Malaysia Custom Clearance Fee

Malaysia Custom Clearance Fee - All import shipment’s duties amount below myr 300.00 will be categorize as auto clearance shipment through sf malaysia. The duty/tax rates for tourists or travellers are subject to the customs duties order 2022 and the sales tax. The customs clearance fee in malaysia is myr 33 (equivalent to usd 10) per customs declaration presented to customs authorities. In addition to import duties and taxes, importers may be required to pay various fees during customs clearance in. Dutiable goods and duty/tax rates.

All import shipment’s duties amount below myr 300.00 will be categorize as auto clearance shipment through sf malaysia. Dutiable goods and duty/tax rates. The duty/tax rates for tourists or travellers are subject to the customs duties order 2022 and the sales tax. In addition to import duties and taxes, importers may be required to pay various fees during customs clearance in. The customs clearance fee in malaysia is myr 33 (equivalent to usd 10) per customs declaration presented to customs authorities.

The duty/tax rates for tourists or travellers are subject to the customs duties order 2022 and the sales tax. Dutiable goods and duty/tax rates. In addition to import duties and taxes, importers may be required to pay various fees during customs clearance in. The customs clearance fee in malaysia is myr 33 (equivalent to usd 10) per customs declaration presented to customs authorities. All import shipment’s duties amount below myr 300.00 will be categorize as auto clearance shipment through sf malaysia.

How To Check Custom Clearance Status Malaysia Viral Rang

The customs clearance fee in malaysia is myr 33 (equivalent to usd 10) per customs declaration presented to customs authorities. All import shipment’s duties amount below myr 300.00 will be categorize as auto clearance shipment through sf malaysia. The duty/tax rates for tourists or travellers are subject to the customs duties order 2022 and the sales tax. Dutiable goods and.

Customs Clearance Malaysia Logistics Information Johann Logistics

The duty/tax rates for tourists or travellers are subject to the customs duties order 2022 and the sales tax. The customs clearance fee in malaysia is myr 33 (equivalent to usd 10) per customs declaration presented to customs authorities. In addition to import duties and taxes, importers may be required to pay various fees during customs clearance in. Dutiable goods.

Custom Clearance Malaysia DHL Malaysia

The customs clearance fee in malaysia is myr 33 (equivalent to usd 10) per customs declaration presented to customs authorities. All import shipment’s duties amount below myr 300.00 will be categorize as auto clearance shipment through sf malaysia. Dutiable goods and duty/tax rates. In addition to import duties and taxes, importers may be required to pay various fees during customs.

All You Need To Know About Free Trade Zone in Malaysia DHL Malaysia

In addition to import duties and taxes, importers may be required to pay various fees during customs clearance in. Dutiable goods and duty/tax rates. All import shipment’s duties amount below myr 300.00 will be categorize as auto clearance shipment through sf malaysia. The duty/tax rates for tourists or travellers are subject to the customs duties order 2022 and the sales.

Customs Clearance Process

All import shipment’s duties amount below myr 300.00 will be categorize as auto clearance shipment through sf malaysia. The customs clearance fee in malaysia is myr 33 (equivalent to usd 10) per customs declaration presented to customs authorities. In addition to import duties and taxes, importers may be required to pay various fees during customs clearance in. Dutiable goods and.

malaysia custom clearance fee Alison McLean

The customs clearance fee in malaysia is myr 33 (equivalent to usd 10) per customs declaration presented to customs authorities. Dutiable goods and duty/tax rates. In addition to import duties and taxes, importers may be required to pay various fees during customs clearance in. The duty/tax rates for tourists or travellers are subject to the customs duties order 2022 and.

Customs Clearance Pengertian, Prosedur, dan Cara Mengurusnya Waresix

All import shipment’s duties amount below myr 300.00 will be categorize as auto clearance shipment through sf malaysia. The duty/tax rates for tourists or travellers are subject to the customs duties order 2022 and the sales tax. The customs clearance fee in malaysia is myr 33 (equivalent to usd 10) per customs declaration presented to customs authorities. Dutiable goods and.

Customs Clearance — Centurion PLC

Dutiable goods and duty/tax rates. The customs clearance fee in malaysia is myr 33 (equivalent to usd 10) per customs declaration presented to customs authorities. All import shipment’s duties amount below myr 300.00 will be categorize as auto clearance shipment through sf malaysia. In addition to import duties and taxes, importers may be required to pay various fees during customs.

malaysia custom clearance fee Alison McLean

In addition to import duties and taxes, importers may be required to pay various fees during customs clearance in. Dutiable goods and duty/tax rates. The duty/tax rates for tourists or travellers are subject to the customs duties order 2022 and the sales tax. All import shipment’s duties amount below myr 300.00 will be categorize as auto clearance shipment through sf.

