Local Vs State Tax

Local Vs State Tax - First, you have to figure out how much state income tax and sales tax you paid. If you're an employee, it's easy to know how. Localities in indiana, iowa, maryland, and new york levy an individual income tax that piggybacks on the state income tax.

If you're an employee, it's easy to know how. First, you have to figure out how much state income tax and sales tax you paid. Localities in indiana, iowa, maryland, and new york levy an individual income tax that piggybacks on the state income tax.

If you're an employee, it's easy to know how. Localities in indiana, iowa, maryland, and new york levy an individual income tax that piggybacks on the state income tax. First, you have to figure out how much state income tax and sales tax you paid.

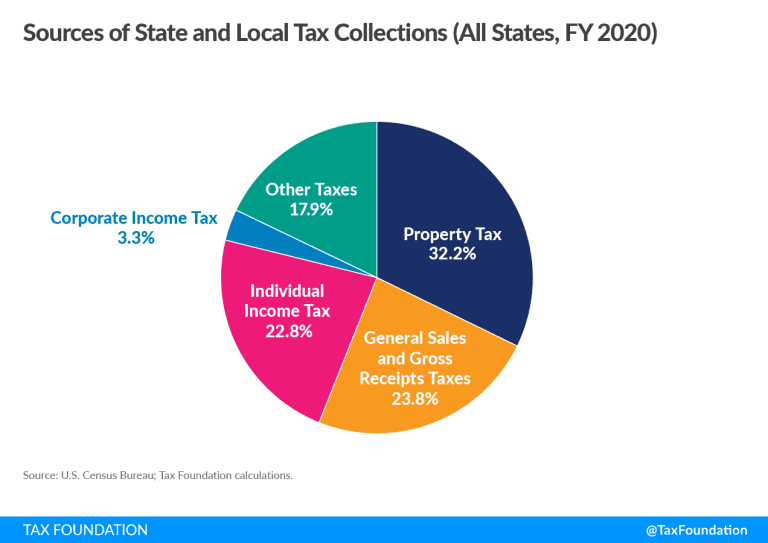

State and Local Tax Collections State and Local Tax Revenue by State

First, you have to figure out how much state income tax and sales tax you paid. If you're an employee, it's easy to know how. Localities in indiana, iowa, maryland, and new york levy an individual income tax that piggybacks on the state income tax.

Federal vs. State Tax What Is The Difference? SuperMoney

Localities in indiana, iowa, maryland, and new york levy an individual income tax that piggybacks on the state income tax. First, you have to figure out how much state income tax and sales tax you paid. If you're an employee, it's easy to know how.

Federal Vs State Tax Credit

First, you have to figure out how much state income tax and sales tax you paid. If you're an employee, it's easy to know how. Localities in indiana, iowa, maryland, and new york levy an individual income tax that piggybacks on the state income tax.

Monday Map Combined State and Local Sales Tax Rates

If you're an employee, it's easy to know how. Localities in indiana, iowa, maryland, and new york levy an individual income tax that piggybacks on the state income tax. First, you have to figure out how much state income tax and sales tax you paid.

