Ss Withholding Form

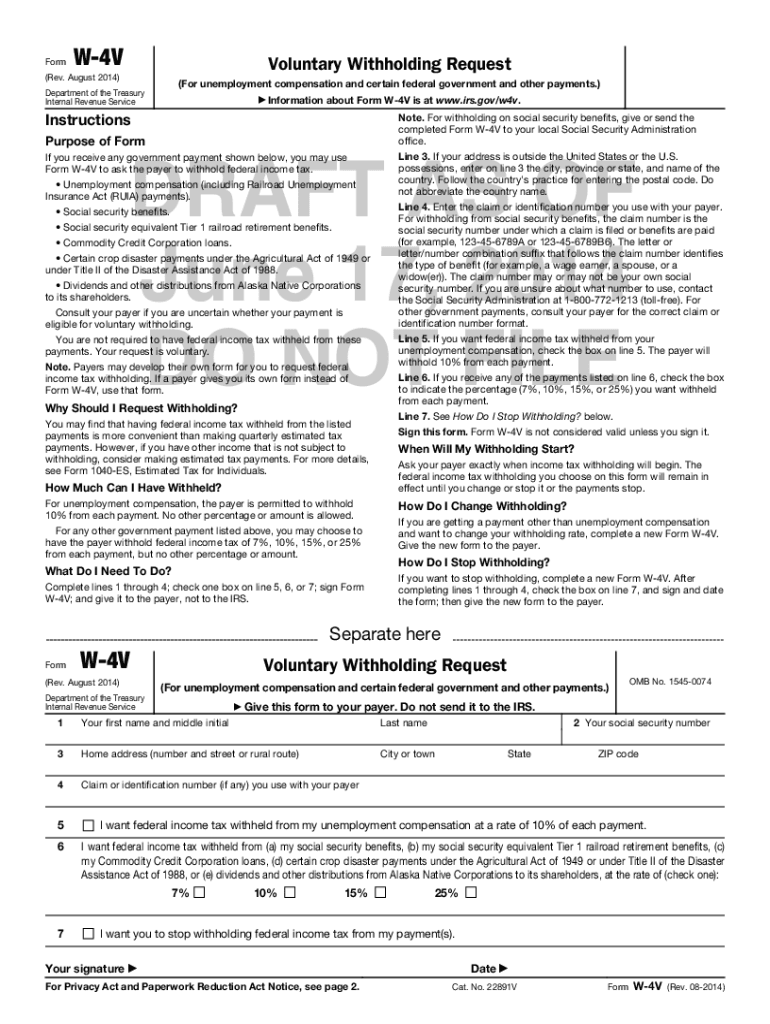

Ss Withholding Form - Not all forms are listed. If you’re already getting benefits and then later decide to start withholding, you’ll need to fill out a voluntary withholding request,. If you can't find the form you need, or you need help completing a form, please call us at 1. You can ask us to withhold federal taxes from your social security benefit payment when you first apply. If you are already receiving benefits. 203 rows all forms are free. Tell the representative you want to withhold taxes from your social security benefit. If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes.

If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. If you’re already getting benefits and then later decide to start withholding, you’ll need to fill out a voluntary withholding request,. If you are already receiving benefits. Not all forms are listed. If you can't find the form you need, or you need help completing a form, please call us at 1. 203 rows all forms are free. You can ask us to withhold federal taxes from your social security benefit payment when you first apply. Tell the representative you want to withhold taxes from your social security benefit.

If you are already receiving benefits. Tell the representative you want to withhold taxes from your social security benefit. If you’re already getting benefits and then later decide to start withholding, you’ll need to fill out a voluntary withholding request,. If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. You can ask us to withhold federal taxes from your social security benefit payment when you first apply. 203 rows all forms are free. Not all forms are listed. If you can't find the form you need, or you need help completing a form, please call us at 1.

