Pa Local Earned Income Tax Instructions

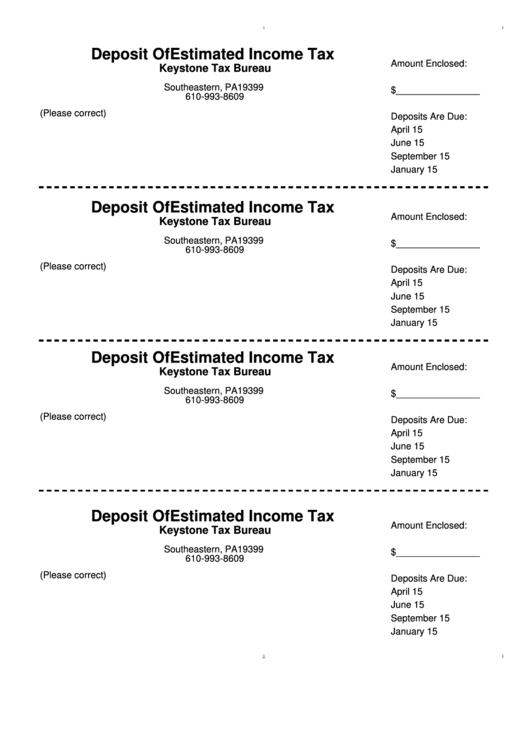

Pa Local Earned Income Tax Instructions - Employers with worksites located in pennsylvania are required to withhold and remit the local. File a local earned income tax return for each taxing jurisdiction. Download and print the taxpayer annual local earned income tax return form for tax year 2023. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Ave employer withholding or are not expecting a. Ofits must file a local earned income tax return online or by mail by april 15, 2021. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Fill out the form with your personal and income. Local income tax requirements for employers. January 1 through december 31, unless otherwise noted.

Fill out the form with your personal and income. Ave employer withholding or are not expecting a. Employers with worksites located in pennsylvania are required to withhold and remit the local. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Download and print the taxpayer annual local earned income tax return form for tax year 2023. Ofits must file a local earned income tax return online or by mail by april 15, 2021. January 1 through december 31, unless otherwise noted. File a local earned income tax return for each taxing jurisdiction. Local income tax requirements for employers.

Remit to the local earned income tax collector for every tax collection district in which you lived during the year. January 1 through december 31, unless otherwise noted. Ave employer withholding or are not expecting a. Fill out the form with your personal and income. Local income tax requirements for employers. Ofits must file a local earned income tax return online or by mail by april 15, 2021. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. File a local earned income tax return for each taxing jurisdiction. Employers with worksites located in pennsylvania are required to withhold and remit the local. Download and print the taxpayer annual local earned income tax return form for tax year 2023.

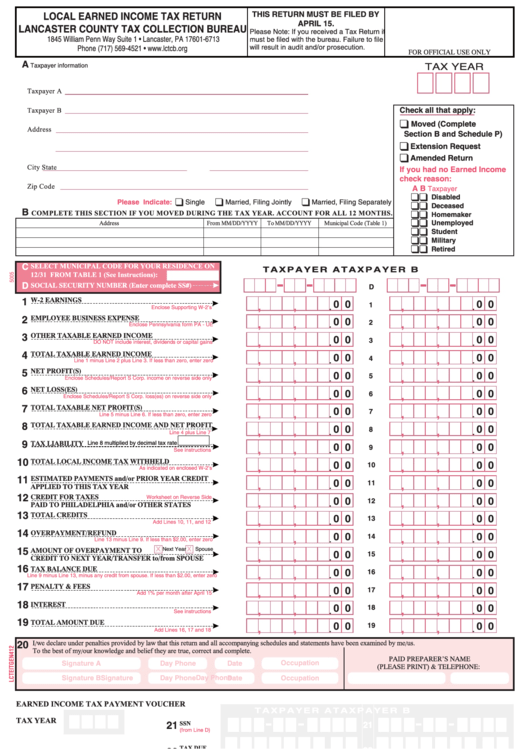

Local Earned Tax Return Form Lancaster County 2005 Printable

Fill out the form with your personal and income. Download and print the taxpayer annual local earned income tax return form for tax year 2023. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Local income tax requirements for employers. Ave employer withholding or are not expecting a.

