Tax Lien Certificate Illinois

Tax Lien Certificate Illinois - To search for a certificate of tax lien, you may search by case number or debtor name. The property owner has a 2 to 2½. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. It is generated when the owner fails to. After the tax sale, the tax buyer is issued a certificate of purchase, which represents a lien on the property. A property tax lien is a claim on a piece of property for an amount owed in unpaid taxes. With the case number search, you may use either the. Meyer & associates collects unwanted tax liens for 80. Iltaxsale.com advertises tax deed auctions for joseph e.

With the case number search, you may use either the. Iltaxsale.com advertises tax deed auctions for joseph e. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. The property owner has a 2 to 2½. After the tax sale, the tax buyer is issued a certificate of purchase, which represents a lien on the property. To search for a certificate of tax lien, you may search by case number or debtor name. A property tax lien is a claim on a piece of property for an amount owed in unpaid taxes. Meyer & associates collects unwanted tax liens for 80. It is generated when the owner fails to.

After the tax sale, the tax buyer is issued a certificate of purchase, which represents a lien on the property. With the case number search, you may use either the. Meyer & associates collects unwanted tax liens for 80. A property tax lien is a claim on a piece of property for an amount owed in unpaid taxes. To search for a certificate of tax lien, you may search by case number or debtor name. The property owner has a 2 to 2½. Iltaxsale.com advertises tax deed auctions for joseph e. It is generated when the owner fails to. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois.

EasytoUnderstand Tax Lien Code Certificates Posteezy

With the case number search, you may use either the. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. It is generated when the owner fails to. Meyer & associates collects unwanted tax liens for 80. A property tax lien is a claim on.

Illinois Certificate of Organization LLC Bible

The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. A property tax lien is a claim on a piece of property for an amount owed in unpaid taxes. It is generated when the owner fails to. After the tax sale, the tax buyer is.

Tax Lien Certificates and Tax Deeds How Tax Lien Auctions Work in Cook

After the tax sale, the tax buyer is issued a certificate of purchase, which represents a lien on the property. The property owner has a 2 to 2½. It is generated when the owner fails to. To search for a certificate of tax lien, you may search by case number or debtor name. Meyer & associates collects unwanted tax liens.

