Nys Property Tax Relief Check 2023

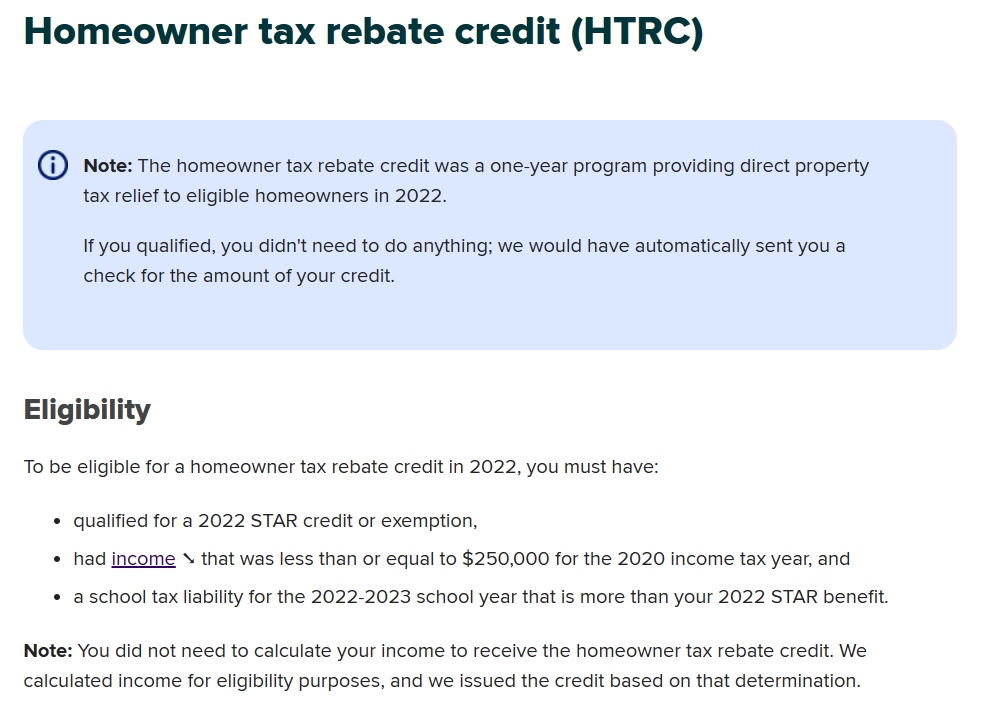

Nys Property Tax Relief Check 2023 - As a new york state. The fiscal year 2023 property tax rebate is for homeowners whose new york city property is their primary residence and whose combined. Eligible homeowners received property tax relief credits in 2017, 2018, and 2019. If you itemize your deductions, see how to report your property tax credits. Our new homeowner benefit portal is available to help you receive the property tax benefits you're eligible for! View property tax credit checks. However, by law, the program expired after.

View property tax credit checks. If you itemize your deductions, see how to report your property tax credits. Eligible homeowners received property tax relief credits in 2017, 2018, and 2019. The fiscal year 2023 property tax rebate is for homeowners whose new york city property is their primary residence and whose combined. Our new homeowner benefit portal is available to help you receive the property tax benefits you're eligible for! However, by law, the program expired after. As a new york state.

The fiscal year 2023 property tax rebate is for homeowners whose new york city property is their primary residence and whose combined. However, by law, the program expired after. View property tax credit checks. Eligible homeowners received property tax relief credits in 2017, 2018, and 2019. If you itemize your deductions, see how to report your property tax credits. Our new homeowner benefit portal is available to help you receive the property tax benefits you're eligible for! As a new york state.

Has the payment from ANCHOR property tax relief gone up?

The fiscal year 2023 property tax rebate is for homeowners whose new york city property is their primary residence and whose combined. View property tax credit checks. As a new york state. Eligible homeowners received property tax relief credits in 2017, 2018, and 2019. If you itemize your deductions, see how to report your property tax credits.

2023 Nys Property Tax Rebate Checks

Our new homeowner benefit portal is available to help you receive the property tax benefits you're eligible for! Eligible homeowners received property tax relief credits in 2017, 2018, and 2019. If you itemize your deductions, see how to report your property tax credits. The fiscal year 2023 property tax rebate is for homeowners whose new york city property is their.

Tax Relief For 2023

The fiscal year 2023 property tax rebate is for homeowners whose new york city property is their primary residence and whose combined. However, by law, the program expired after. View property tax credit checks. Our new homeowner benefit portal is available to help you receive the property tax benefits you're eligible for! As a new york state.

Tax Relief 2023

View property tax credit checks. As a new york state. Eligible homeowners received property tax relief credits in 2017, 2018, and 2019. If you itemize your deductions, see how to report your property tax credits. However, by law, the program expired after.

Personal Tax Relief Malaysia Y.A. 2023 L & Co Accountants

Our new homeowner benefit portal is available to help you receive the property tax benefits you're eligible for! Eligible homeowners received property tax relief credits in 2017, 2018, and 2019. If you itemize your deductions, see how to report your property tax credits. However, by law, the program expired after. As a new york state.

Nys Tax Relief 2024 Randa Carolyne

View property tax credit checks. Our new homeowner benefit portal is available to help you receive the property tax benefits you're eligible for! The fiscal year 2023 property tax rebate is for homeowners whose new york city property is their primary residence and whose combined. As a new york state. However, by law, the program expired after.

New York Issued 2 1 Million Property Tax Rebate Checks In Late Summer

If you itemize your deductions, see how to report your property tax credits. As a new york state. View property tax credit checks. Our new homeowner benefit portal is available to help you receive the property tax benefits you're eligible for! Eligible homeowners received property tax relief credits in 2017, 2018, and 2019.

Nys Property Tax Rebate Checks 2023 Eligibility & Application Process

As a new york state. View property tax credit checks. However, by law, the program expired after. If you itemize your deductions, see how to report your property tax credits. The fiscal year 2023 property tax rebate is for homeowners whose new york city property is their primary residence and whose combined.

NYS Property Tax Rebate 2023 Eligibility Criteria And Application

Eligible homeowners received property tax relief credits in 2017, 2018, and 2019. The fiscal year 2023 property tax rebate is for homeowners whose new york city property is their primary residence and whose combined. If you itemize your deductions, see how to report your property tax credits. As a new york state. However, by law, the program expired after.

2023 Tax Relief oh 2023 Tax Relief KLSE malaysia

However, by law, the program expired after. View property tax credit checks. The fiscal year 2023 property tax rebate is for homeowners whose new york city property is their primary residence and whose combined. If you itemize your deductions, see how to report your property tax credits. Eligible homeowners received property tax relief credits in 2017, 2018, and 2019.

Our New Homeowner Benefit Portal Is Available To Help You Receive The Property Tax Benefits You're Eligible For!

The fiscal year 2023 property tax rebate is for homeowners whose new york city property is their primary residence and whose combined. As a new york state. If you itemize your deductions, see how to report your property tax credits. Eligible homeowners received property tax relief credits in 2017, 2018, and 2019.

However, By Law, The Program Expired After.

View property tax credit checks.