Tax Foreclosure Sale

Tax Foreclosure Sale - In some states, the government will seize homes with unpaid property taxes and then. The taxing authority simply executes. A tax lien foreclosure is the sale of a property resulting. In some jurisdictions, though, a sale isn't held. Tax lien foreclosures and tax deed sales allow the governmental entity to promptly. What is a tax lien foreclosure?

Tax lien foreclosures and tax deed sales allow the governmental entity to promptly. What is a tax lien foreclosure? A tax lien foreclosure is the sale of a property resulting. The taxing authority simply executes. In some jurisdictions, though, a sale isn't held. In some states, the government will seize homes with unpaid property taxes and then.

A tax lien foreclosure is the sale of a property resulting. In some jurisdictions, though, a sale isn't held. What is a tax lien foreclosure? In some states, the government will seize homes with unpaid property taxes and then. The taxing authority simply executes. Tax lien foreclosures and tax deed sales allow the governmental entity to promptly.

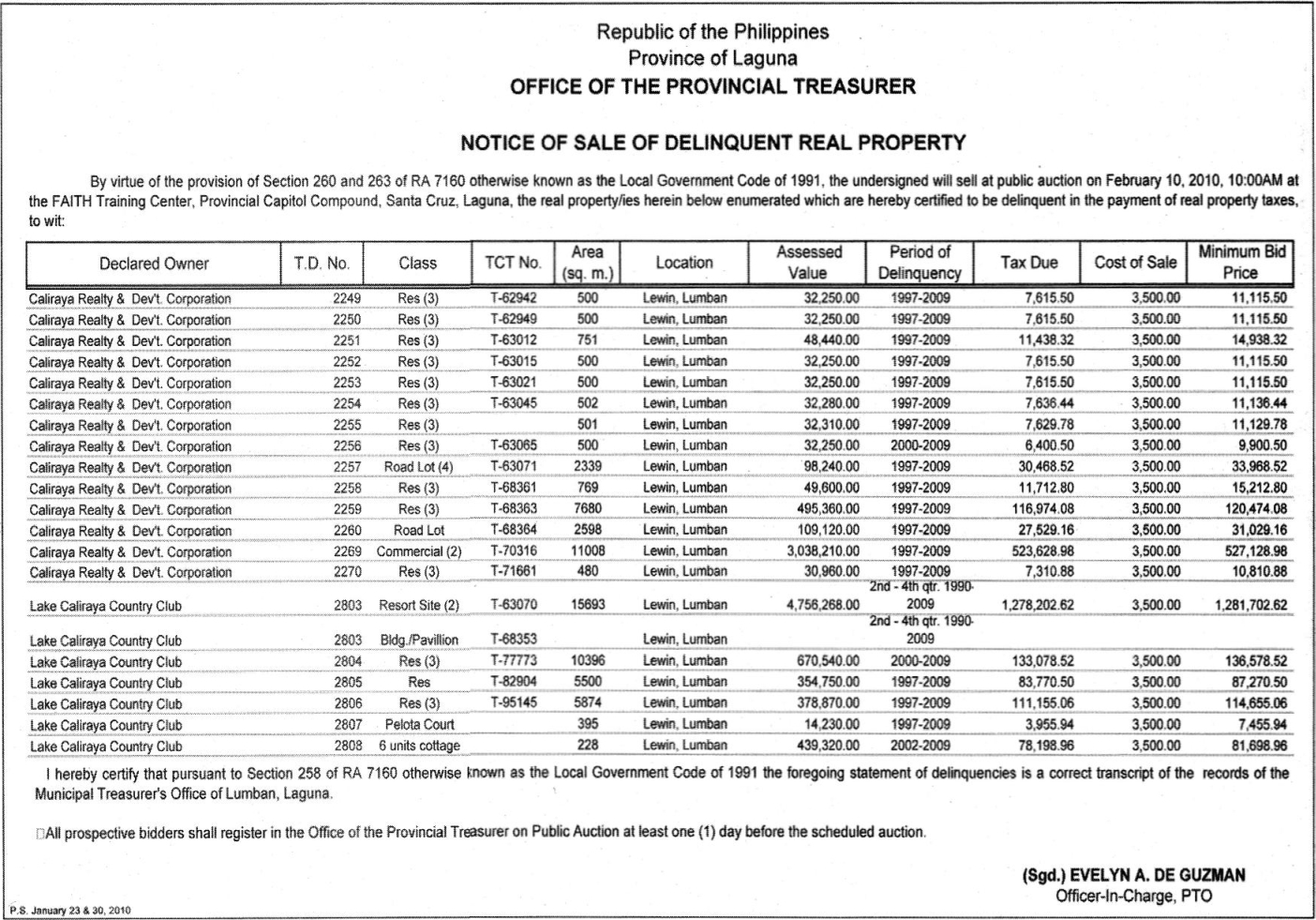

Tax foreclosure sale of delinquent real properties in Laguna slated on

The taxing authority simply executes. In some states, the government will seize homes with unpaid property taxes and then. A tax lien foreclosure is the sale of a property resulting. Tax lien foreclosures and tax deed sales allow the governmental entity to promptly. In some jurisdictions, though, a sale isn't held.

Tax Foreclosure Properties Snohomish County, WA Official Website

A tax lien foreclosure is the sale of a property resulting. In some states, the government will seize homes with unpaid property taxes and then. In some jurisdictions, though, a sale isn't held. What is a tax lien foreclosure? Tax lien foreclosures and tax deed sales allow the governmental entity to promptly.

