State Of Ohio Tax Lien

State Of Ohio Tax Lien - Local governments in ohio may levy taxes on real property. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. An official state of ohio site. Property taxes are imposed as a lien of the state against the property until they are. A tax lien is filed with the county courts when a tax liability is referred for collection. The department of taxation does not forward.

Property taxes are imposed as a lien of the state against the property until they are. An official state of ohio site. Local governments in ohio may levy taxes on real property. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. A tax lien is filed with the county courts when a tax liability is referred for collection. The department of taxation does not forward.

An official state of ohio site. A tax lien is filed with the county courts when a tax liability is referred for collection. The department of taxation does not forward. Property taxes are imposed as a lien of the state against the property until they are. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. Local governments in ohio may levy taxes on real property.

Tax Lien Ohio State Tax Lien

A tax lien is filed with the county courts when a tax liability is referred for collection. Local governments in ohio may levy taxes on real property. The department of taxation does not forward. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. An official state of ohio site.

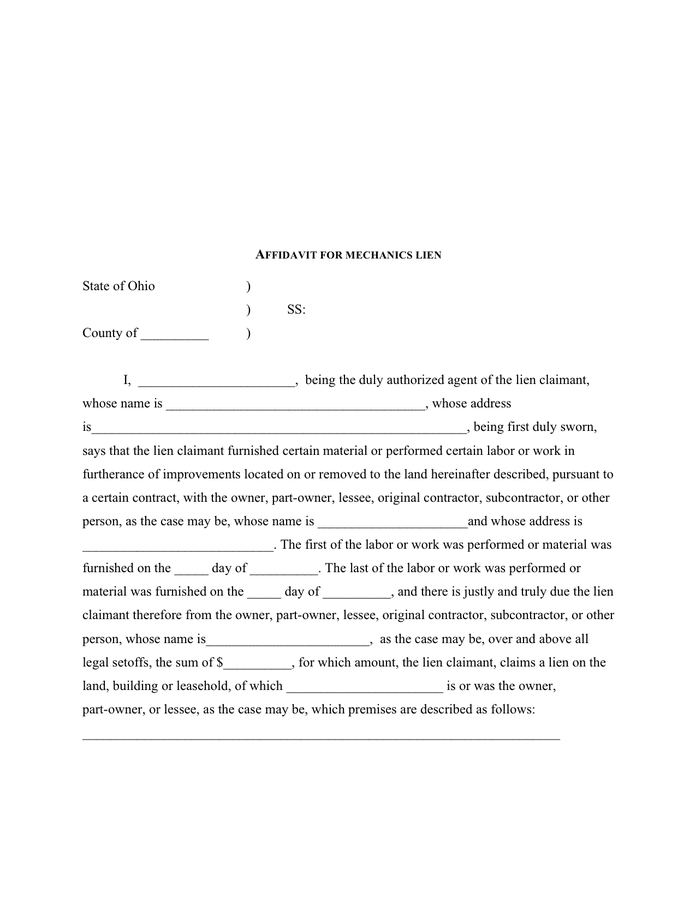

Affidavit for mechanics lien (Ohio) in Word and Pdf formats

Local governments in ohio may levy taxes on real property. An official state of ohio site. Property taxes are imposed as a lien of the state against the property until they are. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. The department of taxation does not forward.

Tax Lien Sale PDF Tax Lien Taxes

A tax lien is filed with the county courts when a tax liability is referred for collection. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. Property taxes are imposed as a lien of the state against the property until they are. An official state of ohio site. Local governments in ohio may.

Ohio Mechanics Lien Form Fill Online, Printable, Fillable, Blank

Property taxes are imposed as a lien of the state against the property until they are. An official state of ohio site. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. A tax lien is filed with the county courts when a tax liability is referred for collection. The department of taxation does.

tax lien PDF Free Download

Property taxes are imposed as a lien of the state against the property until they are. The department of taxation does not forward. An official state of ohio site. A tax lien is filed with the county courts when a tax liability is referred for collection. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax.