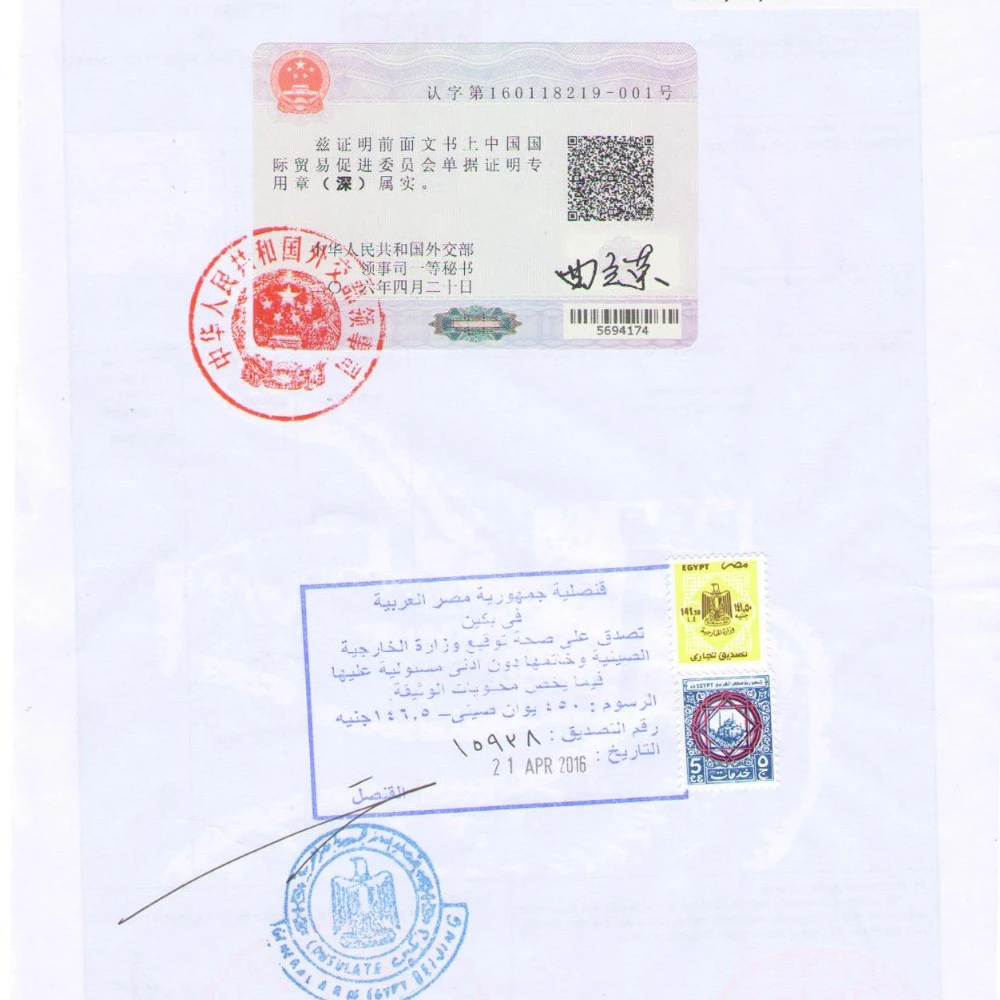

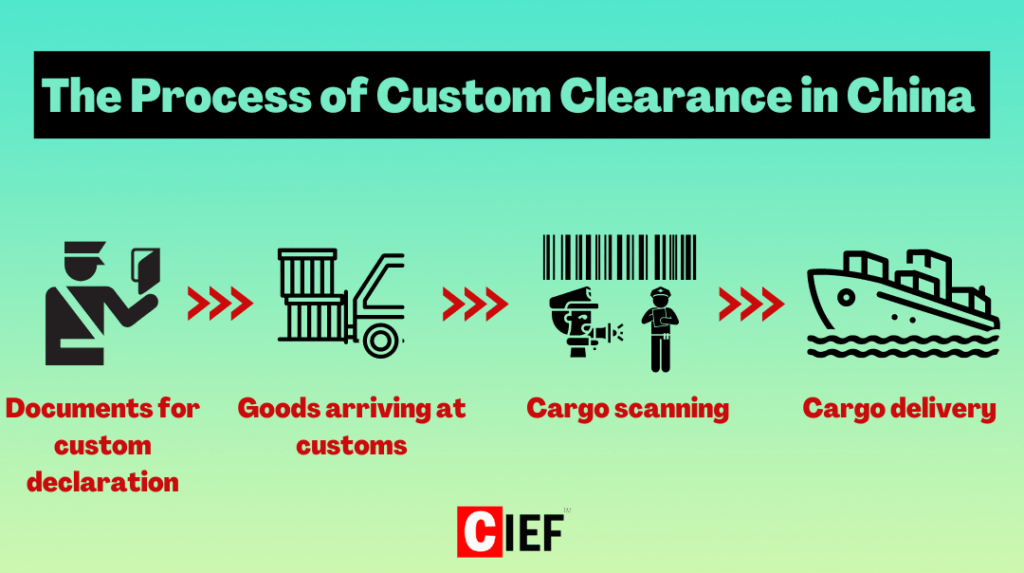

Malaysian importers dealing with custom clearance in China C.I.E.F

Dutiable goods and duty/tax rates. The customs clearance fee in malaysia is myr 33 (equivalent to usd 10) per customs declaration presented to customs authorities. In addition to import duties and taxes, importers may be required to pay various fees during customs clearance in. All import shipment’s duties amount below myr 300.00 will be categorize as auto clearance shipment through.

Dutiable Goods And Duty/Tax Rates.

All import shipment’s duties amount below myr 300.00 will be categorize as auto clearance shipment through sf malaysia. The customs clearance fee in malaysia is myr 33 (equivalent to usd 10) per customs declaration presented to customs authorities. In addition to import duties and taxes, importers may be required to pay various fees during customs clearance in. The duty/tax rates for tourists or travellers are subject to the customs duties order 2022 and the sales tax.