Tax Form 8862

Tax Form 8862 - Information to claim earned income credit after disallowance to your return. If your return was rejected because you need to file form 8862,. Be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862. In the earned income credit section when you see do any of these. Information to claim earned income credit after disallowance to your return. To resolve this rejection, you'll need to add form 8862: If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Please see the faq link provided below for. If so, follow the instructions in the irs letter for how to send the form, and what else to. You'll need to add form 8862:

In the earned income credit section when you see do any of these. If so, follow the instructions in the irs letter for how to send the form, and what else to. Please see the faq link provided below for. You'll need to add form 8862: To resolve this rejection, you'll need to add form 8862: Information to claim earned income credit after disallowance to your return. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Did you get a letter from the irs asking for form 8862 after you filed your tax return? You do not need to file form 8862 in the year the credit was disallowed or reduced. Be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862.

Information to claim earned income credit after disallowance to your return. Please see the faq link provided below for. In the earned income credit section when you see do any of these. If your return was rejected because you need to file form 8862,. You'll need to add form 8862: Did you get a letter from the irs asking for form 8862 after you filed your tax return? You do not need to file form 8862 in the year the credit was disallowed or reduced. Be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862. If so, follow the instructions in the irs letter for how to send the form, and what else to. Information to claim earned income credit after disallowance to your return.

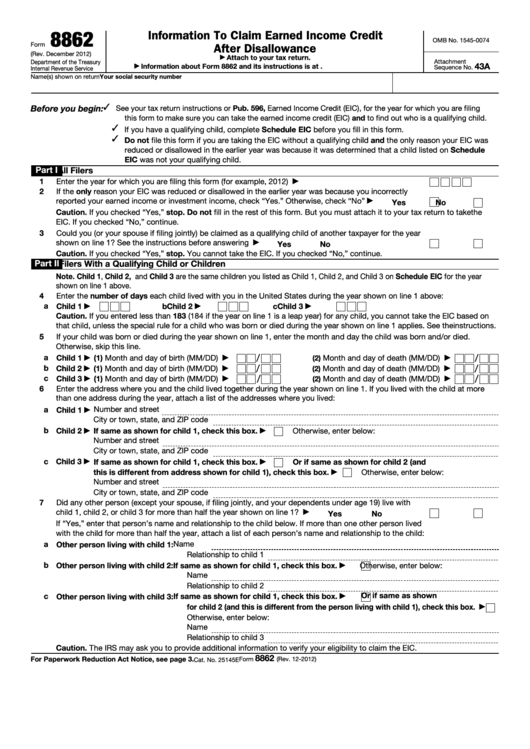

Form 8862 Information to Claim Earned Credit After

If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862. You'll need to add form 8862: In the earned income credit section when you see do any.