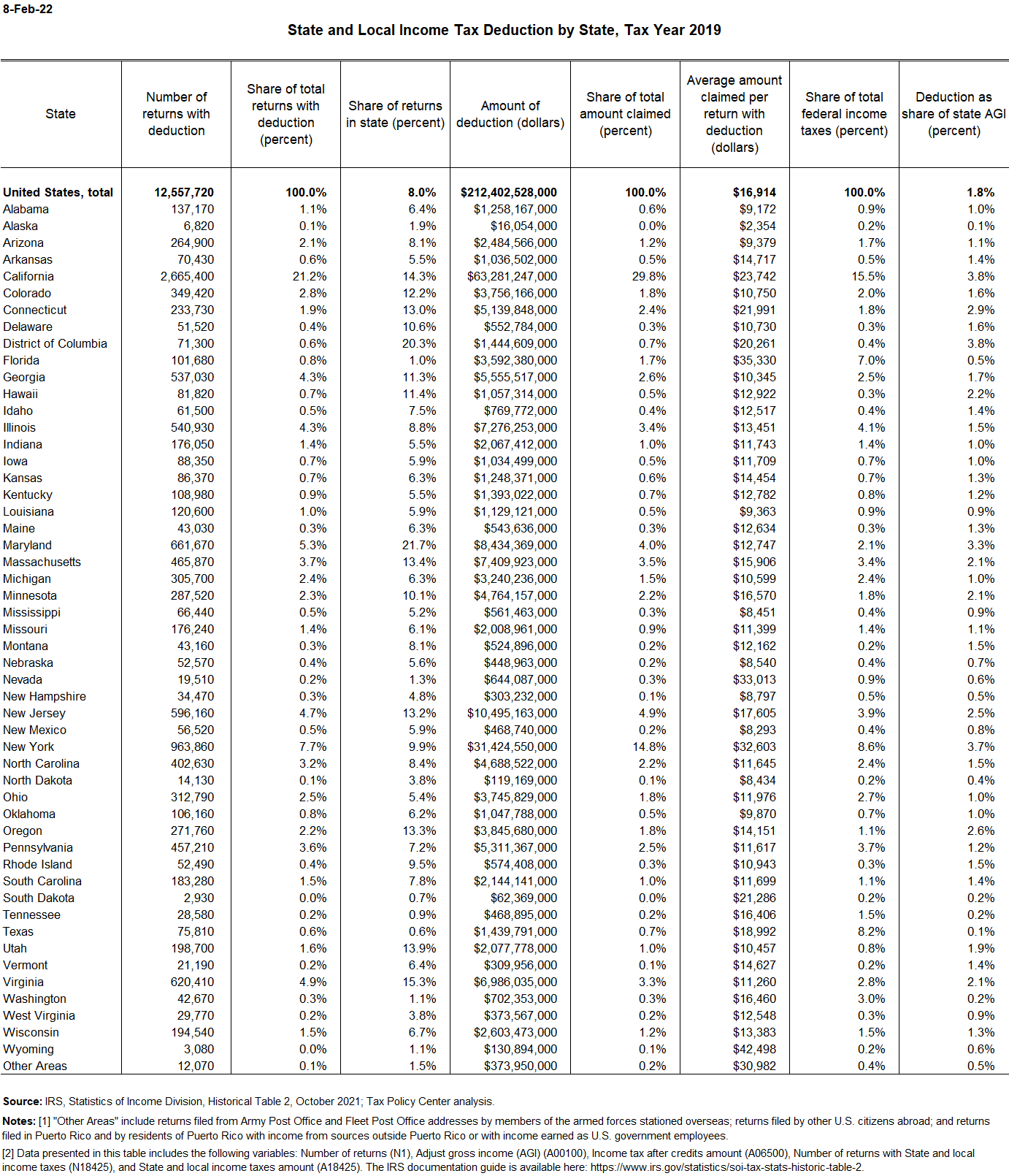

State and Local Tax Deduction by State Tax Policy Center

First, you have to figure out how much state income tax and sales tax you paid. If you're an employee, it's easy to know how. Localities in indiana, iowa, maryland, and new york levy an individual income tax that piggybacks on the state income tax.

Quiz & Worksheet Local vs. State vs. Federal Ordinances

First, you have to figure out how much state income tax and sales tax you paid. Localities in indiana, iowa, maryland, and new york levy an individual income tax that piggybacks on the state income tax. If you're an employee, it's easy to know how.

Understanding Federal vs. State vs. Local Taxes Taxes US News

If you're an employee, it's easy to know how. Localities in indiana, iowa, maryland, and new york levy an individual income tax that piggybacks on the state income tax. First, you have to figure out how much state income tax and sales tax you paid.

State & Local Tax Toolkit Sources of Tax Collections Tax Foundation

If you're an employee, it's easy to know how. Localities in indiana, iowa, maryland, and new york levy an individual income tax that piggybacks on the state income tax. First, you have to figure out how much state income tax and sales tax you paid.

Navigating State and Local Sales Tax Laws and Rates State Tax Advisors

If you're an employee, it's easy to know how. Localities in indiana, iowa, maryland, and new york levy an individual income tax that piggybacks on the state income tax. First, you have to figure out how much state income tax and sales tax you paid.

State and Local Sales Tax Rates in 2014 Tax Foundation

First, you have to figure out how much state income tax and sales tax you paid. Localities in indiana, iowa, maryland, and new york levy an individual income tax that piggybacks on the state income tax. If you're an employee, it's easy to know how.

First, You Have To Figure Out How Much State Income Tax And Sales Tax You Paid.

Localities in indiana, iowa, maryland, and new york levy an individual income tax that piggybacks on the state income tax. If you're an employee, it's easy to know how.

.png)

.png)