State Of Arizona Tax Liens

State Of Arizona Tax Liens - Make an online payment at aztaxes.gov. In arizona, a tax lien is automatically placed on real or personal property when taxes are levied, as outlined in state. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. Redeemed liens have been paid off by their owners. Also known as a state cp, assignments are unsold tax liens that are struck to the state of arizona, and available for purchase by bidders through. 29 rows state liens have been auctioned at each tax sale, but did not sell. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to. You may be eligible if you owe more tax than you can pay. Individual income tax filing season in the state provides potential benefits for arizonans whose income level is below minimum threshold. Find out how an arizona tax lien sale works and how to save your home if your arizona property taxes are delinquent.

Find out how an arizona tax lien sale works and how to save your home if your arizona property taxes are delinquent. 29 rows state liens have been auctioned at each tax sale, but did not sell. You may be eligible if you owe more tax than you can pay. Make an online payment at aztaxes.gov. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. Redeemed liens have been paid off by their owners. Also known as a state cp, assignments are unsold tax liens that are struck to the state of arizona, and available for purchase by bidders through. In arizona, a tax lien is automatically placed on real or personal property when taxes are levied, as outlined in state. Request a monthly installment plan.

Request a monthly installment plan. Also known as a state cp, assignments are unsold tax liens that are struck to the state of arizona, and available for purchase by bidders through. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to. Make an online payment at aztaxes.gov. In arizona, a tax lien is automatically placed on real or personal property when taxes are levied, as outlined in state. You may be eligible if you owe more tax than you can pay. Find out how an arizona tax lien sale works and how to save your home if your arizona property taxes are delinquent. 29 rows state liens have been auctioned at each tax sale, but did not sell. Individual income tax filing season in the state provides potential benefits for arizonans whose income level is below minimum threshold. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government.

Tax liens arizona Fill out & sign online DocHub

Redeemed liens have been paid off by their owners. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. Make an online payment at aztaxes.gov. Also known as a state cp, assignments are unsold tax liens that are struck to the state of arizona, and available for purchase by bidders through..

Arizona Tax Liens Primer Foreclosure Tax Lien

Request a monthly installment plan. Individual income tax filing season in the state provides potential benefits for arizonans whose income level is below minimum threshold. In arizona, a tax lien is automatically placed on real or personal property when taxes are levied, as outlined in state. Tax liens are a “hold” against your member’s property, superior to all liens except.

37+ Arizona State Tax Calculator MegganDeniz

Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. Redeemed liens have been paid off by their owners. Also known as a state cp, assignments are unsold tax liens that are struck to the state of arizona, and available for purchase by bidders through. Make an online payment at aztaxes.gov..

Investing In Tax Liens Alts.co

Individual income tax filing season in the state provides potential benefits for arizonans whose income level is below minimum threshold. Request a monthly installment plan. You may be eligible if you owe more tax than you can pay. In arizona, a tax lien is automatically placed on real or personal property when taxes are levied, as outlined in state. Upon.

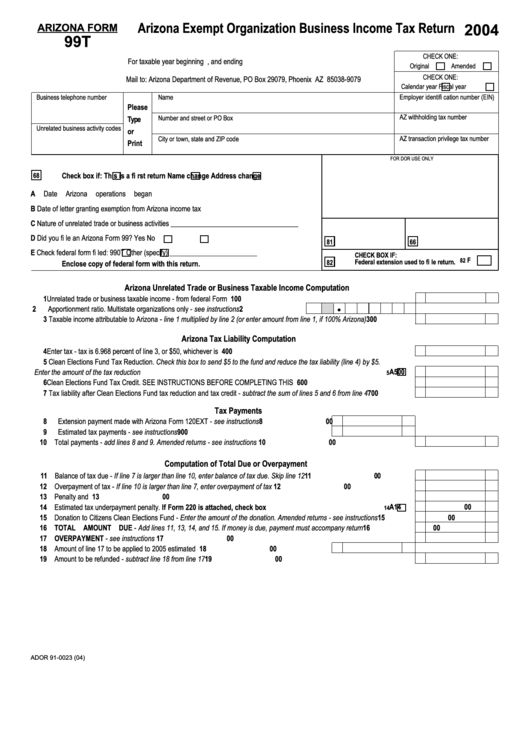

Arizona Tax Exempt Form

You may be eligible if you owe more tax than you can pay. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to. Redeemed liens have been paid off by their owners. Request a monthly installment plan. Individual income tax filing season in the state provides potential benefits for.

Arizona Tax Credit Choices Pregnancy Centers

Request a monthly installment plan. In arizona, a tax lien is automatically placed on real or personal property when taxes are levied, as outlined in state. Individual income tax filing season in the state provides potential benefits for arizonans whose income level is below minimum threshold. Make an online payment at aztaxes.gov. 29 rows state liens have been auctioned at.

96 best ideas for coloring Arizona State Tax

Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. Make an online payment at aztaxes.gov. Request a monthly installment plan. In arizona, a tax lien is automatically placed on real or personal property when taxes are levied, as outlined in state. Redeemed liens have been paid off by their owners.

Arizona Primary Election 2024 Live Results — WSJ

Find out how an arizona tax lien sale works and how to save your home if your arizona property taxes are delinquent. In arizona, a tax lien is automatically placed on real or personal property when taxes are levied, as outlined in state. Make an online payment at aztaxes.gov. 29 rows state liens have been auctioned at each tax sale,.