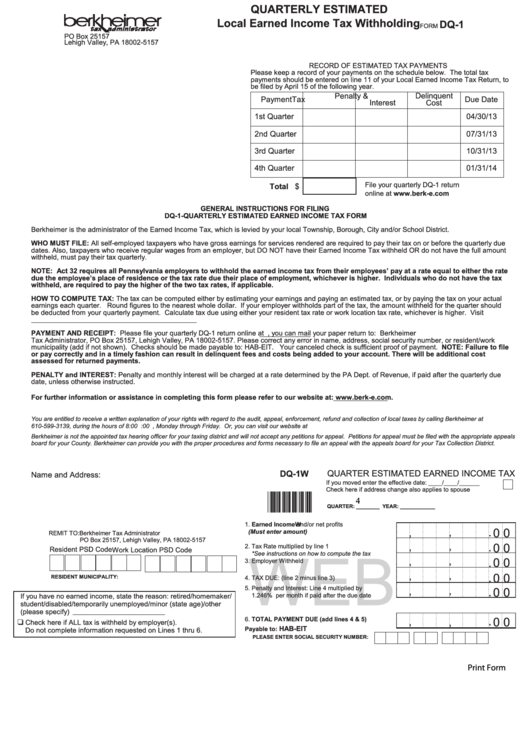

Local Pa Resident Tax Withholding Form

Download and print the taxpayer annual local earned income tax return form for tax year 2023. Ave employer withholding or are not expecting a. Local income tax requirements for employers. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Remit to the local earned income tax collector for every.

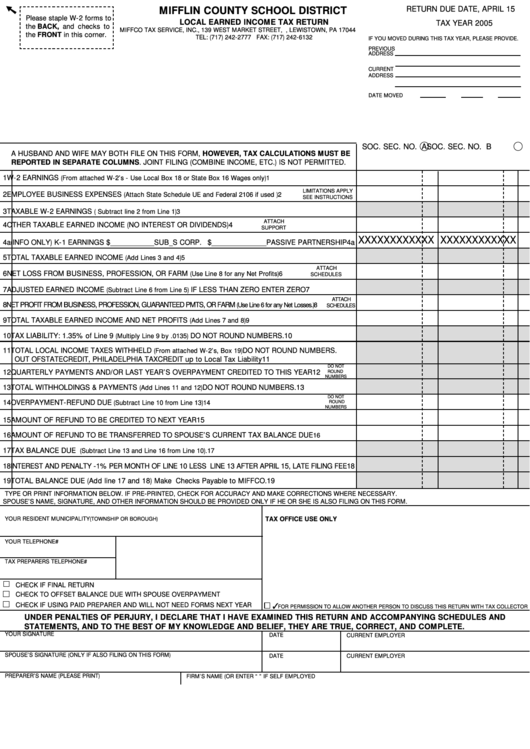

Local Earned Tax Return Form 2005 printable pdf download

Fill out the form with your personal and income. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Ofits must file a local earned income tax return online or by mail by april 15, 2021. Download and print the taxpayer annual local earned income tax return form for tax.

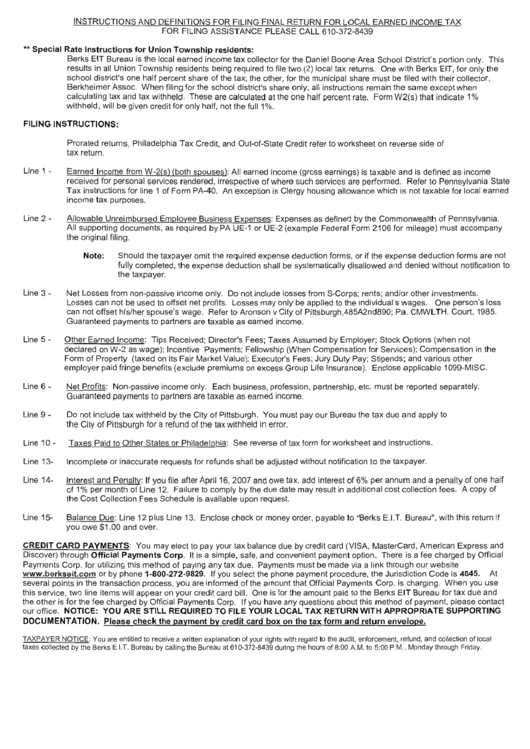

Instructions And Definitions For Filing Final Return Of Local Earned

January 1 through december 31, unless otherwise noted. Fill out the form with your personal and income. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Ofits must file a local earned income tax return online or by mail by april 15, 2021. File a local earned income tax.

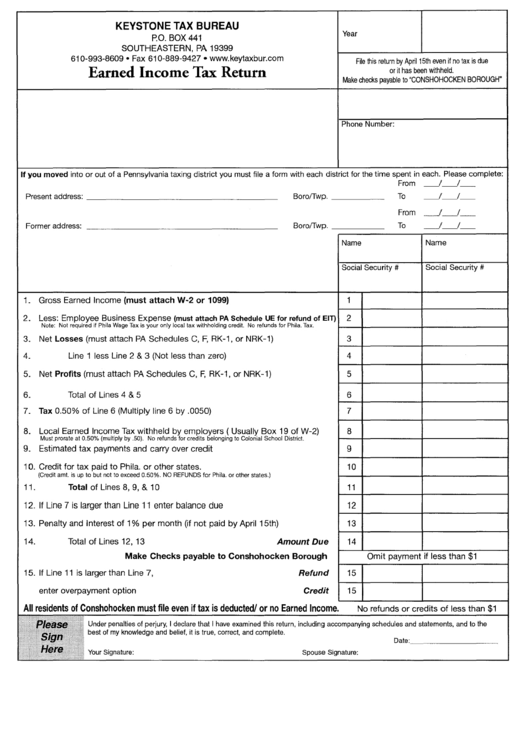

Earned Tax Return Form Pennsylvania printable pdf download

Fill out the form with your personal and income. Employers with worksites located in pennsylvania are required to withhold and remit the local. Ofits must file a local earned income tax return online or by mail by april 15, 2021. Remit to the local earned income tax collector for every tax collection district in which you lived during the year..

