Sales Tax Definition Math

Sales Tax Definition Math - It is based on a certain percent of the price. A sales tax is a tax that is paid for the sale of certain goods and services. The sales tax is the sum of money a buyer pays over and above the price of a commodity to buy it. The rates of tax on purchase of different. Sales tax, value added tax, goods and services tax are the types of taxes imposed by the government on the products and services for. In the united states, different states have different sales tax rates,. Sales tax is a consumption tax imposed by governments on the sale of goods and services. Sales tax is a tax on goods and services purchased and is normally a certain percentage added to the buyer’s cost. The formula to calculate the sales. A tax charged by the government to raise money so it can provide public services.

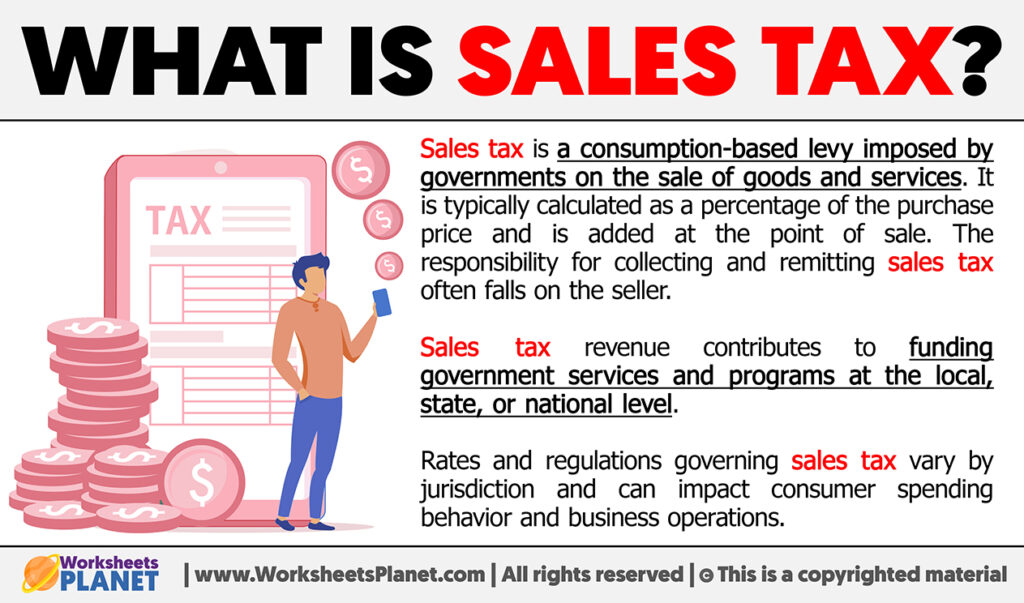

Sales tax is a percentage added to the actual price of a product charged during the time of the transaction. Sales tax is a consumption tax imposed by governments on the sale of goods and services. A tax charged by the government to raise money so it can provide public services. Sales tax is a tax on goods and services purchased and is normally a certain percentage added to the buyer’s cost. It is typically calculated as a percentage of the. It is based on a certain percent of the price. The rates of tax on purchase of different. Sales tax, value added tax, goods and services tax are the types of taxes imposed by the government on the products and services for. A sales tax is a tax that is paid for the sale of certain goods and services. In the united states, different states have different sales tax rates,.

It is based on a certain percent of the price. The sales tax is the sum of money a buyer pays over and above the price of a commodity to buy it. A tax charged by the government to raise money so it can provide public services. It is typically calculated as a percentage of the. Sales tax, value added tax, goods and services tax are the types of taxes imposed by the government on the products and services for. Sales tax is a tax on goods and services purchased and is normally a certain percentage added to the buyer’s cost. Sales tax is a percentage added to the actual price of a product charged during the time of the transaction. In the united states, different states have different sales tax rates,. The formula to calculate the sales. The rates of tax on purchase of different.