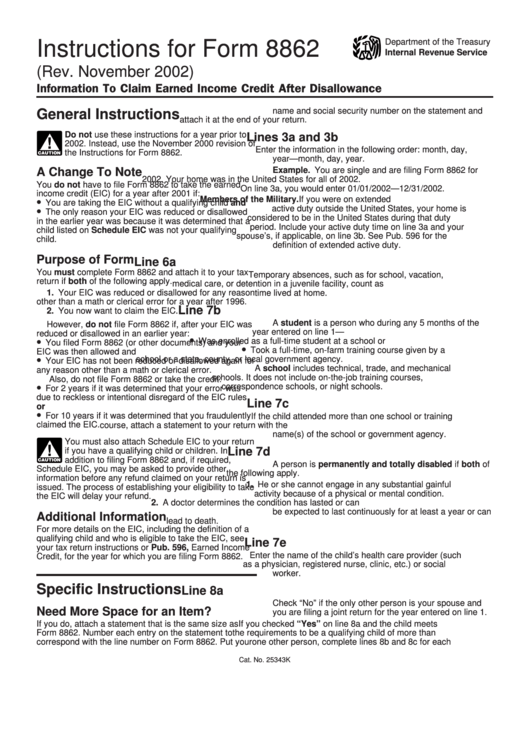

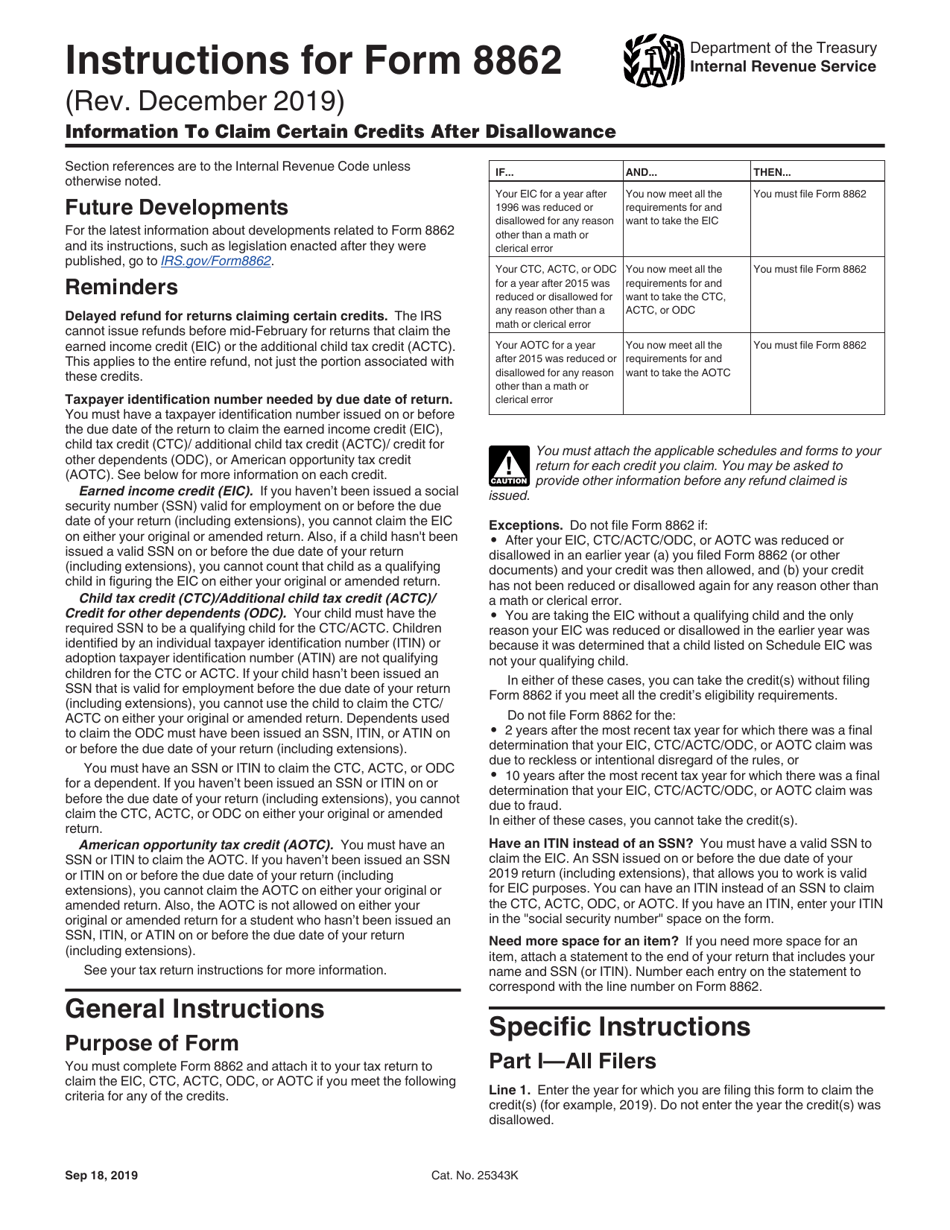

Instructions For Form 8862 Information To Claim Earned Credit

If so, follow the instructions in the irs letter for how to send the form, and what else to. Please see the faq link provided below for. To resolve this rejection, you'll need to add form 8862: Be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862. If you are.

What Is An 8862 Tax Form? SuperMoney

If so, follow the instructions in the irs letter for how to send the form, and what else to. Did you get a letter from the irs asking for form 8862 after you filed your tax return? You'll need to add form 8862: Information to claim earned income credit after disallowance to your return. If your return was rejected because.

