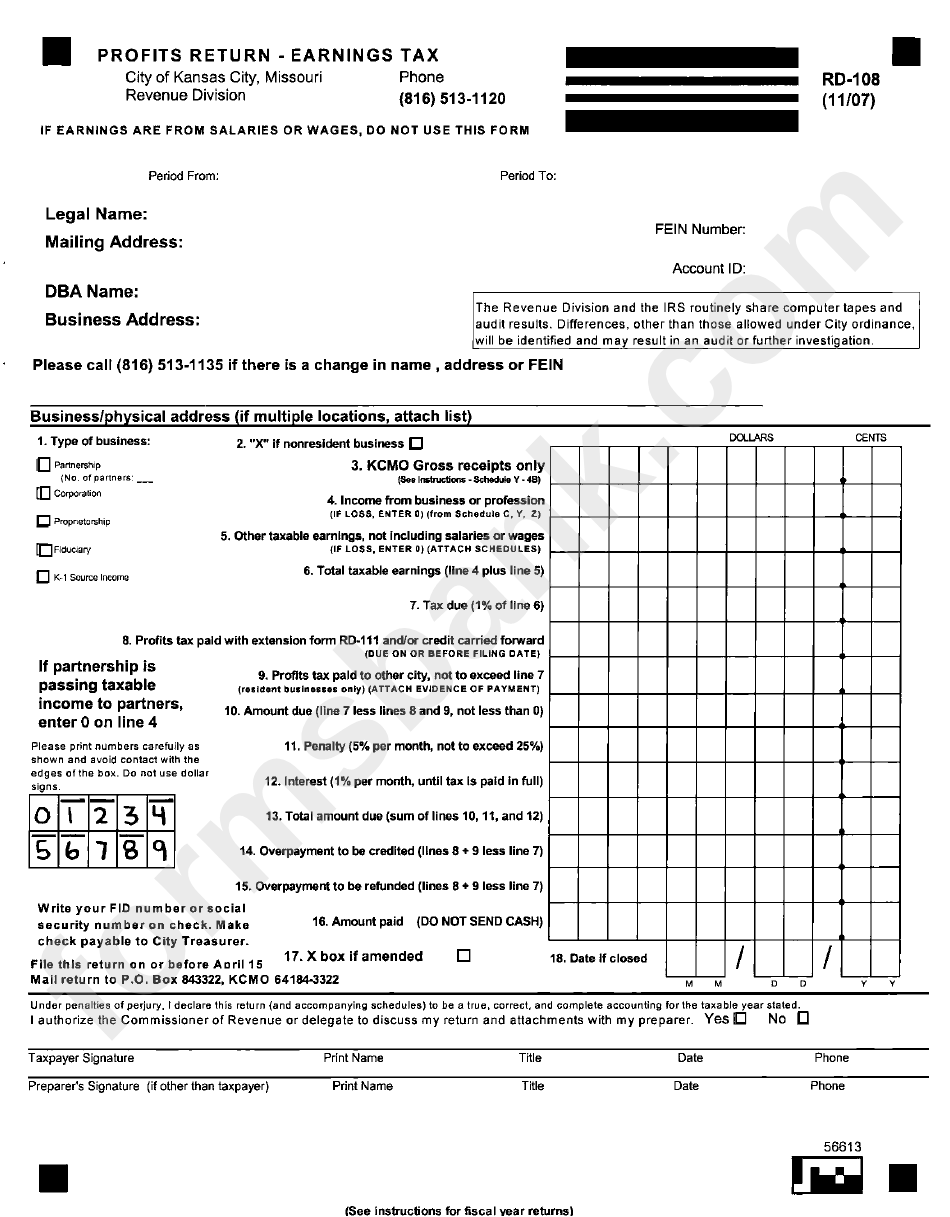

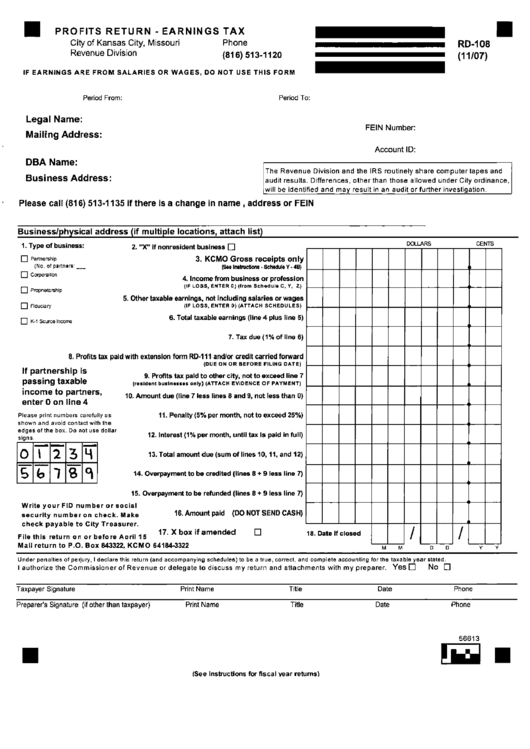

Fillable Form Rd108 Profit Return Earnings Tax City Of Kansas

Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to. You can click on any city or county for more details, including the. Generally, the department of revenue collects and distributes only state and local (city, county, and district) sales tax. We have information on the.

Missouri & Kansas be like r/kansascity

All taxes can be filed and paid online at kcmo.gov/quicktax. Generally, the department of revenue collects and distributes only state and local (city, county, and district) sales tax. Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. Once you sign up, you will.