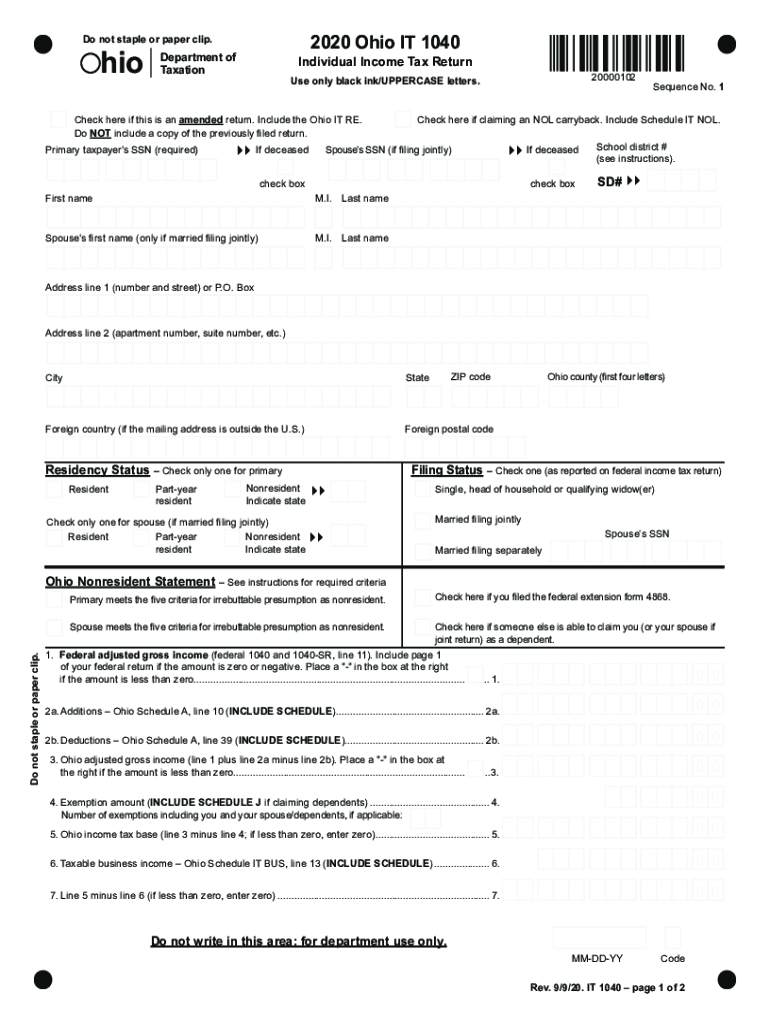

2020 Form OH IT 1040 Fill Online, Printable, Fillable, Blank pdfFiller

An official state of ohio site. A tax lien is filed with the county courts when a tax liability is referred for collection. Property taxes are imposed as a lien of the state against the property until they are. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. The department of taxation does.

Tax Lien What Is A State Tax Lien Ohio

Local governments in ohio may levy taxes on real property. Property taxes are imposed as a lien of the state against the property until they are. The department of taxation does not forward. An official state of ohio site. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund.