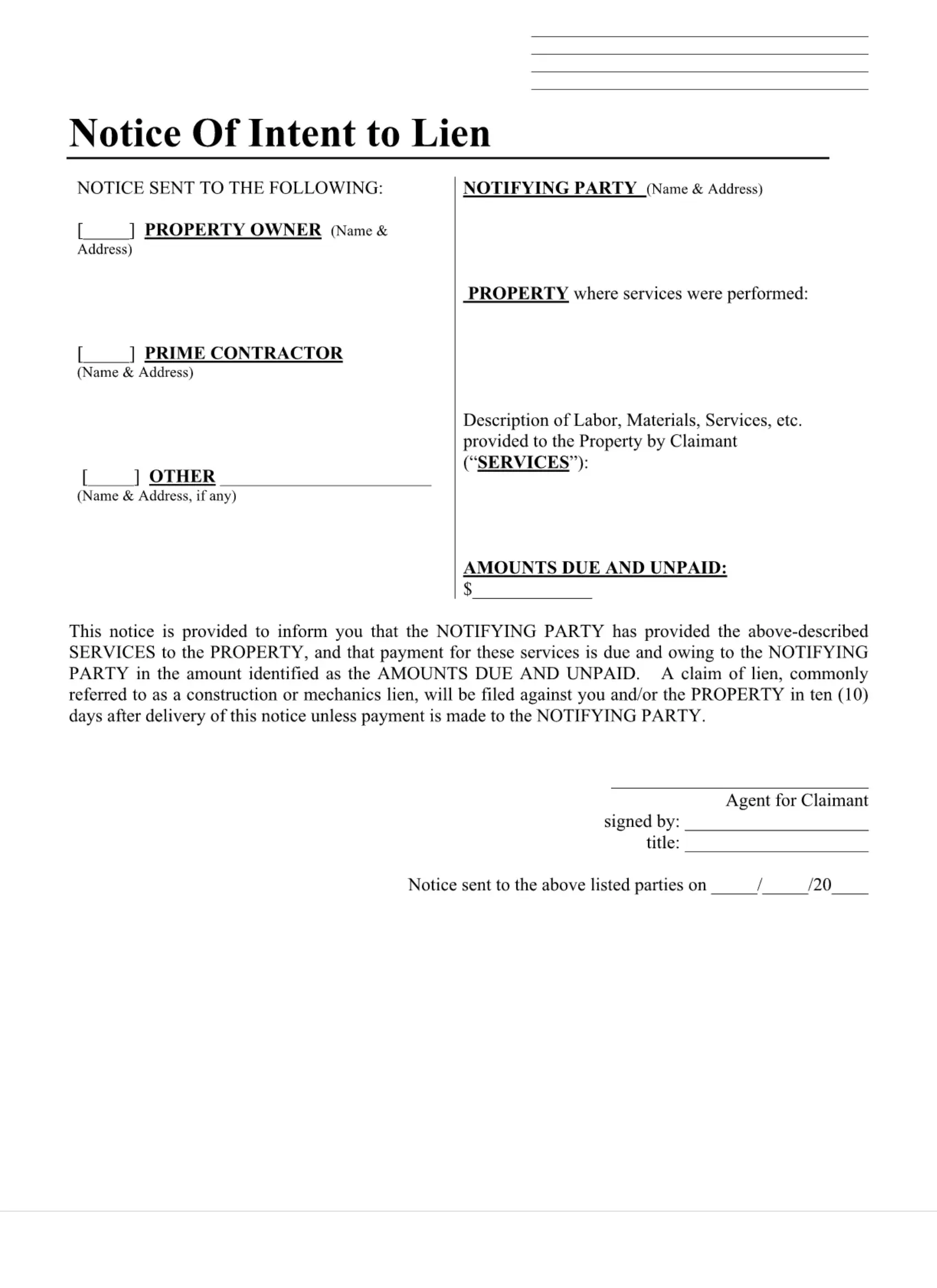

Illinois Notice Lien Form ≡ Fill Out Printable PDF Forms Online

Meyer & associates collects unwanted tax liens for 80. A property tax lien is a claim on a piece of property for an amount owed in unpaid taxes. The property owner has a 2 to 2½. To search for a certificate of tax lien, you may search by case number or debtor name. With the case number search, you may.

Anne Arundel County Tax Lien Certificates prosecution2012

With the case number search, you may use either the. It is generated when the owner fails to. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. To search for a certificate of tax lien, you may search by case number or debtor name..

Tax Lien Certificate Investment Basics

The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. With the case number search, you may use either the. The property owner has a 2 to 2½. To search for a certificate of tax lien, you may search by case number or debtor name..

Illinois Notice Lien Form ≡ Fill Out Printable PDF Forms Online

To search for a certificate of tax lien, you may search by case number or debtor name. With the case number search, you may use either the. It is generated when the owner fails to. Meyer & associates collects unwanted tax liens for 80. After the tax sale, the tax buyer is issued a certificate of purchase, which represents a.

Tax Lien Sale Download Free PDF Tax Lien Taxes

Meyer & associates collects unwanted tax liens for 80. The property owner has a 2 to 2½. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Iltaxsale.com advertises tax deed auctions for joseph e. After the tax sale, the tax buyer is issued a.

tax lien PDF Free Download

Meyer & associates collects unwanted tax liens for 80. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Iltaxsale.com advertises tax deed auctions for joseph e. A property tax lien is a claim on a piece of property for an amount owed in unpaid.

What Is Tax Lien Certificate Investing?

Meyer & associates collects unwanted tax liens for 80. The property owner has a 2 to 2½. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. It is generated when the owner fails to. A property tax lien is a claim on a piece.

The Property Owner Has A 2 To 2½.

To search for a certificate of tax lien, you may search by case number or debtor name. It is generated when the owner fails to. A property tax lien is a claim on a piece of property for an amount owed in unpaid taxes. Iltaxsale.com advertises tax deed auctions for joseph e.

Meyer & Associates Collects Unwanted Tax Liens For 80.

After the tax sale, the tax buyer is issued a certificate of purchase, which represents a lien on the property. With the case number search, you may use either the. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois.