New Jersey Tax Lien

New Jersey Tax Lien - Cods are filed to secure tax debt and to protect the. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. In new jersey, a cod is a tax lien filed against you. This legislation establishes requirements for publication of notice, issuance of notice to. New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. A tax lien is filed against you with the clerk of the new jersey superior court.

New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. A tax lien is filed against you with the clerk of the new jersey superior court. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. In new jersey, a cod is a tax lien filed against you. Cods are filed to secure tax debt and to protect the. This legislation establishes requirements for publication of notice, issuance of notice to.

Cods are filed to secure tax debt and to protect the. In new jersey, a cod is a tax lien filed against you. A tax lien is filed against you with the clerk of the new jersey superior court. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. This legislation establishes requirements for publication of notice, issuance of notice to. New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales.

The Complete Guide to New Jersey Lien & Notice Deadlines National

Cods are filed to secure tax debt and to protect the. This legislation establishes requirements for publication of notice, issuance of notice to. In new jersey, a cod is a tax lien filed against you. A tax lien is filed against you with the clerk of the new jersey superior court. A tax lien is the state's legal claim to.

tax lien PDF Free Download

A tax lien is filed against you with the clerk of the new jersey superior court. Cods are filed to secure tax debt and to protect the. In new jersey, a cod is a tax lien filed against you. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. This legislation establishes.

More Than 400 Listings In West Orange 2022 Tax Lien Sale West Orange

New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. This legislation establishes requirements for publication of notice, issuance of notice to. Cods are filed to secure tax debt and to protect the. A tax lien is the state's legal claim to your assets in relation to your unpaid.

New Jersey Tax Lien Sales 2024 Rena Valina

New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. Cods are filed to secure tax debt and to protect the. In new jersey, a cod is a tax lien filed.

New Jersey Tax Liens Tax Lien & Deed Investment

New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. In new jersey, a cod is a tax lien filed against you. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. Cods are filed to secure tax debt and to.

New Jersey Tax Lien Investing by Peter O'Reilly Goodreads

In new jersey, a cod is a tax lien filed against you. New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. This legislation establishes requirements for publication of notice, issuance of notice to. Cods are filed to secure tax debt and to protect the. A tax lien is.

Your Family May Be Eligible for a Property Tax Rebate in New Jersey

New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. A tax lien is filed against you with the clerk of the new jersey superior court. Cods are filed to secure tax debt and to protect the. In new jersey, a cod is a tax lien filed against you..

Understanding NJ Tax Lien Foreclosure Westmarq

A tax lien is filed against you with the clerk of the new jersey superior court. New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. This legislation establishes requirements for publication of notice, issuance of notice to. A tax lien is the state's legal claim to your assets.

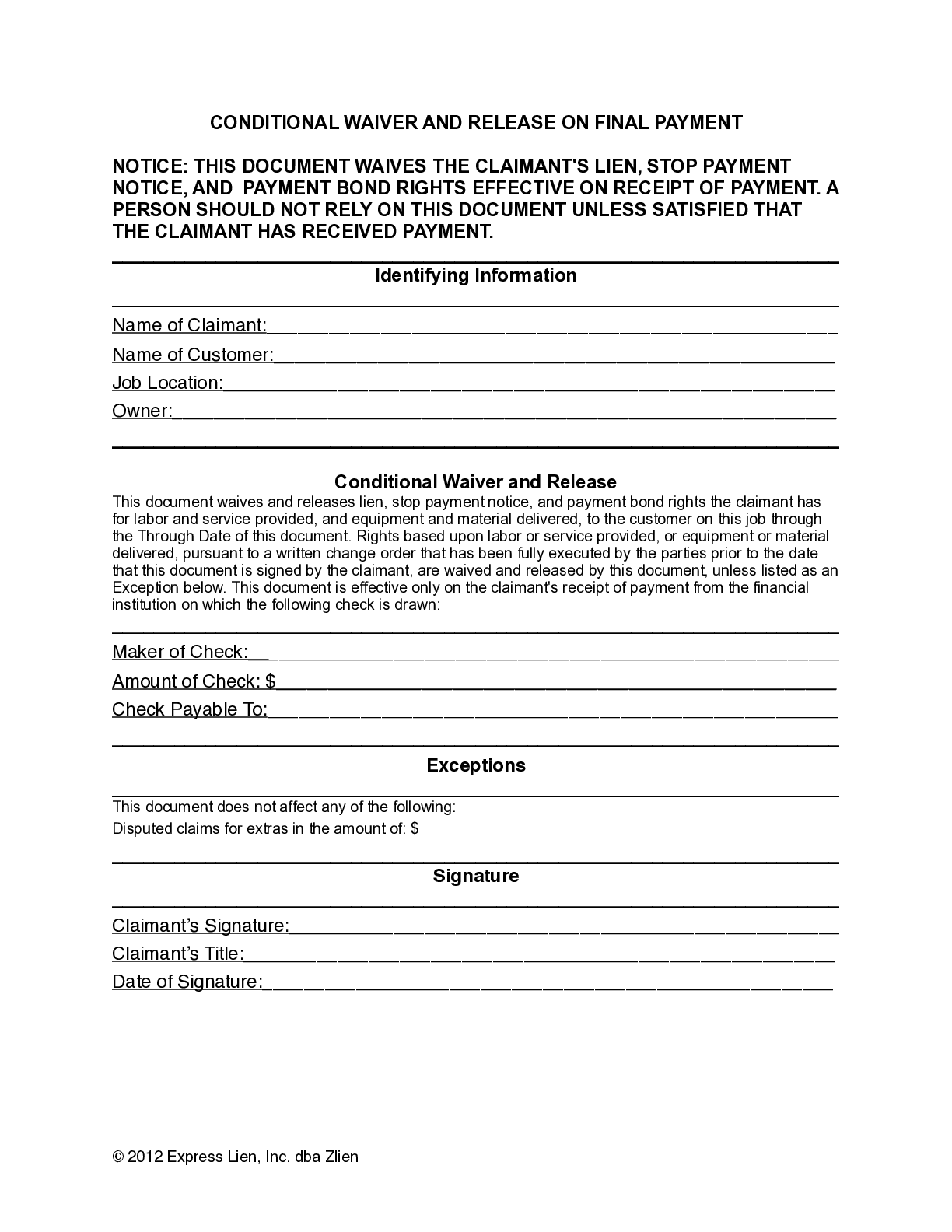

New Jersey Lien Waiver FAQs, Guide, Forms, & Resources

Cods are filed to secure tax debt and to protect the. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. A tax lien is filed against you with the clerk.

Tax Lien Sale Download Free PDF Tax Lien Taxes

In new jersey, a cod is a tax lien filed against you. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. Cods are filed to secure tax debt and to.

In New Jersey, A Cod Is A Tax Lien Filed Against You.

New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. A tax lien is filed against you with the clerk of the new jersey superior court. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. This legislation establishes requirements for publication of notice, issuance of notice to.