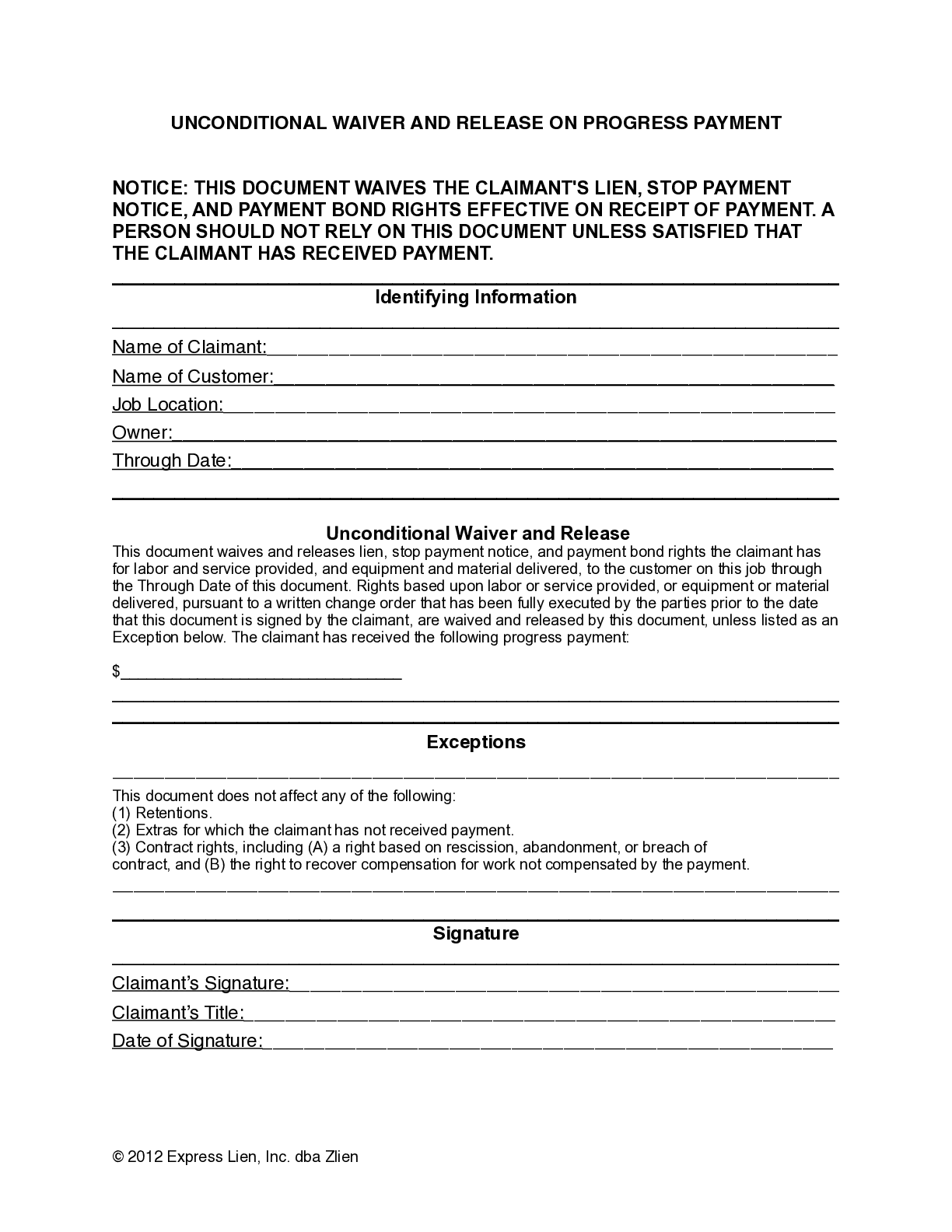

Ohio Lien Waiver FAQs, Guide, Forms, & Resources

A tax lien is filed with the county courts when a tax liability is referred for collection. Local governments in ohio may levy taxes on real property. An official state of ohio site. The department of taxation does not forward. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund.

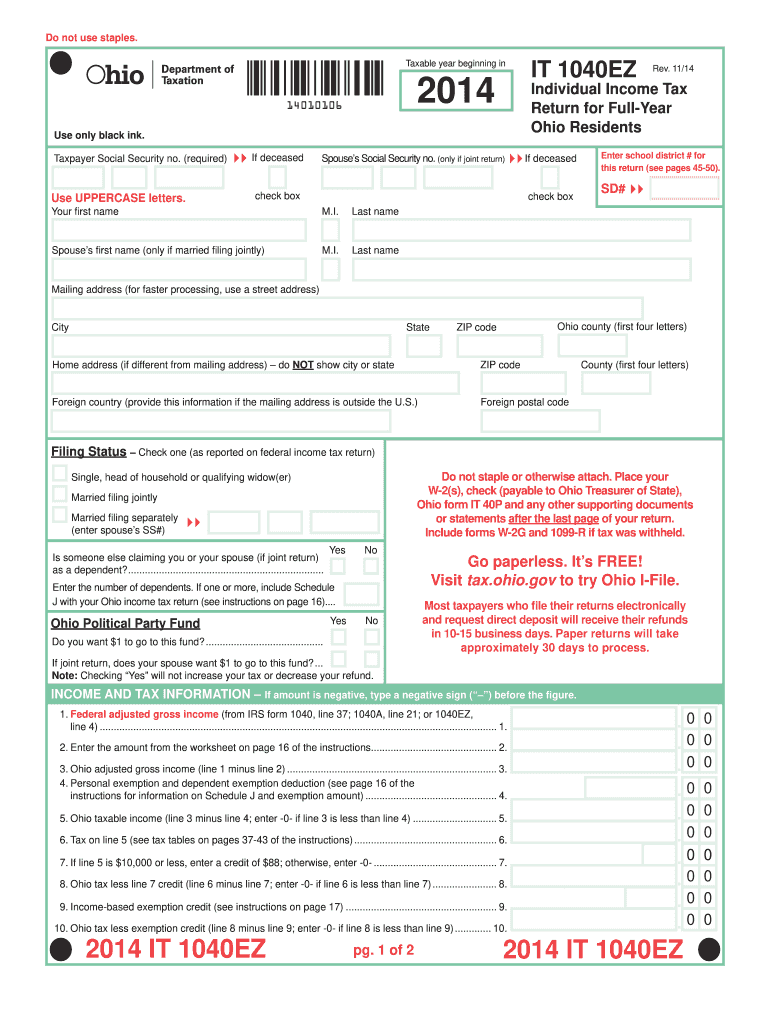

Ohio State Tax Forms Printable Printable Forms Free Online

Property taxes are imposed as a lien of the state against the property until they are. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. The department of taxation does not forward. An official state of ohio site. Local governments in ohio may levy taxes on real property.