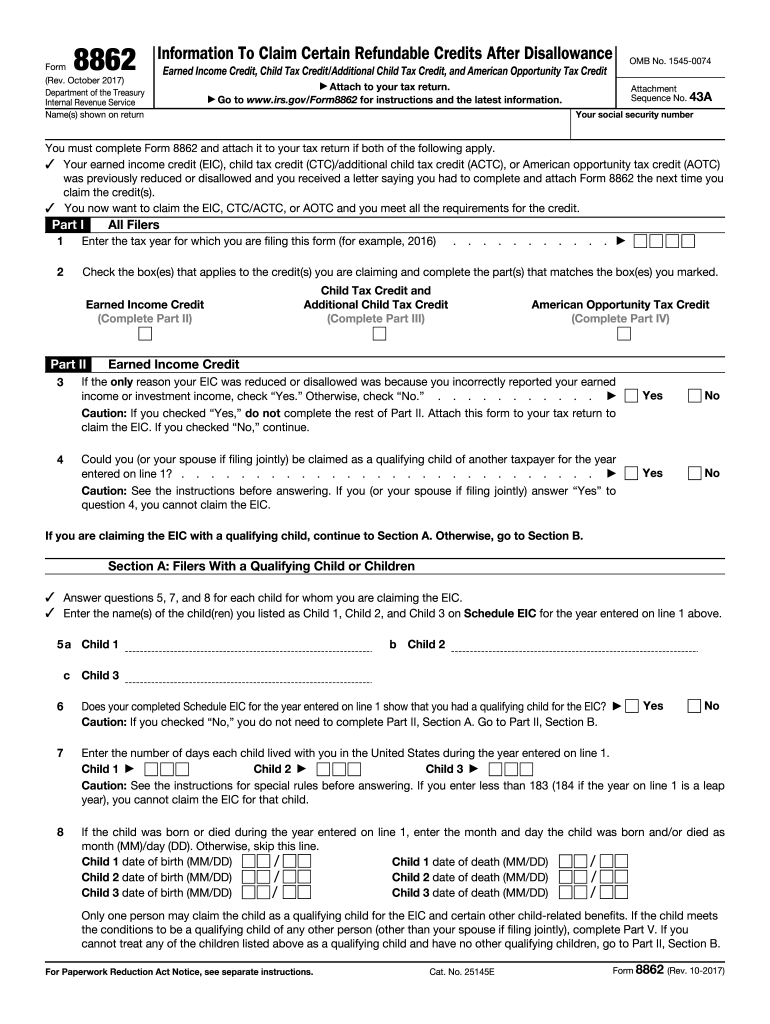

Fillable Online Irs Tax Form 8862 Instructions Fax Email Print pdfFiller

You do not need to file form 8862 in the year the credit was disallowed or reduced. In the earned income credit section when you see do any of these. Please see the faq link provided below for. You'll need to add form 8862: If so, follow the instructions in the irs letter for how to send the form, and.

IRS Form 8862 Fill Out and Sign Printable PDF Template airSlate SignNow

If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. If so, follow the instructions in the irs letter for how to send the form, and what else to. You do not need to file form 8862 in the year the credit was disallowed or reduced. Be.

IRS Form 8862 Instructions

If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. If your return was rejected because you need to file form 8862,. If so, follow the instructions in the irs letter for how to send the form, and what else to. Be sure to follow the instructions.

