Tax Lien Properties Florida

Tax Lien Properties Florida - These sales occur when property owners default on. Enter a stipulated payment agreement. In an effort to recover unpaid property taxes, florida organizes annual tax lien sales. Florida, currently has 185,709 tax liens and 43,209 other distressed listings available as of january 6. Smart homebuyers and savvy investors looking. Pay the amount in full. To resolve your tax liability, you must do one of the following: In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june.

In an effort to recover unpaid property taxes, florida organizes annual tax lien sales. Florida, currently has 185,709 tax liens and 43,209 other distressed listings available as of january 6. Smart homebuyers and savvy investors looking. Enter a stipulated payment agreement. These sales occur when property owners default on. To resolve your tax liability, you must do one of the following: In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. Pay the amount in full.

Florida, currently has 185,709 tax liens and 43,209 other distressed listings available as of january 6. Pay the amount in full. Smart homebuyers and savvy investors looking. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. In an effort to recover unpaid property taxes, florida organizes annual tax lien sales. To resolve your tax liability, you must do one of the following: These sales occur when property owners default on. Enter a stipulated payment agreement.

The Demand for Tax Lien Properties Tax, Demand, Property

Pay the amount in full. Enter a stipulated payment agreement. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. To resolve your tax liability, you must do one of the following: These sales occur when property owners default on.

Exploring the Landscape of Tax Lien Properties A Comprehensive

Florida, currently has 185,709 tax liens and 43,209 other distressed listings available as of january 6. In an effort to recover unpaid property taxes, florida organizes annual tax lien sales. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. To resolve your tax liability, you must do one.

Tax Lien Properties Texas Real Estate Tax Lien Investing for Beginners

Florida, currently has 185,709 tax liens and 43,209 other distressed listings available as of january 6. Pay the amount in full. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. To resolve your tax liability, you must do one of the following: These sales occur when property owners.

How to Find Tax Lien Properties Unlocking the Secret World of

Enter a stipulated payment agreement. In an effort to recover unpaid property taxes, florida organizes annual tax lien sales. Florida, currently has 185,709 tax liens and 43,209 other distressed listings available as of january 6. To resolve your tax liability, you must do one of the following: Smart homebuyers and savvy investors looking.

How to Buy Tax Lien Properties in Florida Expert Guide

In an effort to recover unpaid property taxes, florida organizes annual tax lien sales. To resolve your tax liability, you must do one of the following: Florida, currently has 185,709 tax liens and 43,209 other distressed listings available as of january 6. Enter a stipulated payment agreement. These sales occur when property owners default on.

Tax Lien Properties Leads GK Leads

Smart homebuyers and savvy investors looking. These sales occur when property owners default on. To resolve your tax liability, you must do one of the following: Enter a stipulated payment agreement. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june.

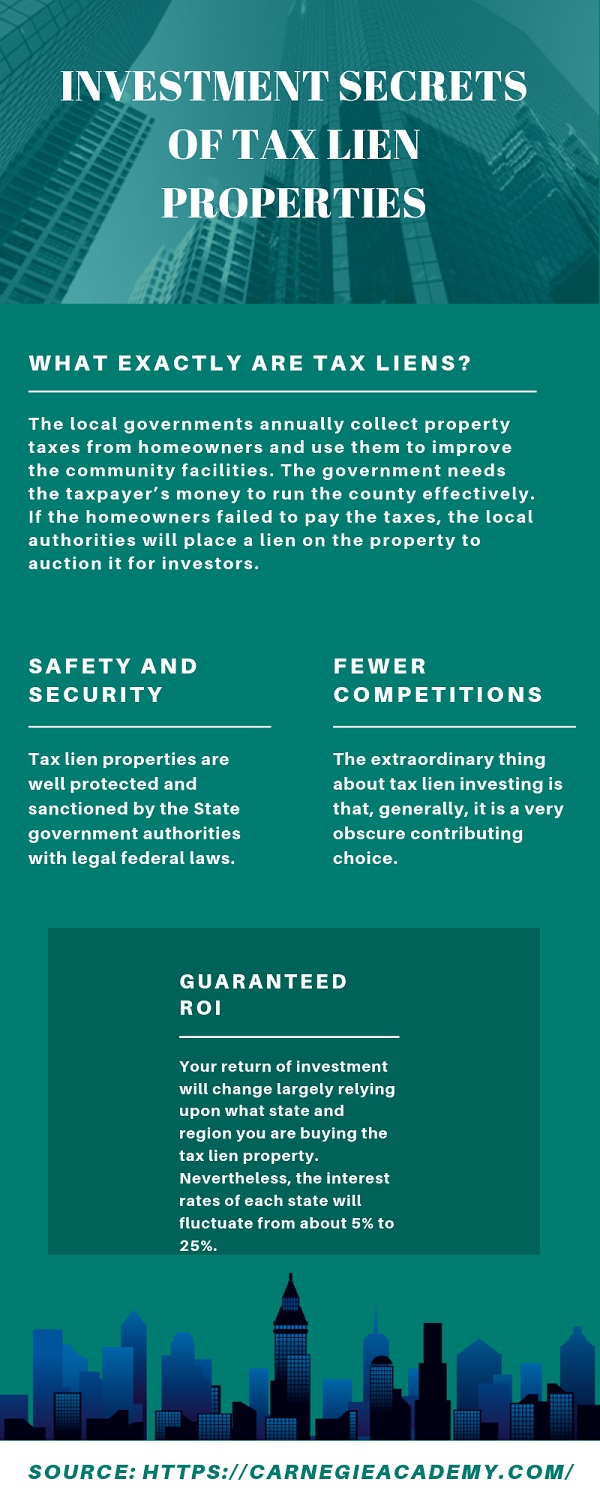

Investment Secrets of Tax Lien Properties Latest Infographics

These sales occur when property owners default on. Florida, currently has 185,709 tax liens and 43,209 other distressed listings available as of january 6. In an effort to recover unpaid property taxes, florida organizes annual tax lien sales. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. Pay.

Free list of Tax Lien Properties, Getting More of What You Want

In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. Florida, currently has 185,709 tax liens and 43,209 other distressed listings available as of january 6. Smart homebuyers and savvy investors looking. To resolve your tax liability, you must do one of the following: Pay the amount in full.

Tax Lien Properties Florida Real Estate Tax Lien Investing for

In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. To resolve your tax liability, you must do one of the following: In an effort to recover unpaid property taxes, florida organizes annual tax lien sales. These sales occur when property owners default on. Enter a stipulated payment agreement.

Tax Lien Properties In Montana Brightside Tax Relief

These sales occur when property owners default on. Florida, currently has 185,709 tax liens and 43,209 other distressed listings available as of january 6. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. Pay the amount in full. Enter a stipulated payment agreement.

Enter A Stipulated Payment Agreement.

Pay the amount in full. Smart homebuyers and savvy investors looking. These sales occur when property owners default on. To resolve your tax liability, you must do one of the following:

In An Effort To Recover Unpaid Property Taxes, Florida Organizes Annual Tax Lien Sales.

Florida, currently has 185,709 tax liens and 43,209 other distressed listings available as of january 6. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june.