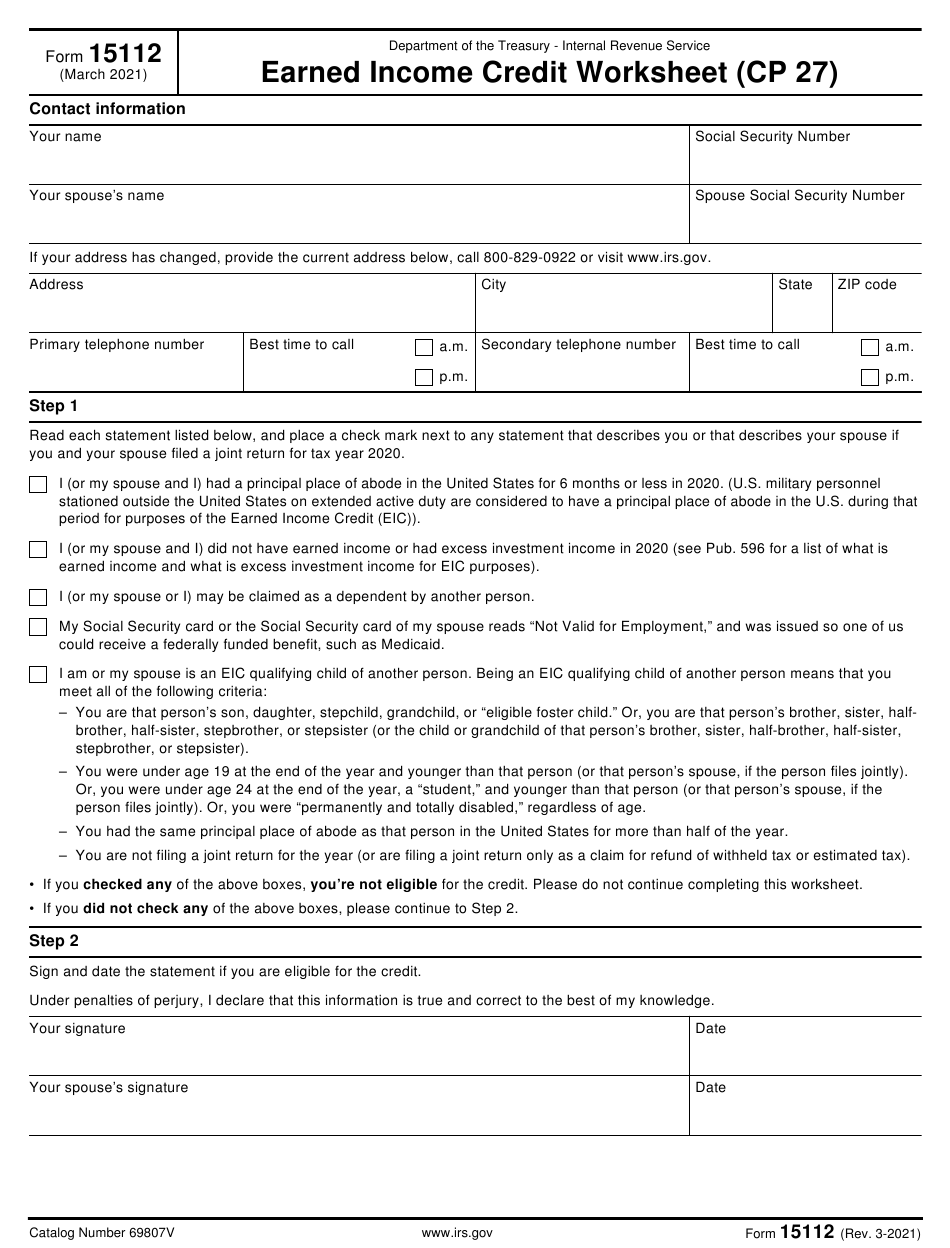

Form SS8 Determination of Worker Status of Federal Employment Taxes

If you are already receiving benefits. Tell the representative you want to withhold taxes from your social security benefit. If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. If you’re already getting benefits and then later decide to start withholding, you’ll need to fill out.

WorldWarCollectibles Postcard with Signature of WaffenSS KC

203 rows all forms are free. If you’re already getting benefits and then later decide to start withholding, you’ll need to fill out a voluntary withholding request,. If you can't find the form you need, or you need help completing a form, please call us at 1. If you get social security, you can ask us to withhold funds from.