Earned Tax Return Form Pennsylvania printable pdf download

Ofits must file a local earned income tax return online or by mail by april 15, 2021. Local income tax requirements for employers. January 1 through december 31, unless otherwise noted. Ave employer withholding or are not expecting a. Remit to the local earned income tax collector for every tax collection district in which you lived during the year.

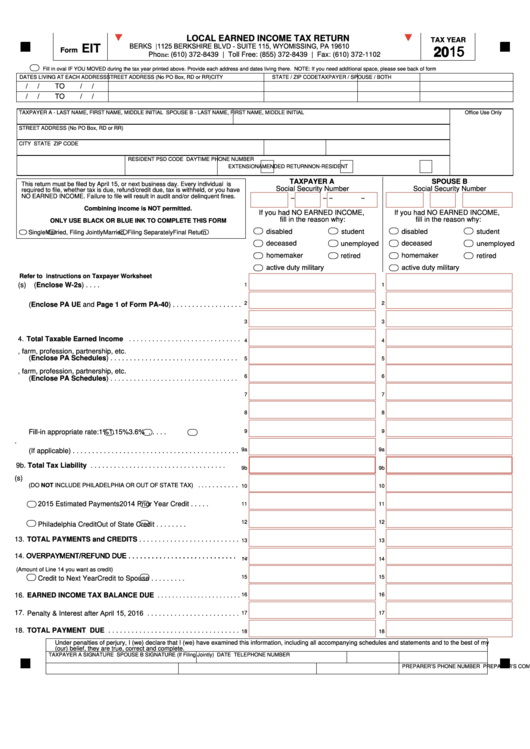

Fillable Local Earned Tax Return Pa Eit 2015 printable pdf download

Fill out the form with your personal and income. Ofits must file a local earned income tax return online or by mail by april 15, 2021. Employers with worksites located in pennsylvania are required to withhold and remit the local. Remit to the local earned income tax collector for every tax collection district in which you lived during the year..

Pennsylvania Local Earned Tax Withholding Form

File a local earned income tax return for each taxing jurisdiction. Ofits must file a local earned income tax return online or by mail by april 15, 2021. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Ave employer withholding or are not expecting a. Local income tax requirements.

Cumberland County Pa Local Earned Tax Return

Download and print the taxpayer annual local earned income tax return form for tax year 2023. Fill out the form with your personal and income. Employers with worksites located in pennsylvania are required to withhold and remit the local. Local income tax requirements for employers. File a local earned income tax return for each taxing jurisdiction.

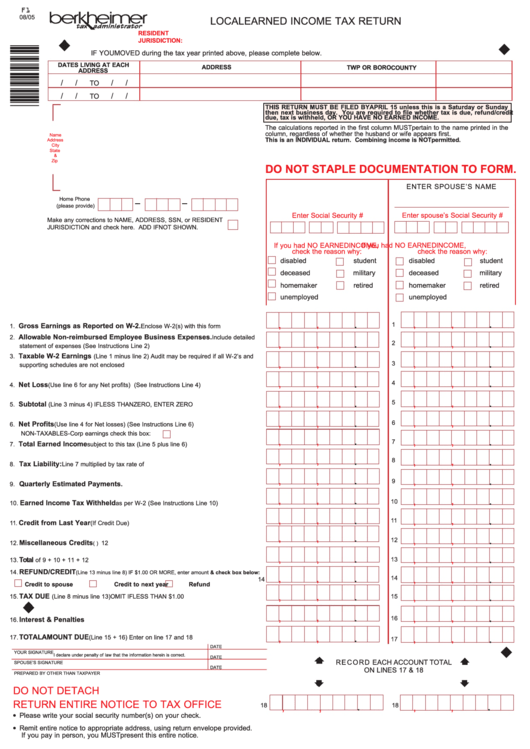

Form F1 Local Earned Tax Return Pennsylvania printable pdf

Ofits must file a local earned income tax return online or by mail by april 15, 2021. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Employers with worksites located in pennsylvania are required to withhold and remit the local. Download and print the taxpayer annual local earned income.

Ave Employer Withholding Or Are Not Expecting A.

Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Ofits must file a local earned income tax return online or by mail by april 15, 2021. Employers with worksites located in pennsylvania are required to withhold and remit the local. Download and print the taxpayer annual local earned income tax return form for tax year 2023.

Remit To The Local Earned Income Tax Collector For Every Tax Collection District In Which You Lived During The Year.

Fill out the form with your personal and income. File a local earned income tax return for each taxing jurisdiction. January 1 through december 31, unless otherwise noted. Local income tax requirements for employers.