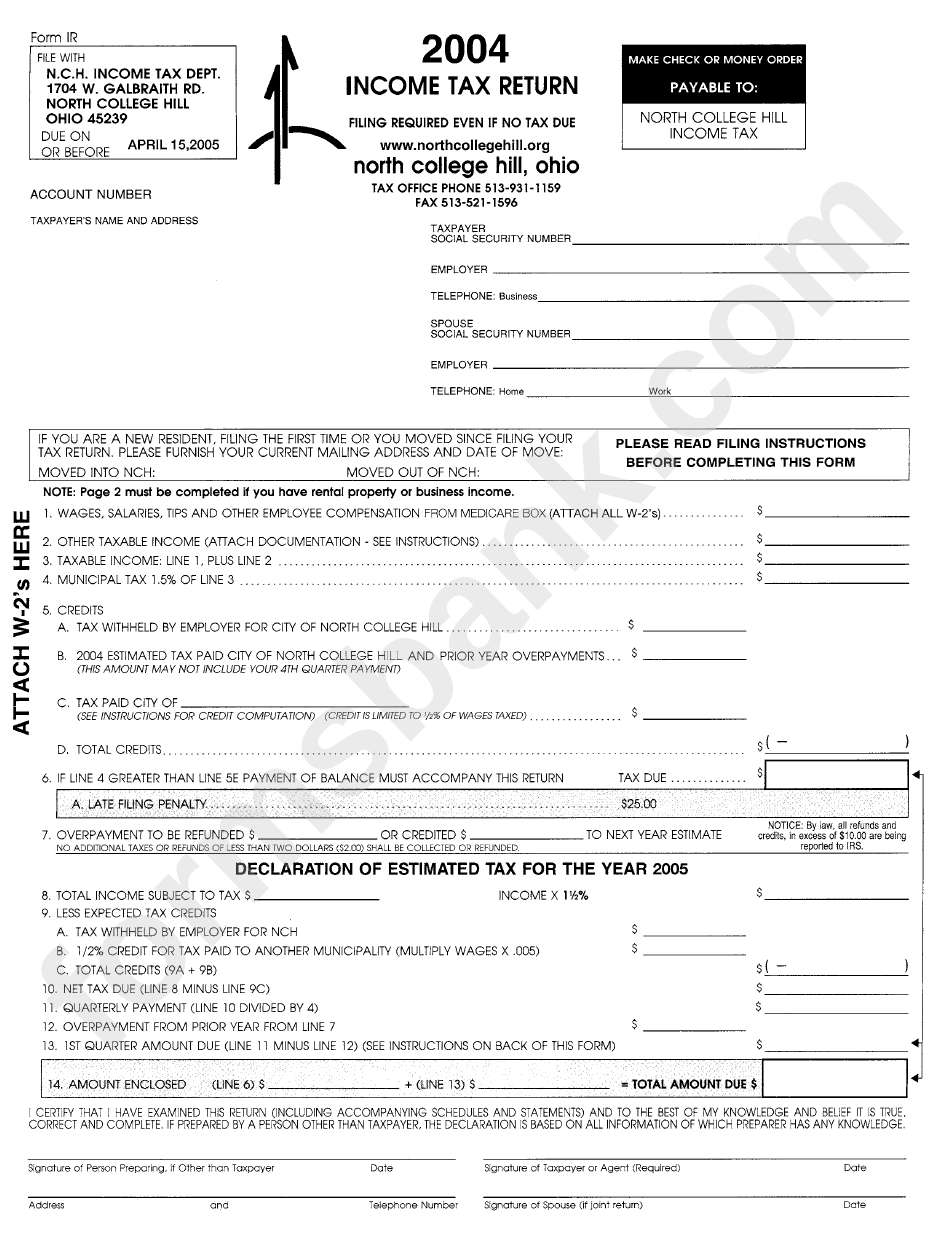

Form Ir Tax Return 2004 State Of Ohio printable pdf download

The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. Local governments in ohio may levy taxes on real property. The department of taxation does not forward. A tax lien is filed with the county courts when a tax liability is referred for collection. An official state of ohio site.

Property Taxes Are Imposed As A Lien Of The State Against The Property Until They Are.

An official state of ohio site. Local governments in ohio may levy taxes on real property. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. A tax lien is filed with the county courts when a tax liability is referred for collection.