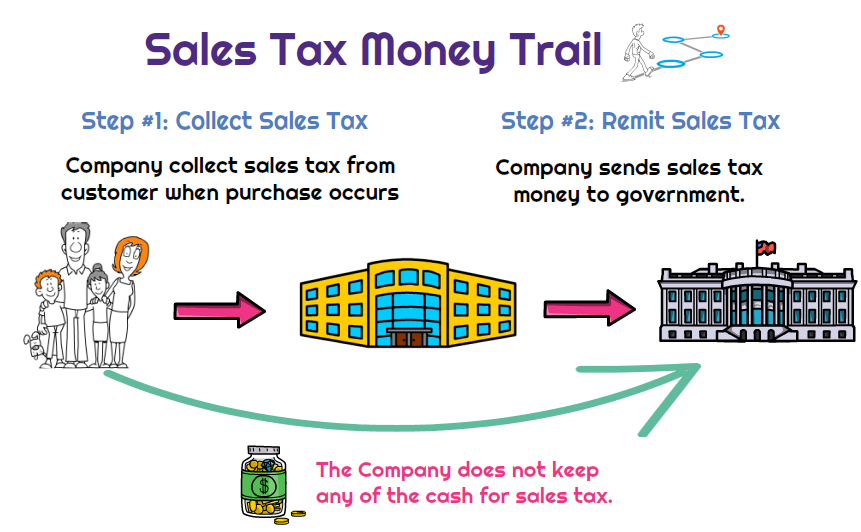

Why is sales tax considered pass through for a company? Universal CPA

Sales tax, value added tax, goods and services tax are the types of taxes imposed by the government on the products and services for. The formula to calculate the sales. The rates of tax on purchase of different. A sales tax is a tax that is paid for the sale of certain goods and services. In the united states, different.

How To Calculate Percentage Vat Haiper

A tax charged by the government to raise money so it can provide public services. Sales tax, value added tax, goods and services tax are the types of taxes imposed by the government on the products and services for. A sales tax is a tax that is paid for the sale of certain goods and services. The sales tax is.

How to Calculate Sales Tax? The Complete Guide ProPakistani

It is typically calculated as a percentage of the. In the united states, different states have different sales tax rates,. Sales tax is a consumption tax imposed by governments on the sale of goods and services. It is based on a certain percent of the price. The sales tax is the sum of money a buyer pays over and above.

4 Tips on Amended Sales Tax Returns CPA Practice Advisor

A tax charged by the government to raise money so it can provide public services. Sales tax, value added tax, goods and services tax are the types of taxes imposed by the government on the products and services for. In the united states, different states have different sales tax rates,. Sales tax is a tax on goods and services purchased.

4 Ways to Calculate Sales Tax wikiHow Sales tax, Tax, Sales and

The sales tax is the sum of money a buyer pays over and above the price of a commodity to buy it. It is based on a certain percent of the price. Sales tax is a consumption tax imposed by governments on the sale of goods and services. The formula to calculate the sales. The rates of tax on purchase.

sales tax A Maths Dictionary for Kids Quick Reference by Jenny Eather

Sales tax is a percentage added to the actual price of a product charged during the time of the transaction. It is based on a certain percent of the price. The sales tax is the sum of money a buyer pays over and above the price of a commodity to buy it. A sales tax is a tax that is.

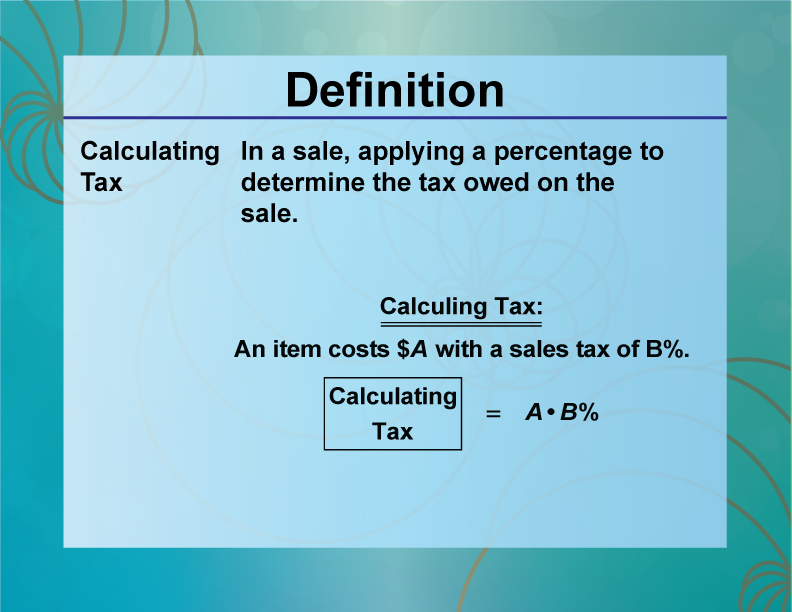

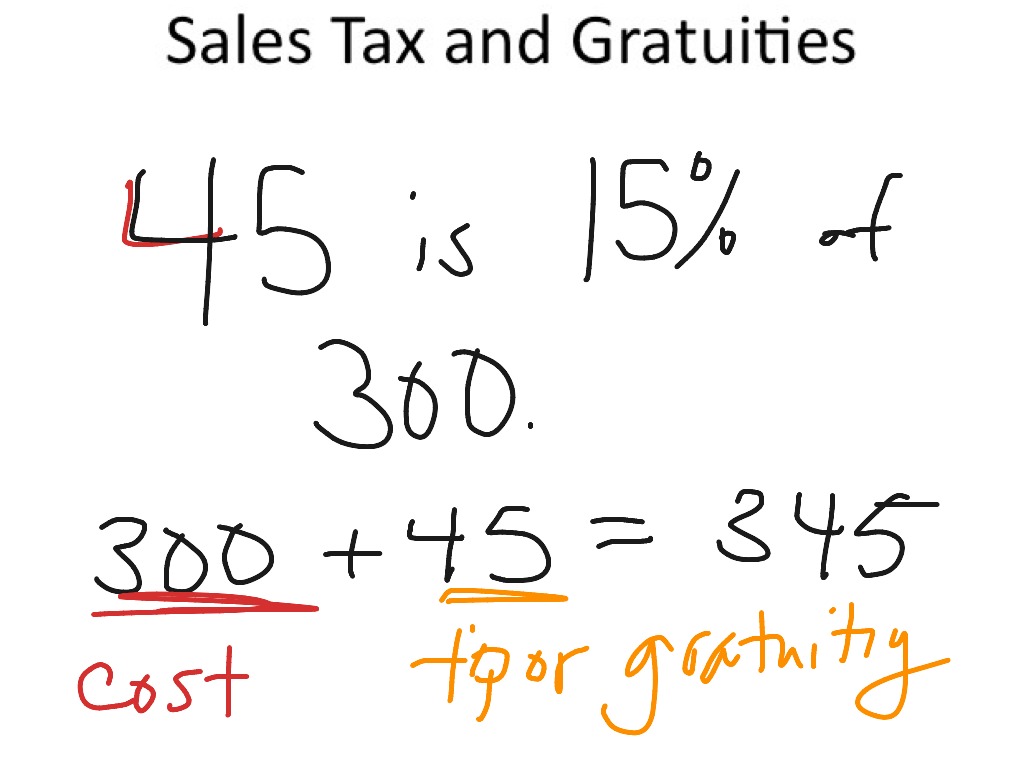

DefinitionRatios, Proportions, and Percents ConceptsCalculating Tax

It is based on a certain percent of the price. The sales tax is the sum of money a buyer pays over and above the price of a commodity to buy it. In the united states, different states have different sales tax rates,. The formula to calculate the sales. Sales tax, value added tax, goods and services tax are the.

Sales Tax Presentation

Sales tax is a percentage added to the actual price of a product charged during the time of the transaction. The sales tax is the sum of money a buyer pays over and above the price of a commodity to buy it. It is based on a certain percent of the price. The formula to calculate the sales. Sales tax.

Sales Tax and Gratuities Math ShowMe

In the united states, different states have different sales tax rates,. It is typically calculated as a percentage of the. The formula to calculate the sales. Sales tax is a tax on goods and services purchased and is normally a certain percentage added to the buyer’s cost. A sales tax is a tax that is paid for the sale of.

What is Sales Tax?

It is based on a certain percent of the price. In the united states, different states have different sales tax rates,. Sales tax is a consumption tax imposed by governments on the sale of goods and services. The rates of tax on purchase of different. Sales tax, value added tax, goods and services tax are the types of taxes imposed.

A Sales Tax Is A Tax That Is Paid For The Sale Of Certain Goods And Services.

It is typically calculated as a percentage of the. Sales tax is a tax on goods and services purchased and is normally a certain percentage added to the buyer’s cost. Sales tax, value added tax, goods and services tax are the types of taxes imposed by the government on the products and services for. It is based on a certain percent of the price.

The Sales Tax Is The Sum Of Money A Buyer Pays Over And Above The Price Of A Commodity To Buy It.

The formula to calculate the sales. The rates of tax on purchase of different. Sales tax is a consumption tax imposed by governments on the sale of goods and services. A tax charged by the government to raise money so it can provide public services.

In The United States, Different States Have Different Sales Tax Rates,.

Sales tax is a percentage added to the actual price of a product charged during the time of the transaction.