Other Deductible State Or Local Tax

Other Deductible State Or Local Tax - You can only deduct state and local income taxes or state and local sales taxes on one return. For most people who itemize, the state and local income tax deduction gives them a bigger tax break. You should claim the salt. These taxes can include state and local income taxes. If you itemize deductions, you can deduct state and local taxes you paid during the year. However, the sales tax deduction may be.

If you itemize deductions, you can deduct state and local taxes you paid during the year. You can only deduct state and local income taxes or state and local sales taxes on one return. You should claim the salt. However, the sales tax deduction may be. These taxes can include state and local income taxes. For most people who itemize, the state and local income tax deduction gives them a bigger tax break.

You should claim the salt. You can only deduct state and local income taxes or state and local sales taxes on one return. However, the sales tax deduction may be. These taxes can include state and local income taxes. If you itemize deductions, you can deduct state and local taxes you paid during the year. For most people who itemize, the state and local income tax deduction gives them a bigger tax break.

T210286 Increase Limit on Deductible State and Local Taxes (SALT) to

These taxes can include state and local income taxes. However, the sales tax deduction may be. You should claim the salt. For most people who itemize, the state and local income tax deduction gives them a bigger tax break. If you itemize deductions, you can deduct state and local taxes you paid during the year.

State & Local Tax Toolkit Sources of Tax Collections Tax Foundation

However, the sales tax deduction may be. You should claim the salt. If you itemize deductions, you can deduct state and local taxes you paid during the year. For most people who itemize, the state and local income tax deduction gives them a bigger tax break. These taxes can include state and local income taxes.

T210251 Increase Limit on Deductible State and Local Taxes (SALT) to

You can only deduct state and local income taxes or state and local sales taxes on one return. You should claim the salt. For most people who itemize, the state and local income tax deduction gives them a bigger tax break. However, the sales tax deduction may be. These taxes can include state and local income taxes.

TaxDeductible Contributions 2024

For most people who itemize, the state and local income tax deduction gives them a bigger tax break. However, the sales tax deduction may be. You can only deduct state and local income taxes or state and local sales taxes on one return. If you itemize deductions, you can deduct state and local taxes you paid during the year. You.

T210279 Increase Limit on Deductible State and Local Taxes (SALT) to

If you itemize deductions, you can deduct state and local taxes you paid during the year. However, the sales tax deduction may be. You should claim the salt. For most people who itemize, the state and local income tax deduction gives them a bigger tax break. You can only deduct state and local income taxes or state and local sales.

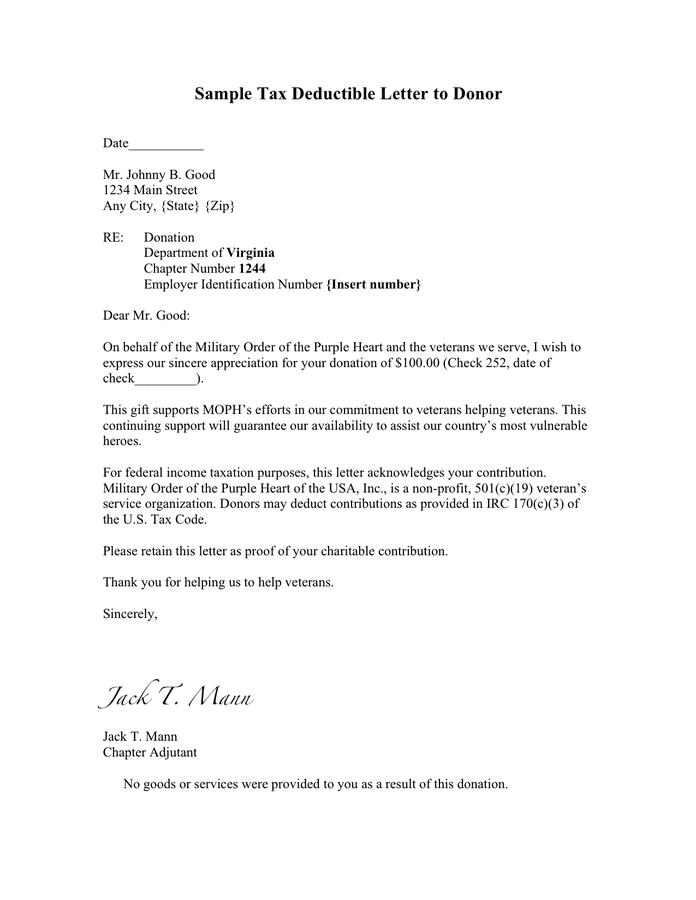

Sample tax deductible letter to donor in Word and Pdf formats

If you itemize deductions, you can deduct state and local taxes you paid during the year. For most people who itemize, the state and local income tax deduction gives them a bigger tax break. You should claim the salt. However, the sales tax deduction may be. These taxes can include state and local income taxes.

Tax Deductible Donations

You should claim the salt. You can only deduct state and local income taxes or state and local sales taxes on one return. For most people who itemize, the state and local income tax deduction gives them a bigger tax break. If you itemize deductions, you can deduct state and local taxes you paid during the year. These taxes can.

accounting services tax deductible Goodly Portal Fonction

If you itemize deductions, you can deduct state and local taxes you paid during the year. For most people who itemize, the state and local income tax deduction gives them a bigger tax break. You can only deduct state and local income taxes or state and local sales taxes on one return. However, the sales tax deduction may be. You.

T170339 Repeal 10,000 Limit on Deductible State and Local Taxes

These taxes can include state and local income taxes. You should claim the salt. If you itemize deductions, you can deduct state and local taxes you paid during the year. You can only deduct state and local income taxes or state and local sales taxes on one return. However, the sales tax deduction may be.

Is Your Car Registration Tax Deductible? Car Tax Tips Sticker

These taxes can include state and local income taxes. If you itemize deductions, you can deduct state and local taxes you paid during the year. You can only deduct state and local income taxes or state and local sales taxes on one return. You should claim the salt. For most people who itemize, the state and local income tax deduction.

You Should Claim The Salt.

If you itemize deductions, you can deduct state and local taxes you paid during the year. However, the sales tax deduction may be. These taxes can include state and local income taxes. For most people who itemize, the state and local income tax deduction gives them a bigger tax break.