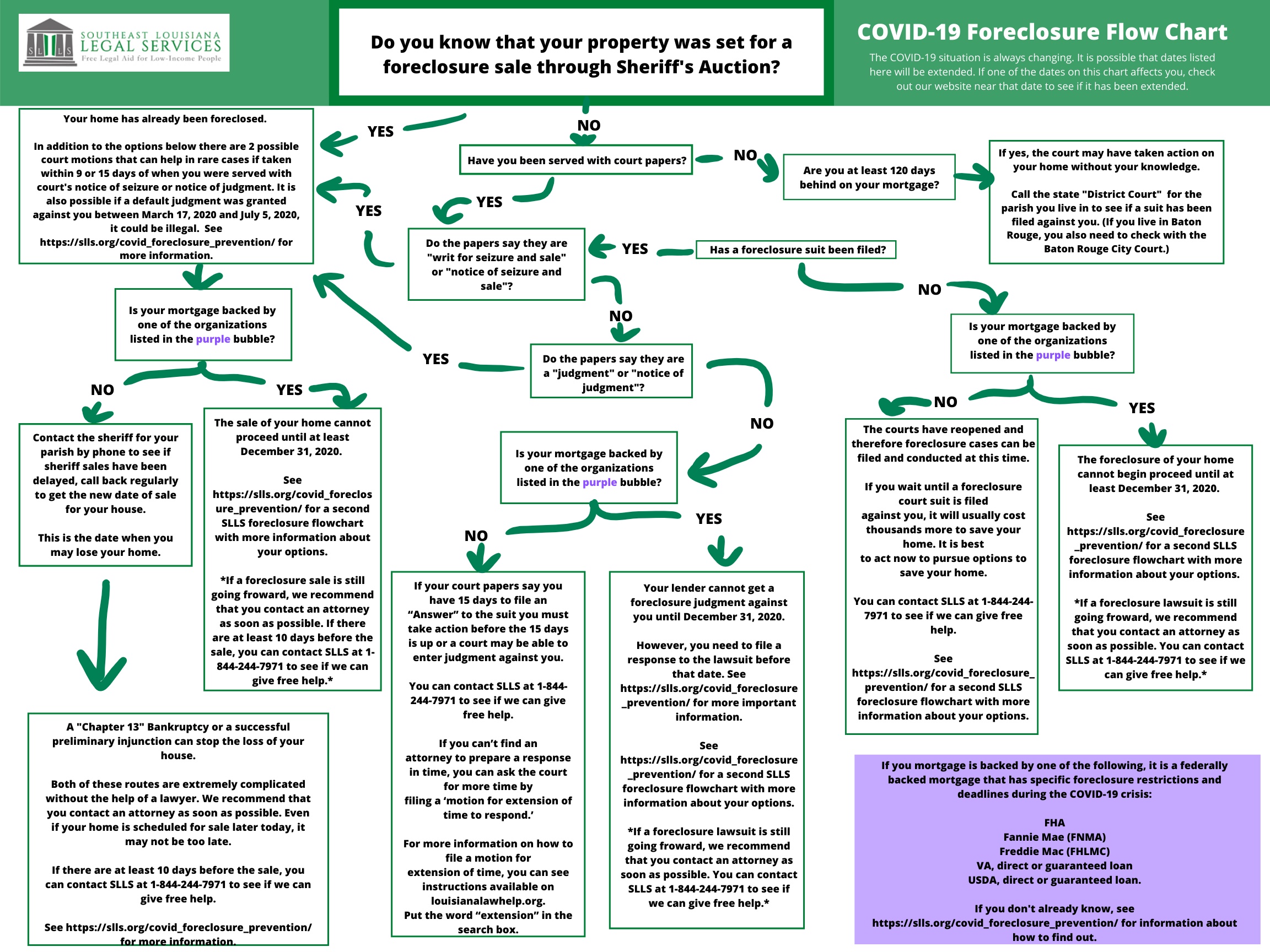

Updated Foreclosure Flow Chart SLLS

In some states, the government will seize homes with unpaid property taxes and then. A tax lien foreclosure is the sale of a property resulting. What is a tax lien foreclosure? Tax lien foreclosures and tax deed sales allow the governmental entity to promptly. In some jurisdictions, though, a sale isn't held.

Tax Foreclosure Sale Halifax County NC Tax Department

What is a tax lien foreclosure? In some jurisdictions, though, a sale isn't held. The taxing authority simply executes. Tax lien foreclosures and tax deed sales allow the governmental entity to promptly. A tax lien foreclosure is the sale of a property resulting.

Tax Foreclosure Sale Halifax County NC Tax Department

In some states, the government will seize homes with unpaid property taxes and then. A tax lien foreclosure is the sale of a property resulting. What is a tax lien foreclosure? In some jurisdictions, though, a sale isn't held. The taxing authority simply executes.

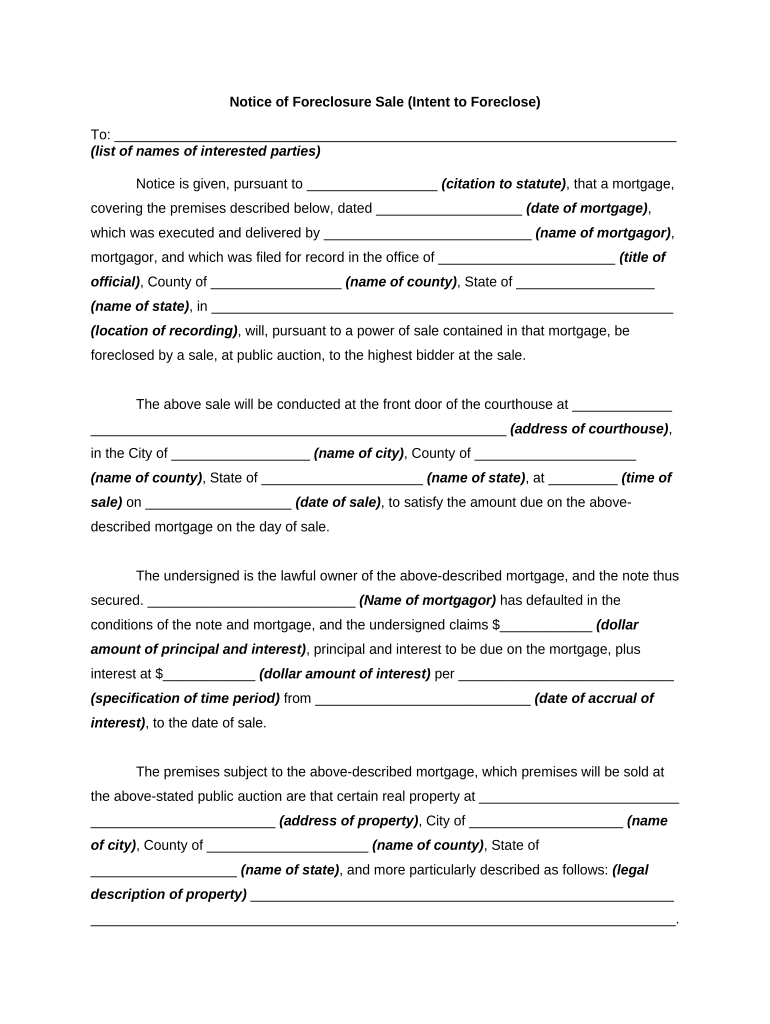

Foreclosure sale Fill out & sign online DocHub

A tax lien foreclosure is the sale of a property resulting. The taxing authority simply executes. Tax lien foreclosures and tax deed sales allow the governmental entity to promptly. What is a tax lien foreclosure? In some states, the government will seize homes with unpaid property taxes and then.

13 Steps to your FIRST Tax Sale Foreclosure Investment eBooks Real

In some jurisdictions, though, a sale isn't held. In some states, the government will seize homes with unpaid property taxes and then. The taxing authority simply executes. Tax lien foreclosures and tax deed sales allow the governmental entity to promptly. A tax lien foreclosure is the sale of a property resulting.

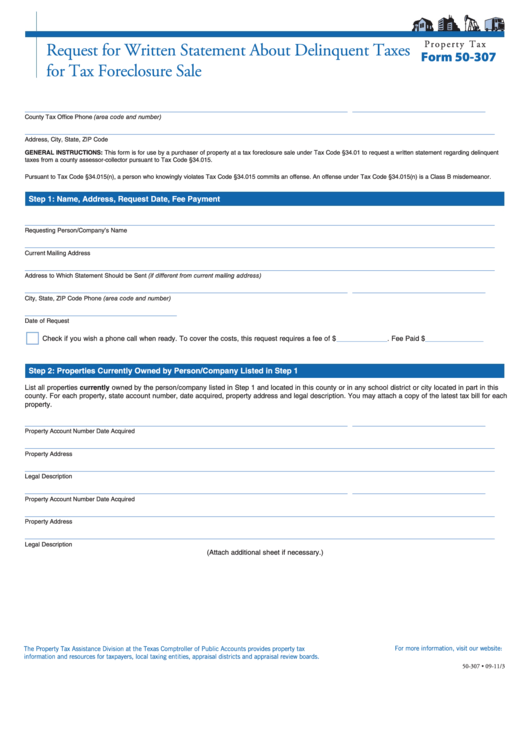

Fillable Property Tax Form 50307 Request For Written Statement About

A tax lien foreclosure is the sale of a property resulting. The taxing authority simply executes. In some states, the government will seize homes with unpaid property taxes and then. What is a tax lien foreclosure? Tax lien foreclosures and tax deed sales allow the governmental entity to promptly.

Tax Foreclosure Sales Gaston County, NC

In some jurisdictions, though, a sale isn't held. A tax lien foreclosure is the sale of a property resulting. The taxing authority simply executes. What is a tax lien foreclosure? In some states, the government will seize homes with unpaid property taxes and then.

INTENSIVE Tax Sale Foreclosure Investing Class Movies and Videos

In some states, the government will seize homes with unpaid property taxes and then. What is a tax lien foreclosure? The taxing authority simply executes. In some jurisdictions, though, a sale isn't held. A tax lien foreclosure is the sale of a property resulting.

The Taxing Authority Simply Executes.

Tax lien foreclosures and tax deed sales allow the governmental entity to promptly. In some states, the government will seize homes with unpaid property taxes and then. What is a tax lien foreclosure? In some jurisdictions, though, a sale isn't held.