Tax Foreclosure Texas

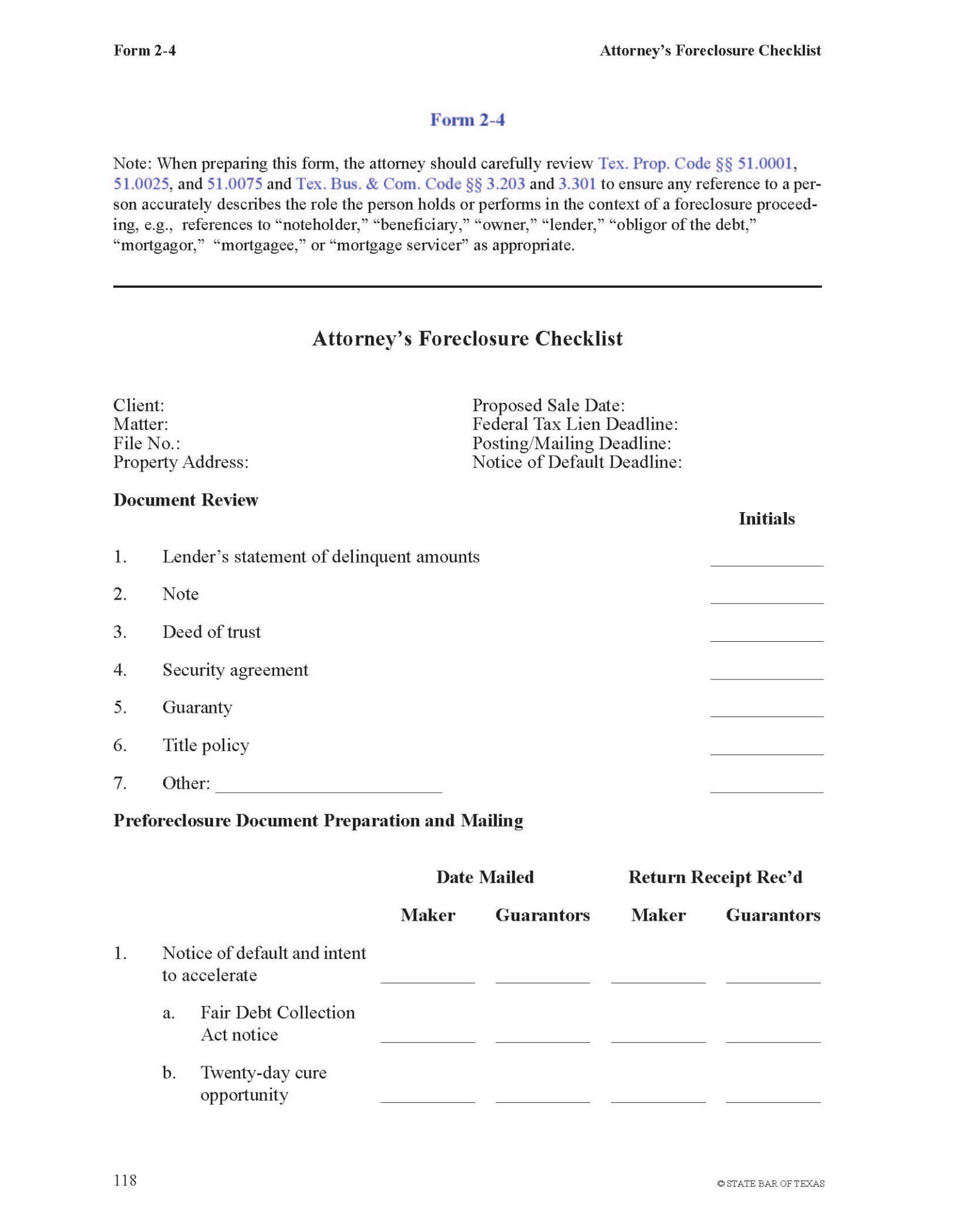

Tax Foreclosure Texas - This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. How the owners are served with notice of the. Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. In order to foreclose, the taxing authority must file a lawsuit against the owner of the property. The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which the property was sold at.