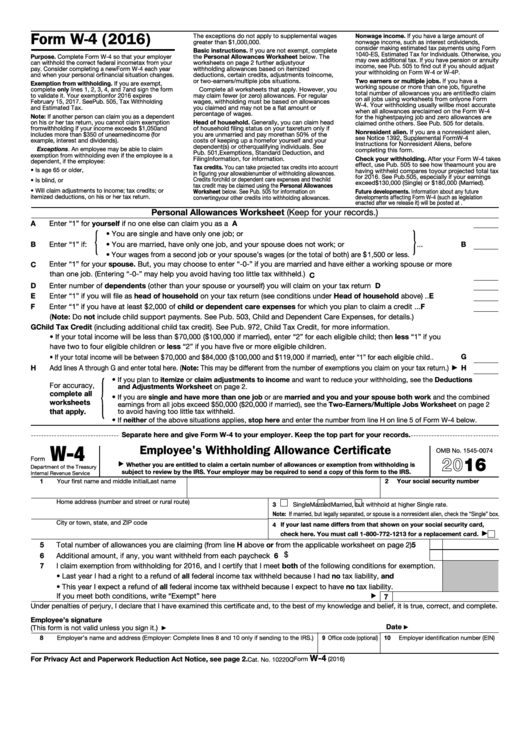

Massachusetts Tax Withholding Forms

Tell the representative you want to withhold taxes from your social security benefit. You can ask us to withhold federal taxes from your social security benefit payment when you first apply. Not all forms are listed. If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes..

North Carolina State Withholding Form Nc4 Ez

203 rows all forms are free. If you can't find the form you need, or you need help completing a form, please call us at 1. Not all forms are listed. You can ask us to withhold federal taxes from your social security benefit payment when you first apply. If you get social security, you can ask us to withhold.

Foreign Tax Withholding Form

Not all forms are listed. If you can't find the form you need, or you need help completing a form, please call us at 1. If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. If you’re already getting benefits and then later decide to start.

Akron Ohio Withholding Tax Forms

If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. Tell the representative you want to withhold taxes from your social security benefit. If you’re already getting benefits and then later decide to start withholding, you’ll need to fill out a voluntary withholding request,. You can.

Social Security Tax Withholding Forms

If you’re already getting benefits and then later decide to start withholding, you’ll need to fill out a voluntary withholding request,. If you are already receiving benefits. Tell the representative you want to withhold taxes from your social security benefit. You can ask us to withhold federal taxes from your social security benefit payment when you first apply. If you.

Form SS8 Determination of Worker Status of Federal Employment Taxes

If you can't find the form you need, or you need help completing a form, please call us at 1. 203 rows all forms are free. Not all forms are listed. You can ask us to withhold federal taxes from your social security benefit payment when you first apply. Tell the representative you want to withhold taxes from your social.

Social Security Tax Withholding Form 2022

If you are already receiving benefits. Not all forms are listed. Tell the representative you want to withhold taxes from your social security benefit. If you can't find the form you need, or you need help completing a form, please call us at 1. You can ask us to withhold federal taxes from your social security benefit payment when you.

W4V Voluntary Tax Withholding form Social Security YouTube

If you are already receiving benefits. If you’re already getting benefits and then later decide to start withholding, you’ll need to fill out a voluntary withholding request,. You can ask us to withhold federal taxes from your social security benefit payment when you first apply. 203 rows all forms are free. Tell the representative you want to withhold taxes from.

If You’re Already Getting Benefits And Then Later Decide To Start Withholding, You’ll Need To Fill Out A Voluntary Withholding Request,.

If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. 203 rows all forms are free. If you are already receiving benefits. Not all forms are listed.

If You Can't Find The Form You Need, Or You Need Help Completing A Form, Please Call Us At 1.

You can ask us to withhold federal taxes from your social security benefit payment when you first apply. Tell the representative you want to withhold taxes from your social security benefit.