Tax Lien Certificate Investing

Tax Lien Certificate Investing - How tax lien investing works. To recover the delinquent tax dollars, municipalities. Governments sell tax lien certificates to investors in order to recover money from. Tax lien investing is an indirect approach to investing in real estate. Tax lien certificates are documents that represent a legal claim against a property due. Tax lien investing is a type of real estate investment that involves purchasing these liens from the.

Tax lien investing is a type of real estate investment that involves purchasing these liens from the. Governments sell tax lien certificates to investors in order to recover money from. Tax lien investing is an indirect approach to investing in real estate. How tax lien investing works. Tax lien certificates are documents that represent a legal claim against a property due. To recover the delinquent tax dollars, municipalities.

Tax lien investing is an indirect approach to investing in real estate. Tax lien investing is a type of real estate investment that involves purchasing these liens from the. How tax lien investing works. Governments sell tax lien certificates to investors in order to recover money from. To recover the delinquent tax dollars, municipalities. Tax lien certificates are documents that represent a legal claim against a property due.

Tax lien certificates Your road map to financial success a

To recover the delinquent tax dollars, municipalities. Tax lien investing is a type of real estate investment that involves purchasing these liens from the. Governments sell tax lien certificates to investors in order to recover money from. Tax lien investing is an indirect approach to investing in real estate. Tax lien certificates are documents that represent a legal claim against.

What Is Tax Lien Certificate Investing?

Governments sell tax lien certificates to investors in order to recover money from. To recover the delinquent tax dollars, municipalities. Tax lien certificates are documents that represent a legal claim against a property due. Tax lien investing is an indirect approach to investing in real estate. Tax lien investing is a type of real estate investment that involves purchasing these.

Tax Lien Investing 101 How to Invest in Tax Deeds and Tax Lien Cert…

To recover the delinquent tax dollars, municipalities. Tax lien certificates are documents that represent a legal claim against a property due. Governments sell tax lien certificates to investors in order to recover money from. How tax lien investing works. Tax lien investing is an indirect approach to investing in real estate.

How Investment in Tax Lien Certificates Work? Latest Infographics

To recover the delinquent tax dollars, municipalities. Tax lien investing is a type of real estate investment that involves purchasing these liens from the. How tax lien investing works. Governments sell tax lien certificates to investors in order to recover money from. Tax lien certificates are documents that represent a legal claim against a property due.

Tax Lien Investing What to Know CheckBook IRA LLC

To recover the delinquent tax dollars, municipalities. Tax lien certificates are documents that represent a legal claim against a property due. Governments sell tax lien certificates to investors in order to recover money from. Tax lien investing is a type of real estate investment that involves purchasing these liens from the. Tax lien investing is an indirect approach to investing.

Tax Lien Certificates Why is the best Real Estate Investment? by Tax

Tax lien investing is a type of real estate investment that involves purchasing these liens from the. Governments sell tax lien certificates to investors in order to recover money from. How tax lien investing works. To recover the delinquent tax dollars, municipalities. Tax lien investing is an indirect approach to investing in real estate.

What Is a Tax Lien Certificate? How They're Sold in Investing

To recover the delinquent tax dollars, municipalities. Tax lien investing is an indirect approach to investing in real estate. Tax lien certificates are documents that represent a legal claim against a property due. Tax lien investing is a type of real estate investment that involves purchasing these liens from the. How tax lien investing works.

Things to Know About Tax Lien Certificate and Its Investment Method

Tax lien investing is an indirect approach to investing in real estate. Tax lien certificates are documents that represent a legal claim against a property due. How tax lien investing works. Governments sell tax lien certificates to investors in order to recover money from. Tax lien investing is a type of real estate investment that involves purchasing these liens from.

Your StartUp Guide To Investing In Tax Lien Certificates

Governments sell tax lien certificates to investors in order to recover money from. How tax lien investing works. To recover the delinquent tax dollars, municipalities. Tax lien investing is a type of real estate investment that involves purchasing these liens from the. Tax lien certificates are documents that represent a legal claim against a property due.

Tax Lien Certificate Investment Basics

How tax lien investing works. Tax lien investing is an indirect approach to investing in real estate. Tax lien certificates are documents that represent a legal claim against a property due. Governments sell tax lien certificates to investors in order to recover money from. To recover the delinquent tax dollars, municipalities.