The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which the property was sold at. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. How the owners are served with notice of the. This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at. In order to foreclose, the taxing authority must file a lawsuit against the owner of the property.

In order to foreclose, the taxing authority must file a lawsuit against the owner of the property. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at. This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. How the owners are served with notice of the. The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which the property was sold at.

What to Know About Tax Lien Foreclosure in Texas Johnson & Starr

The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which the property was sold at. How the owners are served with notice of the. This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. In order to.

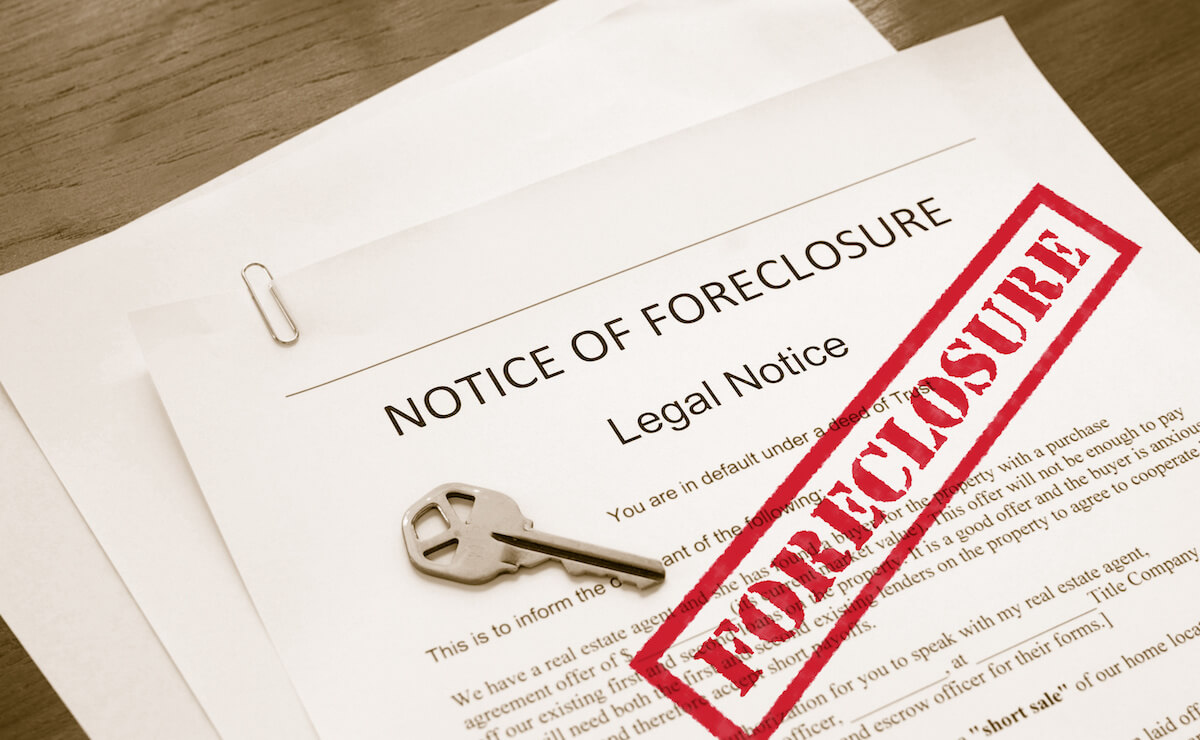

Understanding the Texas Property Tax Code Facing Foreclosure Houston

The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. The notice of the sale must contain a description of the property to be sold,.