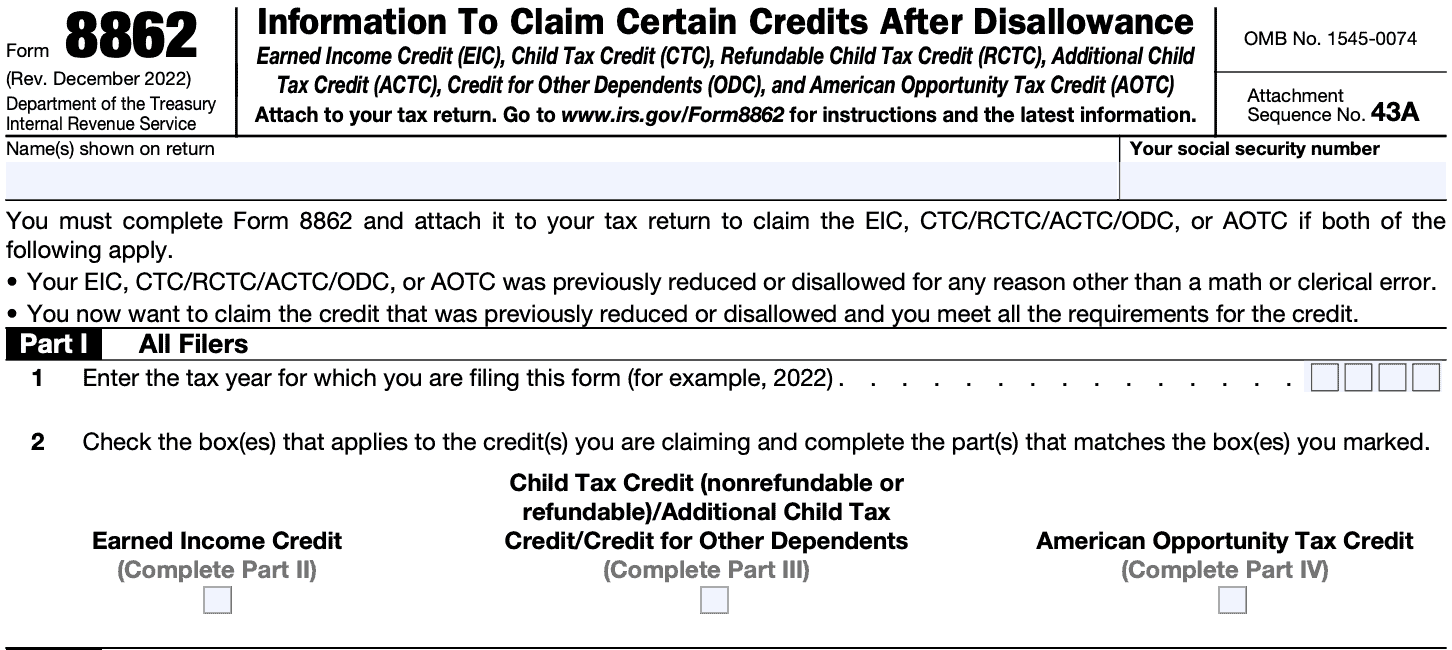

Download Instructions for IRS Form 8862 Information to Claim Certain

Did you get a letter from the irs asking for form 8862 after you filed your tax return? Information to claim earned income credit after disallowance to your return. If so, follow the instructions in the irs letter for how to send the form, and what else to. Please see the faq link provided below for. You'll need to add.

8862 Tax Form Fill and Sign Printable Template Online US Legal Forms

You do not need to file form 8862 in the year the credit was disallowed or reduced. You'll need to add form 8862: If your return was rejected because you need to file form 8862,. In the earned income credit section when you see do any of these. If you are filing form 8862 because you received an irs letter,.

Fillable Form 8862 Printable Forms Free Online

Did you get a letter from the irs asking for form 8862 after you filed your tax return? Please see the faq link provided below for. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. You'll need to add form 8862: Information to claim earned income.

What Is IRS Form 8862?

In the earned income credit section when you see do any of these. To resolve this rejection, you'll need to add form 8862: Please see the faq link provided below for. Be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862. Information to claim earned income credit after disallowance to.

Information To Claim Earned Income Credit After Disallowance To Your Return.

Please see the faq link provided below for. In the earned income credit section when you see do any of these. You do not need to file form 8862 in the year the credit was disallowed or reduced. If your return was rejected because you need to file form 8862,.

If So, Follow The Instructions In The Irs Letter For How To Send The Form, And What Else To.

You'll need to add form 8862: Information to claim earned income credit after disallowance to your return. To resolve this rejection, you'll need to add form 8862: If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter.

Be Sure To Follow The Instructions From The Irs If You Received A Notice Requiring You To File Form 8862.

Did you get a letter from the irs asking for form 8862 after you filed your tax return?

:max_bytes(150000):strip_icc()/2022-01-1111_48_02-Form8862Rev.December2021-f23f0eab085a467eb521f33bd3758904.jpg)