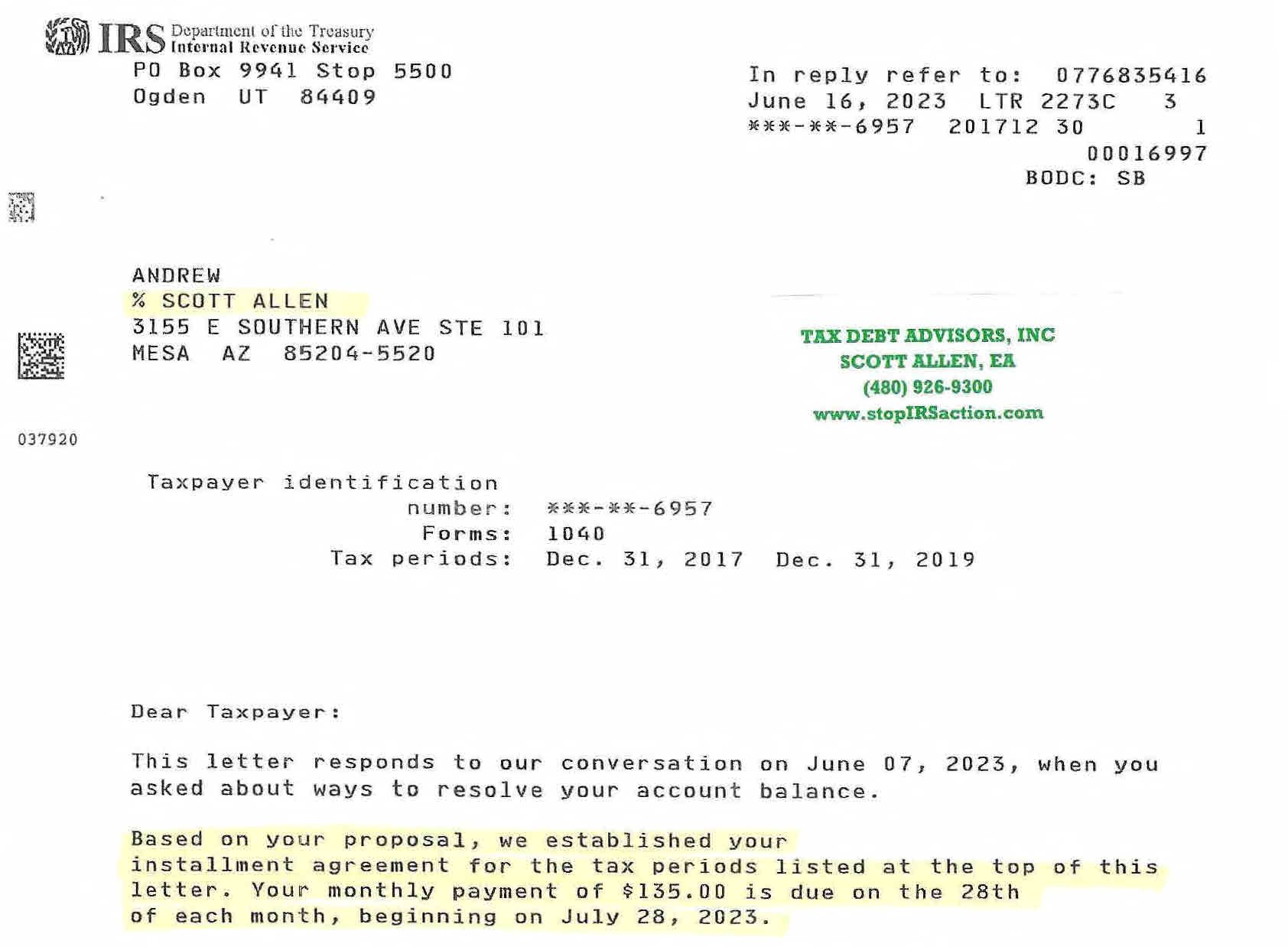

Facts about IRS tax liens for Arizona Residents IRS help from Scott

Redeemed liens have been paid off by their owners. Request a monthly installment plan. Find out how an arizona tax lien sale works and how to save your home if your arizona property taxes are delinquent. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. In arizona, a tax lien.

Learn About 1031 Exchange Rules for Arizona to Pay Less Tax

Also known as a state cp, assignments are unsold tax liens that are struck to the state of arizona, and available for purchase by bidders through. 29 rows state liens have been auctioned at each tax sale, but did not sell. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government..

Redeemed Liens Have Been Paid Off By Their Owners.

Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to. 29 rows state liens have been auctioned at each tax sale, but did not sell. Find out how an arizona tax lien sale works and how to save your home if your arizona property taxes are delinquent. Request a monthly installment plan.

Individual Income Tax Filing Season In The State Provides Potential Benefits For Arizonans Whose Income Level Is Below Minimum Threshold.

Also known as a state cp, assignments are unsold tax liens that are struck to the state of arizona, and available for purchase by bidders through. You may be eligible if you owe more tax than you can pay. In arizona, a tax lien is automatically placed on real or personal property when taxes are levied, as outlined in state. Make an online payment at aztaxes.gov.