Paris of the Plains A Local’s Guide to Visiting Kansas City, Missouri

Ensure you are meeting any federal, state, or local tax requirements for your business. All taxes can be filed and paid online at kcmo.gov/quicktax. You can click on any city or county for more details, including the. Quick tax is the city’s online tax filing system. Residents of kansas city pay a flat city income tax of 1.00% on earned.

Fillable Form Rd108 Profit Return Earnings Tax City Of Kansas

Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to. Once you sign up, you will be able to submit returns and payments for all tax types. Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and.

Kansas City, Missouri, Logo Artwork HEBSTREITS

Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to. Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. Generally, the department of revenue collects and distributes only state.

What to do in Kansas City, Missouri A Locals Guide Rachel's Crafted Life

Quick tax is the city’s online tax filing system. Ensure you are meeting any federal, state, or local tax requirements for your business. All taxes can be filed and paid online at kcmo.gov/quicktax. Generally, the department of revenue collects and distributes only state and local (city, county, and district) sales tax. You can click on any city or county for.

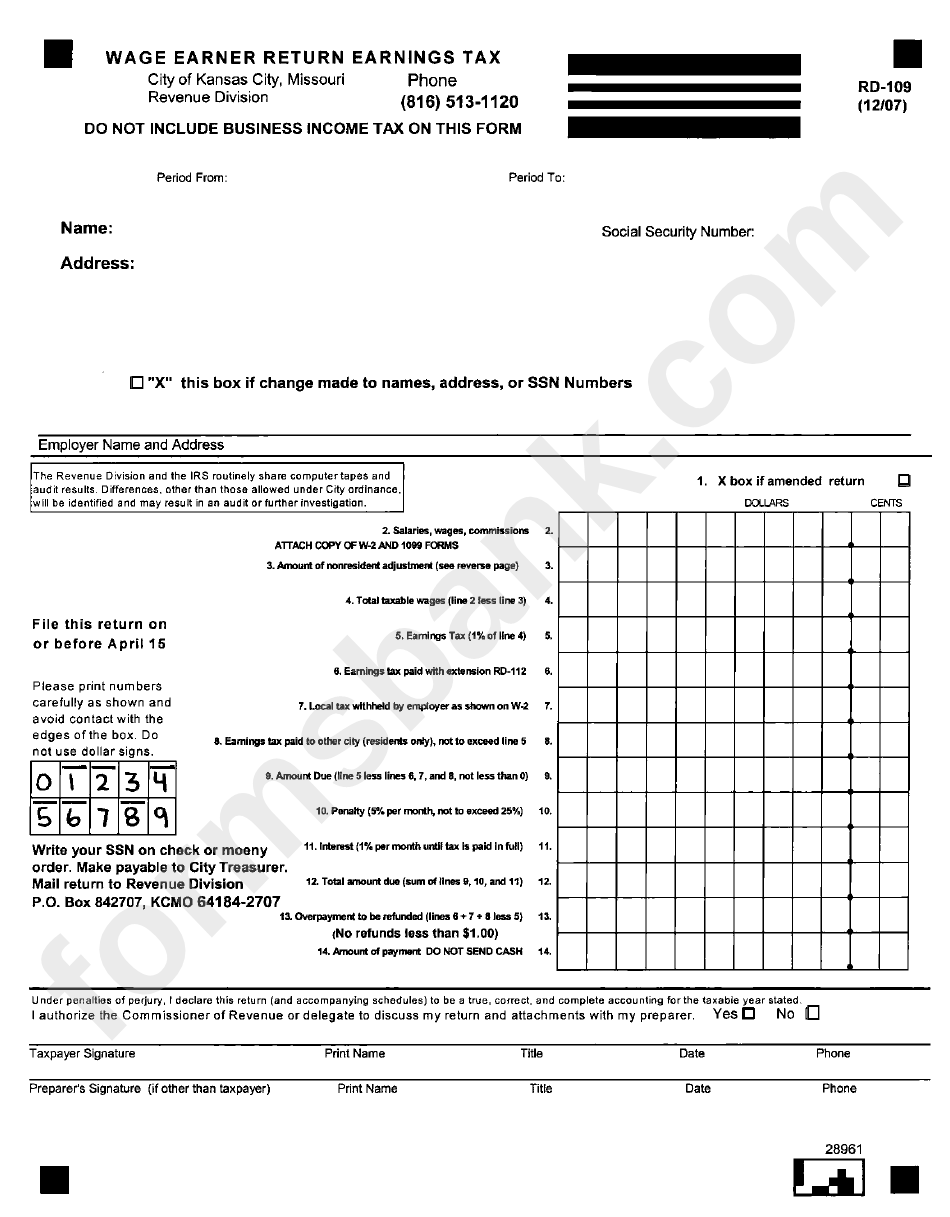

Fillable Form Rd109 Wage Earner Return Earnings Tax City Of Kansas

You can click on any city or county for more details, including the. Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. Quick tax is the city’s online tax filing system. All taxes can be filed and paid online at kcmo.gov/quicktax. Quick tax.

The Seller Remits State And.

Quick tax is the city’s online tax filing system. All taxes can be filed and paid online at kcmo.gov/quicktax. Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to. Ensure you are meeting any federal, state, or local tax requirements for your business.

Once You Sign Up, You Will Be Able To Submit Returns And Payments For All Tax Types.

You can click on any city or county for more details, including the. Generally, the department of revenue collects and distributes only state and local (city, county, and district) sales tax. Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. We have information on the local income tax rates in 2 localities in missouri.