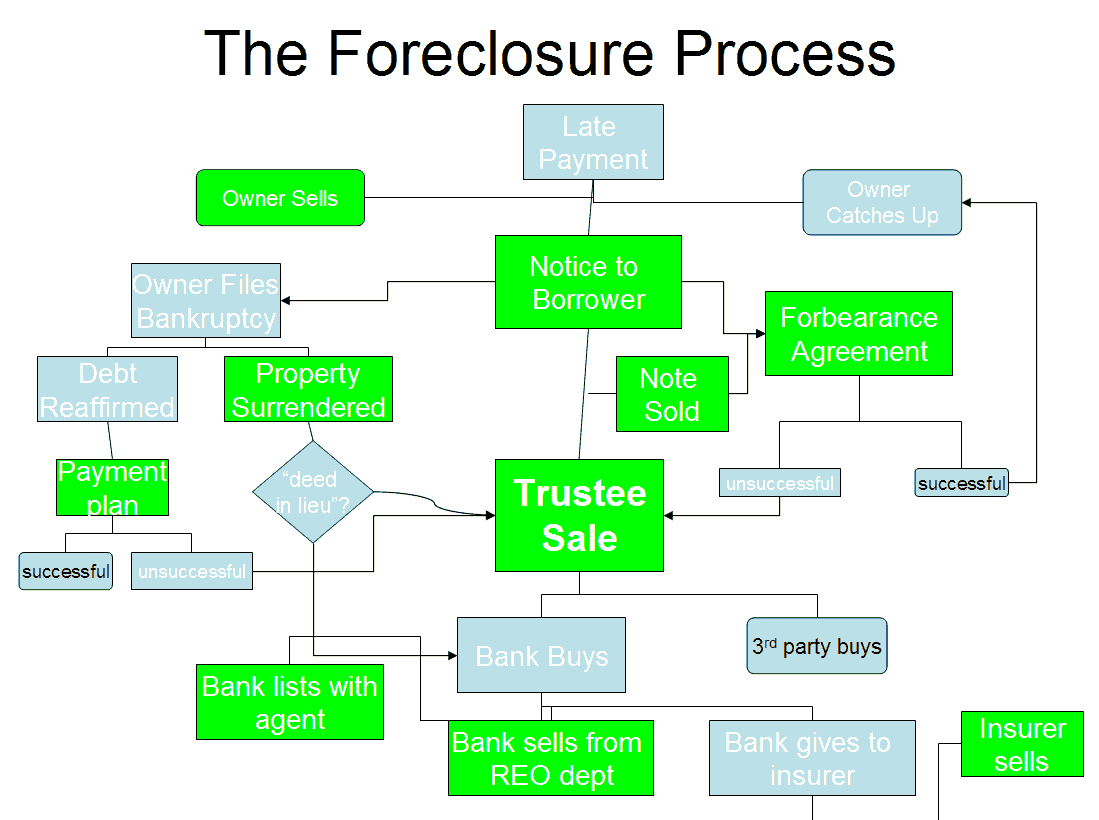

Texas Foreclosure Process

The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at. This state bar of texas manual covers foreclosure laws and procedures in.

Texas Foreclosure Laws & Process Overview [2024]

This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. In order to foreclose, the taxing authority must file a lawsuit against the owner of the property. Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at. How the.

Texas Foreclosure Manual, 2023 ed. Texas Bar Practice

How the owners are served with notice of the. The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which the property was sold at. This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. The only way.