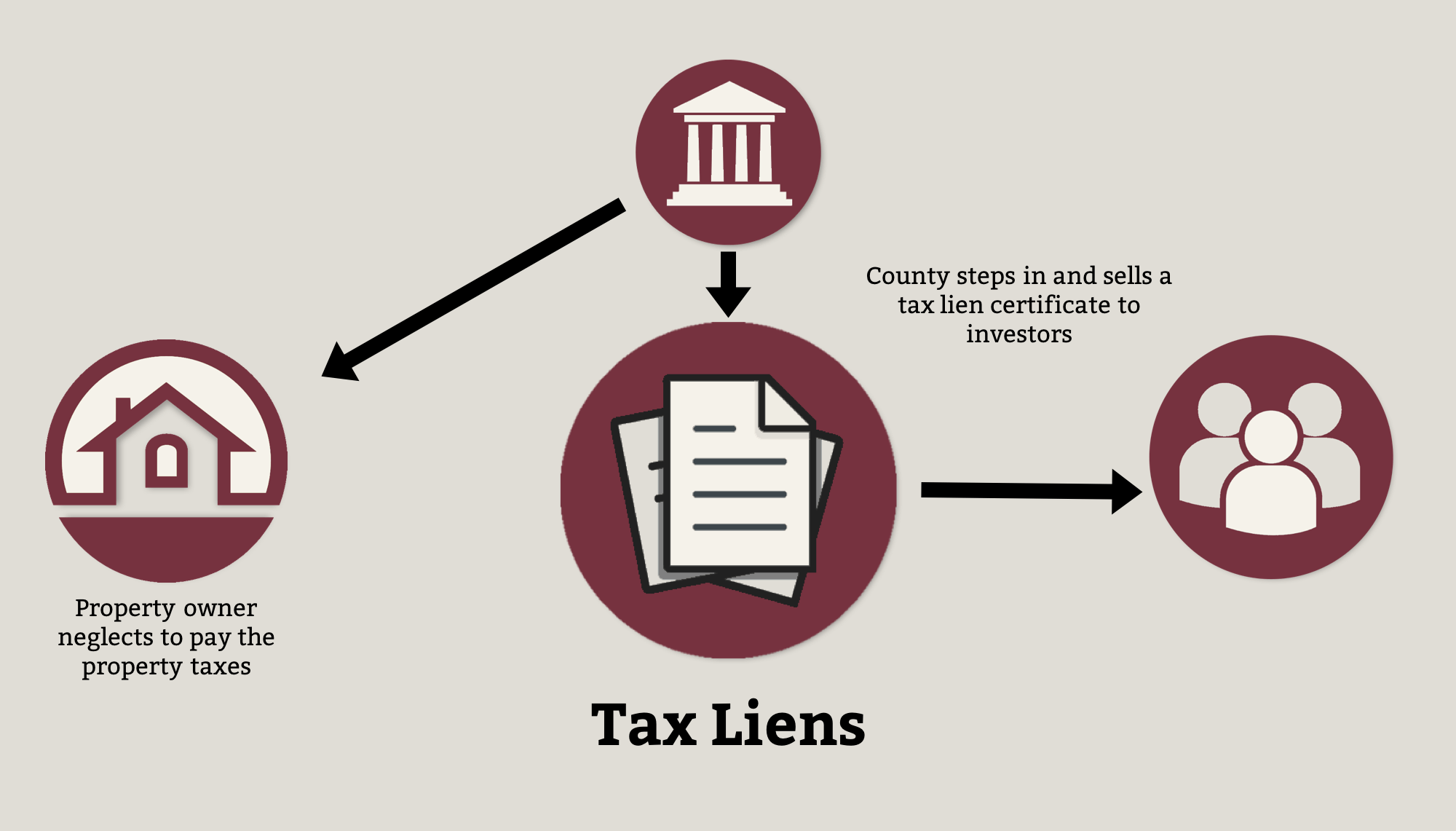

How Tax Lien Investing Works.

To recover the delinquent tax dollars, municipalities. Tax lien investing is a type of real estate investment that involves purchasing these liens from the. Tax lien investing is an indirect approach to investing in real estate. Tax lien certificates are documents that represent a legal claim against a property due.

:max_bytes(150000):strip_icc()/taxliencertificate.asp-final-b2b6b823202f45b9ab56efc51304ed44.png)