Seattle Wa Local Sales Tax Rate

Seattle Wa Local Sales Tax Rate - 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Washington has a 6.5% sales tax and king county collects an additional n/a, so the minimum sales tax rate in king county is 6.5% (not including. You’ll find rates for sales and use tax, motor. There is no applicable county tax or. The seattle sales tax rate is 3.85%. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Look up the current rate for a specific address using the same geolocation technology that powers the avalara. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax.

Look up the current rate for a specific address using the same geolocation technology that powers the avalara. There is no applicable county tax or. The seattle sales tax rate is 3.85%. Washington has a 6.5% sales tax and king county collects an additional n/a, so the minimum sales tax rate in king county is 6.5% (not including. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. You’ll find rates for sales and use tax, motor. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Use our tax rate lookup tool to find tax rates and location codes for any location in washington.

Washington has a 6.5% sales tax and king county collects an additional n/a, so the minimum sales tax rate in king county is 6.5% (not including. You’ll find rates for sales and use tax, motor. Look up the current rate for a specific address using the same geolocation technology that powers the avalara. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. There is no applicable county tax or. The seattle sales tax rate is 3.85%. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax.

Ultimate Maine Sales Tax Guide Zamp

536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Washington has a 6.5% sales tax and king county collects an additional n/a, so the minimum sales tax rate in king county is 6.5% (not including. Look up the current rate for a specific address using.

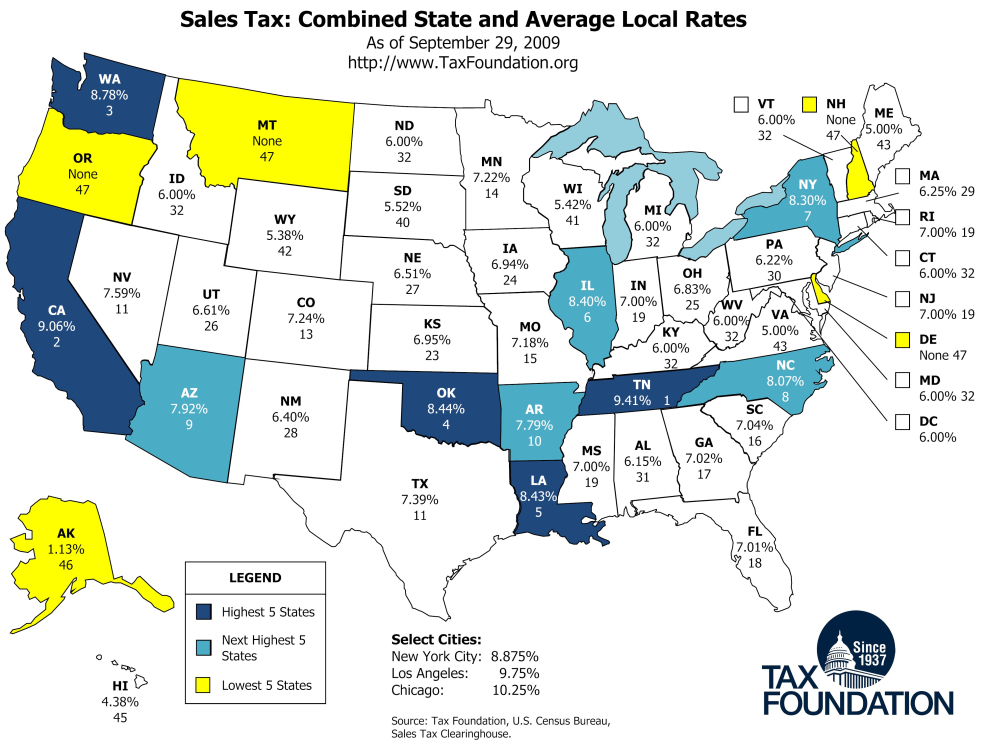

State & Local Sales Tax Rates 2023 Sales Tax Rates American Legal

536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. The seattle sales tax rate is 3.85%. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. There is no applicable county tax.

Seattle Washington State Sales Tax Rate 2023

The seattle sales tax rate is 3.85%. Washington has a 6.5% sales tax and king county collects an additional n/a, so the minimum sales tax rate in king county is 6.5% (not including. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Lists of local.

Seattle Sales Tax Rate Changes

The seattle sales tax rate is 3.85%. There is no applicable county tax or. You’ll find rates for sales and use tax, motor. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. 536 rows washington has state sales tax of 6.5%, and allows local governments to.

Sales Tax In Seattle Washington 2024 Mufi Tabina

Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. There is no applicable county tax or. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. The seattle sales tax rate is 3.85%. 536 rows washington has state.

Kirkland Wa Sales Tax Rate 2024 Maria Scarlet

There is no applicable county tax or. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. The seattle sales tax rate is 3.85%. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. Washington has a 6.5% sales.

Washington has nation's 4th highest statelocal sales tax rate

There is no applicable county tax or. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. The seattle sales tax rate is 3.85%. Look up the current rate.

WA state / Seattle area owners 11.8 sales tax look right? Rivian

Look up the current rate for a specific address using the same geolocation technology that powers the avalara. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. There is no applicable county tax or. The seattle sales tax rate is 3.85%. Use our tax rate lookup tool to find tax rates.

Louisiana has nation’s highest combined state and local sales tax rate

Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. You’ll.

Seattle tax passes first hurdle

The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Washington has a 6.5% sales tax and king county collects an additional n/a, so the minimum sales tax rate.

The 10.35% Sales Tax Rate In Seattle Consists Of 6.5% Washington State Sales Tax And 3.85% Seattle Tax.

536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. The seattle sales tax rate is 3.85%. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Washington has a 6.5% sales tax and king county collects an additional n/a, so the minimum sales tax rate in king county is 6.5% (not including.

There Is No Applicable County Tax Or.

You’ll find rates for sales and use tax, motor. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Look up the current rate for a specific address using the same geolocation technology that powers the avalara.