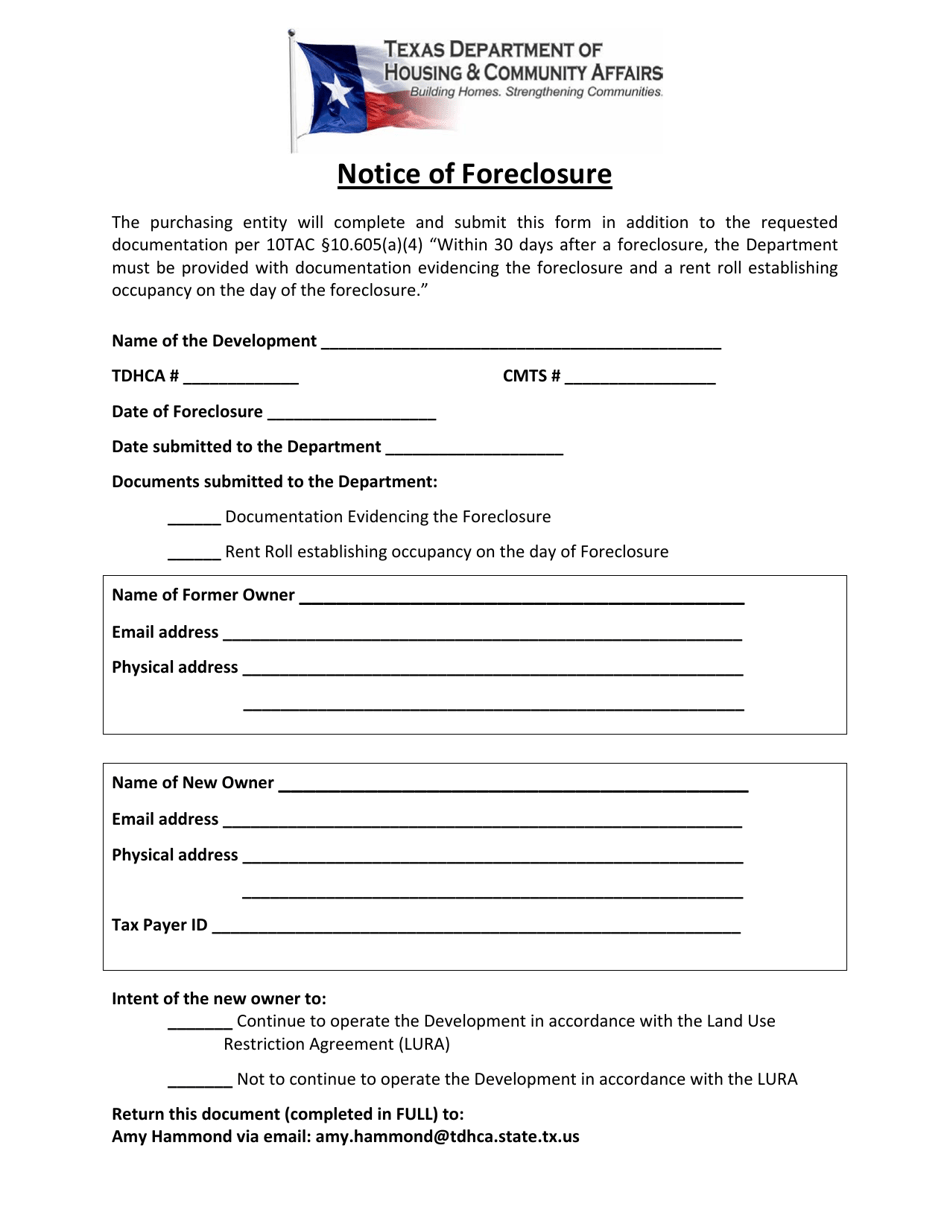

Texas Notice of Foreclosure Fill Out, Sign Online and Download PDF

This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which the property was sold at. How the owners are served with notice of the. The only way.

Texas Foreclosure Process And Timeline.

The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at. This state bar of texas manual covers foreclosure laws and procedures in.

Texas Property Tax Basics ppt download

The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which the property was sold at. How the owners are served.

How to Buy Property with Delinquent Taxes Texas Tax Liens

Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at. How the owners are served with notice of the. In order to foreclose, the taxing authority must file a lawsuit against the owner of the property. The notice of the sale must contain a description of the property.

Understanding how the foreclosure process operates in Texas

The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which the property was sold at. Delinquent tax foreclosure sales and.

Delinquent Tax Foreclosure Sales And Resales Will Be Conducted By The County Constables Through An Online Platform Operated By Real Auction At.

The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which the property was sold at. How the owners are served with notice of the. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid.

![Texas Foreclosure Laws & Process Overview [2024]](https://www.amerinotexchange.com/wp-content/uploads/2024/04/Foreclose-Laws-and-Process-Texas.png)