Tax Lien Lookup California

Tax Lien Lookup California - Access titles, boundaries, mortgages, legal descriptions, appraisals, gis maps, foreclosure. Explore detailed property records in california. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). To view your confidential tax or fee records, log into your account for the following types of information: If you receive a demand for tax payment, it means you have a tax or fee liability that is due and payable by the date shown. This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of. See publication 58a, how to.

Access titles, boundaries, mortgages, legal descriptions, appraisals, gis maps, foreclosure. This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of. See publication 58a, how to. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). Explore detailed property records in california. If you receive a demand for tax payment, it means you have a tax or fee liability that is due and payable by the date shown. To view your confidential tax or fee records, log into your account for the following types of information:

To view your confidential tax or fee records, log into your account for the following types of information: Explore detailed property records in california. See publication 58a, how to. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). Access titles, boundaries, mortgages, legal descriptions, appraisals, gis maps, foreclosure. If you receive a demand for tax payment, it means you have a tax or fee liability that is due and payable by the date shown. This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of.

What is a tax lien certificate? Ray Seaman, eXp Realty

To view your confidential tax or fee records, log into your account for the following types of information: Access titles, boundaries, mortgages, legal descriptions, appraisals, gis maps, foreclosure. Explore detailed property records in california. If you receive a demand for tax payment, it means you have a tax or fee liability that is due and payable by the date shown..

Tax Review PDF Taxes Tax Lien

See publication 58a, how to. This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). To view your confidential tax or fee records, log into your account for the following.

Tax Preparation Business Startup

Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). To view your confidential tax or fee records, log into your account for the following types of information: If you receive a demand for tax payment, it means you have a tax or fee liability that is due.

EasytoUnderstand Tax Lien Code Certificates Posteezy

Explore detailed property records in california. Access titles, boundaries, mortgages, legal descriptions, appraisals, gis maps, foreclosure. To view your confidential tax or fee records, log into your account for the following types of information: Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). See publication 58a, how.

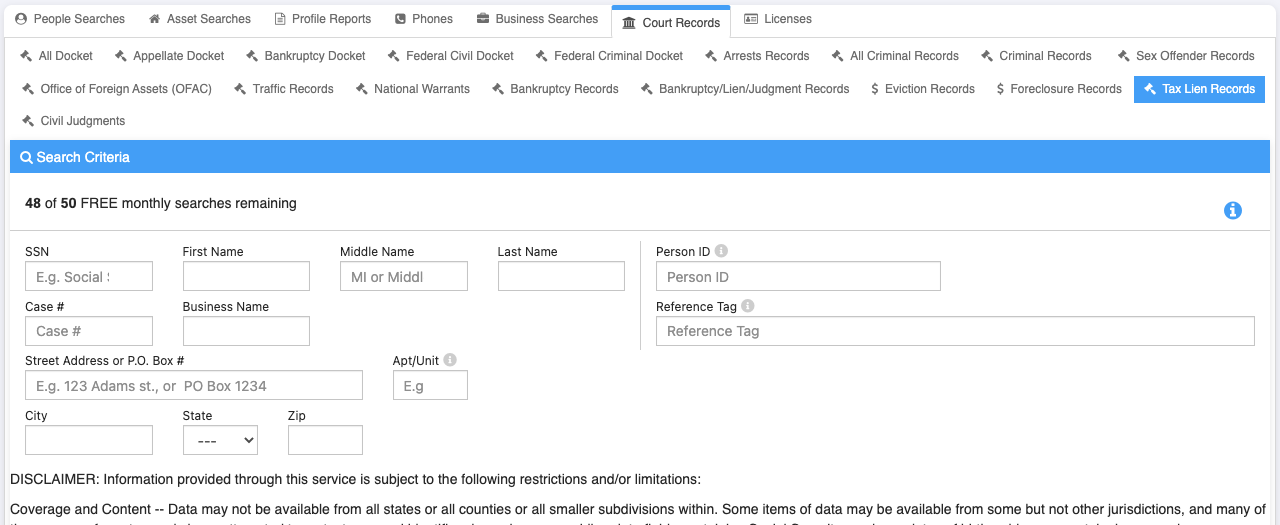

Tax Lien Records Tax Lien Lookup Endato

Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). Access titles, boundaries, mortgages, legal descriptions, appraisals, gis maps, foreclosure. See publication 58a, how to. If you receive a demand for tax payment, it means you have a tax or fee liability that is due and payable by.

California Property Tax Lookup Commercial Loan Corp, Provider of

This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). Access titles, boundaries, mortgages, legal descriptions, appraisals, gis maps, foreclosure. If you receive a demand for tax payment, it means.

Pursuant to the Tax Lien, Tax May be Collected from Estate Property in

See publication 58a, how to. If you receive a demand for tax payment, it means you have a tax or fee liability that is due and payable by the date shown. To view your confidential tax or fee records, log into your account for the following types of information: Explore detailed property records in california. Access titles, boundaries, mortgages, legal.

Tax Lien Focus Group Real Estate And Profit Acceleration Enjoy Your

Access titles, boundaries, mortgages, legal descriptions, appraisals, gis maps, foreclosure. To view your confidential tax or fee records, log into your account for the following types of information: This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of. If you receive a demand for tax payment, it means you have a tax.

Tax Lien Foreclosure Update Levitt & Slafkes, P.C.

See publication 58a, how to. This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). Access titles, boundaries, mortgages, legal descriptions, appraisals, gis maps, foreclosure. Explore detailed property records in.

Tax Lien Sale PDF Tax Lien Taxes

See publication 58a, how to. This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). Explore detailed property records in california. Access titles, boundaries, mortgages, legal descriptions, appraisals, gis maps,.

Explore Detailed Property Records In California.

Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). Access titles, boundaries, mortgages, legal descriptions, appraisals, gis maps, foreclosure. See publication 58a, how to. If you receive a demand for tax payment, it means you have a tax or fee liability that is due and payable by the date shown.

To View Your Confidential Tax Or Fee Records, Log Into Your Account For The Following Types Of Information:

This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of.